Full Answer

Who pays the fees in the GFE?

The GFE outlines all of the costs of your mortgage loan, including your loan amount, term, interest rate, whether there is a prepayment penalty, origination charge, and more. In the fees outlined in the GFE, some fees are paid by the buyer and some by the seller.

What is a good faith estimate (GFE)?

Receiving a good faith estimate. Lenders are required by law to give you the Good Faith Estimate (GFE) within three business days of receiving the loan application. This will explain your loan terms and costs associated with the loan.

What is a GFE form?

Prior to October 3, 2015, the GFE was a required document that lenders had to give mortgage applicants within three days of the application to explain the terms and charges associated with the mortgage. On October 15, 2015, the GFE was replaced by the Loan Estimate and Closing Disclosure Form.

How long does it take to get a GFE from a broker?

The GFE must be mailed or hand-delivered by the end of the third day. A mortgage broker will also send a GFE if you use a broker to apply for a loan. You will receive another GFE from the lender shortly after the lender accepts your application.

Is loan estimate the same as GFE?

The GFE has been replaced by the Loan Estimate, and the HUD-1 by the Closing Disclosure. If you purchased a home after October 3, 2015, you should have received these documents. The new document is very similar to the original.

When should you receive the loan estimate of settlement costs?

within three business daysA Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

What does GFE mean in mortgage?

Good Faith EstimateGood Faith Estimate (GFE) 1 This GFE gives you an estimate of your settlement charges and loan terms if you are approved for this loan. See page 3 for more detailed instructions. Instructions. Borrower. Property.

How accurate is a Good Faith Estimate?

An analysis of new research suggests that, contrary to the views of some observers, the Good Faith Estimate disclosure has been an accurate predictor of actual mortgage closing costs.

Why is my loan estimate so high?

Here are some common reasons why the estimated charges in your Loan Estimate might increase: You decide to change the kind of loan, for example moving from an adjustable-rate to a fixed-rate loan. You decide to reduce the amount of your down payment. The appraisal on the home you want to buy came in lower than expected.

How long after loan estimate can you close?

three business daysAt least three business days before you're scheduled to close on your mortgage loan.

What are some of the fees that are listed on the Good Faith Estimate?

The fees included within a good faith estimate fall into six basic categories:Loan fees.Fees to be paid in advance.Reserves.Title charges.Government charges.Additional charges.

Who gets GFE?

A Good Faith Estimate, also called a GFE, is a form that a lender must give you when you apply for a reverse mortgage. The GFE lists basic information about the terms of the mortgage loan offer. The GFE includes the estimated costs for the mortgage loan.

What must be included in a Good Faith Estimate?

What does a GFE Need to Include?The patient's name and date of birth;A description of the primary item or service and, if applicable, the scheduled date;An itemized list of items or services reasonably expected to be furnished;More items...•

Does a Good Faith Estimate mean you are approved?

What is the Good Faith Estimate? The GFE is a standardized form you should receive from your lender after applying for a mortgage. It provides you with an estimate of the settlement charges and loan terms you'll likely have if you're approved for the loan.

Do lenders still give good faith estimates?

Generations of mortgage applicants used a document known as a good faith estimate to understand and compare home-loan lending terms, until a 2015 update to the Truth in Lending Act replaced the good faith estimate with a new form called a loan estimate.

Do lenders still do GFE?

Prior to October 3, 2015, the GFE was a required document that lenders had to give mortgage applicants within three days of the application to explain the terms and charges associated with the mortgage. On October 15, 2015, the GFE was replaced by the Loan Estimate and Closing Disclosure Form.

Do you get a loan estimate after pre approval?

Receiving a Loan Estimate from a lender isn't the same thing as receiving an approval on a loan. Instead, the Loan Estimate shows the details of the loan that the lender expects to offer you should you decide to move forward. After you decide to proceed, your lender will ask for additional financial information.

What happens after signing loan estimate?

After choosing a lender and running the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that it contains the locked-in costs of your loan and the specific amount you'll need to pay at closing.

Who is ultimately responsible for ensuring that the loan estimate is provided?

Generally, a creditor is responsible for ensuring that a Loan Estimate is delivered to a consumer or placed in the mail to the consumer no later than the third business day after receipt of the consumer's “application” for a mortgage loan subject to the TRID Rule. 12 CFR §1026.19(e)(1)(iii).

Why is consistency important between the loan estimate and the closing disclosure?

It shows how much you'll actually pay if you go through with closing and take on the loan. Tip: To keep your lender honest, compare your Loan Estimate from the same lender to your Closing Disclosure to make sure all the key terms of your loan are as expected.

