What happens if I dispute a charge on my credit card?

Federal law provides protection to credit card consumers when disputing billing errors and charges for fraudulent purchases. Disputing a charge doesn’t necessarily mean you won’t have to pay it though. Whether you’re responsible for paying the disputed amount depends on the results of the card issuer’s investigation.

Can you negotiate a credit card debt settlement with a lawyer?

It is possible to get some of the balance negotiated down with lower monthly payments (time to pay), but that is not a frequent option in a lawsuit situation with your creditor. Negotiating and Settling a Credit Card Debt When You’re Being Sued by a Collection Attorney Representing a Debt Buyer is Different

How does credit card debt settlement work?

Credit card debt settlement is an agreement between an indebted consumer and a creditor that entails the consumer submitting a lump-sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges.

How far behind on your credit card payments can you settle?

In other words, you have to be around 180 days behind on your credit card payments to even qualify for consideration. With that said, there are two basic types of debt settlement: 1) do it yourself debt settlement; and 2) service-assisted debt settlement. You can also attempt to settle the following types of debt:

How do you get a paid settlement off your credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

Can you remove settled debts from your credit history?

That's a common question. Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed.

How long does it take to remove settled accounts from credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached.

What happens when you do a settlement on a credit card?

As stated above, a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in one single payment or as a series of payments, as determined through the specific agreement.

Is settled in full good on credit report?

Settled in Full For lenders, debt settlement is not as favorable. As a result, it is not exactly ideal for your credit report or credit score. Having a "settled in full" account on your credit report shows lenders that you have a history of not paying your entire loan or credit card back.

Can a paid charge-off be removed from credit report?

And now, due to COVID, credit bureaus are offering free weekly credit reports until April 2022. The only sure way to remove a paid charge-off account from your credit before the seven years end is if there's a mistake. If there isn't, there's nothing to do but wait for it to be removed automatically.

Is a settlement better than a charge off?

It's always better to pay off debt in full than settle debt. But if you can't afford to pay in full, settling your debt can be an alternative that won't damage your credit as much as not paying at all.

Does a paid collection affect a credit score?

When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve. However, because older scoring models do not ignore paid collections, scores generated by these older models will not improve.

Do settled accounts affect credit score?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Is it worth it to settle debt?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you.

What percentage will credit card companies settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Do settled accounts affect credit score?

Yes, settling a debt instead of paying the full amount can affect your credit scores. When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount.

Will settling a charge off raise credit score?

If you pay a charge-off, you may expect your credit score to go up right away since you've cleared up the past due balance. Unfortunately, it's not that easy. Over time, your credit score can improve after a charge-off if you continue paying all your other accounts on time and handle your debt responsibly.

