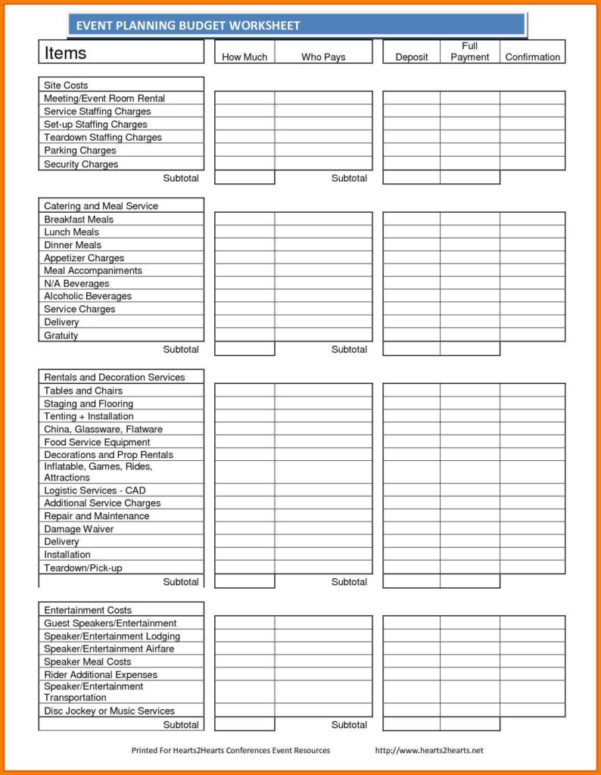

Your debt settlement letter should include the following pieces of information:

- Your proposed settlement amount — Make sure you state this as a dollar amount, not a percentage of your debt.

- How you want the creditor to report the debt to the credit bureaus — Let them know that you want them to report the debt...

- Why they should accept your offe r — This can include a...

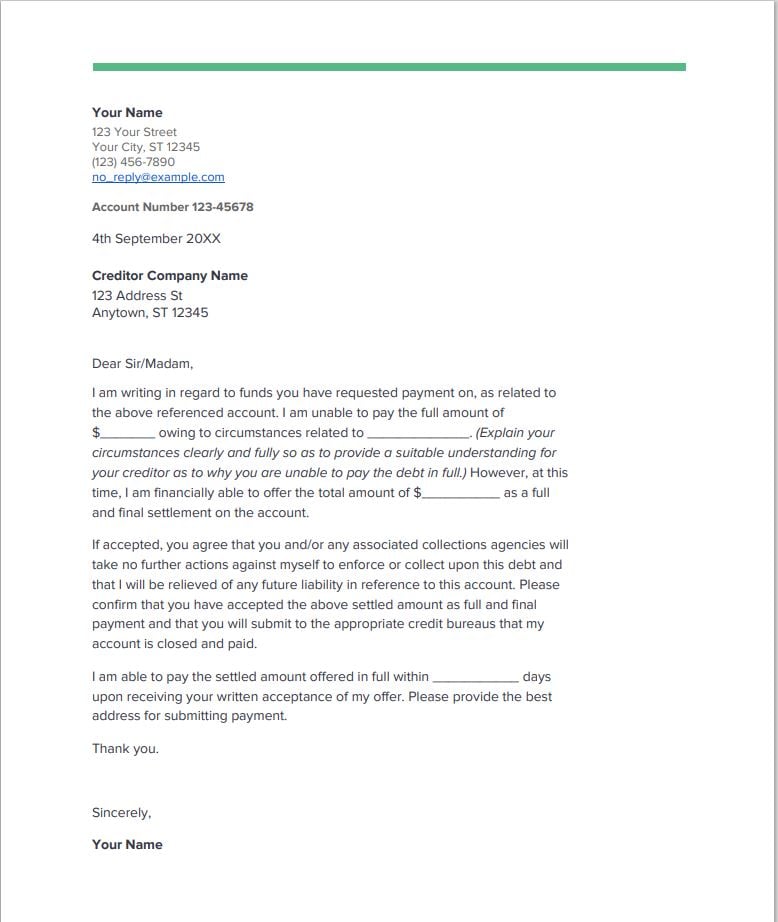

How to write a debt settlement proposal letter?

