The settlement date is the day that the stock's owner has to pay for a sale. You can sell your shares before then, or after, and you'll receive the same price. If a stock trades for less than the calculated settlement price, and you're planning on selling it, you'll have to wait until the settlement date to sell it.

Can you sell stock before it is settled?

Settlement is the delivery of stock against the full payment that must take place within three business days after the trade. You can sell the purchased stock before the settlement — daytraders do it all the time — provided that you do not violate the free ride rule.

How long does it take for a stock trade to settle?

U.S. stock market rules allow a stock market trade three business days to settle, or become official. For an investor to be a shareholder of record on the record date, the shares must be purchased at least three business days before the record date to allow the settlement process to complete.

What happens if you sell stock before the dividend is paid?

All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold. So, if you sell stock before dividend payable date and about two business days before the record date you will probably get the dividends for the previous period you held the investment.

Can you sell a stock 2 days before the record date?

Record Date Selling While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount. To make this strategy work, a trader must wait for the share price to move back above the value on the date before the shares went ex-dividend.

How soon after buying a stock can I sell it?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

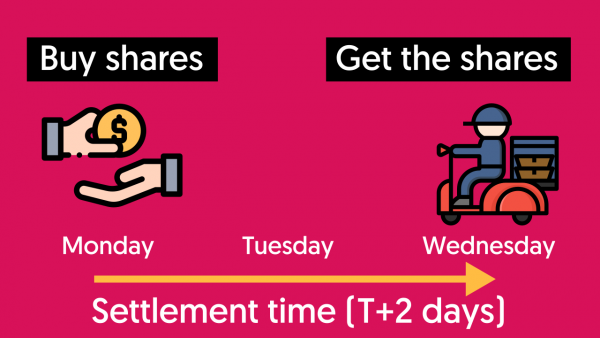

Why do stocks take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

How long does selling a stock take to settle?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

Can I sell on t2 day?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

Can I buy and sell a stock the same day?

There are no restrictions on placing multiple buy orders to buy the same stock more than once in a day, and you can place multiple sell orders to sell the same stock in a single day. The FINRA restrictions only apply to buying and selling the same stock within the designated five-trading-day period.

What is the best time of day to sell stocks?

Regular trading begins at 9:30 a.m. EST, so the hour ending at 10:30 a.m. EST is often the best trading time of the day. It offers the biggest moves in the shortest amount of time. Many professional day traders stop trading around 11:30 a.m., because that's when volatility and volume tend to taper off.

Why is settlement date necessary?

The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market.

Why does it take 3 days for stocks to settle?

The origins of settlement dates are rooted in trading practices which predate the modern electronic stock market. In the early days, a stock trade was executed by a buyer and a seller who had three days to deliver the securities and the money required to settle the transaction.

What time of day are stock prices lowest?

The opening 9:30 a.m. to 10:30 a.m. Eastern time (ET) period is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

Can I buy stock today and sell tomorrow?

You can do a BTST(Buy Today Sell Tomorrow) trade at Zerodha by simply buying a stock using the CNC product type today and selling the same stock tomorrow by using CNC. After you buy the stock today, the stock is supposed to be delivered into your Demat account in T+2 days because of the settlement cycle .

Can I buy back a stock I just sold?

You can buy the same stock back at any time, and this has no bearing on the sale you have made for profit. Rules only dictate that you pay taxes on any profit you make from assets.

Why does it take 3 days for stocks to settle?

The origins of settlement dates are rooted in trading practices which predate the modern electronic stock market. In the early days, a stock trade was executed by a buyer and a seller who had three days to deliver the securities and the money required to settle the transaction.

Why is there a settlement period?

Originally, the settlement period gave both buyer and seller the time to do what was necessary—which used to mean hand-delivering stock certificates or money to the respective broker—to fulfill their part of the trade.

What does it mean when a stock settles?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What does awaiting settlement mean when selling stocks?

Stock Settlement This means that the stock trade must settle within three business days after the stock trade was executed. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date.

What is day trading?

To day trade, which would involve you buying and selling stock with unsettled funds (in other words, in a shorter time frame than T+3 for US equities), you must apply and be approved for a margin account.

What to disclose when applying for margin account?

When applying for a margin account, you will be asked to disclose things like your years of experience trading various financial instruments, liquid net worth, and investment objectives. It makes sense -- by approving you for a margin account, a brokerage firm is essentially extending you a line of credit, and needs to evaluate your credit-worthiness.

What is margin account?