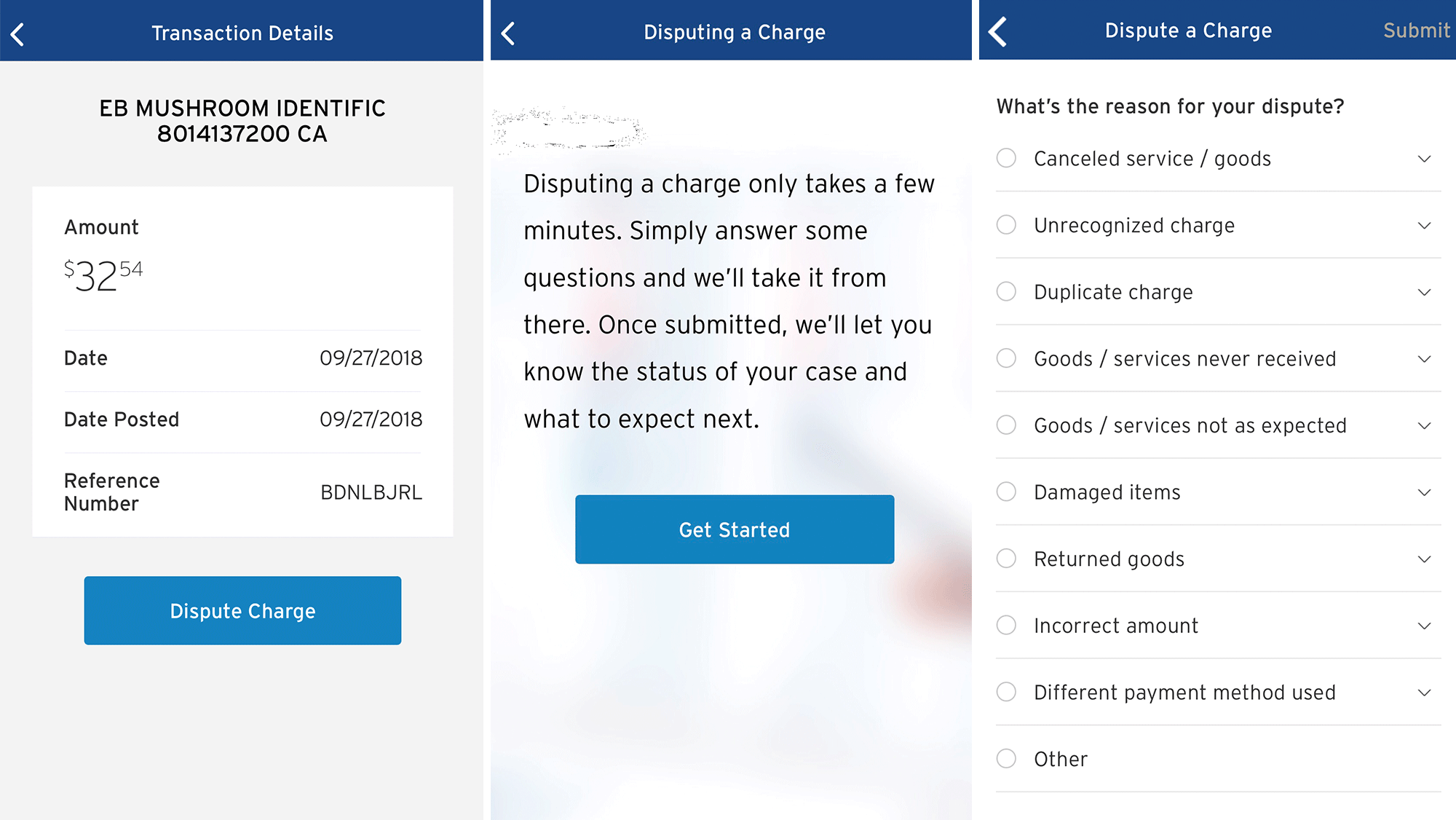

How to dispute a purchase on a credit card?

Filing a dispute is simple. Often, you just need to click the “dispute” button on your issuer’s online portal or app and answer a few questions. The purchase is credited back to you immediately. But “simple,” of course, doesn’t mean “inconsequential.”

What to do if you believe someone is making fraudulent purchases on your credit card?

If you believe someone’s making fraudulent purchases on your card, alert your issuer as soon as possible and request a new card and account number.

What to do if a merchant is unwilling to resolve your problem?

And if a merchant is unwilling to resolve your problem, you have another option: asking your credit card company to reverse your payment, known as a chargeback.

What to do if you are dissatisfied with a purchase?

But if you’re simply dissatisfied with a purchase, the law requires you to make a good-faith effort to resolve the issue with the merchant first. Calling customer service first, rather than hitting the “dispute” button, could get you your money back while keeping you on good terms with your retailer.

Why should every purchase be on a credit card?

by Virginia C. McGuire, Paul Soucy. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't have to go into debt, and you don't have to pay interest. Explore Credit Cards.

Can you file a chargeback for online purchases without your permission?

Check with authorized users to see if they made a purchase you were unaware of. A good rule of thumb: If you’re not willing to file a police report on your child or partner for making an online purchase without your permission, don’t file a chargeback for it.

Can you get your money back if you are not satisfied with your purchase?

Chargebacks can be a valid way to get your money back if you are not satisfied with your purchase and the merchant won’t resolve the problem.

How to dispute a credit card statement?

If you want to dispute a billing error on your credit card statement under the FCBA, write your card issuer at the address listed under “billing inquiries” (it may be different from where you send your payments). Check out the Federal Trade Commission’s sample dispute letter to help you get started.

What is a credit card dispute?

In a Nutshell. Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or services purchased with your card. The Fair Credit Billing Act helps consumers in these ...

How much is a credit card liability?

Your liability for fraudulent or unauthorized charges on your credit card is limited to $50 under the Fair Credit Billing Act. But many card issuers have $0 liability policies, so you may not have to pay anything if your issuer has this type of policy and you have eligible unauthorized charges on your bill.

What to do if you discover a fraudulent charge?

If you discover that a charge is fraudulent, contact your credit card issuer immediately to report it. The issuer should cancel your card so that it can’t be used anymore and send you a new one with a different card number. How to guard against credit card fraud.

What happens if you don't pay a credit card charge?

If you don’t pay the disputed charge and the card issuer reports your account as delinquent to the credit bureaus, it must include a statement that explains that you don’t believe you’re responsible for paying the disputed amount.

