Can the IRS take my lawsuit settlement?

In some cases, the IRS can take a part of personal injury settlements if you have back taxes. Perhaps the IRS has a lien on your property already, and if so, you could find yourself losing part of your settlement in lieu of unpaid taxes. This can happen when you deposit settlement funds into your personal bank account.

Does the IRS tax workers comp settlements?

You do not have to pay taxes on a workers' compensation settlement in most cases. According to the Internal Revenue Service (IRS), the workers' compensation benefits that you receive are not taxable. This is in response to the limits that being on workers' compensation benefits imposes on your ability to earn a living.

What is the highest workers comp settlement?

This year, Los Angeles workers' compensation attorney Harry Samarghachian, a partner with Rose Klein & Marias, secured a settlement of $11.3 million for his client who suffered a catastrophic traumatic brain injury. This marked California's largest workers' compensation settlement in history.

Can I collect unemployment after workers comp settlement California?

It is possible to collect unemployment after a workers' compensation settlement, but oftentimes a resignation letter will become part of the settlement deal. If you signed off on the resignation letter then you will no longer be able to collect unemployment.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

How does workers comp affect tax return?

Repayment of Workers' Compensation Benefits While you are completing your income tax return, deduct the same amount of your benefit (shown in box 10) on line 25000. This deduction allows your workers' compensation benefits to be deducted from your income. This ensures that you are not taxed on both amounts.

How long do most workers comp settlements take?

around 12-18 monthsHow Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process—from filing your claim to having the money in your hands—can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

How long does it take to get the Rtwsp check?

An eligibility determination will be made within 60 days. Privacy Notice on Collection of Personal Information: The Department of Industrial Relations will use the personal information collected below to determine your eligibility for, and pay the benefit authorized by Labor Code § 139.48.

How are compromise and release settlements calculated?

How are Compromise and Release settlements calculated? To calculate a Compromise and Release settlement, three factors need to be considered: permanent disability rating, future medical treatments, and attorney fees.

How long does workers comp take to disburse a settlement California?

If the judge approves the settlement, you will receive your lump-sum payment within 30 days.

What is a Compromise and release?

A Compromise and Release Agreement is a settlement which usually permanently closes all aspects of a workers' compensation claim except for vocational rehabilitation benefits, including any provision for future medical care. The Compromise and Release is paid in one lump sum to you.

Do I have to report a settlement to unemployment California?

Once you are eligible and receiving benefit payments, you must report any income you received, or that you have returned to work.

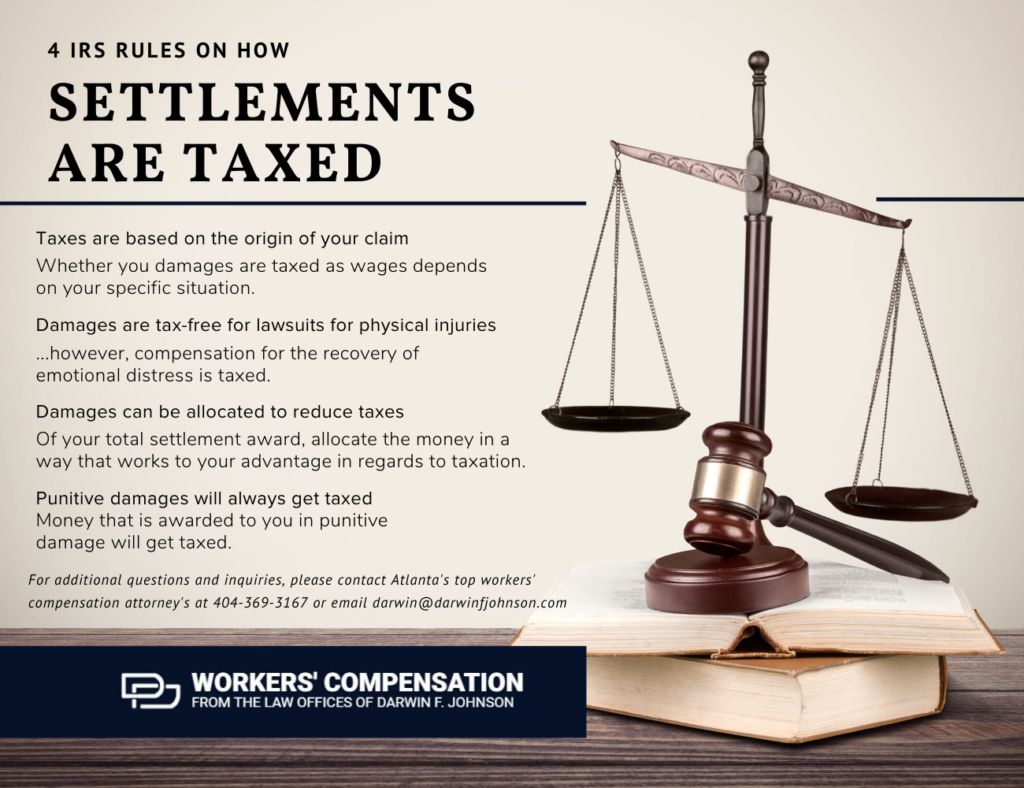

Are lawsuit settlements taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is OWCP schedule award taxable?

Social Security considers OWCP Sched- ule Awards as disability benefits, and will deduct the full amount from any Social Security disability benefits due. Moreover, Social Security will report the full amount of the deduction to the IRS as taxable income, even though it never was paid to the injured worker.

Is disability income taxable?

In most cases, Disability Insurance (DI) benefits are not taxable. But, if you are receiving unemployment, but then become ill or injured and begin receiving DI benefits, the DI benefits are considered to be a substitute for unemployment benefits, which are taxable.

Where do I put workers comp on TurboTax?

@aman2020 You should receive a form 1099-G reporting your workmen's compensation income and you will enter that in the Unemployment section of TurboTax, which is in the federal Wages and Income section.