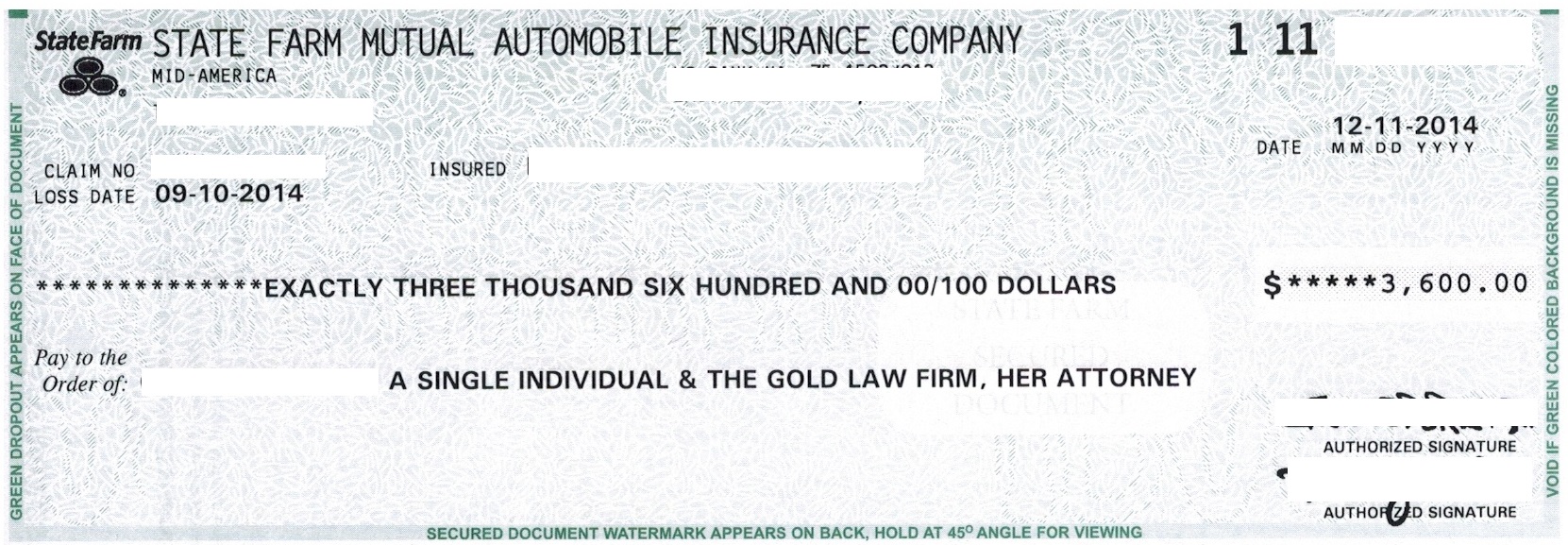

A settlement check refers to an amount of money that you expect to receive in the form of a check following the resolution of a lawsuit. Although the term settlement check refers to a physical “check”, many use the phrase to refer to a direct deposit of settlement proceeds directly to a bank account.

How does it take to receive a settlement check?

What factors determine how long it takes to get a settlement check after a car accident?

- Security of the injury. ...

- Medical treatment duration. ...

- Time is taken by the other party’s insurance company to settle. ...

- Time is taken by your lawyer to review the amount of compensation owed. ...

- State Laws. ...

- Time is taken by your judge to review the settlement amount. ...

- Time required by the attorney to fill all the necessary paperwork. ...

Is my settlement check taxable?

You must report the full settlement of $100,000 to the IRS, on which you are taxed, even if your attorney is entitled to a share. So, yes, you read that right. The settlement total amount is fully taxable even if you split it into separate checks.

How to cash an insurance settlement check?

Where to Cash Insurance Checks – 5 Places

- Walmart Insurance Check Cashing. Walmart stores provide one of the best places one can cash their insurance claim checks. ...

- Local grocery stores. In most cases, grocery stores are unreliable check cashing spots. ...

- 7-Eleven. The only trick involved here is that one must download the app called Transact by 7-Eleven. ...

- Using Apps. ...

- NetSpend. ...

Will an insurance company offer a settlement?

Unless the insurance representative has a solid reason not to pay the claim, you can almost always expect a settlement offer after filing a claim with an insurance company. Of course, the insurance adjuster will start by looking for reasons not to pay.

How long are credit card settlement checks valid?

Is a fake check a scam?

Is the American Express FX fee settlement a scam?

About this website

How can I cash a settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

Do banks cash settlement checks?

If the issuing bank operates a local branch, you can cash the settlement check at the issuing bank. You must present two forms of identification that can include a driver's license or a state-issued identification card.

Can the IRS take my lawsuit settlement?

In some cases, the IRS can take a part of personal injury settlements if you have back taxes. Perhaps the IRS has a lien on your property already, and if so, you could find yourself losing part of your settlement in lieu of unpaid taxes. This can happen when you deposit settlement funds into your personal bank account.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

How long does a 50 000 check take to clear?

