A settlement agent is the third party who makes everyone at the closing table happy (sellers are the 1st party, buyers are the 2nd party; everyone else in the transaction are 3rd parties):

What is the role of a settlement agent at closing?

For a real estate transaction, closing agents are professionals who function chiefly for the buyer by conveying the selling interest from the buyer to the seller and ensuring the orderly transfer of the legal title from the seller to the buyer through the closing process. A settlement agent plays a central role in...

Who is involved in a real estate settlement?

Those who are directly involved include buyers, sellers and their real estate agents. Escrow agents, title agents and real estate attorneys are third parties who facilitate the legal transaction. Additionally, loan officers forward paperwork and funds from lenders for the settlement process.

Is the name of the individual conducting the closing required?

The name of the individual conducting the closing is not required. 38 (a) (3) (iv) Settlement agent. The name of the settlement agent conducting the closing, labeled “Settlement Agent.” 1. ENTITY NAME. Section 1026.38 (a) (3) (iv) requires the name of the entity that employs the settlement agent.

What is a settlement agent under 1026 hide?

Hide Under §1026.38 (a) (3) (iv), Settlement Agent refers to the entity that employs the individual conducting the closing. The name of the individual conducting the closing is not required. 38 (a) (3) (iv) Settlement agent.

What is the role of the settlement agent?

Settlement agents are third parties or intermediaries that help a buyer and seller complete a transaction. In financial markets, settlement agents are clearing houses responsible for ensuring the delivery of securities to the buyer, transferring the funds to the seller, and recording the details of the transaction.

What is the settlement statement a closing disclosure?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

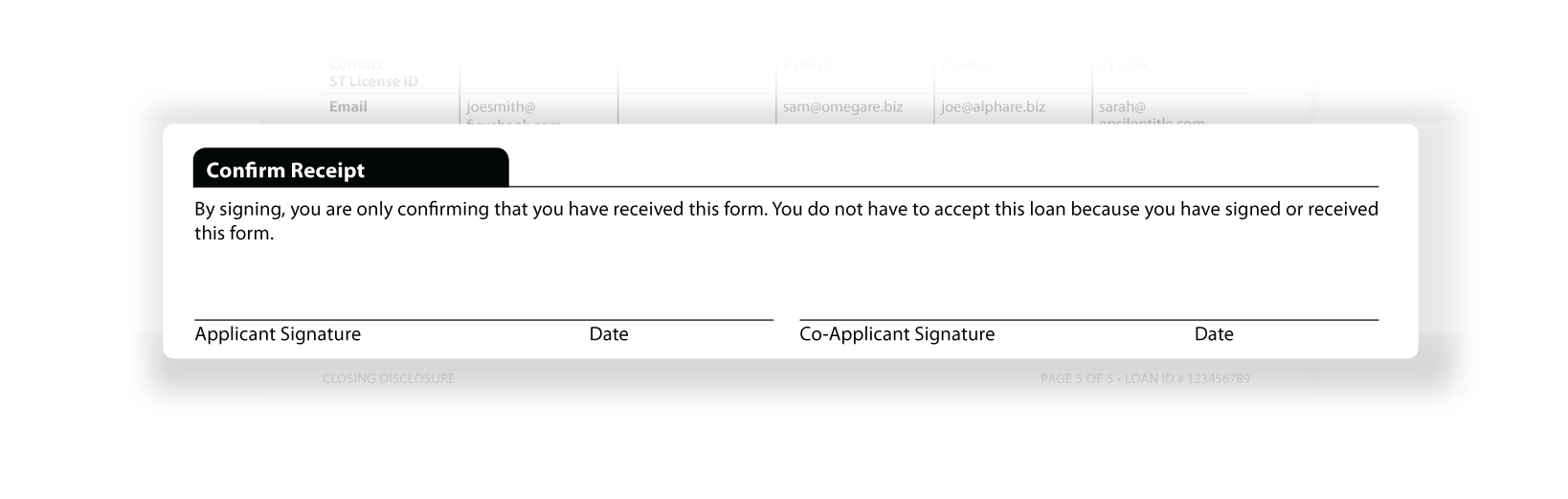

Who is responsible for reviewing the closing disclosure before closing?

Your lender has to get the Closing Disclosure to you at least three business days before you close on your home. It's your responsibility to review the Closing Disclosure and ask questions about anything you don't understand.

