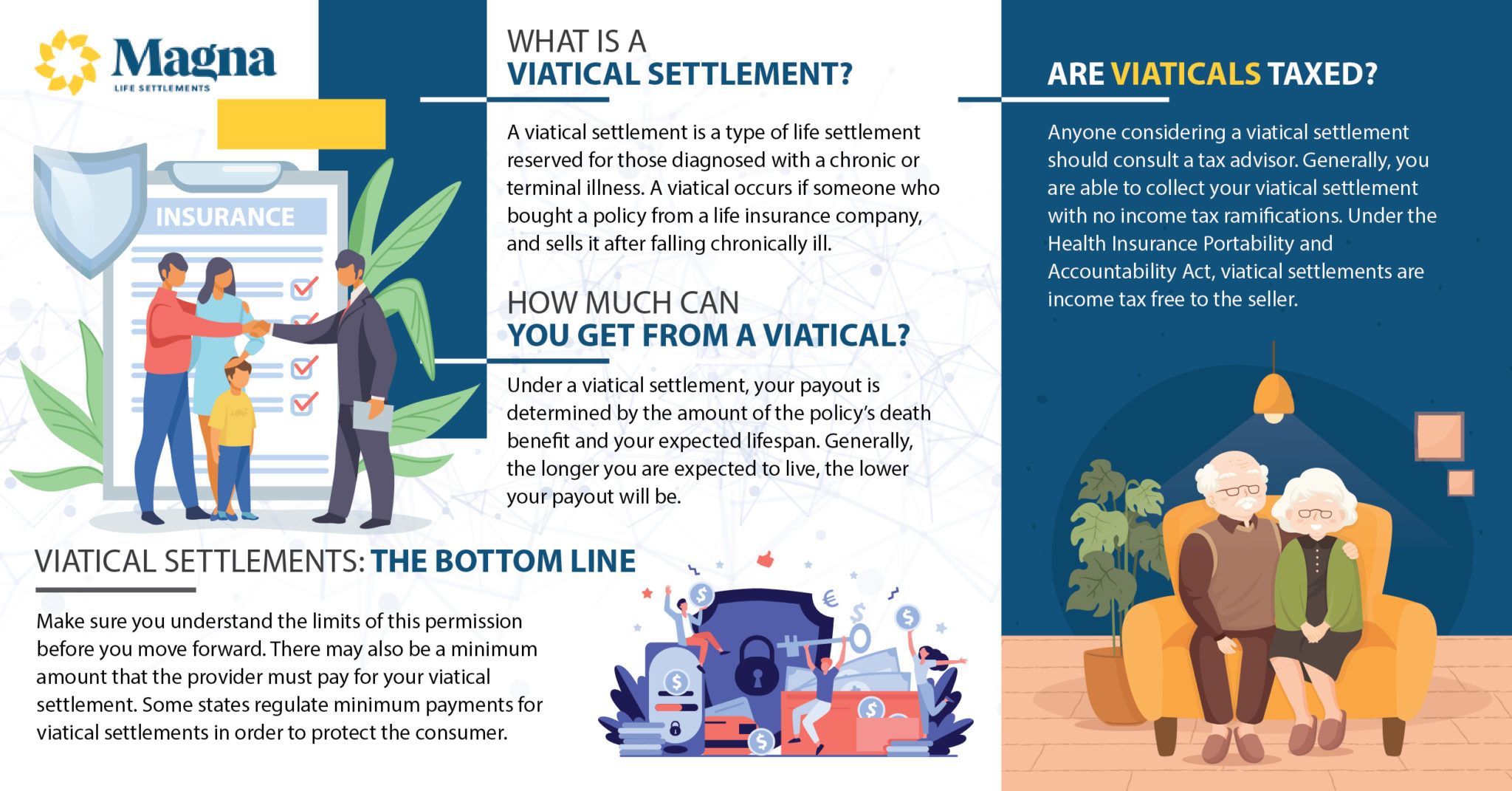

A viatical settlement is an arrangement in which you sell a life insurance policy to a settlement company before the insured person dies. The settlement company takes ownership of the policy and eventually receives the death benefit. A viatical settlement is one way to access a significant portion of your policy’s value prior to death.

Full Answer

What is a viatical settlement company?

