Who Pays Title Costs in a Real Estate Contract?

- Contract Controls. As with any real estate transaction, the negotiated contract dictates the terms of the deal, including who is responsible for various costs.

- Buyer's Closing Costs. A buyer is responsible for several title charges, depending on the state in which title insurance is being obtained.

- Seller's Closing Costs. ...

- Other Closing Expenses. ...

Who pays The QDRO fee?

Your attorney will contact a financial consulting firm to prepare the QDRO. 3. Both parties will submit their one-half share of the QDRO fee. The total fee is usually $600 to $800 and is divided equally between the parties. The parties pay the financial services firm directly. The payment does not come out of the QDRO.

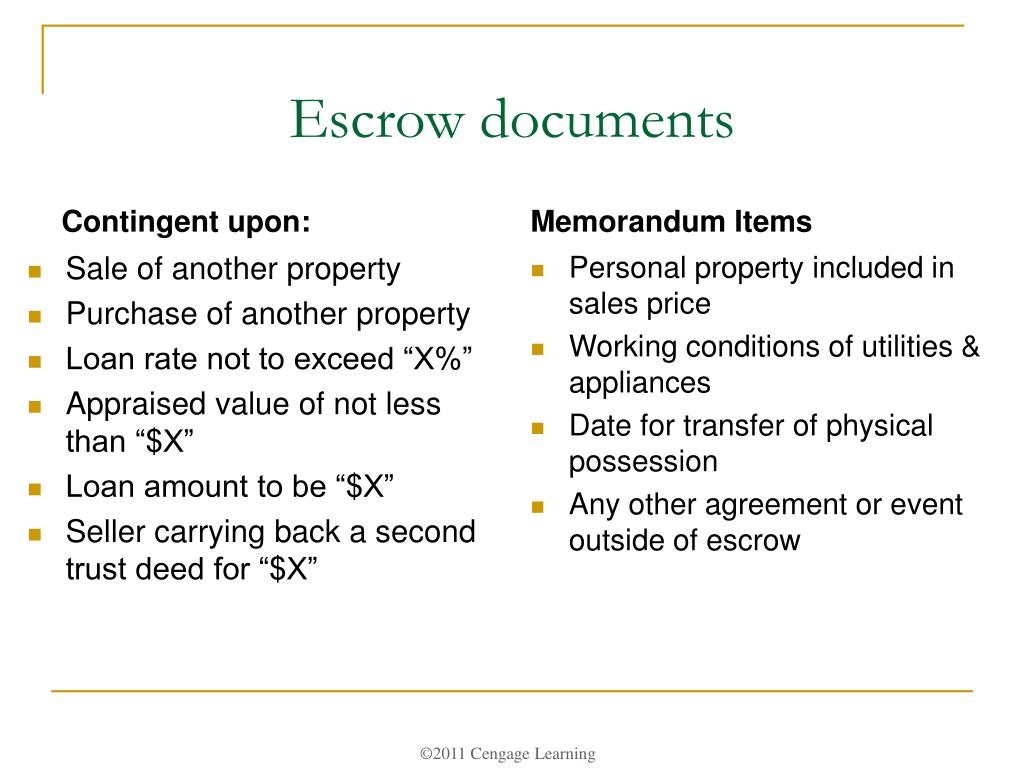

Who usually pays escrow fees?

Who Usually Pays Escrow Fees?

- Escrow Handling Fee. The escrow handling fee is generally split between the buyer and seller, but this can be negotiable depending on contract details.

- Title Insurance Fee. Title insurance can include both the owner's policy and also the lender's policy. ...

- Transfer Tax Fee. ...

- Miscellaneous Lender Fees. ...

- Taxes and Insurance. ...

Who pays strata fees?

Strata fees . Each strata lot owner must pay strata fees to cover budgeted common expenses.In some strata corporations common expenses may only be paid by some strata lot owners; for example, if owners are in a section with common expenses that only apply to that section or in a type of strata. Strata fees will include contributions to the operating fund, for expenses that occur once a year or ...

Who pays title costs in a real estate contract?

