Do you have to pay taxes on a personal injury settlement?

The quick answer no, Y ou don’t have to pay income tax taxes on a personal injury settlement. So, you may be thinking, “are there exceptions to the rule? We’re dealing with the government, so, of course, there are exceptions. The official statement from the IRS is as follows:

Can I be taxed on my personal injury settlement?

In general, the proceeds from a personal injury settlement or jury verdict will not be subject to state or federal tax. The general exclusion from taxation applies to the damages an individual receives as a result of the expenses incurred due to their bodily injuries or physical illness.

What are the tax consequences of personal injury settlement?

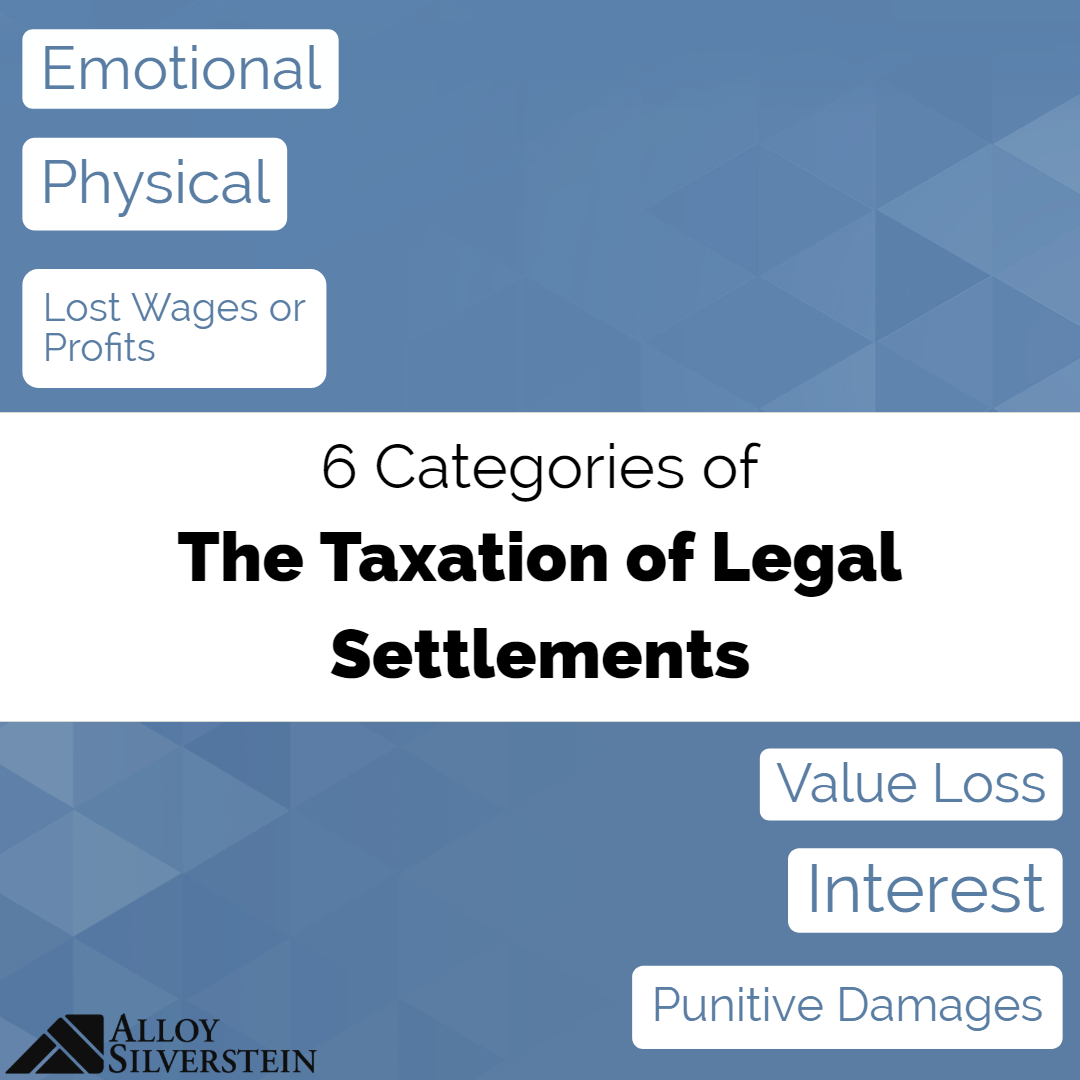

Taxability of Personal Injury Settlements. Receiving money in a personal injury settlement or judgment may have tax consequences. In fact, depending on the type of settlement or judgement, you could have multiple tax payment structures tied to the types of damages you recover. For example, if your settlement has elements of back pay, emotional ...

Does the IRS tax personal injury settlements?

Personal injury settlements are generally not considered to be income that is subject to taxation. Rather, a settlement is intended to reimburse an injured party for costs and expenses that are paid to reimburse economic losses. Certain categories of damages are not within the definition of economic losses:

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is pain and suffering taxable IRS?

Physical pain and suffering are not taxable. The IRS lumps physical pain and suffering together with medical expenses as a part of the settlement it calls “personal physical injuries or physical sickness.” In this instance no taxes are due on this portion of the settlement.

How do I report settlement income on my taxes?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

Do you have to pay taxes on insurance payouts?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Are 1099 required for settlement payments?

Issuing Forms 1099 to Clients That means law firms often cut checks to clients for a share of settlement proceeds. Even so, there is rarely a Form 1099 obligation for such payments. Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Can you deduct lawsuit settlement payments?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162(f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Do you get a w2 for a settlement?

The settlement agreement should also explicitly provide for how the settlement will be reported as well. The two primary methods to report the settlement to the IRS are either on a Form W-2 or a Form 1099-MISC.

Do I have to report insurance settlement to IRS?