A viatical settlement company specializes in viatical settlements, or investments wherein the settlement company buys a life insurance policy from an insured person. The seller receives an upfront cash payment for their life insurance policy, while the viatical settlement company gets ownership of the insurance policy.

Do I qualify for a life insurance viatical settlement?

Life insurance policyholders who are seriously or chronically ill, have a policy with a face value of a minimum of $100,000, and have held their policy for at least two years will typically qualify for a viatical settlement. How Much is Paid in a Viatical Settlement?

What is a'viatical settlement'?

What is 'Viatical Settlement'. A viatical settlement is an arrangement in which someone with a terminal disease sells his or her life insurance policy at a discount from its face value for ready cash. The buyer cashes in the full amount of the policy when the original owner dies. A viatical settlement is also referred to as a life settlement.

What is a viatical provider?

There is also a third party, which is called a viatical provider, who takes responsibility for all of the expenses associated with the policy. If you’re familiar with a life settlement, you might be wondering what makes it different from a viatical settlement.

What is a viatical settlement in insurance?

A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at a price that is less than the death benefit of the policy. When the seller dies, you collect the death benefit.

Who approves a viatical settlement?

the CommissionerA viatical settlement contract or disclosure statement form shall be deemed approved by the Commissioner if not disapproved within 60 days from submission.

Who negotiates viatical settlements between a policy owner and an viatical settlement provider?

Viatical settlement broker“Viatical settlement broker" means a licensed agent who acts on behalf of a viator and for a fee, commission or other valuable consideration offers or attempts to negotiate viatical settlements between a viator and one or more viatical settlement providers.

What are viatical settlement companies?

Essentially, viatical companies and life settlement providers purchase life insurance policies of individuals with life-threatening illnesses for a fair price. They give you a lump-sum settlement, typically in the form of a cash payment, in exchange for your life insurance policy.

Who negotiates viatical settlement contracts?

Viatical settlement broker(10) "Viatical settlement broker" or "broker" means a person that on behalf of a viator and for a fee, commission, or other valuable consideration offers or attempts to negotiate viatical settlement contracts between a viator and one or more viatical settlement providers.

Which of the following are required to obtain a viatical settlement?

To be eligible for a viatical settlement, a seller must meet these requirements: The policyholder must be terminally ill or chronically ill. Generally, this means a person with a short life expectancy. Sellers must have medical records to prove they meet these specifications.

What is another name for the insured in a viatical settlement?

What is another name for the insured in a viatical settlement? The insured in a viatical settlement is also known as the viator.

Which of the following is not true regarding regulations of viatical settlements?

All of the following are true regarding viatical settlements, EXCEPT: Select one: A terminally or chronically ill insured can sell their life insurance policy to a third party in exchange for payment of a large portion of the death benefit.

What is the primary feature of a viatical settlement?

So, What Is the Primary Feature of a Viatical Settlement? Essentially, it is the prepayment of a death benefit at a reduced rate. However, it is important to note that the cash settlement is provided in exchange for the sale and transfer of the ownership rights of the life insurance policy.

Who benefits from viatical settlement?

Viatical settlements are for people who are terminally or chronically ill, no matter their age. Also, as noted, the proceeds from a viatical settlement typically aren't considered taxable income. Life settlements are generally only available only to women age 74 and older and to men age 70 and older.

What is meant by a viatical?

viatical. / (vaɪˈætɪkəl) / adjective. of or denoting a road or a journey. botany (of a plant) growing by the side of a road.

What is the difference between a life settlement and a viatical?

The two main categories of insurance policy sales are life settlements and viatical settlements. A life settlement differs from a viatical settlement because the insured in a life settlement is usually healthy, while a viatical settlement pertains to a sale by an insured with a terminal illness.

What is another name for the insured in a viatical settlement?

What is another name for the insured in a viatical settlement? The insured in a viatical settlement is also known as the viator.

How do I become a viatical settlement broker?

To apply for a registration as a Viatical Broker, an individual must: pay the applicable fee of $250.00; complete and submit the Maryland Limited Lines Supplement Form; complete and submit the NAIC Uniform Individual Application.

Who does a life settlement broker represent?

the policy ownerA life settlement broker is a state licensed professional who represents life insurance policyholders in the life settlement marketplace. This individual or entity is regulated by the Department of Insurance in the home state of the policy owner to solicit life settlement offers from multiple life settlement providers.

