What is unfair settlement practices?

An unfair claims practice is what happens when an insurer tries to delay, avoid, or reduce the size of a claim that is due to be paid out to an insured party. Insurers that do this are trying to reduce costs or delay payments to insured parties, and are often engaging in practices that are illegal.

What is the unfair property and casualty settlement Practices Act?

This regulation is adopted under the authority of the Unfair Claims Settlement Practices Act. The purpose of this regulation is to set forth minimum standards for the investigation and disposition of property and casualty claims arising under contracts or certificates issued to residents of the State.

What are the four classifications of unfair claims settlement practices?

These practices can be broken down into four basic categories: (1) misrepresentation of insurance policy provisions, (2) failing to adopt and implement reasonable standards for the prompt investigation of claims, (3) failing to acknowledge or to act reasonably promptly when claims are presented, and (4) refusing to pay ...

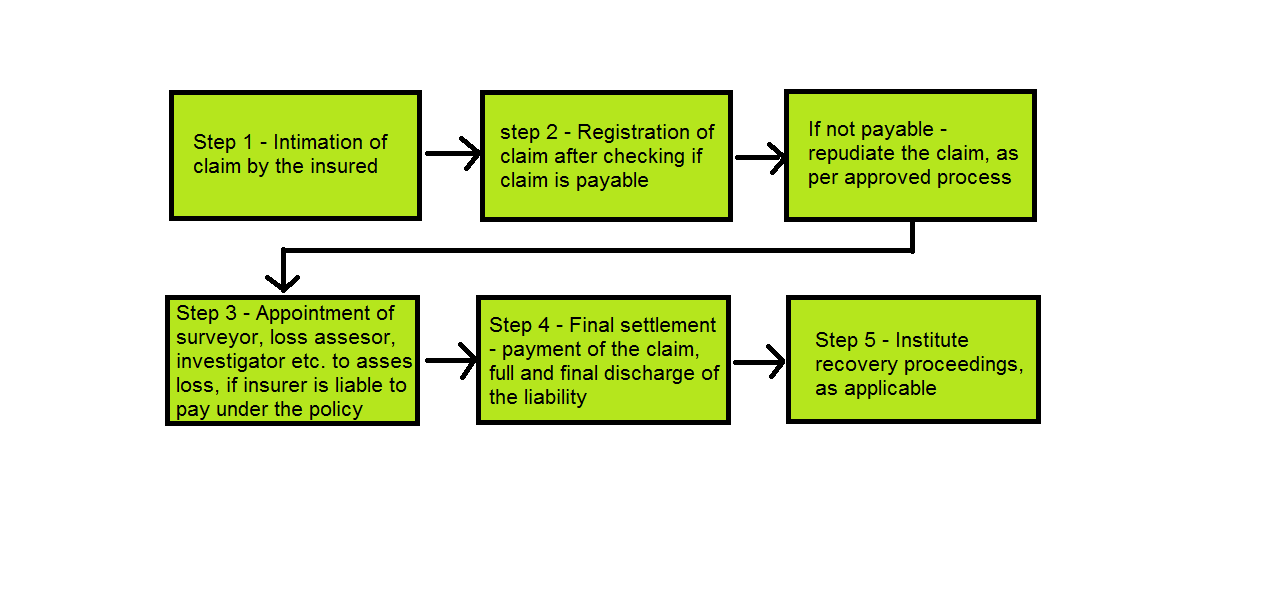

What is claim settlement process?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process. Claim Genius too has a wide array of AI-based tech for automating the claims settlement process.

What is the difference between an unfair claim practice and an unfair trade practice?

These unfair trade practices also serve to define those practices that may be harmful or deceptive to consumers. Unfair claims settlement practices acts, as legislated by the states, protect consumers from some of the more egregious claims settlement and delay practices.

What is the NAIC Model regulation?

The NAIC Model Laws, Regulations, and Guidelines (available in the library) contains documents promulgated by the National Association of Insurance Commissioners as proposed statements of insurance laws that should be adopted by the 50 states.

What does NAIC stand for?

National Association of Insurance CommissionersThe National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia, and five U.S. territories.

Which of the following authorities is in charge of investigating claims held against licensees?

Which of the following authorities is in charge of investigating claims held against licensees? The Commissioner has the power to conduct investigations, administer oaths, interrogate licensees, and issue subpoenas to any licensee or other person in connection with any investigation, hearing, or other proceeding.

Which of the following actions is considered to be an unfair trade practice?

Unfair business practices include misrepresentation, false advertising or representation of a good or service, tied selling, false free prize or gift offers, deceptive pricing, and noncompliance with manufacturing standards.

Who process the claims?

Claims processing begins when a healthcare provider has submitted a claim request to the insurance company. Sometimes, claim requests are directly submitted by medical billers in the healthcare facility and sometimes, it is done through a clearing house.