Typically, margin accounts are considered suitable for investors with a "speculation" investment objective (meaning that you have a high risk tolerance and can afford to lose most or all of your investment), who have prior trading experience, and are able to maintain a certain minimum account balance that is correlated to the amount of stock you buy on margin.

How long does it take to settle a stock?

Two days is by convention, you can get same-day settlement or one-day settlement if you want. Most shops want two days—or at least one day—in order to locate the shares and arrange any financing.

What is short selling?

HOW : There’s a term called ‘short selling’ . If the person who had sold you shares on monday (from whom you bought always anonymous ) had no particular shares left in his account which you bought so there is a possibility that he may not be able to deliver your stocks on t+2 day i. e. wednesday (exchange will impose penalty on him but that’s not your concern) .In that particular case exchanges will arrange on auction for your shares and you in that case will get delivery of your stocks on t+3 day i.e.Thursday BUT on thursday evening .

How much equity do day traders need?

Before he can do that, the broker must approve his account for day trading and the day trader must maintain a minimum $25,000 equity in the account at all times.

What is free riding?

Free riding is a serious violation that is regulated by the Federal Reserve Bank through Regulations T and U and is enforced by the Securities and Exchange Commission. [ 1]

What does it mean to sell after ex dividend?

The three day stock settlement means someone who buys shares two business days before the record date will not become a shareholder of record until the day after the record date. This investor will not receive the dividend.

What is the record date for dividends?

With a soon to be paid dividend, the record date is used to determine who receives the dividend and which investors purchased shares too late to earn the dividend. The rules of stock settlement make it possible to sell shares before the actual record date. However, the financial results may not be what you are expecting.

How long before record date can you sell stock?

Record Date Selling. While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount.

What is the day before the record date called?

The day two days before the record date is called the ex-dividend date . So if you already own shares, it is possible to sell the shares on the ex-dividend day or the next day -- both before the record date -- and you will still be a shareholder of record on the record date. 00:00.

Do shareholders of record receive dividends on the record date?

All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold.

Why do you have to wait two days after selling a stock?

Securities and Exchange Commission (SEC) calls this violation “free-riding.” Formerly, this time frame was three days after purchasing a security, but in 2017, the SEC shortened this period to two days. The reason for waiting two days is to allow the settlement cycle to run its course and ensure the successful transfer of stock securities.

What regulation outlaws free riding?

The Federal Reserve Board’s Regulation T outlaws free-riding, which is selling a security before you pay for it. For example, suppose you have $100 in your cash account, and you purchase $1,000 of ABC stock on Monday (day zero, the trade date).

How long does it take for a stock to leave your brokerage account?

At the end of the three days , the money leaves your brokerage account, replaced by the shares you bought.

How long do you have to wait to sell a stock?

Waiting two days to sell a stock will help you avoid any federal free-riding violations, which include freezing your trading account for 90 days. But some investors continue to observe the older three-day rule as a preference, although it's no longer a requirement.

How long does it take for a broker to freeze your account?

The penalty for free-riding is that your broker will freeze your account for 90 days . This doesn't mean you can’t trade during the penalty period. It does mean you must have the cash upfront to buy securities. You can’t rely on unsettled cash to pay for securities.

When did the T+2 settlement cycle change?

In 2017, the SEC amended the T+3 settlement cycle to a T+2 settlement cycle, effectively shortening the three-day rule to a two-day rule. The SEC's goal in changing this time frame was threefold: it more closely aligns with new technology, new products and the growth of trading volumes.

Who is Eric Bank?

Eric Bank is a senior business, finance and real estate writer, freelancing since 2002. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com. Eric holds two Master's Degrees -- in Business Administration and in Finance. His website is ericbank.com.

Why did the stock market have settlement dates?

Settlement dates were originally imposed in an effort to mitigate against the fact that in earlier times, stock certificates were manually delivered, leaving windows of time where a stock's share price could fluctuate before investors received them.

What is the date of a security purchase?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What is the first date of a buy order?

The first is the trade date , which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

How long after the trade date do you settle a mutual fund?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2". In most cases, ownership is transferred without complication.

When is the settlement date for a government bond?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date 2

Do buyers and sellers transfer ownership?

In most cases, ownership is transferred without complication. After all, buyers and sellers alike are eager to satisfy their legal obligations and finalize transactions. This means that buyers provide the necessary funds to pay sellers, while sellers hold enough securities needed to transfer the agreed-upon amount to the new owners.

Who is Chad Langager?

Chad Langager is a co-founder of Second Summit Ventures. He started as an intern at Investopedia.com, eventually leaving for the startup scene. When purchasing shares of a security, there are two key dates involved in the transaction. The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange.