What are the pros and cons of a debt settlement?

There definitely are some things to like about debt settlement, such as:

- If you’re organized and persistent, you can attempt debt settlement on your own. ...

- If, instead, you require representation and all goes well, you can be clear of your unsecured debt in 24 to 48 months, at a fraction of what you owed — ...

- You won’t owe an add-on fee as each debt is settled; that’s already worked into your escrow account deposits.

What is the best way to settle debt?

Part 1 of 3: Negotiating the Debt Amount Download Article

- Read the judgment. Debtors and creditors should review the court order (judgment) to determine the total amount due and any specific payment instructions ordered by the court.

- Evaluate your financial situation. Whether you are the creditor or the debtor, you should review your finances before negotiating the amount of the debt.

- Contact the other party. ...

Can I negotiate a debt settlement by myself?

Negotiating a debt settlement with a creditor on your own can save you time and money. Here’s how DIY debt settlement negotiations work, how it compares to settlement through a company and how ...

Is it better to pay off debt or settle debt?

It is alway preferable to pay off your debt in full, IF possible. Although settling your debt for a smaller amount will not hurt your credit as much as not making any payments, it is still considered a red flag for lenders. However, there are times when settling your debt can be a smart move.

See 7 key topics from this page & related content

See 7 key topics from this page

Can I do my own debt settlement?

You may be able to get faster results with DIY debt settlement. While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

What percentage of a debt is typically accepted in a settlement?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

How long does it take to rebuild credit after debt settlement?

between 6 and 24 monthsYour credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

What are the negative effects of debt settlement?

Debt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years. If your creditors close accounts as part of the settlement process, this can cause your credit utilization to increase, which also negatively affects your credit score.

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

How can I get out of debt without paying?

Ask for a raise at work or move to a higher-paying job, if you can. Get a side-hustle. Start to sell valuable things, like furniture or expensive jewelry, to cover the outstanding debt. Ask for assistance: Contact your lenders and creditors and ask about lowering your monthly payment, interest rate or both.

Why you should not pay collections?

Making a payment on the debt will likely reset the statute of limitations — which is disastrous. If the collection agency can't show ownership of the debt. Frequently, the sale of a debt from a creditor to a collector is sloppy. A collection agency hounding you may not be able to show they actually own your debt.

Should I pay a 5 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

Can paying off collections raise your credit score?

Unfortunately, your credit score won't increase if you pay off a collection account because the item won't be taken off your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can you negotiate a debt after a Judgement?

Negotiate With the Judgment Creditor It's never too late to negotiate. The process of trying to grab property to pay a judgment can be quite time-consuming and burdensome for a judgment creditor.

Will Capital One negotiate a settlement?

Yes, Capital One does accept debt settlements, either directly or through a collection agency. You can refer to the most recent notice you've received and reach out to that party to begin the negotiation process for an amended payment agreement.

What is a settlement offer from a debt collector?

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or “settle,” your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

How much of your debt should you settle?

When negotiating, you need to come to the table with at least 50% of what you owe for the creditor to seriously consider offering a debt settlement.

What is debt settlement?

Debt settlement is a financial agreement where the lender agrees to accept a lump-sum payment from the borrower to settle an outstanding debt. The payment is for a significantly lower dollar amount that what was owed, making it one of the most attractive debt-relief options available.

What happens if a creditor believes they are unlikely to receive the full payment?

If the creditor believes they are unlikely to receive the full payment, you have a great chance at debt settlement. The older the debt is, the better the chance you will succeed with a debt settlement offer.

What happens if you settle a debt yourself?

If you do it yourself, you negotiate the debt settlement on your terms without the cost of hiring someone who you can’t afford.

How long does it take to settle a debt?

Working with a debt settlement company can take 3-5 years to complete. Doing it yourself involves only you and the creditor when you cut out the third party. This saves you money from paying a percentage of the settlement to the third-party settlement company.

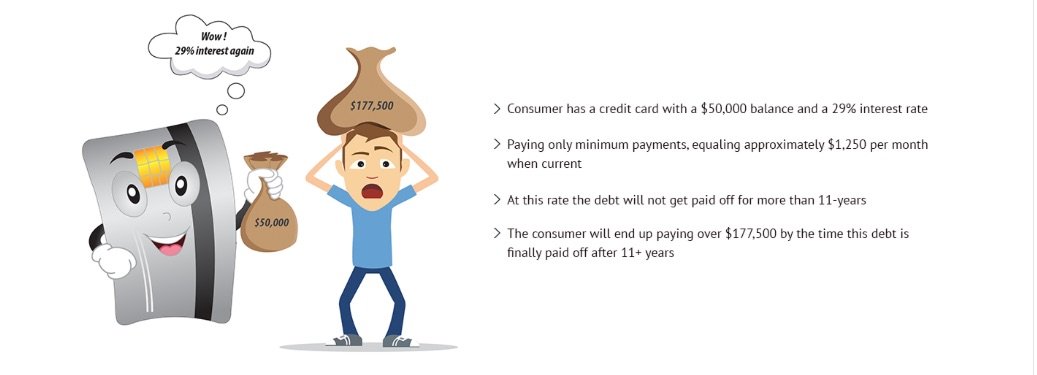

How long does debt settlement stay on your credit report?

A drawback to debt settlement is that it stays on your credit report for seven years, discouraging any lenders (home, auto, credit card, etc.) from giving you more credit. It also damages your credit score by 75-100 points, meaning that if a lender gave you credit, they would do so at a very high interest rate. For example, a 5% car loan might cost you 18% -20% because of debt settlement. That would be thousands more you must pay for a car because you have debt settlement on your credit report.

What happens if you make a plan and save money to execute the plan?