What is the latest date that a settlement agent is allowed to provide the seller with the closing disclosure?

What is the latest date that a settlement agent is allowed to provide the seller with the Closing Disclosure? At consummation of the transaction. Which of the following is TRUE regarding the recording of a deed? It is not a legal requirement that a deed be recorded in the County Clerk's office.

Is the settlement statement and closing disclosure the same thing?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What comes after closing disclosure?

What happens after the closing disclosure? Three business days after you receive your closing disclosure, you will use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

Who is responsible for reviewing the closing disclosure before closing quizlet?

RESPA requires the lender to provide the buyer with a CD at least three business days before closing because: - this allows the buyer to review the numbers and understand the transaction before closing.

What is the 3 7 3 rule in mortgage?

Timing Requirements – The “3/7/3 Rule” The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.

What is the 3 day rule for closing?

One of the important requirements of the rule means that you'll receive your new, easier-to-use closing document, the Closing Disclosure, three business days before closing. This will give you more time to understand your mortgage terms and costs, so that you know before you owe.

How many days after CD can you close?

three business daysLike a re-disclosed TIL, the CD has to be delivered three business days before closing (the signing date of the note). Like the HUD-1, if anything changes, a corrected CD must be delivered at or before closing. Like a re-disclosed TIL, a loan may not close within three business days after the CD is delivered.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

What is a closing agent?

For a real estate transaction, closing agents are professionals who function chiefly for the buyer by conveying the selling interest from the buyer to the seller and ensuring the orderly transfer of the legal title from the seller to the buyer through the closing process. A settlement agent plays a central role in ensuring a "quick close.".

What Is a Settlement Agent?

A settlement agent is a party who helps complete a transaction between a buyer and a seller. This is done through the transfer of securities to the buyer and the transfer of cash or other compensation to the seller.

What is clearing house?

For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reporting transaction details to all parties.

What is default risk in forex?

Default risk is when one of the parties completely fails to deliver on their obligations, such as when a firm goes bankrupt. Settlement timing risk is when the transaction eventually settles, but not within the agreed-upon time frame. In the past, settlement timing risk occurred more often in the forex (FX) market, although the development of the continuous linked settlement system has lessened the frequency of these occurrences.

What is clearing in financial markets?

This process can occur several days after the original transaction. In the financial markets, clearing is the process by which trades settle. Clearing is the reconciliation of orders between the transacting parties in the purchase and sale of options, futures, stocks, and other securities.

Why do clearing houses have margin requirements?

In financial markets, clearing houses will impose margin requirements on traders in order to mitigate default risk.

What are the hurdles buyers and sellers must overcome in order to successfully settle the transaction?

A home inspection could show expensive defects, the title search could reveal problems with legal claims to the property, or the buyer's financing could fall through.

What does "if the creditor is not the settlement agent" mean?

In 1026.19 (f) (4) (iv) there is this phrase -- "If the creditor is not the settlement agent." It made it clear to me that creditor and settlement agent are two separate roles in the settlement process. In some transactions (often refinancings and home equity loans), the creditor takes on the role of settlement agent, that doesn't negate the role of settlement agent.# N#I believe that the Bureau's opinion (which is not addressed in the proposed amendments as far as I can see) that Jerrod alluded to makes sense. And yes, that means I've done a "180" on the question. Not first change of mind on TRID, for sure.

Can you be your own settlement agent?

If you aren't using a settlement agent, you don't disclose one. Put another way, you can't be your own agent.

Do you have to be an attorney to be a settlement agent?

So, I am now back to my old opinion that if the lender doesn't use a settlement agent, it doesn't make an entry in the settlement agent column.

Does a creditor negate the role of settlement agent?

In some transactions (often refinancings and home equity loans), the creditor takes on the role of settlement agent, that doesn't negate the role of settlement agent. I believe that the Bureau's opinion (which is not addressed in the proposed amendments as far as I can see) that Jerrod alluded to makes sense.

How long do you have to provide closing disclosure?

Lenders are required to provide your Closing Disclosure three business days before your scheduled closing. Use these days wisely—now is the time to resolve problems. If something looks different from what you expected, ask why.

What do you need to pay at closing?

