Seller escrow fees will differ from a Buyer’s; however, they will both have the same Escrow Fee, Processing Fee. REQUEST AN ESTIMATE: Once all the final terms have settled and all demand statements received, request an estimated statement from your escrow officer for a complete accounting of all transaction fees.

Full Answer

What is an estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is escrow used for in real estate?

It is typically used in real estate transactions involving the purchase of a home. Both the buyer and seller have specific responsibilities in any escrow settlement procedure. How Does Escrow Work? In escrow, the buyer, seller, lender, or borrower create, sign, and deliver escrow instructions to an escrow officer.

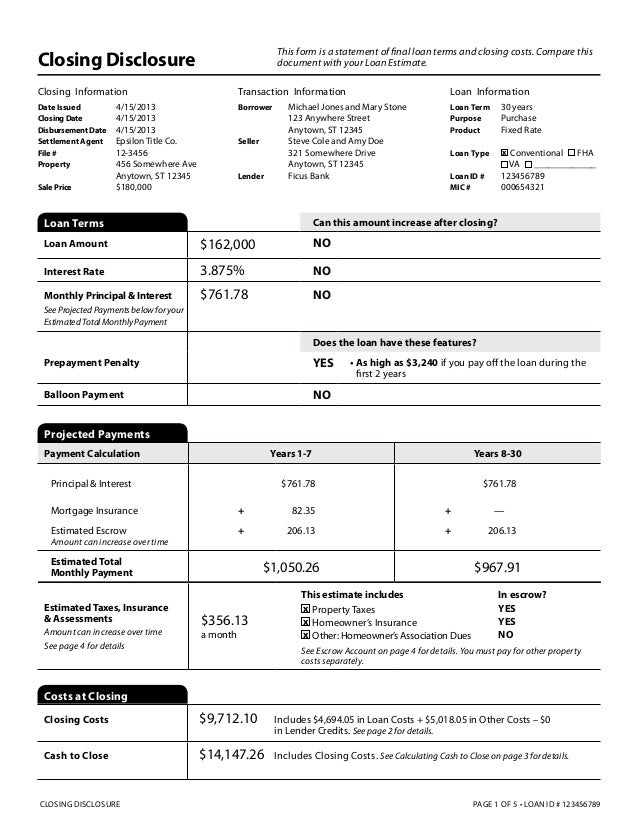

Is the estimated settlement statement the same as the Closing Disclosure?

Note: The estimated settlement statement is not the same document as the Closing Disclosure. The fees/costs seen on a buyer’s Closing Disclosure are the same fees and costs you will see on the estimated settlement statement displayed in a different way.

Can a seller ask for a longer escrow period?

The seller may request a shorter or longer escrow, depending on his circumstances, and as long as the buyer agreed, that date will be set. Generally, a “financing contingency” is put into the offer to purchase in which the buyer is given a specified amount of time to obtain a mortgage.

What is the escrow settlement procedure?

An escrow is an arrangement in which a disinterested third party, called an escrow holder or settlement agent, holds legal documents and funds on behalf of a buyer and seller, and distributes them according to the buyer's and seller's instructions.

What is an estimate settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is the difference between a settlement statement and a closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Can you negotiate price during escrow?

Can a home buyer negotiate with the seller during the escrow process? YES! All aspects of a real estate transaction are a negotiation.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a settlement statement for a mortgage?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Which document provides an estimate of the costs a buyer is likely to pay at settlement?

A Good Faith Estimate (GFE) of settlement costs must also be provided to the borrower. The GFE must describe all the charges the buyer is likely to pay at closing. The GFE is only an estimate, and the total amount of the charges the borrower may be liable for may vary from the amount set forth in the GFE.

What is the latest date that a settlement agent is allowed to provide the seller with the closing disclosure?

What is the latest date that a settlement agent is allowed to provide the seller with the Closing Disclosure? At consummation of the transaction. Which of the following is TRUE regarding the recording of a deed? It is not a legal requirement that a deed be recorded in the County Clerk's office.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What should you not do during escrow?

What Should I Not do During Escrow?Do not make large purchases which could be viewed as debt.Do not apply to or open any new lines of credit.Do not make finance related changes, like a new job or bank.

Can a seller back out of an accepted offer?

Can a seller back out of an accepted offer? Accepting an offer on your home occurs when a contract is made in signed writing. Home sellers can back out of the terms of these agreements in select instances (and for a limited time period), subject to the individual rules, terms and contingencies defined in the document.

Can a seller back out of a contract if they get a better offer?

A higher offer comes in If the agreement has already been signed, it's next to impossible for a seller to back out. But if an appraisal changes what a seller is willing to sell the house for, they can cancel the agreement before signing.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is the settlement statement a closing disclosure?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What Are The Seller’s Responsibilities During Escrow?

Some examples of the seller’s legal responsibilities during escrow might include:

What is escrow in real estate?

Escrow is the depositing of instruments and funds with instructions to a neutral third party to carry out the provisions of an agreement or contract. It is typically used in real estate transactions involving the purchase of a home . In any escrow settlement procedure, both the buyer and seller have certain responsibilities.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

What happens if the appraisal comes in higher than the sales price?