If you make a plan, and save money to execute the plan, you will be well on your way to being debt free.

Your Attorney Knows the Rules

An additional issue that has arisen in the debt settlement industry is that debt settlement companies do not always play by the rules. An attorney understands his or her ethical responsibilities and know that any debt settlement between you and your creditor must be in accordance with all laws.

Contact the National Debt Settlement Attorneys of Ariano & Associates, PLLC Today

Millions of individuals and businesses from all across the United States have been able to successfully settle their debt without the assistance of attorney. However, the debt settlement process can be very confusing and will be different from one person or business to the next. Some financial situations are easier to deal with than others.

Why is DIY debt settlement the best way to go?

Time, or lack thereof, is one of the key reasons why DIY debt settlement is the way to go.

How much can you save with one creditor?

Each creditor will have it’s own policy regarding what it will settle a debt for. For example, you may find that you are able to save 60% with one creditor, but only 45% with another. Read more about why banks settle debt.

Why did my creditor reject my offer?

The creditor you’re negotiating with may reject your offer, maybe because it’s too small, in which case you may want to increase the size of your offer, if you can afford to. It’s also possible that your offer was rejected because you’re off on your timing, or because there was irregular activity on your account prior to your default.

How long before you can negotiate with a creditor?

If you are going to negotiate with an original creditor (the lender that extended you credit), you usually want to do so before the account is more than six months past due. Otherwise, you’ll often have to try to negotiate a settlement with the collection agency that your creditor may hire to collect your debt, or with the agency that may purchase the debt.

How late can you settle a Chase charge?

Chase settlements are best between 150 and 180 days late too, but the Chase settlements I do are often better savings, and done with the collection agencies Chase uses after the charge off.

Can you settle your own debt?

Despite advertising to the contrary by some debt settlement companies, you are well-positioned to settle your own debts with your creditors. In other words, there is no need to pay a lot of money to a debt settlement firm to negotiate for you, and DIY debt negotiation means that you’ll have more money to put toward your debts. You can get out of debt faster by settling your unpaid bills yourself.

Can I work on DIY debt settlement?

You can work one on one with someone in the network in order to make sure that you understand the details and nuances of the process and provide encouragement and support when you need it. It is good to know when you should bend this way, or that, and when to stretch to reach a settlement that you would otherwise not want to miss (no better low balance offer is likely to come). I would not offer to coach you through DIY debt settlement off line if I thought the website was the only tool anyone needed. DIY debt settlement is not for everyone (though I have changed many peoples opinions about this), and if it is not for you I would encourage you to request a consult with me.

How to settle a medical bill?

With this method, you contact a company first and make a settlement offer. You offer a certain percentage of what you owe and request for the remaining balance to be discharged. You can use this method with debt collectors, medical service providers for unpaid medical bills, or with a credit card company if your account is behind but still with the original creditor.

How long does it take to get out of debt?

Unless you file for Chapter 7 bankruptcy, which can take as little as six months to complete, debt settlement is typically the fastest way to get out of credit card debt. Debt settlement programs can be completed in as little as 12 months, depending on your financial situation. Even if you have limited funds for generating settlement offers, a good debt settlement company may be able to help you set up a plan that would have you out of debt less than 48 months. That’s equal to the average term you’d face with a debt consolidation loan, and you’ll likely eliminate your debt for half the cost!

What is debt settlement?

Debt settlementis a debt relief option that focuses on getting you out of debt for a percentage of what you owe. It’s also commonly called debt negotiationbecause you negotiate to only pay back a portion of the outstanding balance. In exchange, the creditor or collector discharges whatever is left.

How long does a settlement stay on your credit report?

The settlement remains on your credit report seven years from when the account first became delinquent.

What is the advantage of debt settlement?

Cost savings is the other big advantage of debt settlement. While other debt reliefsolutions focus on reducing the interest rate applied to your debt, debt settlement makes APR a complete non-issue. With debt settlement, you only pay back a percentage of principal – that’s the actual debt you owe.

How much does it cost to file Chapter 7?

The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectationsbefore you take your case to the courts. Let a certified debt relief specialist help you weigh the pros and cons of debt settlement based on your needs, credit, and budget.

How much does it cost to file for bankruptcy?

Keep in mind that bankruptcy isn’t free. The filing fee for Chapter 7 is $335, then you’ll also have fees for your attorney. This is why it’s important to have the right filing expectations before you take your case to the courts.

Why do creditors accept settlement offers?

Creditors can either send your accounts to collections, sue you for nonpayment, or sell the debt to a third-party debt buyer or collector.

What to do if a creditor doesn't settle?

If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

How to settle debt for less than what you owe?

While many creditors might agree to settle your debt for less than what you owe, there’s no guarantee that debt settlement will work. If you’re considering trying it on your own, here’s a rough guide to the steps you may want to take: 1. Assess your situation. Create a list of your past-due accounts with the creditors’ names, how much you owe, ...

How long do you have to be late to settle a credit card?

For example, you may need to be at least 90 days late on an account before a creditor considers settling. Or, some creditors might not settle at all, and you’ll have to wait until the debt is sold to another company. Some creditors might also be more likely to sue you to collect an unpaid debt than others.

What to do if you feel like you're drowning in debt?

If you feel like you’re drowning in debt, the idea of settling for less money than you owe can be appealing. You could hire a debt settlement company that will work on your behalf to negotiate settlements with your creditors.

How good is MMI?

MMI is rated as “Excellent” (4.8/5) by reviewers on Trustpilot, a global, online consumer review platform dedicated to openness and transparency. Since 2007, Trustpilot has received over 116 million customer reviews for nearly 500,000 different websites and businesses. See what others are saying about the work we do.

What to do if you think you have enough money to settle an account?

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.