Full Answer

What is the interest rate on Vanguard money market?

Vanguard Treasury Money Market Fund: Short-term, U.S. Treasuries: $3,000: 0.09%: 0.09%: VMSXX Vanguard Municipal Money Market Fund: Short-term, tax-exempt securities: $3,000: 0.05%: 0.15%: VCTXX Vanguard California Municipal Money Market Fund: Short-term California municipal securities: $3,000: 0.01%: 0.16%: VYFXX Vanguard New York Municipal Money Market Fund

What happened to Vanguard Prime money market?

- Name change. Vanguard Prime Money Market Fund will change its name to Vanguard Cash Reserves Federal Money Market Fund.

- Even safer. It will now invest only in securities fully backed by the U.S. ...

- Even cheaper. Basically, everyone will get the lower expense ratio from Admiral shares which previously had a $5,000,000 minimum (!). ...

- No more checkwriting. ...

How to send money to Vanguard?

Invest by sending a check

- Don't send a check without a purchase form.

- Make your personal check payable to Vanguard. ...

- Be sure to sign your check. ...

- If you're submitting an employer's check, simply enclose it without endorsing it.

- Don't include additional forms or hand-written instructions with your check.

Does Vanguard have transaction fees on index funds?

Vanguard itself doesn't charge anything if a fund enrolled in an automatic investment plan normally has no transaction fee. However, if the fund isn't on the broker's NTF list, Vanguard imposes a $3 fee for each transaction. Cash management services are available today at many brokerage houses free of charge.

What is federal money market settlement fund mean?

Money market fund A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon.

What is Vanguard federal settlement fund?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

What is the return on a Vanguard Federal Money Market Fund?

The performance of Vanguard Federal Money Market Fund Investor Shares is as follows: 1 year, 1.39%; 5 years, 1.10%; 10 years, 0.55%; 20 years, 1.60%; 30 years, 2.75%; since inception (July 13, 1981), 4.09%. The fund's current 7-day SEC yield (August 21, 2020) is 0.09%.

How safe is Vanguard Federal Money Market Fund?

You could lose money by investing in this Fund. Although a money market fund seeks to preserve the value of an investment at $1 per share, it cannot guarantee it will do so. Investment in this Investment Option is not insured or guaranteed by the FDIC or any other government agency.

Can you withdraw from settlement fund Vanguard?

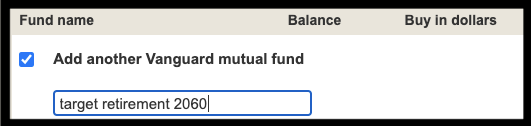

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

How do I withdraw money from my Vanguard money market account?

How do I make a withdrawal?Log into your account.Select 'Payments' from the 'My Portfolio' menu.Select 'Money out'Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash'Follow the on-screen instructions.

Can Vanguard money market lose money?

Vanguard Cash Reserves Federal Money Market Fund and Vanguard Federal Money Market Fund: You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

How much interest does Vanguard money market pay?

Vanguard State-Specific Money Market Funds It has an average one-year return of 0.25%. Investors encounter the same minimum investment amount and expense ratio as the California fund with the Vanguard New York Municipal Money Market Fund (VYFXX).

Does Vanguard pay interest on cash?

Interest on cash balances We do not charge a service fee for holding your cash. Instead we currently keep up to 0.20% of any interest we receive on cash held in your account, to cover our costs of administering it.

What are the disadvantages of a money market account?

Disadvantages of a Money Market AccountMinimums and Fees. Money market accounts often need a minimum balance to avoid a monthly service charge, which can be $12 per month or more. ... Low Interest Rate. Compared to other investments, money market accounts pay a low interest rate. ... Inflation Risk. ... Capital Risk.

What is a money market fund and how does it work?

A money market fund is a mutual fund that invests solely in cash and cash equivalent securities, which are also called money market instruments. These vehicles are very liquid short-term investments with high credit quality. Money market funds generally invest in such instruments as: Certificates of deposit (CDs)

Does money double every 7 years?

According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

Can you withdraw from a Roth IRA settlement fund?

The early withdrawal penalty for a Roth or traditional IRA is 10% of the amount you withdraw before age 59½. You may also owe income tax in addition to the penalty. You can withdraw contributions (but not earnings) at any time from a Roth IRA, without being subject to tax and the penalty.

Does a settlement fund earn interest?

The plaintiff receives all interest earned while the money remains in the fund. In the case of a settlement for millions of dollars, daily interest payments can mean thousands of dollars in additional money in the plaintiff's pocket.

What is a Federal money market settlement fund Roth IRA?

Your money gets transferred to a “settlement fund” inside of your traditional IRA. The settlement fund is in the Vanguard Federal Money Market Fund. This settlement fund will hold your money (i.e. prevent you from using it) that you wired from your bank account for up to 7 days.

What are settled funds?

What are settled funds or settled cash? You guessed it: Settled funds are basically the inverse of unsettled funds. Proceeds from selling a security become settled funds after the settlement period has ended. Similarly, cash you deposit or wire into your brokerage account to use for trading is considered settled.

Preserve your cash until you decide how to use it

Money market mutual funds offer you a place to store your cash and potentially earn income—without as much risk to your investment as stock or bond funds.

Are you investing outside of an IRA or other retirement account?

If you're in one of the highest tax brackets and investing outside of your retirement account, you may be able to reduce your tax exposure with a tax-exempt money market fund.

