^ Only statutory fines or penalties imposed for the non-compliance/breach of a requirement of law are not deductible against your rental income.

What rental expenses are deductible on my taxes?

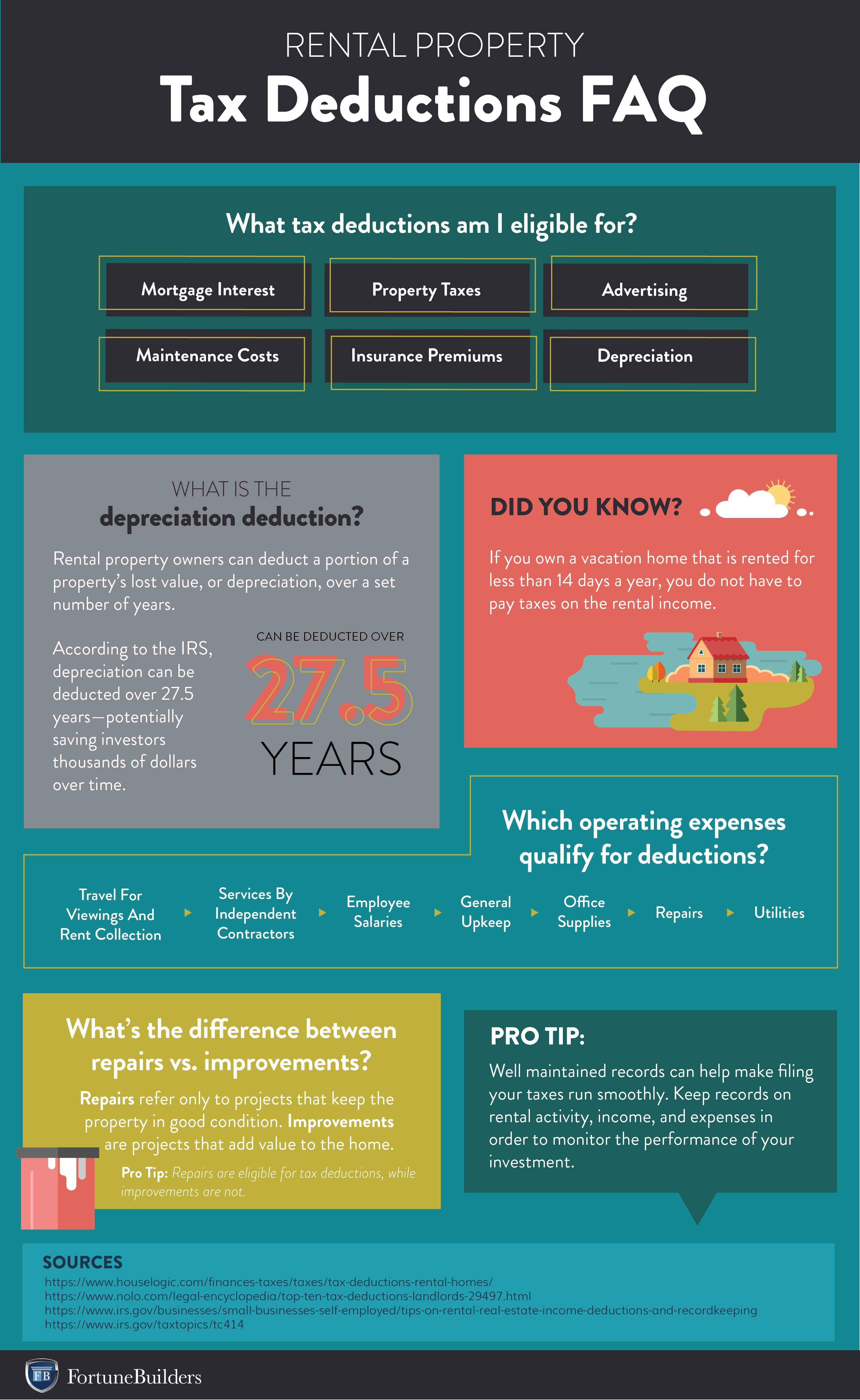

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs.