What happens if a credit card company finds an error?

If the company finds an error, the amount must be credited back to you, along with any related finance charges. But if the card issuer decides the charges were accurate, you’ll be responsible for paying the disputed amount, including any finance charges that accrued while the disputed charge was being investigated.

How to dispute a charge?

When to dispute a charge 1 You were charged for purchases you didn’t make 2 You were charged for items you bought but never received 3 You didn’t receive a credit for an item you returned 4 The amount you were charged for a purchase you made was incorrect

What happens if a settled account is faulty?

If the settled account was faulty, it will then be removed from your account. The only way it will appear again is if the creditor proves it was accurate. This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

What happens if you close a credit card?

If you close an account like a credit card and it has been paid off, then your credit score can also be negatively affected. Your credit score is based on available credit, payment history, and the age of your accounts.

What Happens When an Account Is Closed?

When you pay off or close an account it’s not available for purchases or payments.

How Will You Attack Your Settled Account?

You know what a settled account is and how it can affect your credit score.

What to do if you feel like going to a credit bureau?

If you feel like going directly to a credit bureau isn’t the right attack, then you can send the lender a goodwill letter directly. This letter is a polite way to ask if a lender will remove the settled account from your credit history.

How long does it take for a missed payment to drop off your credit report?

In at most 7 years from the first date of your missed payment or the date you paid the account in full, it will drop from your report. By reviewing your credit report you can see how much time is left on the settled account and from there determine how long it will still appear on your account.

How long does a credit card account stay on your credit report?

These accounts can appear on your credit report for up to 7 and a half years from the date it was paid in full.

How long does it take to get sued for credit card debt?

Most of the time (but not all), you have at least 6 months of nonpayment before the risk of being sued begins. The risk of being sued increases incrementally from there.

How do debt buyers buy defaulted credit cards?

Debt buyers buy defaulted accounts in bulk from credit card issuers. They pay different amounts for the legal rights to the debts they buy. The “fresher” the debt (6 to 12 months in default) the higher the purchase price. As defaulted credit card debts age, the less it costs to buy them. Credit card debts that get charged off by your original creditor are often bought and resold several times. The cost to purchase debts that have already been sold once or twice will be much less than was paid originally.

What does a debt buyer do?

Debt buyers settle credit card debts they own for less than the total you owe on the account. They will either collect debts using in house debt collectors, assign accounts to a subsidiary collection agency, hire another debt collection firm, or place accounts with attorney debt collection law firms they have relationships with.

When a lawsuit is ignored, a default judgment is entered?

When the lawsuit is ignored, a default judgment is entered because the court assumes the legitimacy of the debt, and that the balance being collected is all accurate and can be backed up by the plaintiff – the debt buyer – because there was no challenge or defense to the lawsuit.

Why use a software package or manually identifying an account for placement with a debt collection attorney with authorization to su?

Use of a software package or manually identifying an account for placement with a debt collection attorney with authorization to sue because the account analysis shows you are paying other unsecured creditors (other credit card bills).

Is debt buyer collection profitable?

Debt buyers invest in unpaid debts and are taking a risk that they can get troubled credit card borrowers to pay up. Debt buyer collection has proven to be profitable. They don’t get people to pay on all of the accounts they buy. Not by a long shot.

What happens when a bank sends your account to a collection law firm?

Once banks send your accounts to collection law firms, and especially after a lawsuit has been filed, you have to make settlement and payment arrangements with the law firm.

How to negotiate with credit card companies?

Be Persistent and Document Everything. If you want to negotiate with a credit card company, the process usually begins with a phone call. However, it may require long conversations with multiple people over days or weeks.

What Happens to Credit Card Debt When You Die?

Credit card debt is paid off by your estate after you die. In other words, the debt will be subtracted from anything you intend to pass onto heirs. Your estate executor will use estate assets to pay down the debt. After your debts are settled, your remaining assets will be passed onto your heirs.

How Do You Consolidate Credit Card Debt?

There are many ways you can consolidate credit card debt. The key is to get a single debt instrument that you can transfer all of your existing debt into. It could be a personal loan, a home equity loan, or even another credit card known as a " balance transfer card ."

What is the worst scenario for a credit card company?

Absent some sort of unique set of circumstances, a bankruptcy filing would be the worst-case scenario for the credit card company because it stands to lose everything it has extended you. It means that they may be willing to forgive a large portion of the debt balance in hopes of getting back something rather than nothing.

Why do credit card companies have priorities?

