Key Takeaways

- A trade date refers to the month, day, and year that an order is executed in the market.

- If a trade is consummated after regular trading hours, it may be booked with a trade date on the following business day.

- The settlement date marks the date and time of the legal transfer of securities effected between the buyer and the seller.

What exactly happens on settlement date?

What happens on settlement day?

- Bank withdraws funds On settlement day, you will need to provide the funds to purchase the new property. ...

- Seller is notified Once the transfer of the balance of the purchase price of the property has been made, the seller will be notified and confirm receipt of the ...

- Documents are signed and exchanged

When do stock trades settle?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is settlement date method?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is ...

What is the definition of settlement date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

What is trade settlement date?

What Is a Settlement Date? The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer.

Can I trade before settlement date?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

What does trade date mean on a loan?

The trade date is the month, day, and year that an order is executed in the market. It catalogs when an order to purchase, sell, or otherwise transact in a security is performed and is determined for all types of investment security transactions in the market.

What is trade and settlement?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

Do I own stock on trade date or settlement date?

Shares or cash are legally transferred to you on the settlement date, but your trade date signals a legal obligation to sell or pay for shares. It's important to know which date is considered the sale date for tax purposes.

Why do trades take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is the difference between trade date and value settlement date?

The trade date is the date on which a transaction was executed. The settlement date is the date on which a transaction is completed. The value date is usually, but not always, the settlement date.

Do you get money on the settlement date?

If you purchase a security, the settlement date is the day you must pay for your purchase. If you sell a security, it is the date you will receive money for the sale.

How do I know if my trade is settled?

0:244:26Understanding Stock Settlement Dates and Avoiding Good Faith ...YouTubeStart of suggested clipEnd of suggested clipThis means if you sold a stock on monday you wouldn't receive the cash until wednesday. Or if youMoreThis means if you sold a stock on monday you wouldn't receive the cash until wednesday. Or if you sold your shares on friday you wouldn't receive the cash until tuesday when the trade settles.

Can I sell share before t 2 days?

In the normal trading process, delivery shares are credited in the demat account on T+2 days (T being the day of order execution). You cannot sell shares before delivery in normal trading. However, with BTST, you can sell shares on the same day or the next day.

Why is trade settlement important?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend.3 That is, the trade must settle before the record date for the dividend in order for the stock buyer to ...

Can I sell shares on t2 day?

BTST in Zerodha is the facility offered to investors to sell the stocks (bought on T day) before receiving its credit in the Demat account (on T+2 day). Zerodha offers free BTST trading. There are no brokerage charges on BTST trades as it gets treated at par with Equity Delivery trading.

Can I sell before settlement?

The good news is there's generally no penalty for selling before settlement. Once you've got the legals out of the way, selling an off-the-plan property is no different to any other real estate transaction. Some developers have experience with re-sales, or you can go down the traditional path of a real estate agent.

Why is there a 3 day settlement period?

Under the T+3 regulation, if you sold shares of stock Monday, the transaction would settle Thursday. The three-day settlement period made sense when cash, checks, and physical stock certificates still were exchanged through the U.S. postal system.

How soon after buying a stock can you sell it?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

What is good faith violation in trading?

What is it? A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Only cash or the sales proceeds of fully paid for securities qualify as “settled funds.”

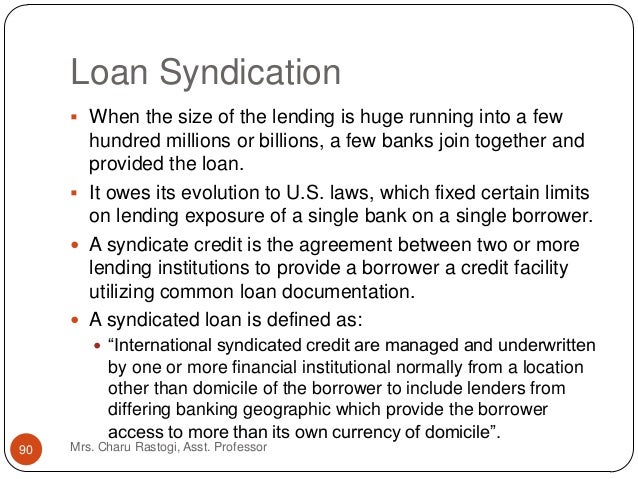

Trade vs. Settlement Date: What’s the Difference?