If the appraisal comes in higher than the sales price, then the buyers can relax and be happy that they have purchased a home for less than its market value. Once the contract has been signed, you as the seller cannot renegotiate the price higher. However, if the appraisal comes in lower than the sales price, then the buyer’s lender will limit the loan amount to that lower value. The buyer may have to come up with additional cash to cover the financing gap or may ask you to renegotiate the contract. Your REALTOR® can advise you about the best way to handle this situation, but in any case you and the buyer are also bound by the contract terms.

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.

Can you move onto your next home after a settlement?

Once the settlement papers are signed and the house keys are transferred, you’re free to move onto your next home.

Do you need to have a home inspection before closing?

Before closing on a house, most transactions include a home inspection, so you’ll need to make your home available to the inspector and then negotiate with the buyers about anything the inspection turns up according to the terms of your contract.

Where to complain about escrow company in California?

Address your complaint to the Department of Corporations at 3700 Wilshire Blvd. #600, Los Angeles, CA 90010 or telephone them at (213) 736-2751.

How long does escrow take to close?

Either buyer or seller may set the closing date, both parties must agree to the date, and generally the buyer puts his request for a 30, 60 or 90 day escrow in the original purchase agreement. The seller may request a shorter or longer escrow, depending on his circumstances, and as long as the buyer agreed, that date will be set. Generally, a “financing contingency” is put into the offer to purchase in which the buyer is given a specified amount of time to obtain a mortgage. Once the buyer has a firm commitment from a lender, the actual closing date can usually be set. Be sure, if your are the buyer, to set the closing date prior to the expiration of your lender’s loan commitment or lock in date for your interest rate.

What is closing escrow?

What is closing or escrow and what is involved in opening escrow? Closing (also referred to as “settlement” or “escrow” in many parts of the country) is the process whereby an impartial third party, such as an attorney, an escrow company or a title company, is entrusted with the job of seeing that the transfer of ownership from the Seller to ...

What happens if you misunderstand closing costs?

This final step to your purchasing a home or property can go smoothly if you take a few precautions beforehand.

When to set closing date for a loan?

Once the buyer has a firm commitment from a lender, the actual closing date can usually be set. Be sure, if your are the buyer, to set the closing date prior to the expiration of your lender’s loan commitment or lock in date for your interest rate.

How long does it take to get a title search?

Depending on the number of documents the examiner must review, a title search will take anywhere from one hour to two weeks to complete. Read this search carefully and look for any hidden problems.

Who must be an escrow agent in California?

Any person who desires to engage in business as an escrow agent in California must be a corporation organized for that purpose. In addition, there are several criteria which must be met:

Who pays for escrow fees — the buyer or the seller?

In many states, it’s customary for the buyer and seller to split escrow fees or negotiate over the amount that each party pays.

What is escrow fee?

Typically, escrow fees cover the distribution of funds, paperwork, mortgage origination fee, and other fees that are part of the real estate transaction. Closing costs such as insurance, attorney’s fees, property taxes are escrow costs that are charged by third parties are held in the escrow account until the escrow company distributes them.

How much does escrow cost on average?

In combination with third-parties fees, the total cost of escrow fees is usually 1% to 2% of the home’s sale price.

What is escrow in real estate?

During escrow, a neutral third party safely transfers funds and key paperwork related to the transaction between the buyer and the seller; this includes the buyer’s earnest money, real estate fees, loan fees, third party payments, and your profits as the seller.

Can a buyer and seller split escrow fees?

In many states, it’s customary for the buyer and seller to split escrow fees or negotiate over the amount that each party pays.

Is escrow the same as title?

While title companies are not technically the same as escrow companies, many offer excellent escrow services. In addition to searching the web, Orefice tells us it’s a good idea to make use of your real estate agent’s network of professional contacts and ask them for recommendations.

Do sellers pay closing costs?

“Previously, sellers would typically pay for closing costs, often up to 6%. But, with the market swinging the way it has and a lack of inventory, a lot of sellers aren’t really covering closing costs,” he notes.

What happens if you push a settlement back?

If the settlement is pushed back after September 30, the taxes will be paid late, and a late fee will apply. Also, if the settlement falls through at the last minute – say for example there is a walk-through dispute that kills the deal – then the payoff lender will have frozen the account and your taxes will not be paid.

When does the title company pay off taxes?

The title company sends out your payoff, but it doesn’t get credited until September 21, and in the meantime the payoff lender has sent in your taxes to the county. As of September 20, the county tax office has not credited your taxes as having been paid. So the title company collects and pays the taxes with the deed.

What happens if you call a payoff lender and ask for a frozen account?

It would be unfortunate (and ironic) that being pro-active about the taxes might cause penalties, interest or, potentially, a tax lien.

Does the title company pay property taxes at closing?

As of September 20, your payoff lender has not sent in the property taxes so the title company, collects the property tax bill from you at closing and pays it, since the deed cannot be recorded unless the taxes are paid.