What is the main purpose of the seven pay test?

What is the main purpose of the Seven-pay Test? It determines if the insurance policy is a MEC. If an insured withdraws a portion of the face amount in the form of accelerated benefits because of a terminal illness, how will that affect the payable death benefit from the policy? The death benefit will be smaller.

What is a Viatical Settlement?

Viatical settlements allow someone diagnosed with a life-threatening illness to sell their life insurance policy for cash. This person is known as...

How Does a Viatical Settlement Work?

Once someone has decided to sell their life insurance policy, they usually reach out directly to a viatical settlement company or viatical settleme...

How Much Money Will I Get from a Viatical Settlement?

Typically, the rate you’ll receive is 50 to 70% of the policy’s value. For example, let’s say the viator, John, has a life insurance policy for $50...

How Much Money Will I Get from a Viatical Settlement?

Typically, the rate you’ll receive is 50 to 70% of the policy’s value. For example, let’s say the viator, John, has a life insurance policy for $50...

Viatical Settlements vs. Senior Life Settlements – How Are They Different?

On the surface, it seems like viatical settlements and senior life settlements are the same things, but they differ in a few crucial ways. Senior L...

Why Choose a Viatical Settlement?

The main reason why a person may choose to sell a viatical settlement is that the policyholder needs the money. This need could be for anything: a...

How Quickly Can I Get a Viatical Settlement?

Typical payout time with American Life Fund is within a few weeks.

Who Qualifies for a Viatical Settlement?

Any individual with a chronic or life-threatening illness and an existing life insurance policy qualifies for a viatical settlement. The policy can...

Why Choose a Viatical Settlement?

The main reason why a person may choose to sell a viatical settlement is that the policyholder needs the money. This need could be for anything: a house, a car, a family emergency, or an investment opportunity.

What is a viatic settlement?

Viatical settlements allow someone diagnosed with a life-threatening illness to sell their life insurance policy for cash. This person is known as the “viator.”

How Quickly Can I Get a Viatical Settlement?

Typical payout time with American Life Fund is within a few weeks. Here’s how it works:

What is viatical life?

Per the National Association of Insurance Commissioners (NAIC), any individual with a chronic illness or terminal illness, defined as a condition that affects the activities of daily living, and an existing policy with an insurance company may qualify for a viatical life settlement.

How long does a viaticated policy last?

Generally speaking, the viaticated policy needs to have been in effect for a minimum of one year and have a valuation of at least $100,000. A viatical settlement purchaser may also have life expectancy requirements for each applicant, typically two to four years or less.

What do policyholders use viatical settlement funds for?

Some policyholders use the funds from their viatical settlement to seek further treatment or even experimental treatments.

How long do you have to live to get a life settlement?

Life settlements are typically given to those who are expected to live more than two to four years or whose diagnosis is debilitating but not terminal, and viatical settlements are given to those expected to live less than two to four years.

What Is a Viatical Settlement?

A viatical settlement is an arrangement in which someone who is terminally or chronically ill sells their life insurance policy at a discount from its face value for ready cash. In exchange for the cash, the seller of the life insurance policy relinquishes the right to leave the policy's death benefit to a beneficiary of their choice.

Who licenses viatical settlements?

In many states in the U.S., companies that buy viatical settlements to sell to investors are licensed by state insurance commissioners. For more information and a list of state insurance regulators, visit the National Association of Insurance Commissioners (NAIC).

How long does a life insurance policy last in a viatical settlement?

In a viatical settlement, the life expectancy of the insured is generally two years or less. If a life insurance policyholder is considering a life settlement, they should first consider all available options for obtaining the needed cash. There might be a better way to utilize a life insurance policy.

How long does a life insurance settlement last?

A life settlement differs from a viatical settlement in that the insured seeking to sell their life insurance policy has an estimated life expectancy greater than two years.

What is ADB in insurance?

An accelerated death benefit (ADB) is also an option. An accelerated death benefit usually pays some of a policy’s death benefit before the insured dies. This could provide the holder of the life insurance policy with the cash needed without having to sell the policy to a third party.

Can a buyer of a viatical settlement check on your health?

The buyer of a viatical settlement is allowed to check on your health condition periodically . Make sure you understand who will get access to this information. All questions on an application form must be answered truthfully and completely—especially questions about medical history.

