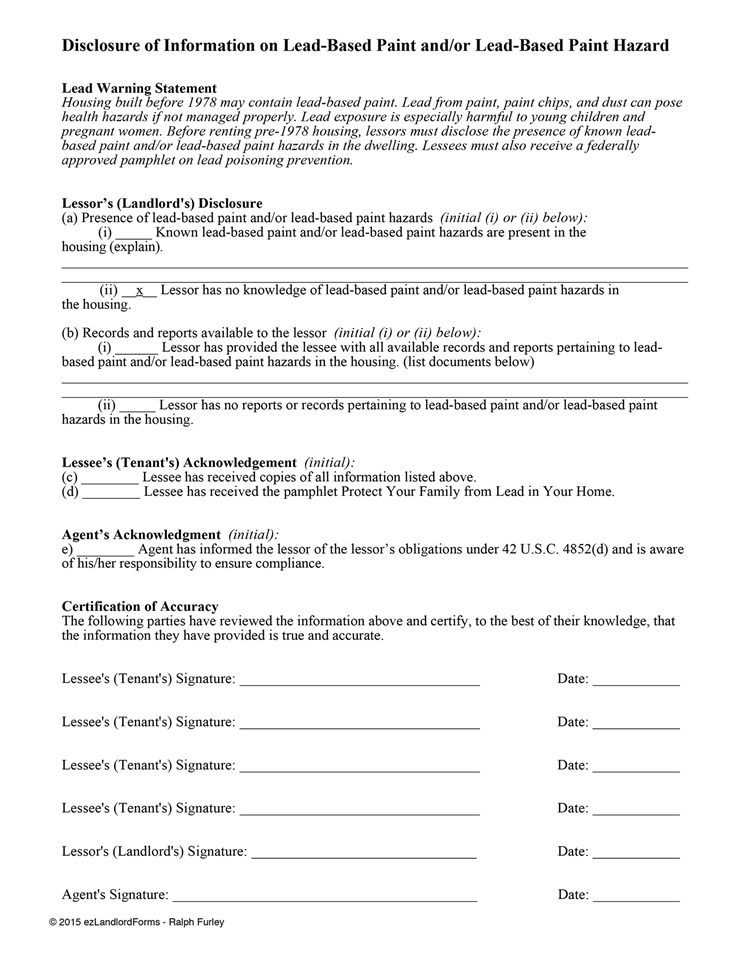

Some parts of a mesothelioma settlement may be taxable. According to the Internal Revenue Service (IRS), personal injury compensation is not taxable, whereas punitive damages and lost wages are taxable. An experienced mesothelioma lawyer can help you understand whether your financial settlement will be taxed.

Full Answer

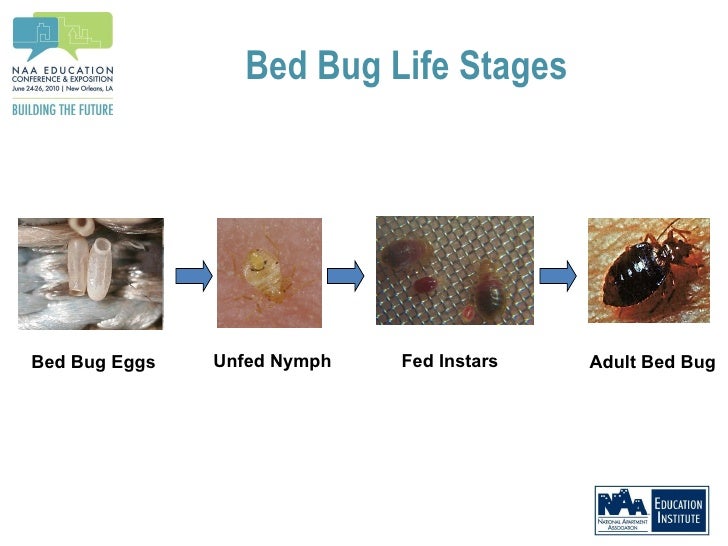

How much is a bed bug lawsuit case worth?