Is escrow a post closing issue?

Whenever a real estate settlement is close to a property tax due date, the potential for a post closing property tax issue increases. Simply, it is a matter of bad timing. Here are a couple escrow issues that can cause problems for home sellers who are planning to close near a property tax due date.

When are property taxes due in Montgomery County?

Let’s take Montgomery County, Maryland for example. Real estate property taxes are due by September 30 and December 31 (assuming a principal residence). Now let’s say that you have scheduled a closing for the sale of your home on September 20.

Can escrow be frozen?

Most lenders will freeze or put a hold on your escrow account if you tell them to do so and they know that you are selling the property. The title company can then collect the taxes at closing and the payoff lender will not have paid the bill, and will therefore refund it to you as part of the escrow refund (which should arrive within 30 days of payoff).

What is a title order for a closing?

The closing agent will then order a title search, a location survey (if required), payoff statements, and real estate tax information in preparation of closing.

What is a title insurance closing letter?

A closing protection letter, sometimes referred to as an insured closing letter, is a document issued by title insurance underwriters that sets forth an underwriter’s responsibility for negligence, fraud and errors in closings performed by agents and approved attorneys.

How long does it take to close a HUD loan?

Generally, the actual closing involves an explanation of the documentation by the closing agent and the acquiring of signatures which takes approximately one hour. In some cases, there may be subsequent adjustments to the HUD-I Settlement Statement or other documentation that will require a longer closing time.

Who is the closing agent?

The closing agent represents all parties in a transaction: the buyer, seller and lender. In essence, the agent represents the process and/or transaction and ensures that all elements and terms are met.

Can you still insure a loan if you can't find your survey?

Even if you can’t find your survey, we can still insure the title to the lender if you sign the affidavit.

Do you have to pay trust tax on a loan that is paid off at closing?

If the new lender is the same lender that is being paid off at closing, the borrower will only be required to pay the Trust Tax on the difference between the new loan amount and the amount of the existing loan being paid off at closing.

Is a title examination good?

No. A title examination is only as good as the land records. Should a filing error happen, if someone perpetrates a fraud, if an estate is mishandled, a title examination would not expose those problems. The title insurance protects you, even thought the title examination did not and could not disclose the problem.

Two Separate Views of The Same Transaction

Buyer Estimated Settlement Statement – Highlighted by Closing Cost Type

- An easy way to understand your closing costs is to group them: 1. lender loan charges (lavender) 2. tax and insurance pre-payments (purple) 3. title and escrow charges (light green and green) 4. other costs, fees, or credits (pink) It’s an overwhelming document, so let’s break it down with each section highlighted for ease of understanding.

Buyer Loan Charges

- Money isn’t cheap! All of the charges associated with the new loan will be summarized in this section. For a buyer with one loan, this is a pretty typical set of charges. If you are paying any points for your loan, that fee will be included in this section. This buyer did not choose an impound account (the bank will pay their insurance and taxes on their behalf), which is typical. San Franci…

Taxes and Insurance

- Regardless of the number of days in the month the deal closes, escrow companies prorate costs based on a 30-day month. Property taxes and HOA fees in condos are the two items most likely to be prorated on a buyer’s settlement statement. The buyer and seller will either be credited or debited for property taxes based on when the closing falls in the...

Title and Escrow Charges

- Title and escrow charges are grouped together in SF because it’s a title company usually provides escrow services in addition to title insurance. Your two typical costs are your owner’s title insurance policy, and the escrow fee. The cost of the title insurance policy is based on the cost of the home, while the lender’s policy (see buyer loan charges) is based on the size of the loan. Th…

Other Fees, Costs, and Credits

- Finally, we’ve got everything else. From estimates to recording fees, charges from building or community homeowner’s associations (HOAs), to miscellaneous charges, insurance policies, home warranties, and anything else that doesn’t fit elsewhere.

Balance Due from Buyer

- Once the buyer’s deposits and loans have been credited to the escrow, and all the debits added up as well, the estimated balance due from the buyer shows the remaining money needed to close the transaction. The balance due is equal to the remainder of your down payment and all of the closing costs as listed on the estimated settlement statement.

Real Estate Commissions

- Regardless of the agency relationship (buyer/seller/dual agency), sellers typically pay the entire real estate commission for both the buyer’s real estate brokerage and the seller’s real estate brokerage.

Other Seller Charges

- Sellers typically have a few miscellaneous charges for reporting, signing, and other admin/compliance fees that are usually no more than several hundred dollars.

It’S Just An Estimate!

- Finally, it is important to remember that all of the charges in the closing statement are estimates! Things often adjust based upon the actual closing date (namely, tax prorations and accrued interest). Escrow agents can close a transaction with excess funds, but they cannot close a transaction that does not have enough money in escrow to cover all costs, so escrow agents wil…

What Contingencies Impact Sellers Before Closing on A House

Negotiating A Settlement Date

- Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back”with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer. Alternatively, some sellers allow the buyers to move in before settleme…

Settlement Services

- The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company,but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determi...