You close a wholesale real estate deal by getting all the inspections, appraisals, surveys, computer searches, etc., done before the seller and buyer sign the purchase and sale agreement contract. The buyer pays the seller for the title to the property. Also, while some of the listed items are required by most states, others are optional.

Does seller pay closing costs in Virginia?

Who Pays Closing Costs in Virginia? Both the buyer and seller pay closing costs in VA, but each party pays for different services and fees. Home sellers pay for the agent commission fees and transfer taxes, while the buyer pays for most other closing costs.

Who pays for title search in Florida?

the seller'sThe cost of a title search in Florida is typically the seller's responsibility and ranges anywhere from $150 to $1500, depending if it's a residential or complex commercial title search and examination.

Is settlement and closing the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Who pays for title insurance in Virginia?

the home buyerIn Virginia, the home buyer typically pays for both title insurance policies. It may be possible to include a credit from the seller in your contract. Your realtor or mortgage lender will probably refer you to the title insurance company they usually work with.

Does seller pay closing costs in Florida?

According to the experts at Royal Shell Real Estate, in most Florida real estate transactions the closing costs are split between the buyer and the seller. The seller typically pays 5% to 10% of the home's value in closing costs, while the buyer is responsible for 3% to 5%.

Why does the seller pay for title insurance in Florida?

The purpose of title insurance is to protect both the buyer and the lender against any sort of financial loss in the event that something comes up that would prevent the seller from selling the home.

What not to do after closing on a house?

So to raise the odds that all goes smoothly, here are five things you should never, ever say at closing.'I quit my job this morning' ... 'I can't wait to get all the new furniture we bought' ... 'I can't believe the appraisal came in $20,000 above the sales price' ... 'I can't wait to gut the house'More items...•

What is the settlement deadline?

What Is a Settlement Date? The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

Who sets the settlement date?

the sellerIt's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale. As a general rule, property settlement periods are usually 30 to 90 days, but they can be longer or shorter.

Does seller pay for title insurance in Virginia?

So, who pays for title insurance? As a general rule of thumb, the homebuyer is responsible for purchasing both lender's title insurance and owner's title insurance.

Does seller pay closing costs?

The real estate commission or the broker's fee has to be paid by the seller at the time of closing. And the rest of the charges and expenses are the buyer's responsibility. Unless the terms of the deal dictate otherwise, it is the responsibility of the buyers to pay the closing costs.

Who pays transfer tax in Virginia?

The buyerThe buyer typically pays the state transfer tax as well as the county or city taxes if applicable. The buyer also pays the recordation taxes or “mortgage stamps.” The buyer needs one stamp from the state and one from the city or county. The state of Virginia also charges the seller a separate transfer tax.

How much does a title company charge in Florida?

How is Title Insurance Calculated in Florida?Liability AmountCost per $1,000Over $100,000 to $1 million$5.00 per $1,000Over $1 million to $5 million$2.50 per $1,000Over $5 million to $10 million$2.25 per $1,000Over $10 million$2.00 per $1,0001 more row

Is a title search required in Florida?

To answer the question, is title insurance required in Florida, yes, at least in the case of a loan policy.

Who pays doc stamps in Florida buyer or seller?

the sellerThe party responsible for payment of the documentary stamp tax on a sale is usually determined by the terms of the purchase agreement. However, because the seller is required to provide marketable title to the property, the seller usually pays these taxes.

Who pays the deed transfer tax in Florida?

sellerThere are some jurisdictions that dictate who pays the tax, but for the most part, there is no mandate and it's up to the buyer and seller to negotiate who makes the payment. In Florida, the seller traditionally pays the transfer tax or documentary stamp.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to rev...

Buyer Or Seller – Who Pays The Title Fees?

It depends on where you live. In some parts of the country, it’s customary for the seller to pay the buyer’s title insurance and the buyer to pay t...

How Much Are Title Fees On Average?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing cos...

Is Title Insurance Required?

Title insurance is not required to own a home. However, without it, you lack protection from claims against your ownership of the home and risk los...

Who Pays For Owner’S Title Insurance Or Closing Costs?

In the case of the home buyer’s title insurance policy, it is customary for the seller to pay the costs of the policy issued to the new home owner....