Bed bug lawsuit settlements are $200,000 to $500,000—but they could surpass these amounts on both sides of the spectrum. Because of that, it is important that you only discuss the value of your claim with an experienced attorney. How Much Is a Bed Bug Lawsuit Case Worth? Sample Verdicts and Settlements

Are lawsuit settlements taxable by the IRS?

You may benefit from hiring a tax accountant in the tax year that you receive your settlement, even if you normally do your taxes yourself online. It can be difficult to determine which parts of a lawsuit settlement are taxable by the IRS. A lawsuit settlement's tax liability depends on the type of settlement.

How do I file a claim for bed bug damage?

If you are in need of legal assistance to file a claim and recover compensation, you must contact the knowledgeable attorneys at Bed Bug Legal Group as soon as possible to discuss your claim with our attorneys and begin fighting for the settlement that you deserve.

Are you eligible for hotel bed bug compensation?

Ultimately, the hotel bed bug compensation or apartment bed bug compensation that you are eligible to recover depends on the details of your claim; therefore, it is essential that you understand how the details of your claim affect your claim’s value. What are the factors that affect the average bed bug settlement?

Are settlement payments taxable income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Are damages taxable?

Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

How do I report a class action settlement on my taxes?

Reporting Class Action Awards The individual who receives a class-action award must report any and all income received on Line 21 of Form 1040, for miscellaneous income. This amount is included in adjusted gross income and is taxable.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Do you receive 1099 for settlements?

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

Are Settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Can you write off legal settlement costs?

If you were awarded money from a legal settlement or case, it's likely that the award amount will be taxable and should be included in your gross income reported to the IRS. Generally, the only exception is if the money was awarded to you as a result of a lawsuit for physical injury or sickness.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Are small class action settlements taxable?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Do you have to pay taxes on a class action settlement check?

Settlement Payment made to the registered plan that suffered the loss. If a Settlement Payment is made directly to the registered plan, the controlling individual does not need to take any further action as the payment is not taxable and is not considered a contribution to the plan.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

How Much is a Bed Bug Settlement Worth?

As noted by legal experts, the average bed bug settlement in 2018 did not necessarily have much bearing on the average settlement amounts for future years. At the same time, bed bug settlements in 2020 may reach bold new heights.

How do bed bug cases benefit society?

Arguably, people who pursue bed bug cases create effects that benefit the whole of society. When property owners are held responsible in a court of law, this encourages more landlord to take precautions against pests. “How much is a bed bug case worth?” This is a question thousands of American citizens ponder every day. For the reasons we have already outlined, it can be very difficult to predict compensation amounts.

What factors go into determining the potential payout for a bed bug lawsuit?

Naturally, victims who have suffered greater loss can expect more serious appraisal by legal authorities. In some jurisdictions, tort requirements are naturally more relaxed than in others.

Why is tort law important?

Without doubt, our tort system helps society maintain its reputation for fairness and decency.

What happens if a lawsuit goes to trial?

If the case goes to trial, the defendant may have to pay for lost wages or pest control expenses.

Why is civil court important?

The civil court system is a powerful tool for righting wrongs and helping injured people achieve justice. When you meet with your attorney, you should be sure to describe your situation with complete honesty.

What happens when a property owner refuses to act?

When the property owner is fully aware of an infestation but refuses to act, this can sometimes result in major civil liability. With the help of a dedicated attorney, you can hold individuals and companies accountable for their negligent behavior.

How Long Does a Bed Bug Lawsuit Take?

Like any other lawsuit, there isn’t a specific amount of time that a bed bug lawsuit will take . There are many factors that will affect the proceedings and settlements in a bed bug lawsuit, which will ultimately influence the length of time of the lawsuit. You attorney will work with you to make sure the outcome of the lawsuit is in your favor, which may mean that the lawsuit will require a longer timespan.

What are the damages for a bed bug bite?

Victims of bed bug bites can receive bed bug compensation for both monetary and non-monetary damages. Monetary damages may include medical bills for treatment, lost wages, replacement of furniture, extermination costs, and others. Non-monetary damages include pain and suffering as a result of the infestation, such as embarrassment ...

