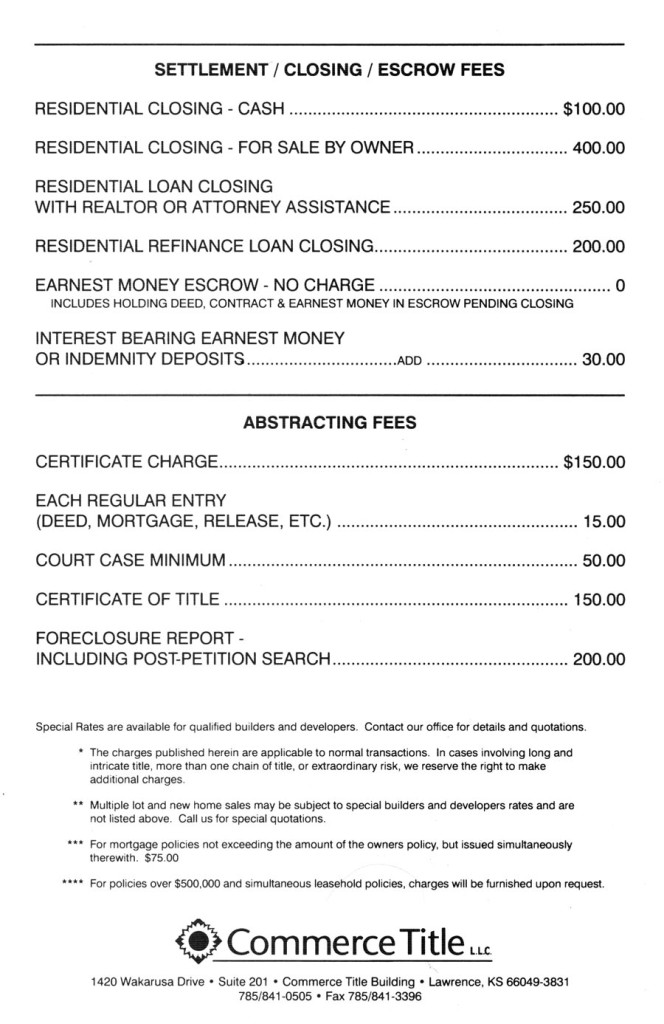

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

What is the difference between a title company and a closing attorney?

So, the difference between a title company and a closing attorney is that the title company will always be the one that's insuring the title and providing the actual escrow . The closing attorney may or may not be involved in that process depending on who has hired that attorney.

What does a title company do?

What does a title company do?

- Perform title searches. Title companies search for past titles to make sure all handoffs have been legal. ...

- Issue title insurance. Title insurance protects the buyer and the lender if there's ever a dispute over who legally owns a property.

- Conduct property surveys. ...

- Prepare abstract of title. ...

- Act as closing agents. ...

- Hold escrow payments. ...

What is a title company responsible for?

The title company is responsible for preparing and providing both buyers and sellers with the necessary documents. Typically, buyers will need to bring a few standard documents like proof of insurance and their photo IDs, but the title company and your real estate agent will be able to let you know if you’ll need to bring anything else with you.

What is a real estate settlement company?

Real estate settlement companies work with the lenders and real estate agents of both the buyer and seller in order to facilitate the terms of a real estate contract.. There can be confusion between real estate settlement companies and mortgage originators. A customer would contact a bank (lender) for a mortgage, and would contact a real estate settlement company to handle the closing of the ...

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What does settlement mean in mortgage?

The settlement is the final stage in the home transaction. This is when the ownership of the property will be transferred from the seller to the buyer.

What are settlement expenses?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

How much does a title search cost in NJ?

$75 to $200A title search in New Jersey ranges from $75 to $200. However, this price varies depending on the location of the property and other factors. It should be noted that New Jersey charges about 0.85% of the sale price of a home to transfer the title to the new owner.

What happens during settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What does settlement mean in property?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What is another name for the closing when buying a house?

The “closing” is the last step in buying and financing a home. The "closing,” also called “settlement,” is when you and all the other parties in a mortgage loan transaction sign the necessary documents. After signing these documents, you become responsible for the mortgage loan.

What is a settlement agent?

