How do I exchange a Vanguard mutual fund for another Vanguard mutual fund online?

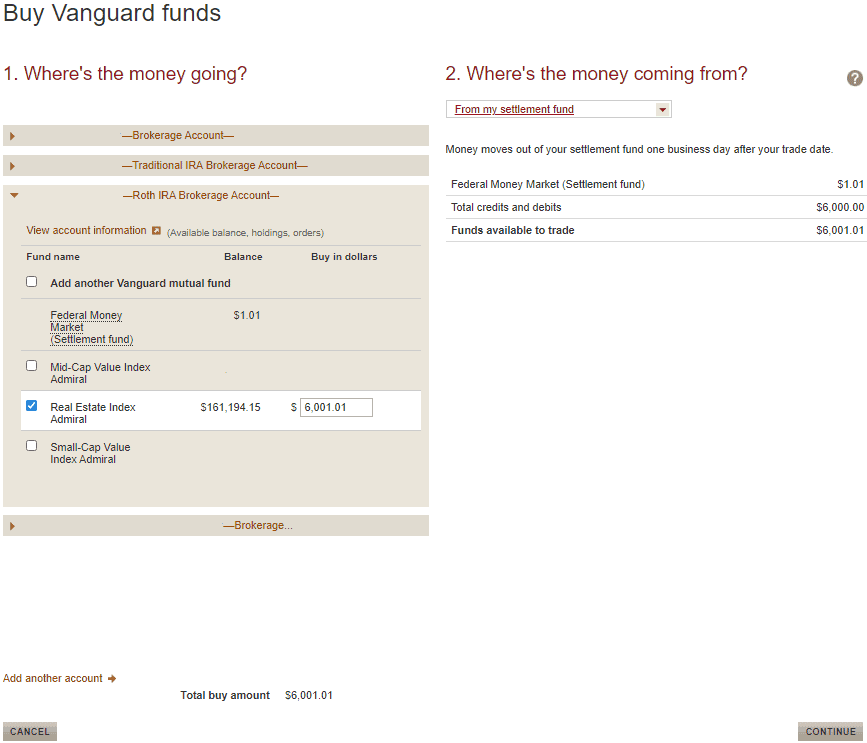

- From the Vanguard homepage, search "Exchange funds" or go to the exchange funds page. After you log in, you'll see the page below.

- Select the checkbox next to the fund name you want to exchange from.

- Enter the dollar amount you want to exchange into the textbox. ...

- In the Where's the money going? ...

Full Answer

How to withdraw money from Vanguard?

To withdraw money from Vanguard, you need to go through the following steps: Log in to your account Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu Select the withdrawal method and/or the account to withdraw to Enter the amount to be withdrawn, and, if prompted, a short reason or description Submit your request

Does Vanguard have a bank?

Vanguard only offers brokerage accounts. It does not have any bank accounts, like checking or savings accounts. The FDIC only guarantees bank accounts, so there is no FDIC insurance at Vanguard. Every brokerage account at Vanguard is protected by SIPC. The insurance limit is $500,000. Up to $250,000 of this maximum can be applied to idle cash.

How to send money to Vanguard?

Invest by sending a check

- Don't send a check without a purchase form.

- Make your personal check payable to Vanguard. ...

- Be sure to sign your check. ...

- If you're submitting an employer's check, simply enclose it without endorsing it.

- Don't include additional forms or hand-written instructions with your check.

Does Vanguard have a gold ETF?

Vanguard gold ETF is a fund that invests in shares of companies, governments, and other securities related to the mining industry. It’s managed by Vanguard Group, an investment company with over $3 trillion in assets under management (AUM).

How do I change my Vanguard settlement fund?

How do I exchange a Vanguard mutual fund for another Vanguard mutual fund online?From the Vanguard homepage, search "Exchange funds" or go to the exchange funds page. ... Select the checkbox next to the fund name you want to exchange from.Enter the dollar amount you want to exchange into the textbox.More items...

Can you switch between Vanguard funds?

You can move your Vanguard mutual funds into your existing brokerage account and keep that account number. You'll no longer need your separate mutual fund account. I want to keep the same investments. Your investments won't change.

Can you withdraw from settlement fund Vanguard?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Do you have to keep money in Vanguard settlement fund?

While you're not required to have a balance in your settlement fund at all times, keeping some money in the settlement fund has these advantages: You're more likely to have money to pay for purchases on the settlement date, when your account will be debited for the amount you owe.

What is Vanguard settlement fund?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

Does Vanguard charge to exchange funds?

Vanguard Brokerage doesn't charge additional fees for a purchase, a sale, or an exchange of any load mutual fund offered through our program.

