How to negotiate with an insurance claims adjuster?

Insurance negotiation tip number one is, know what the real value of your claim is before you ever pick up the phone and talk to the insurance claims adjuster negotiation process. One is the claim settlement range of our case.

What is the first step in the insurance claim negotiation process?

Filing a claim is the first step in the negotiation process with the insurance claim adjuster. The “Reservation of Rights” Letter: The Second Step in the Negotiation Process Soon after filing an insurance claim, you should receive a reservation of rights letter.

What does a claims adjuster do?

The adjuster represents the interests of the insurance company, not the claimants. These damages might result from a direct claim or a personal injury case. The claims adjuster might speak with the claimant and any witnesses to the accident.

Can you negotiate a settlement in a Workers Comp case?

Here is a look at what you’re in for if you want to negotiate a settlement in a workers compensation case. Experience matters in claims settlement. It doesn’t cost anything to speak with a skilled attorney who knows how to maximize your benefits. When Will Workers Comp Offer a Settlement? That’s an easy one: As soon as possible!

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do insurance companies negotiate?

Once the insurance company has received your demand package, the adjuster will attempt to negotiate. Most of the time, the adjuster will send back an offer based on your demand package: often an offer that attempts to meet in the middle between their initial offer and your demands.

Is an insurance settlement negotiable?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How do settlement negotiations work?

What Is A Negotiated Settlement? Reaching a successful settlement agreement typically involves determining an amount for the responsible party to pay in compensation. Deciding on that number typically includes a back-and-forth exchange with the two parties trading offers to reach an agreed-upon amount.

What is an insurance negotiator?

The claim negotiation process consists of back-and-forth communication between you and the insurance company's claims adjuster. The goal of the negotiation process is to convince the claims adjuster that your claim is worth more than what his or her damage report says it is.

How do you respond to a low settlement offer?

If you're wondering how to respond to a low settlement offer, you and your injury attorney can follow these steps:Remain Calm and Polite. ... Table Your Questions. ... Give All the Facts. ... Develop a Counter Offer. ... Respond in Writing. ... Only Settle When Fully Healed.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

How are insurance settlements calculated?

The basic formula insurance companies use to calculate auto accident settlements is: special damages x (multiple reflecting general damages) + lost wages = settlement amount.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long do job negotiations take?

Salary negotiations can take some time. They're typically representative of the company's hiring process on the whole. If the company already has a lengthy interview process (upwards of two months), expect salary negotiations to take a week or two.

How long do settlement negotiations last?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

What is the number one tip for insurance negotiation?

Insurance negotiation tip number one is, know what the value of your claim is before you ever pick up the phone and talk to the insurance adjuster.

What questions do insurance adjusters ask?

But questions allow another person to speak, and they do two things: 1 One, they give you information. Where is the insurance adjuster coming from? What do they perceive to be the bad facts of your case that maybe aren’t bad facts, and that you can remedy by listening to them? Where are they off? Do they have facts that are wrong and that you can correct them? 2 And two, they also give the insurance adjuster the opportunity to speak, and in his own mind listen to what he’s saying, and maybe realize that some of his positions are untenable or unreasonable.

What is the ninth tip when negotiating your claim?

The ninth and final tip when negotiating your claim, to try to maximize your value when you’re negotiating with the insurance adjuster is knowing when to not negotiate. That’s right, it’s probably the most important tip, which is knowing when negotiation is the wrong way. Know when to step away from the table, and file a lawsuit.

Why does my insurance adjuster discount my medical bills?

Sometimes the insurance adjuster discounts your medical bills, perhaps because the insurance adjuster thinks that the medical treatment was unnecessary, or it was too much , or sometimes the insurance adjuster discounts your medical bills because the insurance adjuster believes that they’re going to be written off.

What is mirroring in negotiation?

Mirroring is the technique of listening to what somebody says and repeating the gist of what they say back to you. And the reason this is so important in negotiation is you probably have no relationship with the insurance adjuster the first moment that you pick up the phone, but every little bit that psychologists tell us that you move forward to develop rapport in a relationship helps, and one of the techniques that psychologists tell us works is to listen and then to mirror.

What is the most important part of a negotiation?

Questions are perhaps the most important part of the negotiation and no one ever talks about them. Everyone thinks it’s what you say that will win the day, but come on, let’s be real, right? Are you really going to convince someone that already has another opinion about something just by telling them how strongly you feel?

Can there be new facts that would emerge later that might increase your settlement range?

That’s not to say that there couldn’t be new facts that would emerge later that might increase your settlement range, or decrease your settlement range, but for purposes of your negotiation know what your framework is.

What is the job of an insurance adjuster?

Their job is to determine the extent of the insurance company’s liability to any claimants. The adjuster represents the interests of the insurance company, not the claimants. These damages might result from a direct claim or a personal injury case.

What does an adjuster do for insurance?

The adjuster will use several resources to determine how much it will cost to repair any property damage. They will then submit their report to the insurance company.

What Is an Insurance Claims Adjuster?

A claims adjuster usually opens in a new window works for the insurance company to investigate insurance claims. In some cases, the insurance company hires a freelance company to handle their claims. The adjuster looks at the damages resulting from an accident to property and to people. Their job is to determine the extent of the insurance company’s liability to any claimants. The adjuster represents the interests of the insurance company, not the claimants.

How to lose your rights?

One of the fastest ways to lose your rights is simply not knowing what they are. Never give the adjuster a recorded statement or sign any documents. The insurance company will ask you to sign a medical authorization to release all of your medical records. An attorney might advise you to forward your own records and bills to the adjuster instead. This prevents them from obtaining additional records that they don’t need and which they might use against you. For example, if you are seeking compensation for a back injury, any previous back conditions give the other side an argument that your injury was “pre-existing.”