Settlement agents are third parties or intermediaries that help a buyer and seller complete a transaction. In financial markets, settlement agents are clearing houses responsible for ensuring the delivery of securities to the buyer, transferring the funds to the seller, and recording the details of the transaction.

What is a survey fee on a mortgage?

A property survey reveals the boundaries and details of the home so you know your legal rights. Your mortgage lender may require a property survey after you make an offer on a home. A survey typically costs a few hundred dollars, but the amount depends on the company and your home.

Who pays for the title search in NJ?

The party that pays for a title search is not necessarily set in stone. The buyer of a home traditionally pays for a search, but if your housing market is in particularly bad shape, you might be able to convince the seller to pay up for a search themselves.

How long does a title search take in NJ?

about between three and five daysA title search in New Jersey usually takes about between three and five days. However, the amount of time can vary greatly depending on the situation. Here is some background information to help explain this process and give you an idea of what to expect.

How far back does a title search go in NJ?

The title company will examine public records — often going back 50 years or more — to look for past deeds, wills, trusts, divorce decrees, bankruptcy filings, court judgments and tax records that may be defective or outstanding.

Is settlement is possible in mortgage loan?

It is usually not feasible to negotiate and settle secured loans like home loans, auto loans or gold loans because the bank can always take possession of the asset which is mortgaged against the loan.

Is a settlement statement and closing disclosure the same thing?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is mortgage settlement letter?

In this case, you inform the lender of your situation and request them to give you some time off before you begin repayments. The lender may give you a one-time settlement option where you take some time off and then, settle the loan in one go. Since you are given some time, you may readily accept this offer.

What is escrow settlement?

The escrow/settlement company is responsible for carrying out the instructions from the various parties involved including lenders, other financial institutions, real estate agents, and borrowers. The responsibilities include but are not limited to receiving funds, wiring funds, ordering payoffs and surveys, examining the title abstract and clearing title, preparing and issuing a title commitment, preparing and distributing a preliminary HUD-1, recording deeds, mortgages, and deeds of trust, preparing and issuing a policy of title insurance, and returning all documentation to the correct companies/government agencies. The escrow/settlement company is also responsible for disbursing funds to lenders (payoffs), sellers (proceeds), and third parties as instructed.

What is Excalibur Title and Escrow?

Excalibur Title & Escrow, LLC is a licensed, bonded, and insured Maryland title company with its headquarters conveniently located in Frederick, in central Maryland. As a part of our licensing and bonding we are authorized to receive and disburse funds pursuant to the terms of any contract for the sale of real property and the instructions provided by lenders. We can do this for any transaction that closes anywhere in the State of Maryland, not just in Frederick. Receiving and disbursing funds is an integral part of the settlement and closing process. Funds from a buyer’s lender, or an owner’s lender, in the case of a refinance, must be received and held by a third party for settlement. Title companies perform this function. The funds are held in escrow until the day of settlement, at which time they are disbursed to various local and state authorities, as payoffs to lenders, for liens and taxes, to pay fees and closing costs, and as net proceeds to sellers, and in the case of a refinance, to the borrowers. All funds are received and disbursed according to the contract, lenders’ instructions, and the HUD-1 settlement statement which is reviewed and approved by all parties prior to signing any other closing documents.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What does the title company do?

A title company handles the review of any title claims and prepares for the closing. They also typically manage the escrow account, which holds funds that must be set aside for the home purchase or refinance until certain conditions are met or the transaction is complete and the funds are disbursed to the necessary parties. For example, if you’re buying a home and you’ve made an earnest money deposit, these funds will usually be held in the title company’s escrow account.

What does title insurance do?

After a title company is confident that a property is free of title defects, they have the green light to move forward and issue title insurance policies. This protects both homebuyers and lenders against claims for things that happened in the past, such as previous owner liens or ownership issues.

What does "clear title" mean?

Before a home purchase or refinance transaction can close, the property must have a “clear” title, meaning no one has a claim to it in the form of outstanding liens or debts. Your title company is responsible for finding anything that can hinder a clear title, and, if anything is discovered, they will take corrective action to enable ...

What is the closing date for a title company?

With a clear title and title insurance policy—and after all other items required by the lender are complete—the title company can schedule a closing date, which is also known as the settlement date. Your title company and lender will work together to prepare the closing paperwork. On settlement day, you should be prepared to sign your closing ...