What is a viatical settlement?

In a viatical settlement, you sell the benefit of your life insurance policy when you have very little time left to live due to illness or injury, often less than two years. You can sell any type of life insurance — term, whole, universal, etc. — but you'll need to find a buyer in the market for that type of policy.

How long do you have to hold a viatical settlement before selling it?

States that regulate viatical settlements often require that you've held the policy for at least two to five years before you sell it. This is so you don't buy a policy to sell immediately after receiving a terminal diagnosis.

What is an accelerated death benefit?

In many cases, an accelerated death benefit will replace the need for a viatical settlement. The process for claiming an accelerated benefit is relatively straightforward. The rider is available on most insurance policies and the benefits are often not much smaller than a settlement would offer.

What is required to take part in a viatical settlement?

In most states, taking part in a viatical settlement requires both you and the buyer (the "viatical settlement provider, " which is usually a company) to meet requirements, including rules about your health. Like an accelerated death benefit, most settlements require you to be chronically sick or suffering from a terminal illness.

How much money do you get on a $1 million death benefit?

Compare that payment to an accelerated death benefit rider, which might allow for monthly payments over a two-year period. Your $1 million policy might allow for $250,000 in total payments and, when you die, your beneficiaries would still get $750,000 — the original $1 million minus your $250,000 in accelerated payments.

What is a life insurance settlement?

Sales of a life insurance policy are generally called life settlements, and when they take place near the end of life, they're called viatical settlements. Viatical settlements are different from policy options that allow you to tap part of your death benefit while you're still alive, though they often apply in the same situations.

Do you have to sell a settlement to get tax treatment?

To get the best possible tax treatment of your payment, you’ll need to sell to a company within your state. Viatical settlement taxation can be complex, and anyone considering a settlement should talk to an independent financial advisor.

What is viatical settlement?

Wondering what a viatical settlement is all about? This kind of settlement happens when somebody who is chronically or terminally sick sells their life insurance policy to someone else. The buyer of the policy gets the death benefit when the seller passes away. The policy seller will receive a payout that is more substantial than the cash surrender value but remains less than the full death benefit amount.

What are the advantages of viatical settlement?

The most considerable advantage of choosing a viatical settlement instead of other options is that the policyholder will acquire more income than would be granted by the policy’s cash surrender value. This can provide extra money for medical expenditures or make life more comfortable while waiting for the end.

What happens to a life insurance policy when the seller dies?

Once the settlement is made , the company or individual who purchased the policy will make payments on premiums and receive the death benefit when the seller dies.

How does a life settlement work?

If you’re familiar with a life settlement, you might be wondering what makes it different from a viatical settlement. There are a few important things that differ between the two: 1 Viatical settlements are created for the chronically or terminally ill. With a life settlement, there is no requirement to be sick. 2 Life settlements only work with permanent policies like variable life insurance, universal life insurance, or whole life insurance. With a viatical settlement, this is not a requirement. 3 Most of the time, a viatical settlement will pay much more money than a typical life settlement. 4 Taxes are different for life settlements and viatical settlements. Viatical settlements aren’t subject to income tax, but some parts of a life settlement will be. The amount spent on premiums isn’t counted, but the remainder will be subject to capital gains and income taxes.

How long do you have to own a life insurance policy before it can be sold?

Keep in mind that New Mexico and Michigan regulate viatical settlements but do not do the same for standard life settlements. One of the things that varies the most is how long you have to have owned your policy before it can be sold. This is typically two years, but some states have no regulations and others can have up to a five-year waiting period.

How many states have viatical settlement laws?

Thorough viatical settlement regulations and laws are provided in Puerto Rico as well as 45 states.

Why do people take out life insurance?

However, if your recipients are independent financially, they may not require the death benefits. Your own needs may be more critical, which can lead to the need for a viatical settlement.

What is viatical settlement?

A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at a price that is less than the death benefit of the policy. When the seller dies, you collect the death benefit. Your return depends upon the seller's life expectancy and ...

Who licenses viatical settlements?

Many state insurance commissioners license the companies that buy viatical settlement to sell to investors and may have information about a specific company or viatical settlements in general. To find out who your state insurance regulator is, please visit the website of the National Association of Insurance Commissioners. The Federal Trade Commission also has information for those who are considering selling their life insurance policies.

