Do I have to pay taxes on my insurance settlement?

Once you file an insurance settlement or claim, the money you receive does not tend to be taxable. However, in some cases, this money is subject to taxes. Unfortunately, many people don’t realize they have to pay taxes on their settlement until it is a little too late. The IRS levies taxes based on income alone. If you receive a payment from your insurance, in most cases, you will only receive enough to cover the situation at hand.

Is an insurance settlement considered taxable income?

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

Do you have to pay taxes on a settlement?

Whether you need to pay taxes on a lawsuit settlement is dependent on the circumstances of the case. You’ll have to determine the nature of the claim and whether it was paid to you. If it was a settlement of an accident, it’ll be treated as ordinary income. Its value will be taxable if the plaintiff made it whole and won’t receive tax breaks.

Do you pay taxes on a settlement?

There are many factors to consider when determining whether you need to pay tax on your settlement. Legal settlements can include lost wages, damages for emotional distress, and attorney fees. All of these items are taxable. While the amount of your award may be large, you will still need to report them on the correct forms.

What percentage are settlements taxed at?

How Legal Fees are Taxed in Lawsuit Settlements. In most cases, if you are the plaintiff and you hire a contingent fee lawyer, you'll be taxed as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut.

Are insurance settlements reported to IRS?

Generally speaking, any settlement or judgment amount you receive as compensation for lost income is subject to income tax.

How is money from a settlement taxed?

Settlements for automobile and property damages are not taxable, but there are exceptions. Like medical expenses, the IRS and the State of California consider these damages as reimbursement for a car or home previously paid.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do insurance payouts count as income?

You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.

How can you avoid paying taxes on a large sum of money?

6 ways to cut your income taxes after a windfallCreate a pension. Don't be discouraged by the paltry IRA or 401(k) contribution limits. ... Create a captive insurance company. ... Use a charitable limited liability company. ... Use a charitable lead annuity trust. ... Take advantage of tax benefits to farmers. ... Buy commercial property.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are insurance payouts taxable?

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are 1099 required for settlement payments?

Therefore, Forms 1099-MISC and Forms W-2, as appropriate, must be filed and furnished with the plaintiff and the attorney as payee when attorney's fees are paid pursuant to a settlement agreement that provides for payments includable in the claimant's income, even though only one check may be issued for the attorney's ...

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Is My Car Accident Settlement Taxable?

The taxability of compensation depends mostly on the reason for the payment -- to offset your lost wages, replace or repair your damaged property,...

Auto Accident Settlements: What's Taxable and What Isn't

How does settlement money get taxed? Some elements of a hypothetical settlement are taxable, including: 1. Payments for lost wages or lost profits...

Reducing Your Car Insurance Settlement Tax Obligation

There are ways to create a settlement with minimal or no tax obligation. A skilled trial lawyer should be able to assist you in one of two ways:

Other Tax Considerations With Auto Insurance Settlements

Taxation issues can get complicated if you live in a no-fault state, says Steven Gursten, an attorney with Gursten, Koltonow, Gursten, Christensen...

What is the tax threshold for life insurance?

For 2018 tax year, that threshold is $11.18 million. That's a huge increase from just two years ago. The federal tax overhaul doubled the threshold.

How to remove life insurance from estate?

If you want to remove your life insurance from your estate, you can transfer ownership to another person or to a trust. Then, the other person or the trust will be responsible for paying the premiums.

Is life insurance settlement taxable?

Are insurance settlements taxable? By Insure.com | Updated on March 21, 2019. Life insurance benefits and settlements for home and car insurance claims are generally not considered to be taxable income. As you file your taxes this year, you probably won’t have to dig out insurance-claims documents. But as you might expect, there are certain cases ...

Is life insurance subject to estate taxes?

Life insurance benefits also may be subject to state and federal estate taxes, depending on the size of the estate and the state in which you live. If you own your own life insurance policy, it will be included when calculating the amount of your estate.

Is a death benefit taxed?

This type of transaction is known as a “life settlement,” and investors could be subject to a tax if the death benefit exceeds what they paid for the policy.

Is restoring a car taxable?

Whether or not you choose to restore the damaged car doesn't affect a taxable gain. But if a car insurance or home insurance settlement exceeds the original cost of your property, the money could be considered income.

Is life insurance taxed?

Life insurance proceeds usually not taxed. While life insurance benefits typically aren' t taxed, there are exceptions. "Generally speaking, life insurance is tax-free because the premiums are not deductible," Davis says. However, if you have group life insurance through work and your employer pays the premiums, ...

Why are punitive damages taxable?

Punitive damages are taxable because they are not compensating you for out-of-pocket losses. In essence, they are income, so you will have to pay taxes on any punitive damages. ×. Compare your quotes from these popular Auto Insurance Companies in Edit.

What is the tax bracket for lost wages?