Is there a tax on lawsuit settlements?

Even worse, in some cases now, there’s a tax on lawsuit settlements, with legal fees that can't be deducted. That can mean paying tax on 100%, even if 40% off the top goes to your lawyer.

Are settlement statements tax deductible when buying a home?

Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year. Compare Offers from Several Mortgage Lenders.

Are legal fees for a lawsuit tax deductible?

One possible way of deducting legal fees could be a business expense if the plaintiff is in business, and the lawsuit relates to it. Some may claim that the lawsuit itself is a business, but in the past, that tax argument usually failed.

Are settlement fees tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

What expenses can be deducted from rental income?

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs.

Are closing costs tax deductible in 2021?

You closing costs are not tax deductible if they are fees for services, like title insurance and appraisals. You can deduct these items considered mortgage interest: Mortgage insurance premiums — for contracts issued from 2016 to 2021 but paid in the tax year. Points — since they're considered prepaid interest.

Can you subtract closing costs from capital gains?

Capital Gains Tax The price you paid for the home is also called the tax basis. The closing costs associated with selling the rental property that are tax deductible, discussed above, can be used to lower overall basis (or price you paid for the home), thus potentially lowering the capital gains tax.

How do I avoid paying tax on rental income?

Use a 1031 Exchange Section 1031 of the Internal Revenue Code allows you to defer paying capital gains tax on rental properties if you use the proceeds from the sale to purchase another investment.

Are refinance closing costs tax deductible on rental property?

Most closing costs for the refinance of an investment property are not deductible. The mortgage interest and property taxes can be deducted, but the rest are added to the cost basis for the asset and are depreciated.

What closing expenses are tax deductible?

Tax-deductible costs may include: Upfront and annual mortgage insurance premiums paid on a loan insured by the Federal Housing Administration (FHA) Funding fees charged for a loan guaranteed by the U.S. Department of Veterans Affairs (VA)

Are loan origination fees tax deductible on rental property?

In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements and any credit card interest for purchases related to your rental property.

What home improvements are tax deductible 2021?

"You can claim a tax credit for energy-efficient improvements to your home through Dec. 31, 2021, which include energy-efficient windows, doors, skylights, roofs, and insulation," says Washington. Other upgrades include air-source heat pumps, central air conditioning, hot water heaters, and circulating fans.

What can I deduct from capital gains on rental property?

Deductions like these are subtracted from any capital gain generated from the sale of a rental property, in order to reduce the amount of capital gains tax owed....Other Expense Deductions When a Rental Property is SoldReal estate commissions.Legal fees.Transfer taxes.Title policy fees.Deed recording fees.

How do I reduce taxes when I sell my rental property?

There are various methods of reducing capital gains tax, including tax-loss harvesting, using Section 1031 of the tax code, and converting your rental property into your primary place of residence.

How do I offset capital gains on sale of rental property?

4 ways to avoid capital gains tax on a rental propertyPurchase properties using your retirement account. ... Convert the property to a primary residence. ... Use tax harvesting. ... Use a 1031 tax deferred exchange.

What if my expenses exceed my rental income?

When your expenses from a rental property exceed your rental income, your property produces a net operating loss. This situation often occurs when you have a new mortgage, as mortgage interest is a deductible expense.

Can you deduct appliances for rental property?

Landlords enjoy a wide array of deductions they can claim for rental property. Most expenses related to renting a home – including appliance purchases, repairs and improvements – are deductible. Appliance purchases and improvements are capitalized and depreciated, while appliance repairs are expensed.

What is the maximum deduction for rental property?

Key Takeaways The rental real estate loss allowance allows a deduction of up to $25,000 per year in losses from rental properties. The 2017 tax overhaul left this deduction intact. Property owners who do business through a pass-through entity may qualify for a 20% deduction under the new law.

