Who pays settlement closing fees?

When it comes down to paying the settlement fees, the buyer and seller will have typically negotiated an agreement. Generally, settlement fees are handled by the home buyer, but it is not unusual for the seller to agree to cover the costs as part of the negotiations while selling their home.

What is a typical title fee?

Title fees depend on the price of your home, where you are located in the country, the complexity of establishing a clear chain of title, defects that need to be corrected, and the selected title agent or insurance company. Typical title fees range from several hundred to a few thousand dollars. The title insurance premiums usually are the ...

How much is a title fee?

Fees Title - Original or transfer of title $164.50 for original title or title transfer $157 for a low speed vehicle $0 (no fee) for title transfer to a surviving spouse or registered domestic partner Title - replacement $20 Security interest (lien): New listing; Duplicate lienholder confirmation form $10 $5

How much title company charge?

The title charges (such as the settlement fee, title search, document preparation, notary fees, etc.) can vary by as much as $1,500.

What is a fee settlement?

Settlement fee means a charge imposed on or paid by an individual in connection with a creditor's assent to accept in full satisfaction of a debt an amount less than the principal amount of the debt.

What is title settlement fee Florida?

Settlement Fee – typically $350 to $600: While you can avoid attorney fees (Florida doesn't require an attorney to be present at closing), you'll still need to pay a settlement fee to the title company or escrow company for their services on closing day.

Is settlement and closing the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

How much does a title search cost in PA?

A title search is done to make sure that there are no outstanding debts or liens on the property, and to make sure that the property is, indeed, owned by the seller. This ranges from $300-600.

How much are closing costs in Florida 2022?

How Much are Closing Costs in Florida? Closing costs in Florida are, on average, $8,554 for a home priced at $375,368, according to a 2022 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 2.3 percent of the home's price tag.

How much are closing costs on a 250k home in Florida?

Seller Closing Costs in Florida Sellers can expect to pay from 7-9% of the home's purchase price in closing costs (this includes the commission fees given to the agents). For the average $225,000 home, this equates to a range of $15,750 to $20,250.

What not to do after closing on a house?

So to raise the odds that all goes smoothly, here are five things you should never, ever say at closing.'I quit my job this morning' ... 'I can't wait to get all the new furniture we bought' ... 'I can't believe the appraisal came in $20,000 above the sales price' ... 'I can't wait to gut the house'More items...•

How long is settlement usually?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What does settlement mean when buying a house?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

How do you get closing costs waived?

7 strategies to reduce closing costsBreak down your loan estimate form. ... Don't overlook lender fees. ... Understand what the seller pays for. ... Think about a no-closing-cost option. ... Look for grants and other help. ... Try to close at the end of the month. ... Ask about discounts and rebates.

How much do title companies charge in PA?

Pennsylvania charges you about 1.00% of your home's sale price to transfer the title to the new owner. If you sell for Pennsylvania's median home value — $266,000 — you'd pay $2,660.

How long does a title search take in PA?

24 to 72 hoursDepending on the information you need, a title search in Pennsylvania can take anywhere from 24 to 72 hours. It may take a bit longer if you need a title search from a rural county, or if your search goes back 50-60 or more years.

Who pays title insurance in Florida buyer or seller?

the sellerIn Florida, the party responsible for handling the cost of title insurance varies from one county to another, and it can often be negotiated in the contract. Typically, the seller will pay for the title insurance in the state of Florida, with the exception of just a few counties.

How much does a title search cost in Florida?

The title search also looks at the chain of ownership, to make sure the transfers between all previous owners was done correctly, so the property can be legally conveyed. A title search in Florida generally costs between $300-$600.

How much are closing costs Florida?

Closing costs can increase or decrease depending on the home purchase price. In Florida, the average closing costs come to approximately 1.98% of the home purchase price. So, if you take out a mortgage worth $200,000 to purchase a home, you'll pay roughly $3,900 in closing costs.

Who pays the transfer tax in Florida?

sellerThere are some jurisdictions that dictate who pays the tax, but for the most part, there is no mandate and it's up to the buyer and seller to negotiate who makes the payment. In Florida, the seller traditionally pays the transfer tax or documentary stamp.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to rev...

Buyer Or Seller – Who Pays The Title Fees?

It depends on where you live. In some parts of the country, it’s customary for the seller to pay the buyer’s title insurance and the buyer to pay t...

How Much Are Title Fees On Average?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing cos...

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

What is a CPL in closing?

Closing Protection Letter (CPL) The CPL is an agreement written by the title company that protects the lender in case of losses caused by misconduct on the part of the closing agent. (Title companies charge this fee to draft the document.) Commitment.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.

Who pays the premium on a refinance?

In a refinance transaction, the lender’s premium is typically paid by the borrower , but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

Are Title Fees Negotiable?

Many title fees are set by state and local government agencies. Who pays them, however, is negotiable. If the conditions are right, a buyer may be able to negotiate that the seller covers all or part of the closing costs. These are referred to as seller concessions. They’re essentially agreements a seller makes to cover certain fees.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

How much does it cost to record a deed?

The national average for this charge is around $125.

Who Pays The Title Settlement Fee?

When it comes down to paying the settlement fees, the buyer and seller will have typically negotiated an agreement. Generally, settlement fees are handled by the home buyer, but it is not unusual for the seller to agree to cover the costs as part of the negotiations while selling their home. Given that the settlement fees are made up of many smaller fees, it is possible that certain parties pay for certain items.

What is settlement fee?

The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

What is a point in a mortgage?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front. For example, paying $1,000 US Dollars (USD) up front might lower a person’s interest paid over the life of his loan by one percent. Points paid at settlement are tax deductible in some jurisdictions as well.