There are two dates that are important for investors to know when making an investment: the trade date versus the settlement date. When a buy or se...

Why the Difference Between Trade and Settlement Date?

Given the state of modern technology, it seems reasonable to assume that everything should happen instantaneously. But the current rules go back de...

What is the T+2 Rule

The T+2 rule refers to the fact that it now takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesda...

What is the difference between settlement date and trade date?

The distinction between trade date and settlement date is an important one, as the initial recognition of a security is different under trade date accounting versus settlement date accounting.

What is the trade date of a security?

The trade date of a security is the date the agreement is entered into where elements of the transaction including the security description, quantity, price, and delivery terms are set . The date the securities must be delivered and payment received is referred to as the settlement date.

When accounting for the initial recognition of investment securities, there are two critical dates to consider?

When accounting for the initial recognition of investment securities, there are two critical dates to consider: the trade date and the settlement date. What is the difference? And why are these dates important? In this blog post, let’s take a closer look at trade date versus settlement date accounting.

Who is required to record securities?

Thus, depository and lending financial institutions, as well as broker and dealers in securities and investment companies, are required to record securities (regular way security trades) on the trade date.

Does GAAP require a trade date?

Well, for general industries, U.S. GA AP does not specify whether trade date or settlement date is required. As such, an entity should elect an accounting policy to account for purchases and sales of securities on a trade date or settlement date basis.

Why did the stock market have settlement dates?

Settlement dates were originally imposed in an effort to mitigate against the fact that in earlier times, stock certificates were manually delivered, leaving windows of time where a stock's share price could fluctuate before investors received them.

How long after the trade date do you settle a mutual fund?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2". In most cases, ownership is transferred without complication.

What is the date of a security purchase?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

When is the settlement date for a government bond?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date 2

What is the first date of a buy order?

The first is the trade date , which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

What is the trade date for tax purposes?

General rule: trade date controls. For most purposes, the tax law uses the trade date for both purchases and sales. For example, if you sell stock on December 31, you’ll report the gain or loss that year, even though the transaction will settle in January.

How long is the wash sale period?

For example, the 61-day wash sale period includes the date of sale plus the 30 calendar days before and after that date. The time between the transaction date and settlement date can be anywhere from two to five days, depending on whether a holiday and/or weekend intervenes.

What is the day your broker fills the order?

The day your broker fills the order is known as the trade date , and the day the transaction closes is the settlement date. It’s important to know which date controls for tax purposes. Here are some of the reasons it matters: We need to know whether a sale transaction occurred before or after the end of a year.

When do stocks change hands?

Yet the shares and the cash generally don’t actually change hands until two business days later. The day your broker fills the order is known as the trade date, and the day the transaction closes is the settlement date.

Can you identify shares when selling?

If you hold more than one lot of shares and sell part of your holdings, you may want to identify the shares you’re selling. You can identify shares (or change your identification) until the settlement date. See How to Identify Shares.

What does settlement date mean on a stock?

The settlement date, on the other hand, reflects the date on which your broker actually "settles" the trade. Technically, even though your online brokerage account will typically list the shares you've just bought among your holdings, your broker doesn't actually take the money out of your account and put the shares in until a later date.

How long after a trade date do you settle?

With stocks and exchange-traded funds, the settlement date is three business days after the trade date. Mutual funds and options settle more quickly, with a settlement date that's the next business day after the trade date. Why trade and settlement dates matter. The trade date is the key date for one very important aspect of investing: tax rules.

Why do settlement dates matter?