How Much Should You Pay in Closing Costs?

For most home buyers, closing costs are a percentage of the total cost to buy a home. Most of the closing costs are the responsibility of the home...

Are You Planning to Close on A Home Soon?

Then, it’s a good idea to work with a knowledgeable team of title insurance experts. Bay National Title Company offers reliable real estate owned a...

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

Are Title Fees Negotiable?

Many title fees are set by state and local government agencies. Who pays them, however, is negotiable. If the conditions are right, a buyer may be able to negotiate that the seller covers all or part of the closing costs. These are referred to as seller concessions. They’re essentially agreements a seller makes to cover certain fees.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

How much does it cost to record a deed?

The national average for this charge is around $125.

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

What is a CPL in closing?

Closing Protection Letter (CPL) The CPL is an agreement written by the title company that protects the lender in case of losses caused by misconduct on the part of the closing agent. (Title companies charge this fee to draft the document.) Commitment.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.

Who pays the premium on a refinance?

In a refinance transaction, the lender’s premium is typically paid by the borrower , but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What is Scott Title?

For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry . We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal services. Buying a home is usually the single largest investment most people make in their lifetime, and our experienced team will make sure you are fully prepared for a smooth and successful closing. Contact us today to learn more about our services.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

Who pays for owner’s title insurance or closing costs?

In the case of the home buyer’s title insurance policy, it’s customary for the seller to pay the costs of the policy issued to the new homeowner. Mortgage lenders also require a title insurance policy. It’s customary for the lender’s policy to be paid by the home buyer.

What is Bay National Title Company?

Bay National Title Company offers reliable real estate owned and title services for home buyer and lenders.

What is closing cost?

Closing costs are the fees associated with the purchase of the home and are paid at closing. Title insurance is a wise investment as it protects home buyers and mortgage lenders against defects or problems with a title when there is a transfer of property ownership.

What happens if you have a lien on your home after you sell it?

When a lien is placed on your home, it can prevent you from refinancing or selling your home unless you pay the outstanding amount.

Can closing costs be negotiable?

Fees can be negotiable, and it’s important to keep in mind that you can shop lenders until you find one that offers you a loan with lower fees. Closing costs may vary depending on where you live, the type of property you buy, as well as the type of loan you choose.

Who registers a new deed?

The title company (or in some cases a lawyer or notary) will register the new deed with the appropriate government office. This record will show the buyer as the new homeowner. The home seller will receive any proceeds they earned from the sale, once their mortgage balance and closing costs have been paid off.

Is title insurance confusing?

Title insurance is confusing for anyone who’s a first-time home buyer. What type of title insurance policy is required to own a home and who is responsible for paying the closing costs and title insurance? It’s important to understand the intricacies that go into the home buying process. First, you need to understand what closing is ...

Who is responsible for title insurance?

A buyer is responsible for several title charges, depending on the state in which title insurance is being obtained. In addition to miscellaneous closing expenses, such as as an appraisal report, credit report and an escrow service charge, the buyer is almost always responsible for paying at least a portion of the title insurance premium ...

Who pays escrow fees?

Who Usually Pays Escrow Fees? While the buyer typically pays the title costs in a real estate transaction, the contract ultimately dictates which party is responsible for the charges. However, because the buyer is the one who is actually obtaining title to the property, it is the buyer who most often pays the costs associated with insuring ...

What is a boilerplate real estate contract?

In a boilerplate real estate contract, the terms typically state that the buyer is responsible for all costs associated with obtaining title insurance, unless the contract alters those obligations.

Do you have to pay transfer taxes on a real estate transaction?

While every state has different tax regulations, the seller typically must pay any applicable transfer taxes. In a real estate transaction, the title company ultimately picks up those costs, and the seller is obligated to reimburse the title company. Additionally, if there was a mortgage on the property, the seller must pay the title company to record a document saying the mortgage has been paid.

Does a title company charge a fee for closing?

Additionally, a title company often charges a title closer fee for a representative of the title company to attend the closing, which the buyer also pays. It is also customary for the buyer to tip the title company representative at the conclusion of the closing. Consumer Financial Protection Bureau.