How does the IRS know if I have rental income?

Ways the IRS can find out about rental income include routing tax audits, real estate paperwork and public records, and information from a whistleblower. Investors who don't report rental income may be subject to accuracy-related penalties, civil fraud penalties, and possible criminal charges.

What expenses can you deduct from rental income?

Rental Expenses. Examples of expenses that you may deduct from your total rental income include: Depreciation – Allowances for exhaustion, wear and tear (including obsolescence) of property. You begin to depreciate your rental property when you place it in service.

When is security deposit used as rent?

If a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you apply it to the last month's rent.

What are repair costs?

Repair Costs – Expenses to keep your property in good working condition but that don't add to the value of the property. Operating Expenses – Other expenses necessary for the operation of the rental property, such as the salaries of employees or fees charged by independent contractors (groundkeepers, bookkeepers, accountants, attorneys, ...

What is the form for personal property rental?

Report income and expenses related to personal property rentals on Schedule C (Form 1040) PDF, if you're in the business of renting personal property.

What is Schedule E 1040?

You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals. If you provide substantial services that are primarily for your tenant's convenience, report your income and expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

Do you deduct rental income?

Most individuals operate on a cash basis, which means they count their rental income as income when they actually or constructively receive it, and deduct their expenses when they pay them. Rental income includes:

Can you deduct uncollected rent?

If you're a cash basis taxpayer, you can't deduct uncollected rents as an expense because you haven't included those rents in income. Repair costs, such as materials, are usually deductible. For information about repairs and improvements, and depreciation of most rental property, refer to Publication 527, Residential Rental Property (Including Rental of Vacation Homes). For additional information on depreciation, refer to Publication 946, How To Depreciate Property.

How to reduce rental income tax?

To calculate the depreciation expense we need to do two things: Deduct the value of the land or lot from the basis, because land does not depreciate. Divide this amount by 27.5 years to determine the annual depreciation expense allowed by the IRS.

What is the initial cost basis for a rental property?

Your initial cost basis when you buy a rental property is the price paid for the property. After that, certain closing costs are added to the initial basis to arrive at an adjusted basis. Settlement fees and closing costs that become additions to your basis include: Abstract fees. Utility installation service charges.

What Are Closing Costs?

Closing costs on a rental property are the fees and expenses paid to close escrow, above and beyond the down payment you make for the home.

Why is depreciation important?

The bigger your basis is the better because your depreciation expense will be higher and your taxable rental income lower. Here’s how a large amount of depreciation can reduce rental income tax.

How many closing costs can be deducted in the same year?

Let’s begin by discussing the deductible closing costs on a rental property that can be deducted right away. According to the IRS, there are only three closing costs that can be deducted in the same year the property is purchased:

How long do you have to deduct real estate taxes?

Real estate taxes are prorated from the day you purchase the property through the end of the year and are deducted in full for each year that you own the property. For example, if property taxes are $2,700 for the year and you close escrow on June 1st, you would be entitled to deduct the remaining seven months of property taxes.

What are professional fees?

Professional fees paid to an attorney or financial advisor to assist you with drawing up and reviewing the closing documents. Mortgage fees such as loan application, credit report, origination, and underwriting fees. Prepaid and impound amounts for property taxes, mortgage interest, homeowners insurance, and HOA fees.

What is interest expense on a rental loan?

Charges on the principal amount of the loan that you take out for a rental property are known as interest expenses. The principal amount is the money you borrow from your bank or lender.

What expenses can you claim as an immediate deduction?

Expenses you may be entitled to claim an immediate deduction for in the income year you incur them include: advertising for tenants. body corporate fees and charges. council rates. water charges. land tax. cleaning. gardening and lawn mowing. pest control.

Why do you need to keep records on a rental loan?

