You can make intraday trades on a settlement holiday, yes. Only BTST trades with shares bought in the previous session wouldn’t be possible. ¶

What is a trading holiday and settlement holiday?

Trading holidays are when markets are closed and no trading or investing takes place on this day. Settlements also do not happen on this day. What will be the impact of the settlement holiday on 1st April 2021 and trading holiday on 2nd April 2021? On account of the holidays on 1st and 2nd April 2021 kindly note the following impact:

Can we trade in futures on settlement day?

In addition to the NSE and BSE holidays, the following holidays were announced for Currency Trading and for Clearing & Settlement. Find out more about settlement holidays and its impact on delivery based equity trading by reading our post here. […] sir, can we trade in Futures on Settlement day..?? Yes, you can.

Can I do intraday trading on Monday 30 April 2018?

You can make intraday trades on a settlement holiday, yes. Only BTST trades with shares bought in the previous session wouldn’t be possible. Will I be able to do the intraday trading on Monday 30 April 2018?? Yes, you can. Sir I have bought cnc shares friday (today), can I sell on Monday (settlement holiday). No, you cannot. Yes, you can.

What is intraday trading settlement process?

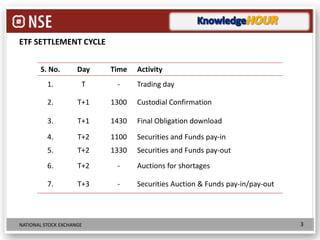

About intraday trading meaning, there are two types of stock market trading settlement processes: Spot settlement: This means the trading settlement process is done immediately according to the rolling settlement principle of T+2. As per the Rolling settlement principle, intraday trading settlement happens within T+2 days.

Is trading allowed on settlement holiday?

A settlement holiday is when the stock market is closed for trading, but the settlement of trades on that previous day will occur as usual. No settlement will take place on these days. As per SEBI mandate, a settlement on weekends/public holidays shall be carried out on the next banking working day.

Can we buy and sell shares on settlement holiday?

If the shares are sold one day before the settlement holiday, the 20% blocked funds will be included in the Kite funds (opening balance) on the next day, i.e. T+1 day, even if it falls on a settlement holiday.

How intraday trades are settled?

According to the recent guidelines issued by the Securities and Exchange Board of India (SEBI), the profits made in intraday trading are credited in T+1 days. This means that the next day when the market session ends, you will receive your intraday trading profits.

What is difference between trading holiday and clearing holiday?

Clearing or settlement holidays are different from trading holidays. So, there are two separate lists of holidays published each year by the exchange. To put it simply, clearing holidays are days when no settlement or delivery of stocks/commodities happens. These are usually the days of banking holidays.

Why is today a settlement holiday?

Settlement Holidays occur due to bank holidays, or for any other reason when the depositories are closed. Saturday and Sunday are always settlement holidays by default.

Is Saturday a settlement day?

The pay-in and payout of funds and securities takes places on the second business day (i.e., excluding Saturday, Sundays and bank and BSE trading holidays) of the day of the execution of the trade.

What is the settlement time for intraday trading?

An intraday trade has to opened and closed on the same day. In the rolling settlement, if it is not closed on the same day, then it goes to compulsory delivery. Hence the timing for intraday trading is from 9.15 am to 3.30 pm on a daily basis in the Indian markets.

What time is best for intraday?

Many experts suggest that 10.15 AM to 2.30 PM is the right time to conduct intraday trading. Morning volatility usually tends to subside by 10.00 to 10.15 AM, making it the perfect time to place intraday trades.

Is there any tax on intraday trading?

Gains earned from intraday trading are treated as business income. It is added to your salary and taxed according to the income tax slab you fall in. So if you're wondering that intraday trading taxable under which head, the answer is business income.

What is settlement in Zerodha?

This process of transferring unused funds back is called 'Running Account Settlement' or 'Quarterly Settlement of funds'. The funds are transferred back to the primary bank account mapped to your Zerodha account.

What is the full form of nifty?

Nifty stands for 'National Stock Exchange Fifty' and is the index for the National Stock Exchange.

Is Good Friday a settlement holiday?

Good Friday is not a settlement date for stocks or mutual funds.

What if I sell shares on settlement holiday?

On settlement holiday, trading in equity markets takes place as usual, but clearing and settlement remain shut for Payin and Payout of stocks and funds. It may be noted that the trading holiday is different from the settlement holiday: in the case of the former, stock markets remain closed and no trading takes place.

Can you sell stocks on a holiday?

The stock markets in the U.S. and worldwide generally close on or around certain holidays. In the U.S. these include Christmas, Thanksgiving, New Year's Day, and several others.

Can I buy stocks on a holiday?

Trading activity takes place in U.S. markets Monday to Friday but is subject to holiday schedules. The NYSE and Nasdaq generally follow the federal government's holiday schedule for closings but remain open on Veterans Day and Indigenous Peoples' Day.

What is the last day I can sell stock for tax loss?

Dec. 31You'll only have until the end of the calendar year to position your portfolio to be in compliance. So you must clear wash sales by Dec. 31 to be able to claim any associated loss on that year's tax return.

How long can you sell a security?

If you buy a security in the U.S. then you can sell it any time that you want whether it be seconds or months/years later .

What does T+X mean in trading?