Do title companies pick up taxes?

For example, if real estate taxes are due within 30 days of a closing, the title company must pick up the taxes, and the buyer will reimburse the title company at closing. Additionally, a title company often charges a title closer fee for a representative of the title company to attend the closing, which the buyer also pays. It is also customary for the buyer to tip the title company representative at the conclusion of the closing.

What are closing costs?

Closing costs include taxes, lender fees and title fees that a homebuyer pays at settlement . Watch this video to prepare for the process.

Do you have to pay transfer taxes on title insurance?

Consumers must also pay transfer & recordation taxes (buyer & seller, respectively) and a title insurance policy premium. These costs vary depending on the purchase price of your home. We encourage you to grab a Quick Quote today for an accurate and anonymous estimate of how much money you will need to bring to the closing table.

Is settlement fee included in closing costs?

Settlement fees are fixed, meaning they remain constant regardless of purchase price; however, settlement fees are not the only fees included in closing costs. Consumers must also pay transfer & recordation taxes (buyer & seller, respectively) and a title insurance policy premium.

What is broker commission?

Brokerage commission (the sum or percentage of the sale price, previously agreed upon by the seller and real estate agent).

What are utility deposits held by?

Utility deposits held by gas) electric, cable, telephone and other companies.

When is the closing date determined?

During the negotiation stage of the transaction, a mutually agreed-upon date for closing is determined.

Who pays title insurance?

Title search and title insurance (paid by either the seller or the buyer).

Who pays escrow fees?

Escrow fees are typically split 50-50 between buyer and seller. Escrow fees cover the services of an independent third party to conduct the closing and manage funds during the transaction.

Who pays for the home inspection?

The buyer pays for a home inspection if they choose to conduct one. Inspections are meant to protect the buyer from any hidden defects in the home that could impact the home’s value, cost a lot of money to repair or make the home unsafe to live in.

Who pays for the appraisal?

Buyers cover the cost of the home appraisal, which is usually required by their lender if they will be taking out a mortgage to buy the home. Even if it isn’t required, buyers sometimes complete appraisals for peace of mind that they’re making a smart investment and not overpaying.

Who pays for a land survey — buyer or seller?

The home buyer pays for a land survey, if they request one. Considered due diligence (much like a home inspection), a land survey lets the buyer know the details of the exact property they’re purchasing, including property boundaries, fencing, easements and encroachments.

Who pays for title insurance?

Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender. In general, title insurance ensures the home is “free and clear” and that no third party has an unknown claim to the property.

Who pays real estate transfer taxes?

The seller is responsible for paying any real estate transfer taxes, which are charged when the title for the home is transferred from the old owner to the new owner. Transfer taxes can be levied by a city, county, state or a combination.

How much does title insurance cost?

Cost: Lender’s title insurance coverage costs between $500 and $1,000.

How do closing costs work?

At the end of a typical home sale, both the seller and buyer pay an assortment of taxes and transaction-related fees that are collectively called "closing costs."

How much does closing cost add up to?

Seller closing costs typically add up to 1-3% of the sale price, while buyers generally owe around 3-5%. How much you'll actually pay will depend on the laws and conventions in your local area, as well as your negotiations with the buyer or seller.

What is loan cost?

Loan costs: Fees that the buyer's lender charges to process and approve the loan. Loan costs are usually paid by the buyer.

What are closing costs when buying a house?

When you buy or sell a house, you must pay a set of taxes and other fees called closing costs. These expenses cover the cost of finalizing the sale and transferring the property's title into the buyer's name.

How much cash can you bring to closing?

This can limit the amount of cash you need to bring to closing. However, there's likely a limit to how much help you can receive, which could be as low as 3% depending on what kind of mortgage you're getting.

What to ask when negotiating a purchase agreement?

When you're negotiating a purchase agreement, you can ask the other party to cover fees or taxes you'd typically pay. Or you can ask them to contribute a lump sum toward your overall closing cost burden.

How to keep money in your pocket on closing day?

If you want to keep more money in your pocket on closing day, your best bet is to work with a real estate agent who offers built-in savings. Clever can help you find one!