Who processes the claims in medical billing?

Clearinghouses: The next step in medical claim billing is clearinghouses to which processed claims are sent to. It is a third-party hub that operates between the Provider and the Payor. Clearinghouses sort out all claims, scrub them for errors, format as per industry standards, and send to various insurance carriers.

What are the guidelines on claim settlement?

As per the regulation 14 (2)(i) of the IRDAI (Policy holder's Interest) Regulations, 2017, the insurer is required to settle a claim within 30 days of receipt of all documents including clarification sought by the insurer. However, the insurance company can set a practice of settling the claim even earlier.

Which of the following actions is considered to be an unfair trade practice?

Unfair business practices include misrepresentation, false advertising or representation of a good or service, tied selling, false free prize or gift offers, deceptive pricing, and noncompliance with manufacturing standards.

Which of the following is considered an unfair claim settlement practice in Utah?

Unfair claim settlement practices. The commissioner may define by rule, acts or general business practices which are unfair claim settlement practices, after a finding that those practices are misleading, deceptive, unfairly discriminatory, overreaching, or an unreasonable restraint on competition.

Which of the following is an example of a producer be involved in an unfair trade practice of rebating?

Which of the following is an example of a producer involved in an unfair trade practice of rebating? Telling a client that his or her's first premium will be waived if he/she purchased the insurance policy today. At distribution, all amounts received by the employee are tax free.

How long do insurance companies have to settle a claim in Maryland?

30 working daysInsurance companies in Maryland have 30 working days to settle a claim after it is officially filed. Maryland insurance companies also have specific timeframes in which they must acknowledge the claim and then decide whether or not to accept it, before paying out the final settlement.

How long does it take for insurance to process claims?

Every insurer shall adopt and communicate to all its claims agents written standards for the prompt investigation and processing of claims, and shall do so within ninety (90) days after the effective date of these regulations or any revisions thereto.

Does an insurer discriminate based on race?

No insurer shall discriminate in its claims settlement practices based upon the claimant's age, race, gender, income, religion, language, sexual orientation, ancestry, national origin, or physical disability, or upon the territory of the property or person insured.

Can an insurer base its settlement practices on the claimant's age?

No insurer shall base or vary its claims settlement practices, or its standard of scrutiny and review, upon the claimant's, age, race, gender, income, religion, language, sexual orientation, ancestry, national origin, or physical disability, or upon the territory of the property or person insured.

Can an insurer withhold reimbursement for overpayment?

No insurer shall seek reimbursement of an overpayment or withhold any portion of any benefit payable as a result of a claim on the basis that the sum withheld or reimbursement sought is an adjustment or correction for an overpayment made under the same policy unless:

When does the insurer pay a claim?

PAYMENT OF CLAIM. (a) Except as otherwise provided by this section, if an insurer notifies a claimant under Section 542.056that the insurer will pay a claim or part of a claim, the insurer shall pay the claim not later than the fifth business day after the date notice is made.

What is 542.008. COMPLAINTS AGAINST INSURERS?

COMPLAINTS AGAINST INSURERS; INVESTIGATION. (a) The department shall establish a system for receiving and processing individual complaints alleging a violation of this subchapter by an insurer regardless of whether the insurer is required to file a periodic report under Section 542.006.

What is the 542.006. PERIODIC REPORTING REQUIREMENT?

PERIODIC REPORTING REQUIREMENT. (a) In this section, "claim" means a written claim filed by a resident of this state with an insurer engaging in business in this state.

When does an insurer notify a claimant of acceptance of a claim?

NOTICE OF ACCEPTANCE OR REJECTION OF CLAIM. (a) Except as provided by Subsection (b) or (d), an insurer shall notify a claimant in writing of the acceptance or rejection of a claim not later than the 15th business day after the date the insurer receives all items, statements, and forms required by the insurer to secure final proof of loss.

What is 542.007?

COMPARISON OF CERTAIN INSURERS TO MINIMUM STANDARD OF PERFORMANCE; INVESTIGATION. (a) The department shall compile the information received from an insurer under Section 542.006in a manner that enables the department to compare the insurer's performance to a minimum standard of performance adopted by the commissioner.

Is Sec 542.061 a remedy?

Sec. 542.061. REMEDIES NOT EXCLUSIVE. The remedies provided by this subchapter are in addition to any other remedy or procedure provided by law or at common law.

Industry Guidance

The Office of General Counsel issued the following informal opinion on, December 24, 2002, representing the position of the New York State Insurance Department.

Re: Fair Claim Settlement

On first party property claims on homeowner, business owner policies, and special multi-peril policies, are there written legal requirements that regulate the following: the length of time in which the insurer must send an adjuster; the length of time from adjustment of a claim until an offer of settlement of such claim is made; length of time from when a claim is settled until a claim check is issued?.