An authentic debt relief company will disclose all of its terms and conditions in a written contract. Scammers, on the other hand, will often refuse to explain their fees and the terms of what they’re offering. On the off chance that a scammer does provide information, they often won’t do it in writing.

Full Answer

What is a debt relief scam?

Debt relief scammers have a different idea in mind. They may claim they can help if you stop communicating with your creditor and stop making payments. These are major red flags. The scammer might say that this will convince your credit card company or other lenders to accept a partial payment of your debt.

Is it illegal for a debt relief organization to not have contracts?

A dishonest debt relief organization might falsely claim that a verbal agreement is enough. Not having a written contract could also be illegal in some cases. The FTC’s Credit Repair Organization Act requires any credit repair contracts (which could be part of credit relief services) to be in writing.

How can you tell if a loan company is a scam?

However, they have several traits that usually indicate they’re a scam: The scammer contacts you first. They charge an upfront fee. They won’t provide a written contract. They ask you to stop communicating with your creditors. They make exaggerated promises.

How do I know if a debt settlement company is legitimate?

7 Signs of a Debt Settlement ScamRobocalls. ... Exaggerated promises. ... Upfront fees. ... Questionable contact information. ... Nothing in writing. ... “Government” debt relief programs. ... Dictate to stop communicating with creditors.

How do debt relief scams work?

Debt Relief Service and Credit Repair Scams Debt relief service scams target consumers with significant credit card debt by falsely promising to negotiate with their creditors to settle or otherwise reduce consumers' repayment obligations.

How long before a debt becomes uncollectible in Missouri?

between five to 10 yearsDepending on the type of debt, Missouri statute of limitations on debt range between five to 10 years. After that period has passed, the debt becomes time-barred, which means collectors no longer have the right to sue you.

How do I get out of a debt settlement agreement?

Generally, those options are to:Continue to handle the debt on your own.Contact the creditors for help.Settle the debt either on your own or with the assistance of a third party.Work with a nonprofit credit counseling agency through a debt management plan. ... Seek legal protection through bankruptcy.

How do I avoid debt relief scams?

No company can ensure that it will reduce your debt by a certain amount or stop collection calls and lawsuits. Don't let a company enroll you in a debt relief program without reviewing your financial situation with you. Don't buy that a company can get negative information out of your credit file.

Is it a good idea to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

Can you go to jail for debt in Missouri?

The Missouri Bill Meaning that although people are still required to pay their board bills, they cannot be jailed for their failure to pay. With no jail time, people have the opportunity to earn the money needed to pay off their debts. The bill took effect on August 28, 2019.

How long can a creditor collect on a Judgement in Missouri?

10 yearsMissouri Judgments The statute of limitations for a balance owed pursuant to a judgment in Missouri is 10 years. Under the law a judgment is deemed satisfied if ten years has passed since the judgment was entered and no attempt to revive the judgment.

Can you dispute a debt if it was sold to a collection agency?

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you don't believe you should pay the debt, for example, if a debt is statute barred or prescribed, then you can dispute the debt.

What is a debt settlement contract?