What happens to a seller's return if she dies?

When the seller dies, you collect the death benefit. Your return depends upon the seller's life expectancy and the actual date he or she dies. If the seller dies before the estimated life expectancy, you may receive a higher return. But if the seller lives longer than expected, your return will be lower. You can even lose part of your principal ...

Can you lose your principal if the seller lives longer than expected?

But if the seller lives longer than expected, your return will be lower. You can even lose part of your principal investment if the person lives long enough so that you have to pay additional premiums to maintain the policy. Viatical settlements can be risky investments.

Should I work with a viatical settlement broker?

If you’re considering a settlement, you already have a lot to deal with. Working with a licensed VSB can:

Is a viatical settlement right for me?

One key consideration is whether you can wait a few months before getting the settlement, since the process can take a while.

What is a Viatical Settlement?

Are you chronically or terminally ill and looking for a way to pay for things that will improve the quality of your remaining life, such as medical treatments, home health care, or travel? Do you have a life insurance policy? If so, then you may have an option for funding these expenses that you didn’t know about. It’s called a viatical settlement.

How Are Viatical Settlement Payouts Determined?

Your policy’s face value, of course, is a big factor in how large your payout from a viatical settlement will be. Recall that your payout will always be less than the policy’s face value but more than its cash surrender value.In addition, your policy’s premiums will affect the payment you receive in a viatical settlement. Because the entity that buys your policy will be paying its premiums, a higher premium will result in a lower settlement.

How to find out if a viatical settlement broker is licensed?

Before choosing a broker to work with, contact your state’s department of insurance to find out if viatical settlement brokers are required to be licensed in your state. If so, you want to make sure the broker is currently licensed. You also want to check the broker’s disciplinary history. Avoid working with a broker who has a history of breaking insurance laws or receiving customer complaints.

What are the two types of viatical settlements?

There are two types of viatical settlements: settlements for the terminally ill and settlements for the chronically ill.

Why do people need viatical settlement?

The fundamental purpose of life insurance is to provide financial support to one’s beneficiaries, and in many situations, that purpose is still paramount.

How much is a life insurance policy worth?

Depending on what source you consult, you may read that your policy needs to be worth at least $50,000, at least $100,000, or at least $200,000 to be a good candidate for a viatical settlement.

How long does it take to get funds from a viatical?

While the viatical transaction process length will vary by situation, you may get funds in as little as a few weeks compared to the six to nine months it usually takes for a life settlement.

What Does Viatical Settlement Company Mean?

A viatical settlement company specializes in viatical settlements, or investments wherein the settlement company buys a life insurance policy from an insured person. The seller receives an upfront cash payment for their life insurance policy, while the viatical settlement company gets ownership of the insurance policy. When the insured dies, the viatical settlement company receives the death benefit.

What happens to a viatical settlement company when an insured dies?

When the insured dies, the viatical settlement company receives the death benefit. A viatical settlement company is also known as a viatical settlement provider. Advertisement.

Why is viatical settlement so risky?

This can be a little risky because their return depends on how long the insured lives. If the insured lives much longer than expected, the viatical settlement company's return will be low. As a result, viatical settlement companies often only work with people who are terminally ill.

Do viatical settlement companies work with terminally ill people?

As a result, viatical settlement companies often only work with people who are terminally ill. This way the company can better predict its earnings and avoid surprises.

How to get a viatical settlement?

Your medical records, personally identifiable information, and financial situation will all be shared with your broker (only after your written consent, of course), so the company should have internal and external safeguards in place to protect your personal details. As an applicant for a viatical settlement, you can always ask to see a copy of the broker’s physical and cybersecurity policies and procedures to reach a personal comfort level with the company.

When was viatical settlement first used?

This term was first applied to life insurance in 1911, when Supreme Court Justice Oliver Wendell Holmes established that a life insurance policy is an asset and therefore, the owner has the right to sell it. A viatical settlement is very similar to a life settlement, with a few crucial differences. Life settlements also allow owners ...

What happens to the buyer of a life insurance policy when the policyholder dies?

In exchange for the cash settlement amount paid to the policyholder, the buyer continues to pay the monthly premiums on the policy and becomes the beneficiary of the policy, receiving the death benefit when the policyholder passes away.

How to get cash for medical crisis?