If you have a loan account that has a fluctuating balance due to a variety of deposits and withdrawals and is used for both private purposes and rental property expenses, you must keep accurate records to enable you to calculate the interest that applies to the rental property portion of the loan.

How far in advance can you claim interest on a rental property?

finance renovations on the rental property, which is currently rented out, or which you intend to rent out (for example, to add a deck to the rear of the rental property) You can also claim interest you have pre-paid up to 12 months in advance.

What is a pre-paid expense?

Pre-paid expenses are those that provide for services extending beyond the current income year, such as payment of an insurance premium on 1 January that provides cover for the entire calendar year.

What does "repair" mean in a rental?

Repairs means working to make good or remedy defects in, damage to or deterioration of the property. Generally, repairs must relate directly to wear and tear or other damage that occurred as a result of renting out the property.

Can you deduct rental expenses?

Rental expenses you can claim now. You can generally claim an immediate deduction against your current year's income for your expenses related to the management and maintenance of the property, including interest on loans. If your property is negatively geared, you may be able to deduct the full amount of rental expenses against your rental ...

What is a lawsuit settlement?

A lawsuit settlement is when two different parties settle their case on an agreeable situation or payment. Mostly in such cases, one of the parties has to pay the other party a settlement amount to close the case legally. If you are new to the business side of the industry you will need to learn how to do your taxes and what things can lead to a deduction of taxes, even in such cases you have to know your limitations as to what extent tax can be deducted, and are lawsuit settlements tax deductible? You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

What is a limitation to deduction?

When we talk about the limitation to the tax deduction we mean the things that you might think or may imagine will be considered part of business’ expenses but are not considered the expenses by the legislation. So, in a legitimate business, you have to be careful of such thing so that you are not burdened with more load regarding taxes than you imagine.

Can you deduct lawsuit settlements?

If you know the limitations to these things and are well aware of what things can increase the deduction you will have to pay a small amount of tax only in such a crisis. Any expenses of the business can help you in tax deduction and lawsuit settlements are one of the business’s expenditures just like the office rent is. So, this is the most understandable example of tax deduction due to lawsuit settlement.

Is personal business expense a business expense?

As we know personal business is one of these things that are not to be mixed in your business and such expenses will never be considered part of your business expenses. Similarly, if the company is facing a lawsuit because of any employee or even the owner of a business, then money spent on them will never be considered a business expense but it will always be a personal expense. This is why any such settlements will not cause the deduction in the taxes.

Can you deduct business taxes from a personal lawsuit?

You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Do business taxes increase or decrease?

Usually, when it comes to the business taxes, they are to be paid from the profit you have earned. Similarly, the tax will increase or decrease according to some loss or profit in your business. For the tax payments, your entire inventory is scanned for the very same reasons. If anything bad happens to your business that results in less profit, then it will eventually reduce the tax.

Is a settlement considered a company's expense?

If the lawsuit is against the whole business based on any kind of services, then the settlement will be considered as the company’s expenses. Even if you claim this as the company’s lawsuit it will be up to the decision of legislation as to what this lawsuit will be labeled as.

Is a wage a part of a 1099?

Nearly every employment case has a wage component. In most employment settlements, employer and employee agree on a wage figure subject to withholding, and the balance goes on a Form 1099. Sometimes, there can be a tax-free portion too. Exactly what is "physical" isn’t so clear, and some of it seems like semantics.

Does a settlement agreement bind the IRS?

As you might expect, tax language in a settlement agreement does not bind the IRS. Even so, you might be surprised at how often the IRS pays attention in an audit if you can hand them a settlement agreement that says something explicit about taxes. It can sometimes be enough to make them walk away.

Is emotional distress taxable?

If emotional distress causes you to be physically sick, that is taxable. The order of events and how you describe them matters to the IRS. If you are physically sick or physically injured, and your sickness or injury produces emotional distress, those emotional distress damages should be tax free.

Do IRS see settlement income?