Credit card companies, many of which are owned by banks, have several priorities. The first is to generate profit for the parent company and its shareholders. When it becomes evident that someone may be unable to pay his or her balance, a shift in the credit card company's priorities happens that can work to your advantage.

How long does it take to settle a debt?

Pursuing debt settlement is a last resort because it involves stopping payments and working with a firm that holds that money in escrow while negotiating with your creditors to reach a settlement, which can take up to four years.

What to know before calling a bank?

Before you call, make sure you know exactly how much you owe, what your interest rate is, and any other important account details.

What is a credit card settlement?

Credit card debt settlement is an agreement between an indebted consumer and a creditor that entails the consumer submitting a lump-sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges.

How long do you have to be behind on credit card payments to settle?

you’re experiencing serious financial hardship). In other words, you have to be around 180 days behind on your credit card payments to even qualify for consideration.

When is Debt Settlement a Good Idea?

People often wonder why they should even bother with a debt settlement given that they’ll already be in default and the damage to their credit standing will already be done. However, debt settlement can be a wise decision for two reasons: 1) It eliminates the threat of a lawsuit, which might force you to pay your full balance; and 2) Paying what you owe is simply the honest thing to do.

Why do you need a debt settlement company?

Advantages: A debt settlement company is likely to know which creditors are more inclined to settle and for how much. A debt settlement program will provide you with the discipline to save money every month that you can use as leverage when negotiating.

How long does a default stay on your credit report?

It’s also important to note that since you are likely to have defaulted on your account prior to reaching a debt settlement agreement, information about the default will remain on your major credit reports for seven years from the date that you became 180 days late. Your credit score will suffer during that timeframe.

What are the two types of debt settlement?

With that said, there are two basic types of debt settlement: 1) do it yourself debt settlement; and 2) service-assisted debt settlement. You can also attempt to settle the following types of debt:

What is debt settlement?

Debt settlement is an amended payment agreement that entails submitting a one-time payment for part of what you owe in return for the creditor/debt collector forgiving the rest. Your account must be in default (or close to it) in order for you to qualify for debt settlement.

Billing Errors

Exercise Your Rights

- To take advantage of the law's consumer protections, you must: 1. write to the creditor at the address given for "billing inquiries," not the address for sending your payments, and include your name, address, account number, and a description of the billing error. Use our sample letter. 2. send your letter so that it reaches the creditor within 60 days after the first bill with the error wa…

The Investigation

- You may withhold payment on the disputed amount (and related charges) during the investigation. You must pay any part of the bill not in question, including finance charges on the undisputed amount. The creditor may not take any legal or other action to collect the disputed amount and related charges (including finance charges) during the investigation. While your acc…

Complaints About The Quality of Goods and Services

- Disputes about the quality of goods and services are not "billing errors," so the dispute procedure doesn’t apply. However, if you have a problem with goods or services you paid for with a credit or charge card, you can take the same legal actions against the card issuer as you can take under state law against the seller. To take advantage of this ...

Additional Billing Rights

- Businesses that offer "open end" credit also must: 1. give you a written notice when you open a new account — and periodically — that describes your right to dispute billing errors 2. provide a statement for each billing period in which you owe — or they owe you — more than one dollar or on which you have been charged a finance charge 3. send your bill at least 21 days before your p…

Complaints

- The Federal Trade Commission (FTC) enforces the FCBA for most creditors except banks. If you think a creditor has violated the FCBA, file a complaintwith the FTC. You also can sue a creditor who violates the FCBA. If you win, you may be awarded damages, plus twice the amount of any finance charge — as long as it's between $500 and $5,000, or higher amounts if a pattern or prac…

When to Dispute A Charge

How to Dispute A Charge

- The proper way to dispute a credit card charge varies based on why you’re disputing it. Here are two scenarios where the FCBA dispute process may apply. One thing to note: Sometimes issuers will let you handle these problems over the phone or online, but that process may not be covered by the FCBA. If you want to be sure you get the full FCBA protections due, mail in your dispute.

Paying For Disputed Charges

- For claims that fall under the FCBA dispute process, you may not have to pay the disputed charge while the credit card company investigates your claim, and the card issuer can’t try to collect payment from you for it. But you’re still responsible for paying other charges that are not disputed. During the investigation, the card issuer can deduct the amount of the charge you’re disputing fr…

Bottom Line

- Federal law provides protection to credit card consumers when disputing billing errors and charges for fraudulent purchases. Disputing a charge doesn’t necessarily mean you won’t have to pay it though. Whether you’re responsible for paying the disputed amount depends on the results of the card issuer’s investigation.