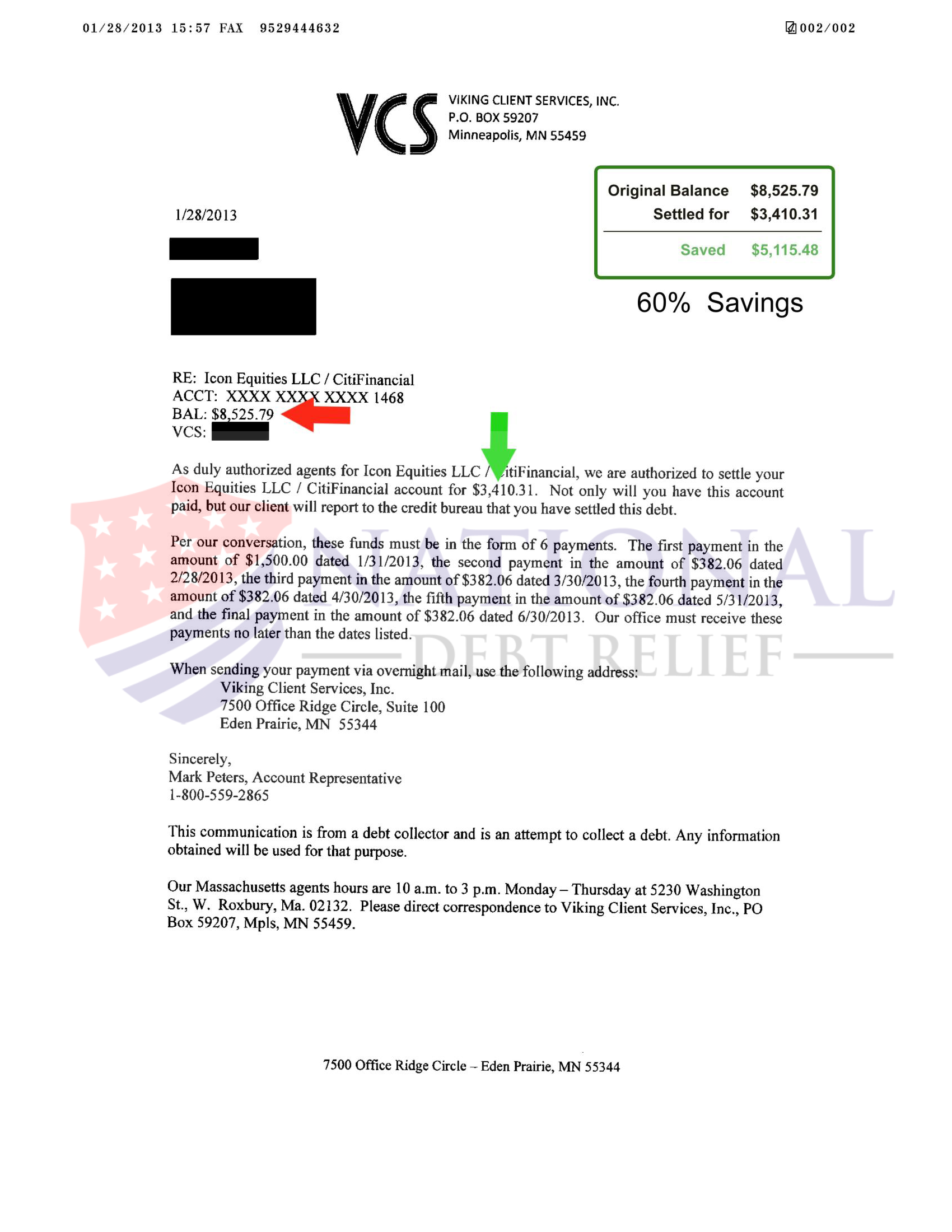

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What are the disadvantages of a debt management plan?

Disadvantages of debt management plans your debts must be repaid in full – they will not be written off. creditors don't have to enter into a debt management plan and may still contact you asking for immediate repayment. mortgages and other 'secured' debts are not covered by a debt management plan.

What happens if you cancel a debt management plan?

When you cancel, the provider will tell your creditors, so they might start charging you interest and late payment fees again, as well as expecting you to resume higher payments. You'll also have to deal with your creditors yourself again. Think about how you're going to cope with this.

Why is debt relief calling me?

Debt relief service telephone scams target consumers with significant credit card debt promising to negotiate with creditors to settle or reduce repayment obligations. These operations will charge consumers a large up-front fee and then do little; or nothing.

Why are debt collectors calling me when I have no debt?

When a debt collector calls, it's possible that you've already taken care of the debt and no longer owe the money. Perhaps you paid the original creditor. Maybe you previously settled with the same or with a different debt collection agency. It could be that the debt was discharged in bankruptcy.

How does debt elimination work?