What to do if title company finds issues?

If the title company finds any issues, they can start working to resolve them immediately to keep your closing on schedule. They may chat with the seller to learn more about ownership disputes, and they may ask for paperwork to prove someone else doesn’t own the home. For example, if the problem involves an unpaid roofing bill, the title company may need to resolve it with the current owner and contractor.

Why do you need a title exam?

The purpose of these exams is to protect you and the lender from being on the hook for any unresolved title issues —for example, mistakes in public records, erroneous surveys, or property or building code violations. It’s important to discover these issues before closing, so that you don’t inherit these problems.

What does a title company look for in a bankruptcy case?

The title company will also look for and examine liens or judgments against the property for bankruptcy cases, divorce agreements, outstanding mortgages, overdue property taxes, and other debts. These outstanding balances must be paid before the transfer of ownership.

Why should a title company and settlement agent be able to access a missing document?

Because the settlement agent and title company are already at their office, and it is the same company with the same system, they should be able to access the missing document and print a new version on the spot. That is why your real estate agent may recommend one that is more expensive.

Who does a settlement agent work for?

The settlement agent may work for the title company , and the title company may also handle your escrow and closing services. But this isn’t always the case.

Why do you need a settlement agent?

One reason for this is if the Settlement Agent forgets a document.

What is the job of a title company?

A settlement agent’s job is to do the actual paperwork for transferring the ownership of the land. Depending on the area and state you live in, the Settlement Agent may or may not also have ...

Who has the job of making sure that the seller is the rightful owner of the property?

In short, the title company has the job of making sure that the seller is the rightful owner of the property, and the buyer will have what appears to be a clean title and the right to own it. Once this is done, the settlement agent will complete all the necessary paperwork to make sure that you become the rightful owner of the property.

Can you choose a settlement agent outside of title company?

It is also not recommended to choose a settlement agent outside of the title company as it adds more people to the mix. It also places two separate groups of people together that may not be familiar with all of the processes from each other’s companies or operations.

Do you have to be a licensed attorney to be a settlement agent?

Depending on the area and state you live in, the Settlement Agent may or may not also have to be a licensed attorney or lawyer. Now here’s where it could get confusing when comparing a title company vs a settlement agent. The settlement agent may work for the title company, and the title company may also handle your escrow and closing services.

What is settlement in escrow?

Settlement, sometimes referred to as a closing or escrow, is an arrangement in which an impartial third party (an escrow agent) holds legal documents and funds on behalf of a buyer and seller and/or lender. Once documents are recorded following state statutes, the funds are disbursed in accordance with the written instructions received from the parties.

Why do people use settlement services?

People buying and selling real estate utilize settlement services for their protection and convenience. All parties rely on the settlement agent to faithfully carry out their mutually agreed upon instructions relating to the transaction, or to advise them if any of the instructions are contradictory or cannot be completed.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

What does a title company do?

The title company will perform a title search to find any potential issues with the title, such as encumbrances or liens. The company can then make any changes and ensure that their findings are correct.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

Title Search and Examination

Fix Any Errors and Resolve Title Issues

- If the title company finds any issues, they can start working to resolve them immediately to keep your closing on schedule. They may chat with the seller to learn more about ownership disputes, and they may ask for paperwork to prove someone else doesn’t own the home. For example, if the problem involves an unpaid roofing bill, the title company may need to resolve it with the curr…

Issue Title Insurance

- After a title company is confident that a property is free of title defects, they have the green light to move forward and issue title insurance policies. This protects both homebuyers and lenders against claims for things that happened in the past, such as previous owner liens or ownership issues. While a lender’s title insurance policy is required in every purchase or refinance mortgag…

Settlement and Signing

- With a clear title and title insurance policy—and after all other items required by the lender are complete—the title company can schedule a closing date, which is also known as the settlement date. Your title company and lender will work together to prepare the closing paperwork. On settlement day, you should be prepared to sign your closing packa...

Mortgage Recording and Funding

- If everything on your closing day goes according to plan, the title company will submit your mortgage for recording at the county records office. Then, local officials will make note of the details for public record. At this point, the title company will disburse funds for the new mortgage loan, and taxes and homeowners insurance (if applicable). If you’re refinancing, the title compan…