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

Why do you need an appraisal before you get a mortgage?

Before a lender will grant a mortgage for a particular property, an appraiser is usually sent out to determine how much the property is worth. Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

What is a GFE loan?

For those loans , you will receive two forms – a Good Faith Estimate (GFE) and an initial Truth-in-Lending disclosure – instead of a Loan Estimate. Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD -1 Settlement Statement.

What does title insurance cover?

Title insurance can provide protection if someone later sues and says they have a claim against the home. Common claims come from a previous owner’s failure to pay taxes or from contractors who say they were not paid for work done on the home before you purchased it.

What is title service fee?

What are title service fees? Title service fees are part of the closing costs you pay when getting a mortgage. When you purchase a home, you receive a document most often called a deed, which shows the seller transferred their legal ownership, or “title,” to the home to you. Title service fees are costs associated with issuing a title insurance ...

Where are title fees listed on a loan estimate?

Title service fees are listed in section B or C of page 2 of your Loan Estimate (and in section B or C of page 2 of your Closing Disclosure ). If the title services are listed in Section C, you can shop for them separately .

Do you get a GFE on a HELOC loan?

If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a GFE or a Loan Estimate, but you should receive a Truth-in-Lending disclosure . Read full answer.

Where is title insurance listed on a loan?

If you choose to purchase owner’s title insurance, it will be listed in section H of your Loan Estimate.

Can I share my PII with my employer?

Yes. No. Additional comment (optional) Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

How much does a title company charge?

The majority of the fee is for the title ins. the settlement/escrow/closing fee is basically the fee charged for the processing of the loan or admin fee. it can range from 100-400 depending on your state and company. this fee does not include any overnight/courier, tax cert., recording or doc prep fees.

Does Chase have a title company?

They have to keep record of the fees they collect and are subject to audits. Chase may very well own or be affiliated in some way with a title company or may have a title company that has a division created specifically for them hence the low fee.

Is escrow independent of title company?

Also, there's a huge difference between escr ow companies in Northern California vs. Southern California as SoCal has escrow companies which are often independent of title companies.

Does Chase include closing costs?

The closing costs would vary from one lender to another. Moreover, certain lenders may not include all items in the closing costs. There's a possibility that Chase may ask the borrowers to pay certain fees (processing fee, application fee and others) prior to closing.

What are closing costs?

Closing costs include taxes, lender fees and title fees that a homebuyer pays at settlement . Watch this video to prepare for the process.

Do you have to pay transfer taxes on title insurance?

Consumers must also pay transfer & recordation taxes (buyer & seller, respectively) and a title insurance policy premium. These costs vary depending on the purchase price of your home. We encourage you to grab a Quick Quote today for an accurate and anonymous estimate of how much money you will need to bring to the closing table.

Is settlement fee included in closing costs?

Settlement fees are fixed, meaning they remain constant regardless of purchase price; however, settlement fees are not the only fees included in closing costs. Consumers must also pay transfer & recordation taxes (buyer & seller, respectively) and a title insurance policy premium.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is home insurance premium?

Homeowner’s insurance premium: This insurance protects you and the lender against loss due to fire, windstorm, and natural hazards. Lenders often require the borrower to bring to the settlement a paid-up first year’s policy or to pay for the first year’s premium at settlement.

What is title insurance binder?

Title insurance binder: Commitment to issue a title insurance policy at future date.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What are points on a loan?

Points: Points are a percentage of a loan amount. For example, when a loan officer talks about one point on a $100,000 loan, this is 1 percent of the loan, which equals $1,000. Lenders offer different interest rates on loans with different points. You can make three main choices about points. You can decide you don’t want to pay or receive points at all. This is a zero-point loan. You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is flood determination?

Flood determination: This is paid to a third party to determine if the property is located in a flood zone. If the property is found to be located within a flood zone, you will need to buy flood insurance. The insurance is paid separately.

Origination Costs

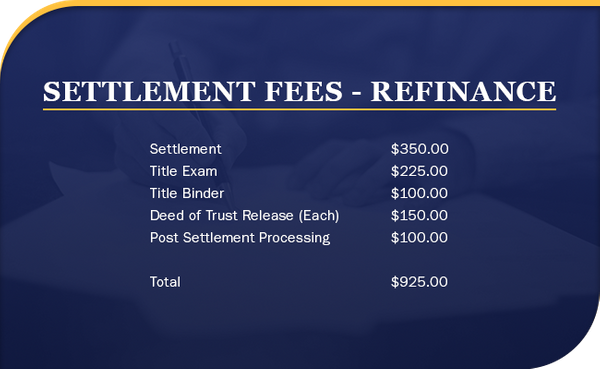

Title Settlement Closing Fee and Other Costs

- Additional costs may also apply whenever you take out a loan. Many of the title costs vary from company to company, allowing you to shop around to get a good deal on title as some are owned by attorneys, while others are not. Usually, you will pay a fee for title services, sometimes there are costs the seller will pay as well. A title is a document...

Administrative Settlement Fees

- Before finalizing a home sale, lenders and other agents must perform a range of administrative tasks. These imply additional fees. Financial institutions, for instance, have to ensure that they have collateral for making any loan. This usually involves an appraisal fee to confirm the value of your property. Banks and brokers will also need to check your credit history to determine if they …

How to Find Your Title Settlement Closing Fee

- You can find title settlement closing fees on your loan estimate and closing disclosure. This legally required document lists all the costs, risks and features associated with your mortgage. Lenders are obliged to provide you with a loan estimate within three days of making your application. Learning more about title settlement closing fees lets you plan for the transaction better.