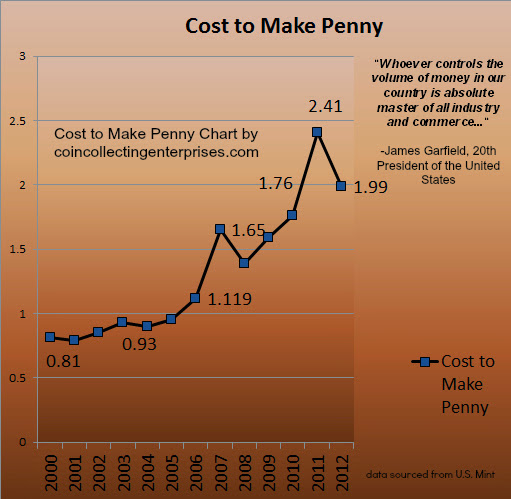

If the overpayment or underpayment produces a difference that is less than the difference that is defined in the Maximum penny difference field, the penny difference amount is posted to the penny difference account.

Full Answer

What happens if the difference is less than the Penny difference?

If the difference is equal to or less than the penny difference that is specified in this field, the difference will be posted to the penny difference ledger account that is specified on the Accounts for automatic transactions page. Maximum overpayment or underpayment – Enter the amount that is accepted for overpayment and underpayment.

How do small (penny) differences arise on customer accounts?

Let’s have a look at the issue of small (penny) differences on customer accounts and how they can arise. The next screenshot shows you a customer transaction that was generated when a free-text invoice for a total amount of 5000 $ was posted. Once the invoice becomes due, the customer pays 4995 $; that is, the customer pays 5$ short.

What is an example of a transaction in settle?

Settlements can also generate transactions. For example, the settlement of an invoice and a payment might produce a cash discount, realized gain or loss, sales tax adjustments, write-offs, or penny differences. When you try to settle a transaction, you might notice a symbol that indicates that the transaction is marked in another location.

What happens if the overpayment or underpayment produces a penny difference?

If the overpayment or underpayment produces a difference that is less than the difference that is defined in the Maximum penny difference field, the penny difference amount is posted to the penny difference account.

How and when transactions are settled?

How and when transactions are settled can be complex subjects, so it's essential that you understand and correctly define the parameters to meet your business requirements. This topic describes the parameters that are used for settlement for both Accounts payable and Accounts receivable.

Why is settlement unable to determine the actual accounts receivable?

Due to the order of processing events, settlement is unable to determine the actual accounts receivable/accounts payable ledger account from the payment’s accounting entry. Settlement reconstructs what the ledger account will be for the payment.

What is specific behavior in a cash discount ledger?

The specific behavior depends on whether the overpayment amount is between 0.00 and the amount that is entered in the Maximum overpayment or underpayment field, or whether the overpayment amount is more than the Maximum overpayment or underpayment amount.

What is an unspecific discount?

Unspecific – The cash discount amount is reduced by the overpayment amount. This behavior is always used, regardless of whether the overpayment amount is more than or less than the amount that is entered in the Maximum overpayment or underpayment field.

What is the default entry in the Cash Discount amount to take field?

If this option is set to No, and a credit note is marked on the Settle transactions page, the default entry in the Cash discount amount to take field is 0 (zero).

What is settlement in Dynamics 365?

Settlement is the process of settling an invoice against a payment or credit note. These parameters are located in the Settlement area of the Accounts receivable parameters and Accounts payable parameters pages.

Where is the cash discount posted on invoice?

Accounts on the invoice lines – The cash discount is posted to the ledger accounts on the original invoice.

What happens if you don't specify a maximum penny difference tolerance?

If we don’t specify a ‘Maximum penny difference’ tolerance that we accept to be posted to the account specified for penny difference we can not post the journal as due to the debit amount being rounded downward, it’s sum will never be equal to the sum of the credit amounts.

What does the amount in transaction currency column show?

The Amount in transaction currency column shows us the journal line amounts, eg. 49.50 and 99, but the ‘Amount’ column(company currency value) shows us the exchange adjusted value in the company currency.

Why is the parameter used in connection with foreign currency postings?

The parameter is used in connection with foreign currency postings as these can cause rounding differences

How to identify 10$ cash discount?

What you can also identify from this form is that no balance remains on the customer account from this transaction.

Can you make a full settlement for vendor transactions?

Final remark: Please note that the full settlement functionality can also be made available for vendor transactions simply by modifying the VendOpenTrans form as illustrated above for the CustOpenTrans form.

Symptoms

Assume that you set a Maximum overpayment or underpayment or Maximum penny difference value on the Settlement tab in the Accounts receivable parameters dialog box in Microsoft Dynamics AX 2012.

Resolution

A supported hotfix is available from Microsoft. There is a "Hotfix download available" section at the top of this Knowledge Base article.

Status

Microsoft has confirmed that this is a problem in the Microsoft products that are listed in the "Applies to" section.

What happens to the outstanding balance of a transaction when it is settled?

As transactions are settled, the outstanding balance of each transaction is increased or decreased, as appropriate. Usually, when an invoice and a payment are settled, the status and balance of each transaction is updated according to the following rules:

What is settlement topic?

It describes which transaction types can be settled, and the timing and process for settling them. It also describes the results of the settlement process.

What happens if the payment amount is more than the invoice amount?

If the payment amount is more than the invoice amount, the invoice balance is reduced to 0.00, and the invoice is closed. The payment remains open, and the balance is the difference between the payment amount and the invoice amount.

What is a payment proposal?

A payment proposal is used to select invoices to pay. The payment proposal is started manually, and then the system automatically marks the selected invoices for settlement when the payments are created. If payments are created manually, you can use the Settle transactions page to select invoices for settlement.

What are some examples of transactions that can be generated by settlement?

For example, the settlement of an invoice and a payment might produce a cash discount, realized gain or loss, sales tax adjustments, write-offs, or penny differences.

When can a transaction be settled?

Transactions can be settled when payments are entered. For example, when you make a payment to a vendor, you typically select which invoices to pay. By selecting invoices, you mark them for settlement against the payment.

Can you settle a payment without settling it?

Transactions can also be settled after they are posted. You can enter and post a customer payment without settling it against any invoices. However, you might want to make sure that the payment is settled against the correct invoice before you post the settlement.