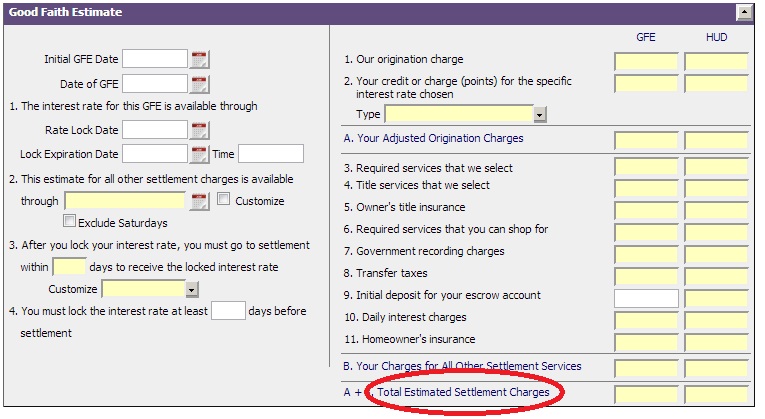

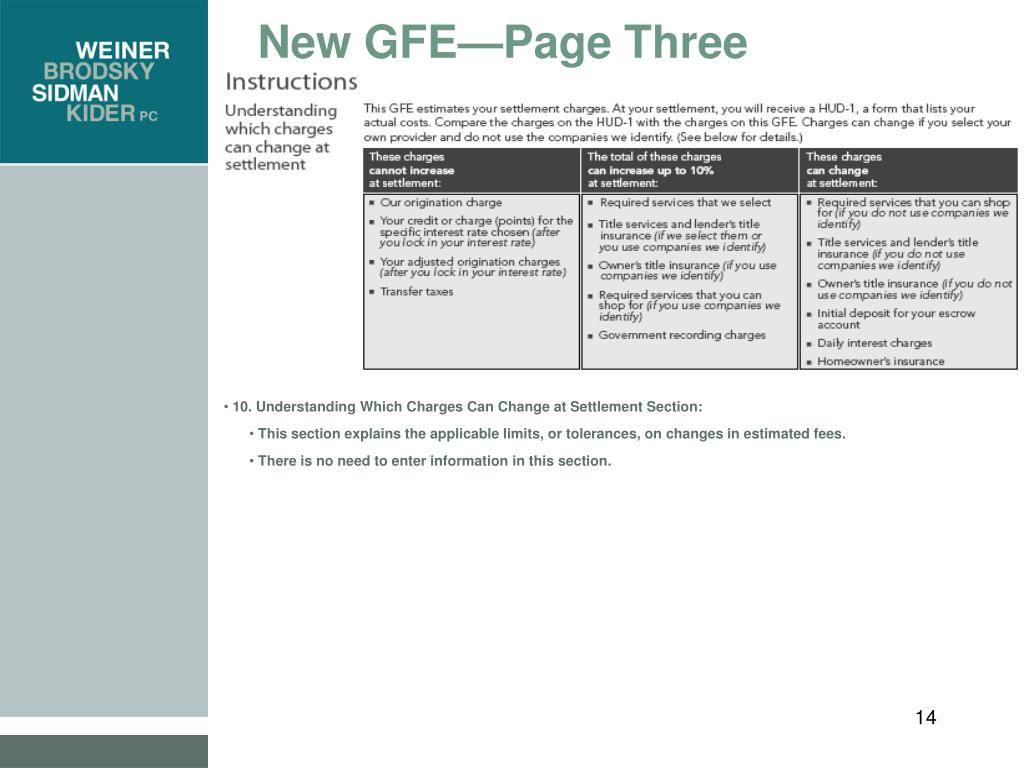

What is the GFE for HUD?

The GFE estimates your settlement charges. At your settlement, you will receive a HUD-1. Compare the charges on the HUD-1 with the charges on this GFE. Charges can change if you select your own provider and do not use the companies your lender suggests.

Can you change your loan terms after settlement?

Lenders can receive additional fees by selling your loan at some future date after settlement. Once you have obtained your loan at settlement, however, your loan terms, adjusted origination charges, and total settlement charges cannot change. After settlement, any fees lenders receive in the future cannot change the loan you received or the charges you paid at settlement.

What is a GFE?

The Good Faith Estimate (GFE) is provided to borrowers to make the terms of a loan and estimated settlement charges transparent. The GFE must be provided to a borrower within three business days after a lender receives their application. The GFE makes comparison loan shopping easier by itemizing the fees that will be charged for the loan. Although the settlement fees are estimated if some of the fees are increased during the settlement process, a new GFE must be provided or the borrower is entitled to a refund after the closing.

How long does it take to get a good faith estimate from a mortgage company?

A mortgage lender or broker is required by the Real Estate Settlement Procedure Act (RESPA) to mail Payton the GFE within three business days. If Payton applies for a loan with other mortgage companies, she will receive a GFE from each lender. The top portion of the document provides an explanation of the purpose of the document and a disclaimer on the importance of utilizing the form to shop and compare loan offers.

How Is a Good Faith Estimate Calculated?

Mortgage lenders consider several factors when calculating the cost of a loan to generate a GFE.

What is a balloon payment?

A balloon payment is a large lump sum payment that becomes due if a mortgage loan is not repaid by a specific time. This section indicates if the loan has a prepayment penalty. A prepayment penalty is a penalty for paying a mortgage loan off early. If Payton pays her mortgage loan in full in 20 years instead of the 30 years as she agreed, the lender will charge her a predetermined amount of money for doing so.

What is a good faith estimate?

A Good Faith Estimate (GFE) is a form that explains the cost of a mortgage loan in an easy to understand, simplistic format. The GFE breaks down the terms of a loan and settlement costs. The goal of the GFE is help borrowers determine if the conditions of a loan are beneficial.

What is the summary of loan terms?

The Summary of Loan Terms section includes an itemization of the loan amount, term, interest rate and what the monthly mortgage payment will be.

Can you increase your GFE at closing?

Certain fees cannot increase during the closing process. If the origination, credit and transfer tax fees are increased, the GFE must be revised to reflect the correct amount. If changes to these fees are not corrected at the time of closing, the lender is required to issue a refund to the borrower.