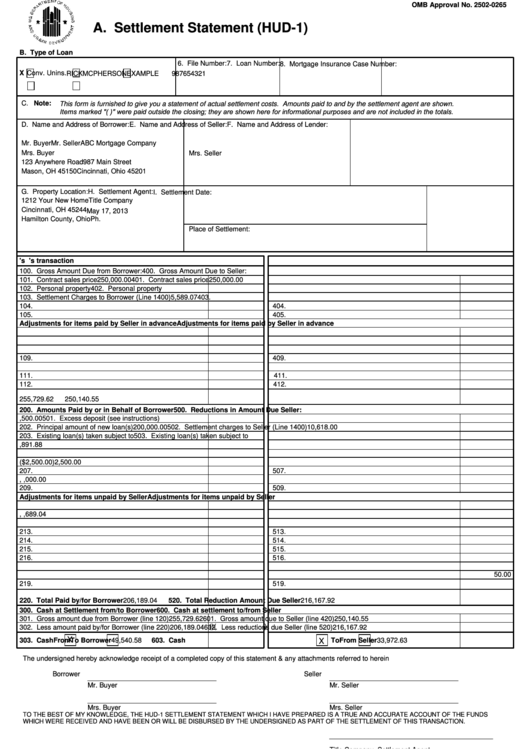

A settlement statement is a standard form used at nearly all home loan closings. The closing costs and charges are listed, as well as how the loan proceeds will be distributed. In some cases, it is simply called the “HUD-1”.

What do you need to know about a settlement statement?

(Solved) A settlement statement is a document given to borrowers at closing that itemizes services and fees charged to the borrower by the lender or broker. 1 What is the purpose of a settlement statement? 2 What is a seller’s settlement statement? 3 Who prepares the settlement statement? 4 What are closing costs on settlement statement?

Is a settlement statement the same as closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What are the different types of settlement statements for a mortgage?

In mortgage lending, there are two main types of settlement statements a borrower may encounter: closing disclosures and HUD-1 settlement statements. A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market.

What types of transactions are typically consummated with a settlement statement?

Business transactions: Large business transactions, such as mergers and acquisitions, are usually consummated with some type of closing or settlement statement.

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement statement used for?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is the HUD and settlement statement the same?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means 'Good Faith Estimate'.

Is a closing statement necessary?

If you're selling a home at a profit, you'll need the closing statement to record the details of the sale when you file your taxes.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

Is HUD and closing disclosure the same?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is closing statement the same as closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

How is a Settlement Statement Used?

When closing on a mortgage loan package, it is mandatory for the borrower to review and sign a settlement statement. With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

How long does it take to get a settlement statement?

Typically, the borrower will receive a settlements statement copy three business days after the borrower applies for a mortgage loan. Note that the form has three pages containing the information which includes:

How many pages are in a closing disclosure?

Closing Disclosure - During the offering of the standard mortgage loan, there is the inclusion of a closing disclosure. The form consists of five pages, and it contains the costs, monthly payments as well as closing costs of the borrower. According to the regulations, a lender has to give a mortgage borrower a closing disclosure three days before the loan closing. The reason is that there are items in a closing disclosure form that may require three days to review. Some of these changes may include:

What are the charges on a loan settlement statement?

The second section has all the charges imposed on the buyers loan and the fee paid by the buyer before the loan closing. Note that any fee paid before or outside closing, are have the initials POC. Some of the charges in this section include the title policy, document preparation, title research, and attorneys fees. The third section highlights research, transfer, survey, and inspection fees.

When to use HUD-1 settlement statement?

Significance - According to RESPA, it is mandatory to use the HUD-1 settlement statement when closing real estate deals. It is on this page that all the mortgage loan terms are stated. The page consists of the following:

Who prepares the settlement statement for closing?

In most cases, it is the third party in the transaction that prepares the settlement statement for closing. The third-party can be the officers that deal with this kind of documents and usually have a title. It could also be an escrow company presiding over the closing. The cost of preparing the document varies depending on the state. Note that states have different customary practices, and this includes fees charged for settlement services. In the state of California, both the seller and the buyer usually sign the document at closing.

Do you need a settlement statement for a mortgage?

With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What should a settlement address?

The settlement should fully address the discriminatory practices alleged in the complaint. For example, in hiring and promotion cases where defendant's selection procedures may have contributed to the exclusion of members of the protected class, the procedures should be revised to eliminate their discriminatory effects. Where appropriate, policies and complaint procedures addressing harassment should be created or revised. Where training of defendant's managers and officials is necessary, the settlement should be specific regarding the content of the training and should permit Commission review of the trainer (s) and materials. Notices generally should contain specific references to the Commission's suit, the allegations in the complaint, and the terms of the resolution; legal units should not agree to notices that merely restate defendant's statutory obligations.

Why should settlements be carefully drafted?

Because of the public policy implications of Commission resolutions, care in drafting is even more important than in most private agreements. Attorneys should use precise language and avoid ambiguities.

What should the General Counsel do in a settlement?

In cases in which the General Counsel has not delegated settlement authority to the Regional Attorney, Commission counsel should inform the other parties early in settlement negotiations that any agreement is subject to the General Counsel's approval. It should be made clear to the parties that the General Counsel will make an independent review of the adequacy of the proposed settlement and reserves the right to request significant changes in its terms. Regional Attorneys should apprise OGC as early in the settlement process as possible of proposed settlement terms in order to minimize any later disagreements between OGC and the legal unit over the adequacy of a recommended settlement.

Who has discretion to engage in presuit settlement efforts in any case?

The Regional Attorney has discretion to engage in presuit settlement efforts in any case, whether filed under his or her redelegated authority or authorized by the General Counsel or Commission. Resolutions agreed to through presuit negotiations must be filed with the court together with a complaint, and this requirement should be made clear to the prospective defendant (s) at the time settlement efforts are initiated.

What is a resolution document?

The resolution document should also contain provisions permitting the Commission, upon reasonable notice, to inspect or require production of relevant documents and to interview employees, including managers , who may possess relevant information.

When the Commission and a claimant disagree on the proper recovery and the Commission believes that continued prosecution of the case is?

Where the Commission and a claimant disagree on the proper recovery and the Commission believes that continued prosecution of the case is not in the public interest, the Commission should notify the claimant of its intention to settle the case on the terms indicated and provide him or her the opportunity to proceed individually.

When should a regional attorney discuss a case with OGC?

Where a Regional Attorney has not been delegated settlement authority and the court requires the presence of a Commission representative with full settlement authority at a conference or at mediation, the Regional Attorney should discuss the case with OGC as early as possible.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Is a statement a reliable source of information?

Most of us are aware that statements are reliable sources of information. Statements vary from being accounts of people about certain topics (as in statement of purpose ), to being used as an evidence in the court of law (as in witness statements ). These, among other things prove that statements are useful sources of facts and information.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, "it's safe to say that you are at the tail end of the process," Moreira says. It's crucial to review this document carefully to ensure all costs are accurate.