Of course, the IRS is likely to view everything as income unless you can prove otherwise. But there’s another reason to be explicit, so each client knows that to expect. That is, try to be explicit in the settlement agreement about tax forms too. If you are the plaintiff, you do not want to be surprised by IRS Forms W-2 and 1099 that arrive unexpectedly around January 31 st the year after you settle your case. That can ruin your day, and maybe even your tax return. For a summary of settlement taxes, see Settlement Awards Post-TCJA.

Was the settlement agreement in Parkinson's case specific?

Notably, the settlement agreement in Parkinson was not specific about the nature of the payment or its tax treatment. And it did not say anything about tax reporting. There was little evidence that medical testimony linked Parkinson’s condition to the actions of the employer. Still, Parkinson beat the IRS. Damages for physical symptoms of emotional distress (headaches, insomnia, and stomachaches) might be taxable.

Is a lawsuit settlement taxable?

Even worse, in some cases now, there’s a tax on lawsuit settlements, with legal fees that can't be deducted. That can mean paying tax on 100%, even if 40% off the top goes to your lawyer. Check out 12 ways to deduct legal fees under new tax law. The rule for compensatory damages for personal physical injuries, like a serious auto accident, is supposed to be easy. There, the compensatory damages should be tax free under Section 104 of the tax code. In employment cases, damages are usually taxable, and usually at least partially as wages. Nearly every employment case has a wage component. In most employment settlements, employer and employee agree on a wage figure subject to withholding, and the balance goes on a Form 1099. Sometimes, there can be a tax-free portion too. Exactly what is "physical" isn’t so clear, and some of it seems like semantics. If you make claims for emotional distress, your damages are taxable.

Is compensatory damages taxable?

There, the compensatory damages should be tax free under Section 104 of the tax code. In employment cases, damages are usually taxable, and usually at least partially as wa ges.

Can contingent fees help plaintiffs?

Add higher contingent fees, high case costs, and bigger recoveries, and the tax problems get even more pronounced. Contingent fee lawyers may try to help plaintiffs where they can. Plaintiffs paying taxes on their gross recoveries–even on the share earned by contingent fee lawyers–is a new tax problem plaintiffs will need time to try to plan around. For those who can’t somehow avoid the tax, it could impact whether cases settle and if they do, at what amount.

Can you deduct legal fees on taxes?

One possible way of deducting legal fees could be a business expense if the plaintiff is in business, and the lawsuit relates to it. Some may claim that the lawsuit itself is a business, but in the past, that tax argument usually failed. There will also be new efforts to explore potential exceptions to the Supreme Court’s 2005 holding in Banks. The Supreme Court laid down the general rule that plaintiffs have gross income on contingent legal fees. But general rules have exceptions, and the Court alluded to some in which this general 100% gross income rule might not apply.

Do you pay taxes on a lawsuit settlement?

Many plaintiffs will face higher taxes on lawsuit settlements under the recently passed tax reform law. Some will be taxed on their gross recoveries, with no deduction for attorney fees even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law should generally not impact qualified personal physical injury cases, where the entire recovery is tax-free. It also should generally not impact plaintiffs who bring claims against their employers. They are still allowed an above the line deduction for legal fees (although there are new wrinkles in sexual harassment cases).

Can you deduct sexual harassment settlements?

Yet plaintiffs in employment claims that involve sexual harassment face new tax problems. The new law denies tax deductions for legal fees and settlement payments in sexual harassment or abuse cases if there is a nondisclosure agreement. Virtually all settlement agreements include confidentiality or non-disclosure provisions. Even legal fees paid by the plaintiff in a confidential sexual harassment settlement are evidently covered. Congress probably intended only to deny defendant tax deductions. But even plaintiffs may have to worry about tax write-offs in sexual harassment cases after Harvey Weinstein.

What are some examples of settlements facing 100% tax?