Short- and long-term disability insurance proceeds, which are both designed to provide you with income if you're unable to work, are taxed the same way income is. You'll need to report these payments as earnings when you're filing.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Is a discrimination settlement taxable?

Yes, settlements for employment discrimination are considered taxable.

What is medical expense?

Medical expenses include bills to diagnose, cure, treat, mitigate or prevent a medical condition.

Is emotional distress considered physical?

Confusion Due to 2017 Law. In 2017, the Trump Administration signed a tax law that said compensation from a personal injury settlement or award is only tax-free if the injuries are physical. Emotional distress does not qualify as physical. Other by-products of emotional distress, such as insomnia, headaches and stomachaches also do not qualify ...

Do you have to pay medical bills on your taxes?

Many personal injury victims must pay their medical bills while they wait for a settlement. Sometimes it takes more than a year to settle a claim, so you might try to maximize your tax refund by itemizing these obligations, especially if other accident-related expenses have piled up. However, if you did not deduct these expense items previously, you do not have to include them on your taxable income.

Is emotional distress taxable?

However, if you claim that the damages were due to emotional distress, your award is taxable. If the emotional distress causes you to suffer some physical symptoms, the physical symptoms do not elevate your claim to tax-free status. However, if you are physically injured or ill and suffer emotional distress, then the emotional distress damages should be tax-free.

Is compensation tax free?

Generally, the way that it works is if you claim that the defendant caused you to be injured or become physically sick, and you receive compensation for damages based on this claim, then this compensation is tax-free.

Is it fair to deduct medical expenses?

The IRS reasons that it is not fair for you to have received a tax deduction for medical expenses that were paid off by money from your settlement. Additionally, whether you receive wages from your employer or those wages are included as part of a settlement award, you are required to pay income taxes on that portion.

Do you have to include damages on your taxes?

However, if you did not deduct these expense items previously, you do not have to include them on your taxable income. If your damages are the result of a breach of contract, they will be taxable if the breach of contract is the basis of your lawsuit. Additionally, punitive damages and interest on a judgment are taxable.