What is VMMXX fund?

Treasury bills and cash. VMMXX is a great option for investors who need immediate access to cash or for long-term investors who want to offset riskier investments.

What is a money market fund?

If you're looking to invest in highly liquid investment vehicles that come with short-term maturities, consider a money market fund. These mutual funds typically invest in cash, highly-rated debt securities, and cash equivalents. These funds were originally designed to offer liquidity, provide current income, and preserve an investor's principal by maintaining a fixed $1.00 share price.

What is VMMXX?

VMMXX is a great option for investors who need immediate access to cash or for long-term investors who want to offset riskier investments.

What are the risks associated with investing in a mutual fund?

Here are some of the most common risks associated with the fund which could hurt your investment: Credit risk: You may experience a drop in security prices if issuers can't make the interest or principal payments. This risk, though, is very low, as the fund invests in high-quality securities.

Why is income risk higher in a fund?

That's because the fund relies heavily on short-term interest rates. As an investor, you can expect income risk to be higher because short-term rates tend to fluctuate over shorter periods of time.

Is VMMRX insured?

Like all mutual fund money market funds, VMMRX is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC). Investors concerned about the lack of insurance may wish to consider a money market fund account offered by a bank since the FDIC insures those accounts up to $250,000.

Do money market mutual funds have yields?

The yields of money market mutual funds are largely dependent on the interest rate environment, meaning their yields will likely rise as interest rates rise. So when interest rates rise, money market mutual funds like Vanguard's Cash Reserves Federal Money Market Fund become much more attractive to investors.

What is a Vanguard money market fund?

Vanguard Municipal Money Market Fund: The Fund is only available to retail investors (natural persons). You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund's liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund's sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. Vanguard Municipal Money Market Fund is only available to retail investors (natural persons). Vanguard Municipal Money Market Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

How much does Vanguard require for CDs?

Vanguard Brokerage imposes a $1,000 minimum for CDs purchased through Vanguard Brokerage. Yields are calculated as simple interest, not compounded. Brokered CDs do not need to be held to maturity, charge no penalties for redemption, and have limited liquidity in a secondary market.

Why do bonds fall?

Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments.

What is a fixed income mutual fund?

A type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer high liquidity with a very low level of risk.

Does Vanguard have a fee?

Vanguard Municipal Money Market Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. Vanguard Cash Reserves Federal Money Market Fund and Vanguard Federal Money Market Fund: You could lose money ...

Does Vanguard recommend CDs?

Vanguard Brokerage makes no judgment as to the creditworthiness of the issuing institution and does not recommend or endorse CDs in any way. For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus.

Does Vanguard have a legal obligation to sponsor a fund?

The Fund's sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. Vanguard Municipal Money Market Fund is only available to retail investors (natural persons).

How to learn more about Vanguard money market funds?

To learn more about Vanguard money market funds, visit the provider's website.

What is Vanguard cash reserve?

With a history going back to 1975, Vanguard Cash Reserves Federal Money Market Fund ( VMMXX) is Vanguard's oldest money market fund. Holdings are made up of cash, U.S. government securities and/or repurchase agreements collateralized by U.S. government securities.

What Are Money Market Funds?

Not to be confused with a money market account, a money market fund is a type of mutual fund that holds cash and high-quality, ultra-short-term cash-equivalent securities.

What is a VMSXX?

3. Vanguard Municipal Money Market Fund. For investors residing in states other than California or New York, the Vanguard Municipal Money Market Fund ( VMSXX) is a good choice for a money market fund in a taxable brokerage account. Tax-exempt at the federal level, VMSXX holds short-term, high-quality debt securities.

Does Vanguard have cash?

But just about every Vanguard investor's assets are held in one of these cash accounts, even if only for a brief period. Thus, it's wise to know how Vanguard's money market funds work, and which one is best for your needs.

Do Vanguard funds get attention?

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media.

Is Vanguard money market tax exempt?

If the investor holds a money market fund with tax-exempt bonds issued in their state of residence, interest may also be tax-exempt at the state level. All Vanguard non-taxable money market funds have a minimum initial investment of $3,000.

How much investment is required for mutual funds?

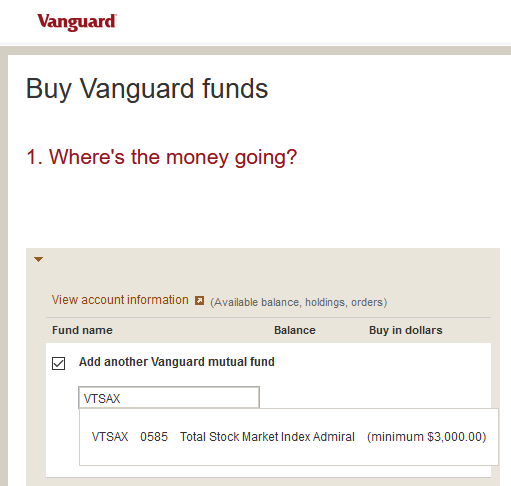

A $3,000 minimum initial investment is required for a mutual fund account (no minimum if you're using the fund as your brokerage settlement fund).

What is the SEC yield?

Actually the SEC yield is net of expenses. So it's 2.19, not 2.08.

Is Vanguard a treasury?

Yes the default settlement account for vanguard is vmfxx, their federal (note not 100% treasuries!) Money market fund.