Examples of settlements facing tax on 100% include recoveries: From a website for invasion of privacy or defamation; From a stock broker or financial adviser for bad investment advice, unless you can capitalize your legal fees; From your ex-spouse for claims related to your divorce or children; From a neighbor for trespassing, encroachment, etc;

Is a lawsuit a business?

Some may claim that the lawsuit itself is a business, but in the past, that tax argument usually failed. There will also be new efforts to explore potential exceptions to the Supreme Court’s 2005 holding in Banks. The Supreme Court laid down the general rule that plaintiffs have gross income on contingent legal fees.

Do you pay taxes on a lawsuit settlement?

Many plaintiffs will face higher taxes on lawsuit settlements under the recently passed tax reform law. Some will be taxed on their gross recoveries, with no deduction for attorney fees even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law should generally not impact qualified personal physical injury cases, where the entire recovery is tax free. It also should generally not impact plaintiffs who bring claims against their employers. They are still allowed an above the line deduction for legal fees (although there are new wrinkles in sexual harassment cases).

Can you deduct legal fees on taxes?

For many, no tax deduction for legal fees will come as a bizarre and unpleasant surprise after the fact. Plaintiffs who have some advance warning and advice may go to new lengths to try to avoid the lawyer's share being income to them, or to somehow deduct it.

Can you deduct legal fees after Harvey Weinstein?

But even plaintiffs may have to worry about tax write-offs in sexual harassment cases after Harvey Weinstein. Up until now, even if you did not qualify to deduct your legal fees above the line, you could deduct them below the line.

Do you have to file a 1099 for a lawsuit?

IRS Form 1099 regulations generally require defendants to issue a Form 1099 to the plaintiff for the full settlement, even if part of the money is paid to the plaintiff’s lawyer. One possible way of deducting legal fees could be a business expense if the plaintiff is in business, and the lawsuit relates to it.

Do you pay taxes on a whistleblower claim?

Fortunately, Congress enacted an above the line deduction for employment claims and certain whistleblower claims. For employment and some whistleblower claims, this deduction remains in the law, so those claimants will pay tax only on their net recoveries.

Expenses You Claim This Year

- You can claim a deduction for these expenses only if you actually incur them and they are not paid by the tenant. Expenses you may be entitled to claim an immediate deduction for in the income year you incur them include: 1. advertising for tenants 2. body corporate fees and charges 3. council rates 4. water charges 5. land tax 6. cleaning 7. garde...

Interest Expenses

- Charges on the principal amount of the loan that you take out for a rental property are known as interest expenses. The principal amount is the money you borrow from your bank or lender. If you take out a loan to purchase a rental property, you can claim a deduction for the interest charged on the loan or a portion of the interest. The property must be rented or genuinely available for re…

Thin Capitalisation

- Thin capitalisationrules may affect you if the combined debt deductions (for example, interest) of you and your associated entities are more than $2 million in any financial year and you are: 1. an Australian resident and you (or any associated entities) have 1.1. certain international dealings 1.2. overseas interests 2. a foreign resident (or associated entity) with certain investments in Au…

Pre-Paid Expenses

- A pre-paid expense is a cost you incur under an agreement for services to be done (in whole or in part) in a later income year. For example, payment of an insurance premium on 1 January that provides cover for the entire calendar year or interest on money you borrow. You can generally claim an immediate deduction in the income year you make the prepayment in for: 1. expenses …

Repairs and Maintenance

- Repair and maintenance expenses are those costs you incur to: 1. keep your property in a tenantable condition 2. fix wear and tear or damage that occurs as a result of renting out your property. To be a deductible expense, the property must either: 1. continue to be rented on an ongoing basis 2. remain genuinely available for rent but there is a short period where the propert…

Legal Expenses

- Rental property legal expenses are those costs you incur to prepare, register, protect and manage your rental property. You can claim a deduction for some of the legal expenses you incur to produce your rental income. You can claim these expenses in the income year you incur them.