How to file a claim in an at fault state?

You should file a claim as soon after the accident as possible. Often, insurance companies accept claims over the phone or online. Filing a claim is the first step in the negotiation process with the insurance claim adjuster.

When should you start preparing evidence for a personal injury claim?

Even so, you should start preparing evidence for a personal injury claim immediately after the accident. If you are unable to come to an agreement, you have everything your attorney needs to get a positive outcome in court.

Does no fault insurance matter?

In no-fault insurance states, it doesn’t matter who causes an accident. You file an insurance claim with your own auto insurance company. In at-fault insurance states like California, that isn’t the case. The person who is liable for the accident must pay the parties who experience damages to property and bodily injuries. That makes liability an important issue for the insurance company.

Negotiator - Healthcare Claims

Handle inquiries after the settlement of claims, including payment status.

Claims Consultant, Commercial Casualty (New York Labor Law)

Makes decisions within maximum authorization; recommends settlement values in the disposition of serious and complex claims.

Claims Specialist

Provide oversight/direction to insurers regarding claim reserves and settlement authority.

Contract Specialist

Negotiation techniques sufficient to negotiate prices, terms and conditions, contract modifications and settlements.

Medical Claims Negotiator Trainee

Ensure timely contact and follow up with related parties for prompt resolution on claims.

What do insurance adjusters ask?

They will likely ask how you feel and other similar types of questions to get a response from you. They may even ask about your day or other questions that make it seem as if they care about your well-being. They hope you will fall for this line of questions and that you may disclose something about your physical condition that the medical report doesn’t include.

How many adjusters can you have with an insurance company?

Keep in mind that more than one insurance adjuster may attempt to contact you to discuss your accident. Your insurer, as well as the responsible party’s insurer, may each have an adjuster contact you. Additionally, each of these parties may have more than one adjuster, one to handle your medical claims and one to handle your property damage claim. This can make the entire process feel overwhelming, and the insurance company wants you to feel this way. Oftentimes, victims wonder how best to negotiate with an insurance claims adjuster. You should contact an accident injury attorney immediately to discuss your claim and legal options.

What is accident investigation?

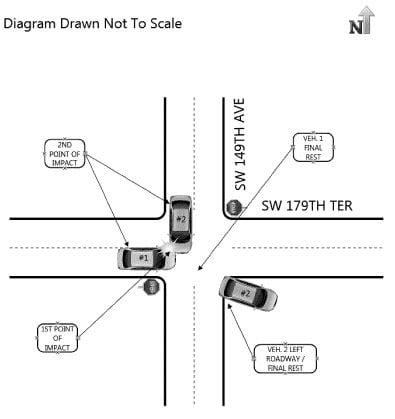

Accident investigations – your attorney will likely use the results of these investigations to determine who caused your accident and better understand the circumstances surrounding it.

What is the importance of evaluating a personal injury case?

They can explain your legal options and explain your rights as they pertain to your case. Importantly, this helps you determine the path forward that works best for you and your family.

How long does it take to file a personal injury claim in New Jersey?

Personal injury cases often take time to resolve. The time limits on filing a personal injury lawsuit in New Jersey and Connecticut provide individuals with two years from the date of the injury to file a claim—except if the accident involves a government entity. In New York, you have three years from the date of your accident. This may seem like a long time, but remember, the clock starts ticking on the date of the accident.

What happens if you owe money on a car and the settlement does not include that amount?

Property damage claims – If you owed money on your vehicle and the settlement does not include that full amount, you will bear the burden of covering that cost.

Do personal injury laws apply to every accident?

Regardless of where you live, certain state-specific personal injury laws will apply to every accident case. While relatively similar across the country, the details of these laws vary by state. Let us assume for a moment that you sustain a brain injury in a preventable accident. These cases may prove complicated because your doctor will need to run numerous tests to determine the severity of the injury, determine your potential recovery time, and determine the long-term impact that the injury may have on your ability to return to work.

What is the first step in the settlement process with an injured worker?

The first step in the settlement process with an injured worker begins after the doctor treating the case declares the patient to be “as healthy as he is going to get.” That is referred to as Maximum Medical Improvement – designated as MMI – and understanding it is vital to everyone involved in workers compensation.

How soon after an injury can you start negotiating?

In fact, as soon as an employee hires a lawyer, negotiations on a settlement can begin. That can be a day after the injury, a week, a month … it’s up to you and your lawyer when you want to start negotiating a settlement.

How many workers compensation cases are settled during mediation?

There is not definitive survey to verify this, but both Judge Sojourner and Pitts agreed that 99% of workers’ compensation cases are settled during mediation.

Why do workers comp cases end up in court?

The 1% of cases that end up in front of a workers compensation judge get there for one of two reasons: The insurance company has denied the worker’s claim for benefits. There are difficult legal issues involved that fall into gray area’s of the law and the two sides want a judge to decide.

Why do we need a workers compensation mediator?

The reason for workers compensation mediation is the two sides can’t agree on a settlement, so they bring another adult in the room and hope everybody is ready to get this matter resolved. The mediator’s job is to act on behalf of both sides and push the process toward a settlement.

What does MMI mean in a work injury?

MMI does not necessarily mean the employee is 100% healthy or even back to where he was before the injury. If you severely injured a shoulder in a work-related accident or suffer with a chronic illness because of your work environment, obviously you won’t be back to 100%.

How many mediators are there in workers compensation?

There is one mediator assigned to every workers compensation judge. However, if the case has some difficult issues and large amounts of money are involved, the two sides could agree to hire a private lawyer to mediate the matter.