What details are included in A HUD-1 Settlement Statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan . It also outlines who is responsible for each of those charges - the buyer or the seller - as well as any credits you may receive for things like taxes, insurance or deposits.

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

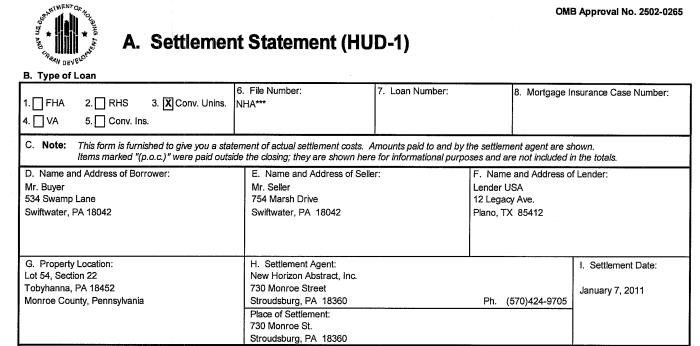

What does a HUD statement look like?

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is a HUD-1 Settlement Statement required for a cash sale?

A: The answer is no. For my readers, a HUD-1 is the settlement statement that is used for most residential closings. HUD stands for the Department of Housing and Urban Development.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is closing disclosure same as HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a final HUD statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is typically required to be included on the closing statement HUD-1?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is a blind HUD?

This simply means all the buyers fees, costs, and cash to close are on one HUD statement, and the seller's costs, fees, monies received, etc. are on a separate HUD closing statement, such that neither party sees the other party's side, also referred to as a Blind HUD's.

What is a closing statement?

6 days agoA closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Is closing disclosure same as HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is a final HUD statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is HUD-1 statement?

The settlement agent shall use the HUD-1 settlement statement in every settlement involving a federally related mortgage loan in which there is a borrower and a seller. For transactions in which there is a borrower and no seller, such as refinancing loans or subordinate lien loans, the HUD-1 may be utilized by using the borrower's side of the HUD-1 statement. Alternatively, the form HUD-1A may be used for these transactions. The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted. The use of the HUD-1 or HUD-1A is exempted for open-end lines of credit (home-equity plans) covered by the Truth in Lending Act and Regulation Z.

Who completes HUD-1?

The settlement agent shall complete the HUD-1 or HUD-1A, in accordance with the instructions set forth in appendix A to this part. The loan originator must transmit to the settlement agent all information necessary to complete the HUD-1 or HUD-1A. (1) In general. The settlement agent shall state the actual charges paid by ...

Who must state the actual charges paid by the borrower and seller on the HUD-1?

The settlement agent shall state the actual charges paid by the borrower and seller on the HUD-1, or by the borrower on the HUD-1A. The settlement agent must separately itemize each third party charge paid by the borrower and seller.

Can HUD-1 be modified?

The HUD-1 or HUD-1A may be modified as permitted under this part. Either the HUD-1 or the HUD-1A, as appropriate, shall be used for every RESPA-covered transaction, unless its use is specifically exempted.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

When to use HUD-1?

The HUD-1 must be used in any transaction where a federally regulated mortgage (deed of trust) is involved. In your case, because you are selling for cash, you don’t need to use that form. Inman Connect.

What does HUD stand for?

HUD stands for the Department of Housing and Urban Development. When Congress enacted the Real Estate Settlement Procedures Act (RESPA) many years ago, it authorized HUD to prepare and implement a uniform settlement statement.

Is it a good idea to withhold rent?

My experience tells me that it is not a good idea to withhold the rent — regardless of the reason. Judges that handle landlord-tenant cases hear all kinds of excuses — some legitimate and some wildly fictitious. Judges sometimes believe that the tenant just does not have the money and is thus fabricating an excuse not to pay.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

When do you need to inspect a HUD-1?

The settlement agent must permit the borrower to inspect the HUD-1 or HUD-1A settlement statement, completed to set forth those items that are known to the settlement agent at the time of inspection, during the business day immediately preceding settlement. Items related only to the seller's transaction may be omitted from the HUD-1.

What is a HUD-1?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development . Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, ...

What is the HUD-1A used for?

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

Is a HUD-1 exempt from the Truth in Lending Act?

The TRID rule mandates the use of a Closing Disclosure form instead. The use of the HUD-1 or HUD-1A is also exempted for open-end lines of credit (home -equity plans) covered by the Truth in Lending Act and Regulation Z. A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts ...

What Information Does the ALTA Settlement Statement Contain?

The charges listed in the ALTA Settlement Statement are broken down into ten different categories, including:

What is the ALTA Settlement Statement?

The ALTA Settlement Statement is a form that itemizes all of the credits and costs associated with a real estate transaction. There are four different versions of this form, including:

Why do buyers and sellers get different versions of closing disclosure forms?

This is partly because the Closing Disclosure contains personal information like your social security number you may not want others to know.

What is the financial section of a mortgage?

The financial section includes important information about the sale of the property including the final purchase price, the amount of earnest money the buyer put down, and the loan amount issued to the borrower. If the seller agreed to pay for repairs or a portion of the buyer’s closing costs, that’s also reflected in this section of the form. You may see a few other charges you’re not familiar with, including:

How much commission does a seller have to pay for a home?

This section shows how much real estate commission the seller will need to pay. Real estate commission usually costs 5% to 6% of the sale price of the home and is split between the buyer’s and seller’s agent.

Does ALTA Settlement Statement have closing disclosure?

The ALTA Settlement Statement doesn’t have the same level of personal detail as the Closing Disclosure form, so it can be shared with all parties involved in a real estate transaction.

How long does it take to file a HUD loan?

One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development (HUD). The three days are meant to allow the borrower to ask the lender questions and clear up any discrepancies or misunderstandings regarding costs before closing.

What Is a HUD-1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction. A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions.

What is the closing disclosure form?

Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form. Either form must be reviewed by the borrower before the closing, in order to prevent errors or any unplanned for expenses.

What form does a settlement agent use for a refinance?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form. Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form.

How many days before closing do you have to provide a mortgage disclosure?

Borrowers must be provided with the disclosure three days before closing. This five-page form includes finalized figures for all closing fees and costs to the borrower, as well as the loan terms, the projected monthly mortgage payments, and closing costs. Mortgage lending discrimination is illegal.

Why do you need to review both mortgages before closing?

Both must be reviewed by the borrower before the closing in order to prevent errors or surprises.

When did HUD 1 replace HUD 1?

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1. In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.