In debt settlement, you stop making payments to your creditors. Instead, you make payments to a savings account you control that builds over time. Meanwhile, the debt settlement company attempts to negotiate payment plans, interest rates, or a lump sum payoff your creditor(s) will stamp as “settled.”

How to get debt relief?

Contacting your creditors directly is a great way to learn about legitimate debt relief options. Lenders can tell you what options you have if they know you’re having trouble repaying your debts.

What happens if a debt is bad?

Then it becomes easier to be a victim to the false or misleading promises made by debt settlement companies and scam artists. The good news is that there are clear warning signs to help you avoid these situations. This article will discuss some of those warning signs and how to avoid getting scammed.

How to contact debt relief companies?

Contact the Federal Trade Commission (FTC). Like your state’s AG, the FTC may have information that can assist you in learning more about a potential debt relief company and any legal trouble they could be in.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How do scammers make contact with victims?

Scammers will often make first contact with their victims through robocalls using pre-recorded messages. If someone reaches out to you out of the blue, saying they can help you with your debt, ignore them.

What is automatic stay?

An automatic stay, which can stop most debt collection actions against you, at least for a while

What is debt consolidation?

Debt consolidation means you take two or more debts and combine them into a single debt. The goal with debt consolidation is to make your monthly payments more manageable or more affordable. This is common with credit card debt. If you can consolidate several high-interest loans into a single loan with a lower interest rate, you can reduce the total amount of money you pay during the life of the loan. But depending on the loan’s terms, it might lead to higher monthly payments.

How long can a debt collector sue for non payment?

When sufficient time passes in a situation in which consumer debts have gone unpaid, a debt collector can lose the legal right to sue for non-payment. In Missouri, the statute of limitations on debt collection is five years for open credit card accounts, five years for oral contracts, ten years for written contracts, and ten years for promissory notes.

What is the unemployment rate in Missouri?

According to the Bureau of Labor Statistics, Missouri’s unemployment rate stood at 3.5% as of February 2020, right in line with the national average of 3.5%. Missouri residents rank 41st nationally in the amount of household credit card debt held, checking in at an average level of $6,491, 30.4% less than the national average of indebted households of $9,333. In terms of FICO scores, compared with the 2019 nationwide average FICO score of 703, the typical Missouri resident’s 2019 FICO score of 701 is slightly lower, and places the state tied for eighteenth nationwide.

Is it easy to get out of debt?

Getting out of debt is never an easy process. If debt settlement is the right avenue for you to pursue, be honest with yourself. Decide whether you possess the background, strength and fortitude to negotiate directly with creditors yourself – or whether engaging the services of an experienced and reputable debt settlement company will serve your needs best.

Can credit card companies contact Missouri residents?

Credit Card companies and other creditors are permitted to contact Missouri residents directly regarding debts, particularly in a situation involving delinquent payments. However, debt collection agencies are required to comply with the the Federal Fair Debt Collection Practices Act (FDCPA), and are therefore prohibited from taking certain actions. Under the FDCPA, collection agencies are prohibited from informing employers about a debt or attempting to collect a fee in excess of any debt owed.

Who is Steven Brachman?

Steven Brachman is the lead content provider for UnitedSettlement.com. A graduate of the University of Michigan with a B.A. in Economics, Steven spent several years as a registered representative in the securities industry before moving on to equity research and trading. He is also an experienced test-prep professional and admissions consultant to aspiring graduate business school students. In his spare time, Steven enjoys writing, reading, travel, music and fantasy sports.

How the Debt Settlement Scam Works

Debt settlement companies are generally designed to be a "middle man"between the debtor and the credit card company they owe. Their main purpose is to negotiate for debtors for a lower payment rate and/or a lower total of debt. Since credit card companies charge the rates they do, it's easy to see how this avenue can be alluring.

What To Do if You are Scammed

Typically there isn't much assistance when it comes to the recovery of funds taken by a debt settlement company, due to the fact that they got the customer to sign a payment contract for a service that was never guaranteed. This can become an extremely frustrating situation for a person in debt.