Actual amount you will have to pay at closing. You will typically need a cashier's check or wire transfer for this amount. Ask your closing agent about how to make this payment. Depending on your location, this person may be known as a settlement agent, escrow agent, or closing attorney.

What to do if your mortgage doesn't match what you were expecting?

It's very important these items match what you were expecting. If they don't, call your lender immediately and ask why they have changed.

How much down payment is required for mortgage insurance?

Mortgage insurance is typically required if your down payment is less than 20 percent of the price of the home.

What to do if closing costs change?

If there are significant changes in your closing costs, ask your lender to explain why.

Why is closing cost increased?

This reduces your upfront costs at closing, but adds to your overall costs because of the added interest you will pay.

Does the seller credit include closing?

It includes the amount you are borrowing, the amount of your deposit, and any rebates or credits paid by the seller or third-party service providers. It does not include the amount you have to bring to closing—that’s below in “Cash to Close.”. Check that your Seller Credit reflects what you agreed upon with the seller.

What is closing or settlement?

The closing or settlement procedure concludes a real estate sale. In this lesson, we will identify who is involved in closing and give a general overview of the process.

Who is involved in closing a house?

The parties directly involved include the buyer, seller and their real estate agents. Neutral third parties also participate in closing. The closing agent will conduct the settlement process. The closing agent may be a title agent, escrow agent or attorney (or someone who holds a combination of these titles).

Who Attends a Property Closing?

Those who are directly involved include buyers, sellers and their real estate agents. Escrow agents, title agents and real estate attorneys are third parties who facilitate the legal transaction. Additionally, loan officers forward paperwork and funds from lenders for the settlement process.

What is an escrow agent?

An escrow agent is a neutral third party who accepts funds on behalf of buyers and sellers for disbursement at closing. Sometimes a real estate attorney conducts the closing and functions as an escrow agent. (Mike and Sally, or Fred the seller, may feel more comfortable having a legal professional oversee the settlement process as closing can be ...

How long before closing do you have to see closing disclosure?

At least three business days before closing day, Mike and Sally will have an opportunity to see the Closing Disclosure for the transaction. This form serves as a final statement which details all funds involved with the transaction and to whom the funds will be allocated. Some buyers use the Closing Disclosure to determine how much to write a check for to pay for the closing costs on the day of settlement, although sometimes other parties will pay closing costs instead, depending on what was decided in the purchase agreement.

What is a loan officer?

Loan Officer. For the purposes of closing, the loan officer is responsible for providing mortgage information and funds on behalf of a lender. As a representative of the lender, the loan officer sends the funds that Mike and Sally have taken out as a loan and gives them to the closing agent to complete the sale.

What is a title agent?

A title agent offers research into the title status of the home and insurance services. Title agents insure that the seller is the legal owner of the property and there are no legal defects in the title which would prevent transfer to the buyer.

What is closing in a deed?

Closing is when the attorney records everything with the county's Register of Deeds. Legally speaking, possession of the home does not occur until the deed is recorded. This is important because the new owners aren't entitled to keys (and garage door openers, etc.) until that time. So make sure to schedule those movers for the next day!

What does "settlement" mean?

Settlement is often what people mean when they say "closing" or "the closing table." The buyers, their agent, and the closing attorney all meet to walk through the Closing Disclosure, Loan Contract, and Deed. The closing attorney leads the conversation and takes everything line-by-line. Once everything is signed, the buyers receive their copy, which is a fairly hefty pack of paperwork.

What happens if the deed is recorded in the afternoon?

If settlement is scheduled for the afternoon, the deed might not record by end-of-business. This means the seller is still the owner, and liable for anything that happens on the property until it is recorded the following morning.

What Is A Settlement Agent?

How A Settlement Agent Works

- During the settlement of a trade in which actual securities and money are exchanged, settlement agents are responsible for settling the accounts of traders and making the process more efficient. This process can occur several days after the original transaction. In the financial markets, clearingis the process by which trades settle. Clearing is the reconciliation of orders between th…

Types of Settlement Agents

- For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reporting transacti…

Special Considerations

- Settlement riskrefers to the risk that a buyer or seller fails to meet their obligations in the transaction. This frequently results in the failure of the transaction to successfully close or settle. In the securities market, there are two main types of settlement risk: default risk and settlement timing risk. Default risk is when one of the parties completely fails to deliver on their obligations, …