The Body of the Letter

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. ...

- Final Paragraph. ...

- Your Signature. ...

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

What percentage should I offer to settle debt?

- Credit Cards, Department Store Cards 40%

- Citibank Accounts 65%

- Discover Accounts 65%

- Cell Phones (Collections over $750) 50%

- Apartment Lease Re-letting Fees 40%

- Medical Debts, Collections 50%

- Judgments/Garnishments, Repossessions 80%

- Pay Day Loans, Signature Loans 40%

- Collection Balance Greater than $750 Settlements 40%

What is a standard settlement agreement?

What is a Settlement Agreement? A Settlement Agreement is a contract between an employer and an employee, which settles claims an employee might have, such as: unfair dismissal, breach of contract and workplace discrimination. An employee is required to have independent legal advice on a settlement agreement – usually from a solicitor.

What should be included in a settlement letter?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a reasonable debt settlement offer?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What should a debt validation letter include?

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What proof do debt collectors have to provide?

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Can you dispute a debt if it was sold to a collection agency?

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you don't believe you should pay the debt, for example, if a debt is statute barred or prescribed, then you can dispute the debt.

What is the difference between debt validation and debt verification?

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is included in full and final settlement?

The full and final settlement consist of clearance of dues towards an employee upon their exit from the company. It includes the salary drawn, leave encashment, reimbursements, variables etc.

How do I write a one time settlement letter?

I am willing to opt for one time settlement in order to close the loan account. I can make the all dues in one payment by ......... (Date). Even though it will be very hard in arranging this money, I am still willing to do it.

What percentage will credit card companies settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Should I accept offer to settle debt?

"If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it," he says. The alternative, according to Ulzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What should be included in a debt settlement letter?

You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

What is debt settlement?

Debt settlement is something many people consider if they are able to offer a lump sum of money up front – usually less than the total amount owed – in the hope the creditor will agree to this and accept the debt as settled.

How to contact PayPlan?

If you are looking for guidance when dealing with creditors and proposing a debt settlement, our team here at PayPlan can help. Speak to our experts on 0800 280 2816 or use our contact form to get in touch.

What to do if creditor accepts offer?

If the creditor accepts your offer, ensure this is in writing before you send any money to them. Keep this written confirmation safe too in case there is any dispute in the future, so you can offer this as proof of the agreement.

What does it mean when you get your debt removed?

Doing this means your debt can be removed earlier and that you will no longer need to worry about making repayments.

What happens if you settle early on a debt?

It’s important to remember that if you settle early on your debt, this means you are not paying it in full and so it will show as partially settled on your credit report instead of settled. This can affect your ability to obtain credit in the future, as it suggests to future creditors that you may not be able to pay back the full amount borrowed.

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right?

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right way. This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by.

What is a debt settlement letter?

A debt settlement letter is sent either by the creditor or the debtor which is supposed to contain all the details of the debt on which the settlement is to be done. This can act as the proof of the settlement agreement.

What is the most important part of a debt settlement letter?

The most important part of the debt settlement letter is explaining the financial hardship that is barring you from making the monthly payments on time. Unless you tell them about your financial hardship, they will never know what the actual reason is, that is barring you from making the total amount you owe them.

How to opt for debt settlement?

So, to opt for debt settlement, firstly, you need to negotiate with your creditors or collection agencies to reduce your outstanding payable amount! They might not agree at first when you try to negotiate with them. But you have to remain calm and propose a fruitful offer to settle debt with a reduced lump sum payment!

What is the key question while negotiating?

The key question while negotiating is what amount a debtor should offer the creditor! Each credit company has its own debt settlement policies. The settlement amount differs from one company to another.

How long does it take for a creditor to sell off a debt?

Usually, your creditors sell off your debts to collection agencies after continued non-repayment of 180 days after your default date, that is, the last due date of your payment.

How to address a debt letter?