Getting Help

To avoid getting taken advantage of, consider using a debt settlement attorney instead of a debt settlement company. Attorneys all have to pass the Bar exam and are held to a code of ethics called the Model Code of Professional Responsibility.

Don't fall for Debt Settlement Scams

We see many new companies and websites open up weekly that appear to offer the same thing and claiming to have been in business for a lot longer than they really are or claim they have credentials they don’t really have. Such as stating they were featured on MSNBC, FOX, CBS etc.

About Our Company

We are the Debt Rx and are one of the longest operating Debt Settlement and Debt Negotiation firms in America. We are not the largest, because our focus has been more on personal attention and service of existing clients than that of enrolling new ones.

Can I Cancel My Contract With A Debt Settlement Company?

More and more frequently, we are finding that some debtors with whom we meet, have already hired a debt settlement company to attempt to resolve their debt issues, prior to coming in to meet with us. The debt settlement companies advertise that they can settle with credit card companies for a fraction of the debt by negotiating a lump-sum payment or “settlement” for less than the balance. They advise debtors to stop making payments to all the creditors with which they wish to settle with (which puts them into delinquent status) and instead pay an agreed upon sum into an escrow account every month in order to build up the necessary funds to pay the settlements. These plans typically take 36 to 48 months and during that time, creditors will keep charging late fees and interest. The balances of the accounts included in a debt settlement plan can double or even triple before they are settled. Creditors may put these accounts into collection and debtors can face collection lawsuits. Most debt settlement plan do not make it to completion and leave debtors in worse shape financially than before they entered the plan.

How does TSR work?

The TSR bans deceptive telemarketing acts or practices that related to debt settlement services. Specifically, the TSR requires that a debt settlement company must disclose, in a clear and conspicuous manner, the following: 1 The debtor owns the funds held in their escrow account and they may withdraw from the debt relief service at any time without penalty. The debtor must receive all funds in the account, other than those funds actually earned by the debt settlement company. 2 the length of time that will be required for the service to make a bona fide settlement offer to each creditor (usually 36 to 48 months as mentioned above); 3 the amount of money or the percentage of each outstanding debt that the debtor must accumulate before they will make a settlement offer to each creditor; 4 the use of the debt settlement company (1) will likely adversely affect the debtor’s creditworthiness, (2) may result in being subject to collections or being sued by creditors or debt collectors, and (3) may increase the amount of money the debtor owes due to the accrual of fees and interest;

How long does it take for a debt settlement to be settled?

These plans typically take 36 to 48 months and during that time, creditors will keep charging late fees and interest. The balances of the accounts included in a debt settlement plan can double or even triple before they are settled. Creditors may put these accounts into collection and debtors can face collection lawsuits.

What happens if a debt settlement company does not return money?

If for some reason, the debt settlement company does not return the money that is being held in escrow, the debtor’s rights to sue to recover those funds and may be limited by an arbitration clause in the debt settlement contract. When the Supreme Court ruled in AT&T Mobility v.

How to get a fresh start in financial life?

Typically, when facing financial difficulty, the best way to obtain a true financial fresh start is to file for bankruptcy. The results that a debtor receives from their bankruptcy filing is generally more favorable than the consequences of debt settlement.

What case did the Supreme Court rule that the Federal Arbitration Act did not allow states to nullify arbitration clauses?

When the Supreme Court ruled in AT&T Mobility v. Concepcion 563 U.S. 333 (2011) that the Federal Arbitration Act did not allow state courts to nullify arbitration clauses in consumer cases even if those courts considered them “unconscionable,” they severely limited consumers ability to get their day in Court.

Does a debt settlement company have to disclose their escrow account?

Specifically, the TSR requires that a debt settlement company must disclose, in a clear and conspicuous manner, the following: The debtor owns the funds held in their escrow account and they may withdraw from the debt relief service at any time without penalty.