Usually within two business days for personal checks; up to seven for some accounts. Usually one business day for government and cashier's checks and checks from the same bank that holds your account.

How do you handle settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Do I have to report settlement money to IRS?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Do you get taxed on settlement money?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How long will bank hold large check?

According to banking regulations, reasonable periods of time include an extension of up to five business days for most checks. Under certain circumstances, the bank may be able to impose a longer hold if it can establish that the longer hold is reasonable.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How long does it take for a large check to clear?

Large deposits (those greater than $5,000) can be held for a “reasonable period of time,” between two and seven business days, depending on the type of check.

I received $ 50.00 due to a settlement .Where should I report ... - Intuit

On August 9,2004 the SEC approved a settlement against Conseco Services and established the Conseco Fair Fund.

Does cashing a check mean accept it as a final settlement?

I demand for my property damage loss. The insurance send me a check for a totaled car. I did not cash the check but continue to demand for the other property loss.

Can I cash a class action settlement check made payable to my ... - Avvo

I live in Miami, FL. My spouse passed away almost 19 years ago. There were no will, no estate to settle. Today I received a class action settlement check in the amount of $104.38 payable to him.

How to Find Out If a Check You Received in the Mail Is ... - sapling

You were likely warned as a kid that if something sounds too good to be true, it probably is. That's the case with most "checks" you receive in the mail from some entity claiming you won a prize, complete with a cashier's check to to prove it. But wait -- there's a catch.

Does cashing an insurance claim settlement check imply my agreement ...

Answer (1 of 6): Normally the check is offered on condition that it is a settlement in full. Actually, most of the time, the insurance company will require you to sign a settlement agreement before they send you the check. Or they may send you something which makes it clear that depositing the ch...

What are the Steps in the Settlement Check Process?

While the time it takes to receive your check will vary, settlement checks undergo a specific process before your funds are ready to deposit. This process proceeds as follows”

How to Deposit Your Personal Injury Settlement Check

You can deposit your settlement check like any other check you receive. Most personal injury firms, including ours, still issue paper checks to clients. The bank teller may bring over a manager to authorize the transaction, but other than that you should be good to go.

Speak with a Personal Injury Attorney Near You!

If you or a loved one would like to know more about filing personal injury claims and recovering compensation for your injuries, you can contact The Advocates by phone at 1-888-565-5277 or use our online form fill here. Don’t wait. You deserve an Advocate.

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

Who pays for a settlement?

Typically, as part of the settlement, the defendant must pay the plaintiff compensation for resulting losses. However, the parties may have very different perspectives on the case. They may disagree about issues of fault or the amount of compensation warranted.

What Is a Legal Settlement?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

How long are credit card settlement checks valid?

(The checks are valid for 90 days, so anyone who receives a check should deposit it within that time frame.)

Is a fake check a scam?

The checks have unnerved many recipients, leaving some wondering if they should cash the check or if it’s some kind of scam. After all, one popular online scam involves sending someone a fake check and then asking them to wire a portion of it back, or collecting personal information before the check can be cashed.

Is the American Express FX fee settlement a scam?

After all, many unexpected windfalls are thinly disguised scams. But if your check comes from the American Express FX Fee Litigation Sett lement Fund, then it's probably legitimate, and you can cash it without worrying.

When Is a Check Issued After a Legal Settlement?

As part of a settlement agreement, the defendant is legally liable to compensate the plaintiff for the costs associated with a personal injury incident. Although the plaintiff agrees to compensate the defendant, it takes negotiations to bridge the gap between the legal issue of fault and the amount of compensation the plaintiff should receive.

How Do I Track My Settlement Check?

Tracking the status of your settlement check starts by determining how long the defendant’s insurance company has to submit the release form. Your lawyer will contact the defendant’s insurance company to discover whether the company has submitted the proper paperwork.

What Happens When the Settlement Check Arrives at Your Lawyer’s Office?

After the settlement check from the insurance company arrives at your lawyer’s office, your personal injury attorney places the funds into an escrow account. Putting the settlement check funds into an escrow account ensures the insurance company has enough money in its account to cover the settlement check. When the settlement check clears, your lawyer can then begin to distribute money out of the escrow account.

What Is a Legal Settlement?

The vast majority of personal injury cases settle outside of a courtroom. Both parties reach an agreement that is worked out between the attorneys representing each party.

How long are credit card settlement checks valid?

(The checks are valid for 90 days, so anyone who receives a check should deposit it within that time frame.)

Is a fake check a scam?

The checks have unnerved many recipients, leaving some wondering if they should cash the check or if it’s some kind of scam. After all, one popular online scam involves sending someone a fake check and then asking them to wire a portion of it back, or collecting personal information before the check can be cashed.

Is the American Express FX fee settlement a scam?

After all, many unexpected windfalls are thinly disguised scams. But if your check comes from the American Express FX Fee Litigation Sett lement Fund, then it's probably legitimate, and you can cash it without worrying.