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

Can I trade with unsettled funds?

Can you buy other securities with unsettled funds? While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade.

How often can I exchange Vanguard funds?

within 30 calendar daysFrequent-trading policy If you sell or exchange shares of a Vanguard fund, you will not be permitted to buy or exchange back into the same fund, in the same account, within 30 calendar days.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

What is a sweep in settlement fund?

Vanguard is offering a new settlement fund option for your cash—but only for some investors. Brokerage clients who end up with cash in their account typically have it deposited automatically in a settlement or “sweep” account until they decide to withdraw or reinvest it.

How often can I exchange Vanguard funds?

within 30 calendar daysFrequent-trading policy If you sell or exchange shares of a Vanguard fund, you will not be permitted to buy or exchange back into the same fund, in the same account, within 30 calendar days.

Is exchanging Vanguard funds a taxable event?

Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC. An exchange is actually two transactions, selling one fund and using the proceeds to buy another fund in the same account. Performing an exchange in a taxable account is a taxable event.

Can you exchange one mutual fund for another?

Exchange privileges allow an investor to exchange ownership from one mutual fund to any other mutual fund in the fund family. Some investors may choose to utilize this privilege in their overall investing strategy, which can be more easily deployed when setting up a family of funds account.

Can I transfer money from one mutual fund to another?

If you're planning to move from one fund to another, you can do it either online or offline. You can switch mutual funds as many times as you want, partially or entirely. It is your decision why you want to make a move, but you should also consider the additional tax and exit fees you would have to pay in return.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

The Motley fool suggests buy and sell

How bad are these guys? Few months ago they suggestion some stock I hold as a good buy. At the beginning of September they have it listed as companies you should avoid like the plague. Today they are listing as stocks you should own in October.

I want to better my investing skills and understand the stock market at a professional level

For background I am a finance major that is wanting to break through into investment banking. I know what data is important and what to look for but I feel like the stock market has become so volatile it’s harder to predict now. I’m struggling with how to read charts and the patterns that go with them.

Why is Vanguard transitioning?

Transitioning may help lower overall costs: Vanguard insists that streamlining their services and phasing out the old platform can help keep costs low for investors. Since Vanguard is known for its low-cost investments, this could be one reason to make the transition.

Is Vanguard voluntary?

It is essential to understand that while Vanguard insists on doing this, it is voluntary. Vanguard themselves have confirmed that customers are not required to transition if they do not wish to. So, the choice is really up to you.

Do you have to transition Vanguard funds?

If you hold a Vanguard fund, you have likely seen emails or pop-ups asking you to transition your funds. If you do not currently have a Vanguard brokerage account, you are probably among the many other customers wondering if you should make the transition. Transitioning your Vanguard account is not mandatory but may yield some benefits.

Is Vanguard a mandatory brokerage?

Transitioning your Vanguard account is not mandatory but may yield some benefits. With a transitioned brokerage account you will be able to hold mutual funds, ETFs stocks, bonds, and CDs and enjoy additional insurance from Lloyd’s of London. In this article, we’ll go over whether you should transition your Vanguard account and ...

Can you reinvest Vanguard funds right away?

Fast fund transactions: When you sell a stock or bond, you can reinvest your profits in Vanguard funds right away. You also will not pay commissions when you buy or sell Vanguard mutual funds or ETFs.

Does Vanguard have a personal advisor?

Account management that is simple and hassle-free: You will receive more simplified records in the form of one statement and one consolidated tax form in the first year after the move to the new platform. The Vanguard brokerage platform also offers personal advisor services that include a customized financial plan, goal-setting, and investment advice. The personal advisor service does come with a fee of 0.03% of your total assets.

Does Vanguard have insurance at Lloyd's?

Additionally, Vanguard has secured extra cover from Syndicates at Lloyd’s of London, which offers an aggregate limit of $250 million for all claims of securities and cash. It also incorporates a per client coverage limit of $49.5 million for securities and $1.9 million for cash.

Who owns Vanguard Brokerage Services?

Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Is investing subject to risk?

All investing is subject to risk, including the possible loss of the money you invest.

Do you lose money in VMFXX?

Yes, you do lose money in VMFXX, because that fund's yield is so much lower than the inflation rate.

Can money market funds lose money?

Possible but very unlikely. Money market funds invest in high grade liquid assets and the primary goal is not to lose money. I have not been able to find an example of a Vanguard money market fund ever "breaking the buck" and having the value of a share go below a dollar. It is possible that this could happen in the event of a large scale financial collapse, but even then I would call it possible rather than likely.