Is pain and suffering taxable income?

If you suffered mental anguish or emotional distress as a result of the accident that injured you, you may have been awarded damages for pain and suffering. The money you obtain from pain and suffering damages may be taxable income. These damages are treated similarly to compensation for injuries or sickness.

Is a settlement for a personal injury taxable?

If you are awarded a settlement for injuries or illness and did not take an itemized tax deduction for medical costs related to that injury or sickness, your settlement is not taxable. You do not have to include your injury case settlement as part of your income on tax documents.

Is punitive damages taxable?

In the event that you are injured in an accident involving intentional harm, gross negligence, or a wanton disregard for public safety, you may be awarded punitive damages. These damages are assigned by a court to punish the defendant, not to compensate you for losses caused by injury. Punitive damages are taxable. Report punitive damages as “other income” on your tax return.

Is property loss taxable income?

There is an exception to take note of. If your compensation for property loss exceeds your estimated loss of value, the excess amount counts as taxable income.

Is medical settlement taxed?

If you have deducted medical expenses in any previous years for the tax benefit using Form 1040, part of your settlement may be taxed.

Is gambling winnings taxable?

The IRS is notorious for taxing any source of income. Gambling winnings are taxable. If you rob a bank, the IRS expects you to include that on your tax return. So, what about your personal injury settlement?

Do you report pain and suffering on taxes?

If you report any amount of your compensation for pain and suffering on your taxes, attach a statement to your tax return. Your statement should include your entire settlement amount minus any eligible medical costs you have not deducted yet or expenses you deducted without receiving a tax benefit.

Is your settlement for a physical injury or sickness?

If your settlement was due to physical injury or sickness, it will not be taxed. But there are certain standards you must meet before the IRS in earning this classification. The agency has ruled that these injuries must be observable, such as cuts or bruises, to qualify as physical. The IRS also specifies that taxes do need to be paid on a portion of the settlement for medical expenses, if you deducted those medical expenses in prior years. If you sustained lasting health consequences or the loss of a limb after a train accident, for example, you can be confident that your settlement won’t be counted as income.

Is your settlement regarding lost wages or loss of profit?

There is an exception for a loss of wage claim when it occurs due to a physical injury or sickness, like if you were unable to continue working after a disability, or fired after being hurt on the job. In these cases, it would fall within the category of the physical injury regulations and would not be taxed.

Is your settlement for a loss in value of property?

If a contractor did sub-standard work causing your bathtub to drain improperly and resulted in water damage , you may have received a settlement that is for loss in value of property. If the amount you were awarded in that settlement is less than what you originally paid for the damaged property, you won’t be taxed for the payment. If the amount in damages is more than what your original property was worth, however, your settlement will be subject to tax.

What to do if you receive a settlement?

Every legal settlement circumstance is different, so if you’ve received a settlement it’s in your best interest to consult with your attorney about the origins of your claim. Armed with this knowledge, you can go to your CPA with the settlement agreement or closing statement. These documents should clearly outline what type of damages you received and will make it easier for your CPA to determine what money is taxable and what is not. Once the IRS is satisfied, you can work towards getting back to a normal life.

What is the last hurdle you have to face when you settle a lawsuit?

But when the legal battle is over, and the settlement is paid, there is one last hurdle you’ll have to face: taxes. The taxability of your settlement will be determined by the origin of the claim. This essentially refers to the cause that led to your legal settlement. Like most tax regulations, there are general rules with numerous exceptions.

How many lawsuits end in settlement?

Most of the time, these disputes are resolved monetarily—according to Black’s Law Dictionary, 95 percent of lawsuits end in settlement prior to trial and more than 90 percent of cases that end in trial result in a judgment for the plaintiff. But when the legal battle is over, and the settlement is paid, there is one last hurdle you’ll have to face: taxes.

What happens if you receive money from a settlement?

If you received money from a settlement, your work isn't over yet. Depending on the circumstances of your case, you may owe taxes on what you were awarded.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.