With T+x obligation to pay for the stock within the time frame, it means that you own the stock. If you sell the stock before the clearing date, you pay/get paid the difference. High-frequency trading works the same way except that it happens in a fraction of a second (not applicable to a country with trading on only one stock exchange)

How much margin is allowed in a PDT?

A PDT is allowed intraday to trade four times the maintenance margin excess in the account as of the close of business of the previous day but must revert to the standard 50% overnight margin by the end of the current day. Brokers have the right to set more restrictive levels of margin (less than 4:1 leverage) and securities like leveraged ETFs require more margin.

What is the T+2 time limit?

T+2 refers to the two day time limit for the exchange of cash and shares between the buyer and the seller.

Is intra day trading risky?

Intra day trading is more risky as you are trying to gauge small swings in market. For it to result in money you have to trade in large volumes. A adverse swing can wipe out any gains q

Is there a margin borrowing charge for T+2 settlement?

IOW, there is no T+2 settlement. For lack of a more precise financial description, you are effectively borrowing the money from your broker until settlement but there is no margin borrowing charge.

Do you have to pay a title until settlement?

You may not receive the cash from the sale until settlement (and you may not have to pay until settlement either). However there are various rules governing how the broker handles these situations in different jurisdictions. Obviously if you have a beneficial interest that is almost as good as holding title, so they may be willing to lend you money using the beneficial interest as collateral.

When is the settlement holiday 2021?

Settlement holiday on 26th May 2021. Tomorrow, 26th May 2021 is a settlement holiday on account of Buddha Purnima. Due to this, all Equity Delivery orders placed on 25th May and 26th May 2021 will reflect in your Demat account on Friday 28th May 2021.

When will the 25th and 26th May 2021 be settled?

All trades placed on 25th and 26th May in the Equity segment will be settled on Friday, 28th May 2021. All trades placed on 25th May in the Derivative segment will be settled on 27th May. All shares bought on 25th May will be visible under T1 holdings on the 26th May but you will only be able to sell them on 27th May.

What Is a Settlement Holiday?

A settlement holiday is a day when the stock markets are closed, but you can trade-in your investments through an online platform. Settlement holidays are also called transfer holidays because you can move your shares from one broker to another if you have invested in mutual funds or stocks. Settlement dates in India also include bank holidays and public holidays.

What Is a Trading Holiday?

A trading holiday is when the stock exchanges are closed for trading, and no transactions can be done. The exchanges declare NSE holidays and BSE holidays as per India's Securities and Exchange Board (SEBI). A trading holiday is when the exchange will operate the stock market as usual, but no settlement will occur these days.

What does "settlement holiday" mean?

Settlement Holiday in Stock Market: Meaning. Settlement Holiday is when the stock market is open, but shares which you bought or sold are not settled. This could be due to bank holidays or because the depositories (CDSL and NDSL) are closed. Let’s take an example.

What does trading day mean?

This means, ‘Trading Day + 1’ i.e. the first day after you bought the shares. On the 2nd day, which is T+2, the shares are deposited into your demat account – after which, you can sell your shares. However, if there is a ‘settlement holiday’ in between, then it takes one extra working day for the shares to get deposited in your demat account.

What happens when you buy shares?

When you purchase shares, you buy it from someone who has sold it. So the shares have to be transferred from their dematerialized (demat) account to yours.

Is 19 February a settlement holiday?

In short, if 19th Feb was not a settlement holiday, you would have received the shares in your demat account by 22nd February. Saturday and Sunday are always settlement holidays. If you liked the article, do follow us on WhatsApp, Twitter, Instagram and Facebook.

What is the settlement holiday for 2021?

We’ve got an important update this week.#N#Thursday 1st April 2021 is a settlement holiday on account of the New Financial Year. Due to this, all Equity Delivery orders placed on 31st March & 1st April 2021 will reflect in your Demat account on Tuesday 6th April 2021.#N#Friday 2nd April 2021 is a trading holiday because of Good Friday. This means markets will remain closed and no trading and investing will happen on this day.#N#To help you understand what this means, we’ve simplified the details below.#N#What’s a settlement holiday?#N#Settlement holidays are when markets are open but settlement of your trades do not take place as per the usual T+2 cycle because either the depositaries (NSDL and CDSL) are closed or banks are closed on that day.#N#What’s a trading holiday?#N#Trading holidays are when markets are closed and no trading or investing takes place on this day. Settlements also do not happen on this day.#N#What will be the impact of the settlement holiday on 1st April 2021 and trading holiday on 2nd April 2021?#N#On account of the holidays on 1st and 2nd April 2021 kindly note the following impact:

When will withdrawals be processed in 2021?

All fund withdrawal requests placed on 2nd April will be processed on Monday, 5th April 2021. You can also check a list of future settlement holidays here and trading holidays here. If you have any queries, you can raise a ticket on the Upstox mobile or desktop platforms. Back.

What is Stock Market Trading, Clearing and Settlement?

Foremost, for intraday trading in the secondary market, you have to open a trading account online with a broker or sub-broker. Once your trading account is active, you can start your intraday trading. You can buy and sell securities as per your choice.

What are the Different Types of Trading Settlement Processes?

About intraday trading meaning, there are two types of stock market trading settlement processes:

Conclusion

Overall, the trading settlement process is a complex process that involves various participants, including clearing corporations, clearing members, custodians, clearing banks, depositories, and professional clearing members. Understanding the stock market trading concept can help you better plan your intraday trading activities.