Settlement dates matter because of funding requirements from your broker. Some brokers will let you buy stock even if you don't have enough money currently in your account to pay for the shares, relying on you to deposit cash at some point between the trade date and the settlement date to cover the cost of the stock.

What is the trade date?

Of these two terms, the trade date makes more sense intuitively. It's the date on which you actually entered and executed the trade. Most investors think of the trade date as the only one that truly matters, as it's the one that you have the most control over.

Does it matter if the settlement date comes later?

So as long as you get that trade executed before the market closes on the last day of the year, it doesn't matter that the settlement date comes later. Also, when measuring how long you've owned a stock to determine whether a gain is short-term or long-term, you'll use the trade date to measure your holding period.

Is settlement date lag good?

Having the settlement-date lag can actually be helpful from a liquidity standpoint. But the Securities and Exchange Commission also pays attention to settlement dates, and it has rules that can trip up investors who aren't mindful of those dates.

Do people think twice about trade dates?

Most people never think twice about those two dates , but there are a couple of situations in which it makes a huge difference knowing how trade dates and settlement dates differ. Let's take a look at the various uses of both dates and what you need to know to avoid some nasty surprises. An archaic distinction.

What is the difference between settlement date and trade date?

The difference between trade date and settlement date accounting. When trade date accounting is used, an entity entering into a financial transaction records it on the date when the entity entered into the transaction. When settlement date accounting is used, the entity waits until the date when the security has been delivered before recording ...

What does settlement date mean?

Further, use of the settlement date means that the actual cash position of a business is more accurately portrayed in the financial statements.

What is trade date accounting?

Trade date accounting gives the users of an organization's financial statements the most up-to-date knowledge of financial transactions, which can be used for financial planning purposes.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

Why is there credit risk in forward foreign exchange?

Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement risk because the currencies are not paid and received simultaneously. Furthermore, time zone differences increase that risk.

What is the difference between a trade date and a settlement date?

Trade dates are followed by a settlement date, which occurs after some lag. The settlement date is when the securities legally change hands. In defining the time between trade and settlement dates, common practice is to denote T + days lag (e.g. T+1, T+2, T+3 ), where 'T' refers to the trade date.

What is the settlement date?

The settlement date, the date on which the transfer between two parties is executed, usually differs from the trade date. The amount of time that passes between the trade date and the settlement date differs depending on the trading instrument and is known as the settlement period.

What Is the Trade Date?

The trade date is the month, day, and year that an order is executed in the market. It catalogs when an order to purchase, sell, or otherwise transact in a security is performed and is determined for all types of investment security transactions in the market.

How long does it take for a mutual fund to settle?

Mutual funds may settle one day after the trade date. In 2017, the Securities and Exchange Commission (SEC) enacted T+2 settlement for most securities.

How long does it take to settle a stock?

The processing time for settlement of most listed stocks is two days, so the buyer would officially receive the shares of stock in their trading account in T+2, which equates to a settlement date of Thursday, December 7, 2019. 1.

What is a T+2 settlement?

T+2 settlement pertains to stocks, bonds, municipal securities, exchange-traded funds, certain mutual funds, and limited partnerships that trade on an exchange. 1. Although rare, there are two ways in which settlements can fail.

When can a trade be booked?

If a trade is consummated after regular trading hours, it may be booked with a trade date on the following business day.

What is the difference between settlement date and trade date?

A company can use either option but must stick to whichever one is chosen. The major difference between trade date and settlement date accounting is timing, which also affects financial statements. The distinction between trade date and settlement date accounting is an important one, as it affects the company's financial statements.

What is trade date accounting?

Key Takeaways. Trade date accounting is a method of accounting used to record transactions. A company using trade date accounting would recognize a transaction when the transaction or deal is entered into. Trade date accounting is in contrast to settlement date accounting, which uses the delivery date as the transaction date.

When can interest be recorded on the books?

If interest is involved in the transaction, it cannot be recorded on the books until the settlement date.