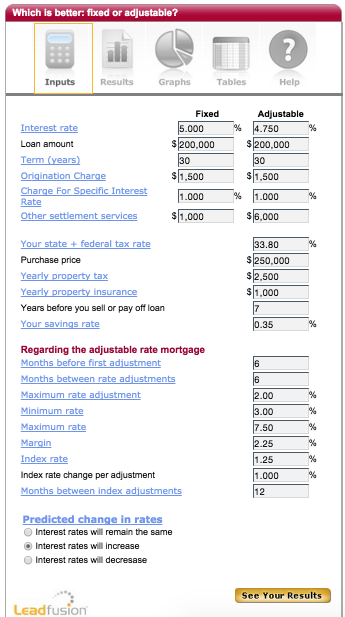

However, if you receive three years of lost wages in your settlement -- you're now paying taxes on $111,000, which puts you in the 28% bracket. You'll also have to pay Social Security and Medicare taxes on the insurance settlement money.

How much tax is paid on a structured settlement?

You'd receive a Form 1099 from the insurance company each year. Typically, a structured settlement can save you between 25% and 35% of taxes on interest income that would otherwise be subject to tax.

What is the tax rate for Medicare?

The tax rate for Medicare and Social Security will run about 15.3%. Large settlement: If you receive a large settlement that represents several years of income all at once, you will most likely end up being taxed at a higher rate than you usually pay. For example, at $37,000 a year, you'd be taxed at a 15% rate.

How much of a settlement do you have to pay in taxes?

Even though your lawyer (working on contingency) will take roughly one-third of your settlement, you will be responsible for taxes on the entire settlement amount in addition to paying the Social Security and Medicare taxes.

What happens if you get a check for a totaled car?

Using our example, if the insurance company determines your vehicle's value is $12,000, and it was totaled in an accident, they will write you a check for $12,000 minus your deductible, putting you back in the same financial place that you started before the accident. You have gained nothing financially (actually, you are slightly less wealthy after paying the deductible), so the IRS will leave you alone.

What happens if you receive a large settlement?

Large settlement: If you receive a large settlement that represents several years of income all at once, you will most likely end up being taxed at a higher rate than you usually pay.

Why is money not taxed?

The reason that this money is not typically taxed is due to the fact that it is not classed as additional income. The IRS only taxes any money or payments that are received that make you have more money than you did before.

When did the law change to state that injuries must be physical?

This didn’t used to be the case, but the law changed in 1996 to state that your injury must be physical, and otherwise, you will be taxed. However, some injuries or illnesses fall into the grey category for this, and you should be aware of any disputes before you settle.

Do you have to pay taxes on a loss of wages?

If you are claiming due to a loss of wages, you will be taxed as your wages would be .

Is a settlement taxable?

However, the same cannot be said for other types of payments that you may be entitled to following a legal settlement. It also doesn’t matter if the case was resolved in court or not, if there is a taxable payment, you will be taxed on the money that you receive from the settlement.

Is punitive damages taxable?

Any punitive damages that you are claiming will always be taxable. This might only be a small part of your entire settlement, but this part will be taxed, even if the rest is tax-free.

Can you be taxed for medical expenses if you were not responsible for a car accident?

So, if you were in a car accident, for example, and you were not responsible, you won’t be taxed on any of the medical expenses that occurred as a result of the incident.

Is insurance settlement taxable?

Therefore, this money will not be taxable, as it is only ‘restoring’ your financial state to what it should have been previous to an incident.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

What happens if you get a settlement from a lawsuit?

You could receive damages in recognition of a physical injury, damages from a non-physical injury or punitive damages stemming from the defendant’s conduct. In the tax year that you receive your settlement it might be a good idea to hire a tax accountant, even if you usually do your taxes yourself online. The IRS rules around which parts of a lawsuit settlement are taxable can get complicated.

What to do if you have already spent your settlement?

If you’ve already spent your settlement by the time tax season comes along, you’ll have to dip into your savings or borrow money to pay your tax bill. To avoid that situation, it may be a good idea to consult a financial advisor. SmartAsset’s free toolmatches you with financial advisors in your area in 5 minutes.

Can you get damages for a non-physical injury?

You could receive damages in recognition of a physical injury, damages from a non-physical injury or punitive damages stemming from the defendant’s conduct. In the tax year that you receive your settlement it might be a good idea to hire a tax accountant, even if you usually do your taxes yourself online.

Is a lawsuit settlement taxable?

The tax liability for recipients of lawsuit settlements depends on the type of settlement. In general, damages from a physical injury are not considered taxable income. However, if you’ve already deducted, say, your medical expenses from your injury, your damages will be taxable. You can’t get the same tax break twice.

Is representation in a civil lawsuit taxable?

Representation in civil lawsuits doesn’t come cheap. In the best-case scenario, you’ll be awarded money at the end of either a trial or a settlement process. But before you blow your settlement, keep in mind that it may be taxable income in the eyes of the IRS. Here’s what you should know about taxes on lawsuit settlements.

Is emotional distress taxable?

Although emotional distress damages are generally taxable, an exception arises if the emotional distress stems from a physical injury or manifests in physical symptoms for which you seek treatment. In most cases, punitive damages are taxable, as are back pay and interest on unpaid money.

Can you get a bigger tax bill from a lawsuit settlement?

Attaining a lawsuit settlement could leave you with a bigger tax bill. Let's break down your tax liability depending on the type of settlement you receive.