Regardless of your motivations or needs, you might find yourself looking at various options for accessing cash to get you and your family through this trying time. One often-overlooked resource for funding is your life insurance policy. Many policies, including whole life insurance and universal life permanent policies, build cash value as you pay your premiums. Borrowing against these savings is an option, as well as withdrawing the funds stored in your policy’s reserves. However, there’s a third option that is especially relevant for someone facing a medical crisis: a viatical settlement.

How long does it take to get funds from a broker to sell a policy?

You’ll receive funds you can use within a matter of weeks. Once you’ve reached out to a broker with your intent to sell your policy, you’ll go through a verification process, review your offer, and complete the necessary paperwork. When you receive your settlement, you can quickly access the proceeds.

Can you cancel a viatical settlement?

Keep in mind, however, that you can cancel a viatical settlement transaction at any time before your closing documents are signed and notarized. Your beneficiaries will no longer receive the face value of your life insurance policy as a death benefit when you pass away.

Can you use viatical settlement funds for your mortgage?

Your viatical settlement funds are yours to use however you choose. Your broker, buyer, and life insurance company do not place any restrictions on how you spend your settlement. Pay off your mortgage and credit card debt, take a vacation, or prepay monthly household bills so you won’t have to worry about making ends meet. You could also create a financial safety net for your spouse to use after you’re gone. Instead of waiting for the event of your death, your family can share the proceeds of your life insurance settlement with you during your final days.

How Viatical Settlements Work

- Life insurance is a powerful tool for protecting loved ones. But in some situations, it’s better to receive the funds before the insured person dies. For example, your spouse and children might be financially secure, not need the death benefit, and prefer that you have plenty of money availabl…

Viatical Settlement Regulations

- Most states regulate viatical settlements, and the rules vary from state to state. Check with your state’s insurance division to verify that any settlement company you’re evaluating is authorized to conduct business in your area. Laws often require settlement providers to disclose important information about your transaction as well as alternatives to using a viatical settlement—but it’s …

Viatical Settlements vs. Life Settlements

- Life settlements are similar to viatical settlements because in both arrangements, you sell your policy for a lump sum, the buyer takes over the death benefit and premium payments, and you can use those funds during your lifetime. However, there are some crucial differences:

Criticisms of Viatical Settlements

- Pitfalls for Investors

Investors considering viatical settlements should be aware of several potential pitfalls. There’s no way to predict if or when your investment will pay off, making insurance policies difficult to value. If somebody lives longer than anticipated, you won’t receive payment when you expect it. As a re… - Pitfalls for Policy Owners

There are a few items to be aware of if you’re considering a viatical settlement: 1. The primary drawback for policy owners is that your beneficiaries will not receive a death benefit after you sell the policy. 2. You could lose access to need-based benefits like Medicare if you no longer qualif…

Alternatives to Viatical Settlements

- There are other ways to access the cash value in your policy that may be more advantageous than selling it through a viatical settlement.

What Is A Viatical Settlement?

Understanding A Viatical Settlement

- Viatical settlements enable owners of life insurance policies to sell their policies to investors. Investors buy the full policy or a portion of it at a cost that is less than the policy's death benefit. The investor's rate of returndepends upon when the seller dies. The rate of return will be lower if the seller outlives their estimated life expectancy. Conversely, the rate of return will be greater if …

Criticism of Viatical Settlements

- From an investment perspective, a viatical settlement can be extremely risky. The rate of return is unknown because it's impossible to know when someone will die. If you invest in a viatical settlement, you are speculating on death. Therefore, the longer the life expectancy, the cheaper the policy. However, because of the time value of money(TVM), the longer the person lives, the l…

Viatical Settlement vs. Life Settlement

- Individuals not facing a health crisis may also choose to sell their life insurance policies to get cash, which is more typically referred to as a life settlement. A life settlement differs from a viatical settlement in that the insured has a longer life expectancy. In a viatical settlement, the life expectancy of the insured is generally two years or less. If a life insurance policyholder is consid…

Special Considerations

- There are various points to consider before deciding on either a viatical settlement or a life settlement: 1. It's important to get quotes from several companies to ensure a competitive offer. 2. Request an in-force illustration or reprojection for your current policy. 3. Not all proceeds received from the sale of a life insurance policy may be tax-free; make sure you understand all ta…