How to determine if you can file a lawsuit for bed bug bites?

The best way to determine whether or not you can file a lawsuit is to consult with an experienced bed bug attorney. You can present evidence to a lawyer, who can then help you file a lawsuit and begin the legal process. Whether you have suffered bites from a mild or extensive infestation, you should seek help with a bed bug lawyer ...

What to do if you have a bed bug infestation?

As soon as you suspect you’ve suffered from a bed bug infestation due to the negligence of hotel staff or others, you need to collect sufficient evidence to file a lawsuit. This will entail taking photographs of bedsheets and other areas where visible evidence is present , such as small red spots or dead bed bugs.

Can you sue for bed bugs?

The best way to determine whether or not you can file a lawsuit is to consult with an experienced bed bug attorney. You can present evidence to a lawyer, who can then help you file a lawsuit and begin the legal process.

Can you file a bed bug lawsuit?

If you or a loved one has been the victim of bed bug bites, and you believe they are the results of the negligence of a third party, you may be entitled to compensation if you file a bed bug lawsuit. Filing bed bug lawsuits and winning a case will require some planning, which a bed bug injury attorney can help you accomplish.

Do you need to notify management of bed bug infestation?

You also need to notify management of the infestation so a proper inspection of the room can be performed. Any evidence supporting your lawsuit will help you successfully file one with the help of a bed bug bite lawyer.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

What is compensatory damages?

What are compensatory damages exactly? Compensatory damages are money awarded to a plaintiff in a personal injury case to compensate for damages, injury, or another loss that happened due to the negligence or unlawful conduct of another party. (This party may be one or more individuals, or an entity such as a business, community organization, or even a church or other religious institution.) In order to receive compensatory damages, the plaintiff needs to demonstrate that the loss is real and that it was caused by the defendant.

What is punitive damages?

What are punitive damages? These are meant not just to compensate the plaintiff, but to also provide a harsher punishment for the defendant in situations where the defendant is found to be wildly or grossly negligent in some way. Essentially, punitive damages are meant to be an extra punishment, on top of compensatory and lost wage damages, for recklessness, intentional misconduct, or complete disregard for the safety of others.

Do you have to pay taxes on punitive damages?

If the judge awards you punitive damages in your case, you will need to pay taxes on them. This includes interest paid by the defendant. However, punitive damages are rarely awarded in personal injury cases, so it is unlikely you will need to worry about this.

Do you have to think about taxes when accepting a settlement?

Questions about taxes and personal injury settlements are very common. This is understandable. You have to think about how much money you’ll actually get if you accept a settlement, and that includes figuring out the tax situation. You may know someone who received a personal injury settlement, then unexpectedly received a large tax bill because of it. However, it’s important to know that this isn’t always the case.

Is compensatory damages taxable?

So are compensatory damages taxable? In most cases, no. Usually settlements for losses involved with physical injuries or illnesses, like broken bones, head injuries, brain damage, traumatic brain injury (TBI), paralysis or spinal cord injuries, loss of vision or hearing, loss of limbs, etc., are tax-exempt.

Can you deduct medical bills on taxes?

In some cases, plaintiffs who have extensive medical bills will have taken these as deductions on their taxes , because in most cases you are allowed to deduct medicare expenses. If you then receive this money back in the form of compensation for your injuries, then you will need to pay the taxes you didn’t pay when taking this money as a deduction. Essentially, the IRS doesn’t permit anyone to get a tax deduction twice—if you already deducted the sum of your medical bills from your taxes last year, you’ll need to pay income tax when you receive that sum back as a settlement.

Can you file a lawsuit for emotional injuries?

Physical or emotional injuries are not the only situations where one can file a lawsuit and receive damages. You may receive damages in a lawsuit over wrongful termination, a breach of contract, or other business disputes, for example. In some situations, plaintiffs may point out that the stress of being fired may have caused a chronic condition to flare up or triggered a migraine. However, if your lawsuit is not about your physical ailment, than you will have to pay taxes on the award.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).