If possible, address the letter to the most helpful person. Explain your prior debt condition and your current financial position. Enlist your net debt amount. Also include any improvement in your condition to pay back your debts, for example, a fresh job or another source of earning.

What should be included in a letter of settlement?

Well, this is one of the important constituents of your letter! Include everything regarding the account which you want to settle. For example, the debt amount, your default date, the date on which you have received the last intimation from your creditors or collection agencies, etc.

What information is needed for a debt settlement letter?

Your personal information includes your full legal name, mailing address, and current date.

What is a debt settlement offer letter?

A debt settlement offer letter is a written proposal that a debtor or his attorney sends to a creditor or a debt collections agency to offer a specific amount of money to forgive a debt. A creditor may also send a debtor an offer letter. Usually, debt settlement offer letters are sent when a debt is past the due date and has probably been moved to a collection agency, and the debtor is unable to pay all the debt they’ve accumulated.

Why is it beneficial to settle debt?

Settling debt is beneficial to the collector because it implies that they will get a significant part of the total amount owed. As you may already know, the odds of getting an account in collections paid are not good. It is more likely that the debtor will file for bankruptcy and the debt automatically discharged. This means that the debt collector risks getting nothing out of what they are owed. And even if the debtor does not file for bankruptcy, it will still cost a lot of time and money trying to take legal action against the debtor to collect the debt.

Is it bad to settle a debt?

Although settling a debt account is considered negative by many people, it won’t hurt you as much as not paying at all. Suppose you are planning to make a major purchase, for example, buying a home. In that case, you may be required to either settle or clear any outstanding delinquent debts before you can qualify for a loan from any financial lending institution. If paying the debt in full is not an option due to financial constraints, consider settling the account because it is more beneficial to your financial health than letting the debt go delinquent or, worse, to default.

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

How to know when a debt settlement letter was made?

The letter should include a date so you know when the settlement offer was made. Make sure the correct account number is listed on the debt settlement letter. This is especially true if you have multiple accounts with the same company. If you’re dealing with a collection agency, ask them to list both the original account number with ...

How to write a settlement letter?

What Your Settlement Letter Should Include 1 The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. This company letterhead helps make the settlement offer official and helps show the offer came from someone within the company. 2 The letter should include a date so you know when the settlement offer was made. 3 Make sure the correct account number is listed on the debt settlement letter. This is especially true if you have multiple accounts with the same company. If you’re dealing with a collection agency, ask them to list both the original account number with the original creditor and the internal control number or account number used by the collection agency. 4 There should be some type of wording to say that your account will be updated as settled or settled in full. The amount of the settlement payment should be listed. Make sure the settlement amount included in the letter is the same settlement amount you agreed to. If the amount is spelled out, it should be spelled correctly. Any error with the settlement amount could come back to haunt you. 5 Make sure the settlement payment due date is listed and spelled correctly. It should be the date that you agreed to. 6 Fax or mailed copies of the official settlement letter are both acceptable as long as they at least include the information listed above.

How long does it take for a settlement to be updated?

After about 30 days, check your credit report to confirm the settlement has been updated . Your account balance for that account should display $0. The status may display “Settled” or “Settled in full.” If that’s not the case, you should contact the creditor or debt collector to confirm the settlement was received and that your credit report will be updated.

How much should a collection and original debt have?

If both an original debt and debt collection are listed for a single debt, they should both have a $0 balance. You may have to contact the original creditor with proof of payment to have the account updated. You can also use the credit report dispute process to have the credit bureau investigate the account.

What is the best way to make a settlement payment?

Once you have the official settlement letter and you’ve confirmed the information contained in the letter is correct, you can make payment. A money order or certified check are the best payment options.

What happens if you don't get a letter from a creditor?

Once you get the creditor to agree to a debt settlement, you should get an official agreement from the company before you make payment. If you make a payment without having such a letter, things could go wrong.

Can a company ask you to send payment if they didn't make a settlement agreement?

Worst of all, the company could continue to ask you to send payment claiming they didn’t make a settlement agreement. Before you make payment, get a settlement letter from the company that includes specific information.