If you have the right account at the right place, you get free wire transfers. Ask your loan officer for wire instructions. They will give you the settlement agent’s bank routing number, account number, name and address on the account, and a set of references to identify the wire as your wire.

Full Answer

How long does it take for a wire transfer to settle?

You can take your sweet time in that 3-day window to get your money to the settlement agent with a wire transfer. After you already signed the papers, you know exactly how much you need. A wire transfer doesn’t have to cost money. If you have the right account at the right place, you get free wire transfers.

What is a wire transfer in real estate?

Don't have an account? Create one now. Wire transfers are a very common aspect of a real estate transaction. Wires are sent from the client’s bank directly to the title company’s bank via the Federal Reserve bank.

Do you have to pay for a wire transfer?

A wire transfer doesn’t have to cost money. If you have the right account at the right place, you get free wire transfers. Ask your loan officer for wire instructions. They will give you the settlement agent’s bank routing number, account number, name and address on the account, and a set of references to identify the wire as your wire.

How do bank wire transfers work?

The bank sends a message through a system like Fedwire to the receiving bank, along with settlement instructions. This is where the process can get a bit tricky. For the wire transfer to work, the banks must have reciprocal accounts with each other, or the sending bank must send the money to a bank that does have such an account with the receiver.

How long does a wire transfer take after settlement?

Transfers typically happen quickly. Generally, domestic bank wires are completed in three days, at most. If transfers occur between accounts at the same financial institution, they can take less than 24 hours. Wire transfers via a non-bank money transfer service may happen within minutes.

How many days before closing do you wire money?

one to two business daysWhen Do You Wire Money For Closing? You will typically wire the money one to two business days before the closing. The exact day will be in your closing disclosure, which you will receive at least 3 days before your closing. You should also confirm when and how much to wire with your lender.

How do banks settle wire transfers?

[i] The sending and receiving institutions' Federal Reserve accounts are used to settle each individual wire transfer payment. The Fed debits the sending institution's account and credits the receiving institution's account, while sending a message to the receiving institution containing all the transaction's details.

Do you wire money before closing on House?

Wire your money one to two days before closing. Don't wait and try wiring money day of closing day. There's too much going on, and there's no guarantee the funds will be available. That could lead to you closing late and not getting your keys on time.

Can a wire transfer delay closing?

You can definitely expect to experience delays if there is a problem with your funding. To close on time, you'll have to have the correct amount of money available to cover your down payment and any closing costs through either a wire transfer or certified check.

Is it better to receive a check or wire transfer for closing?

Which Is Right for You? At Title Partners of South Florida, we've used both wire transfers and cashier's checks in the past, but like most title companies, we now require wire transfers for all of our real estate closings. They have proven to be the most reliable and safest choice for transferring money at closing.

How do I check the status of my wire transfer?

You can contact your bank to track your wire transfer, and they'll use your Federal Reference number to trace it. They'll be able to see the transactional details between your bank, the corresponding bank into which funds are being deposited, as well as identify the wire transfer's current location.

Who handles wire transfers?

The sender is the one who provides all the instructions for the transfer, which may include the recipient's name, bank, account number, amount, and sometimes a pickup location. The wire transfer can be facilitated by a bank (sometimes referred to as a “bank wire”) or by a nonbank money transfer provider.

Are wire transfers reported to IRS?

Understanding the basics of international money transfer laws is important if you're receiving or sending large amounts of money abroad. If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS).

How do you wire money on closing day?

Wire transfers are sometimes convenient in a closing because the recipient will almost always have the money right away, ensuring the closing can proceed. To conduct a wire transfer for closing, simply talk to your bank, either in person or on the phone.

Is cashier's check or wire transfer for closing?

A cashier's check or wire transfer is really the only option for a safe and reliable closing transaction, says Steve Hill, lead mortgage broker at SBC Lending in Southern California. "Most escrow companies won't accept a personal check due to fraud," Hill says.

How do you wire a large sum of money?

7 methods to consider when transferring large amounts of moneyAutomated clearing house (ACH) ... Bank-to-bank. ... Money transfer. ... Cash-to-cash. ... Prepaid debit cards. ... Foreign currency check. ... International money transfer service.

How do you wire money for closing?

To conduct a wire transfer for closing, simply talk to your bank, either in person or on the phone. In some cases, depending upon the bank, you can even set up a wire transfer online; but they still have their drawbacks.

Does a wire transfer happen immediately?

Where you're sending or receiving funds. Domestic wire transfer: Due to EFAA regulations, most bank-to-bank wire transfers between accounts in the U.S. are completed within 24 hours. Some banks make wired funds available to recipients immediately, especially on transfers between accounts at the same institution.

How do I do a wire transfer with escrow?

How to Wire MoneyDecide which provider to use. Banks and money transfer companies offer wire transfers.Gather the information. You'll need your recipient's name, location and bank account information to start.Check costs and choose the transfer method. ... Read the fine print. ... Fill out the form carefully.

What time do wire transfers post?

5:00 p.m. ET for same-business-day (wire) transfer. Funds will be received by the recipient's bank on the same business day. 5:00 p.m. ET for international wire transfer. Sending customer will be informed when the funds will be available to the recipient at the time the transfer is scheduled.

How much does a wire transfer cost?

Wire transfers typically involve fees that vary from about $15 to as much as $50, depending on: Whether the transfer is incoming or outgoing. Whether the transfer is domestic or international.

What Is a Wire Transfer?

More specifically, a wire transfer is an electronic transfer of funds from a bank or credit union to another bank or credit union. This definition is why a wire transfer is sometimes called a "bank wire." International wire transfers are called "remittances."

How to wire money to a bank account?

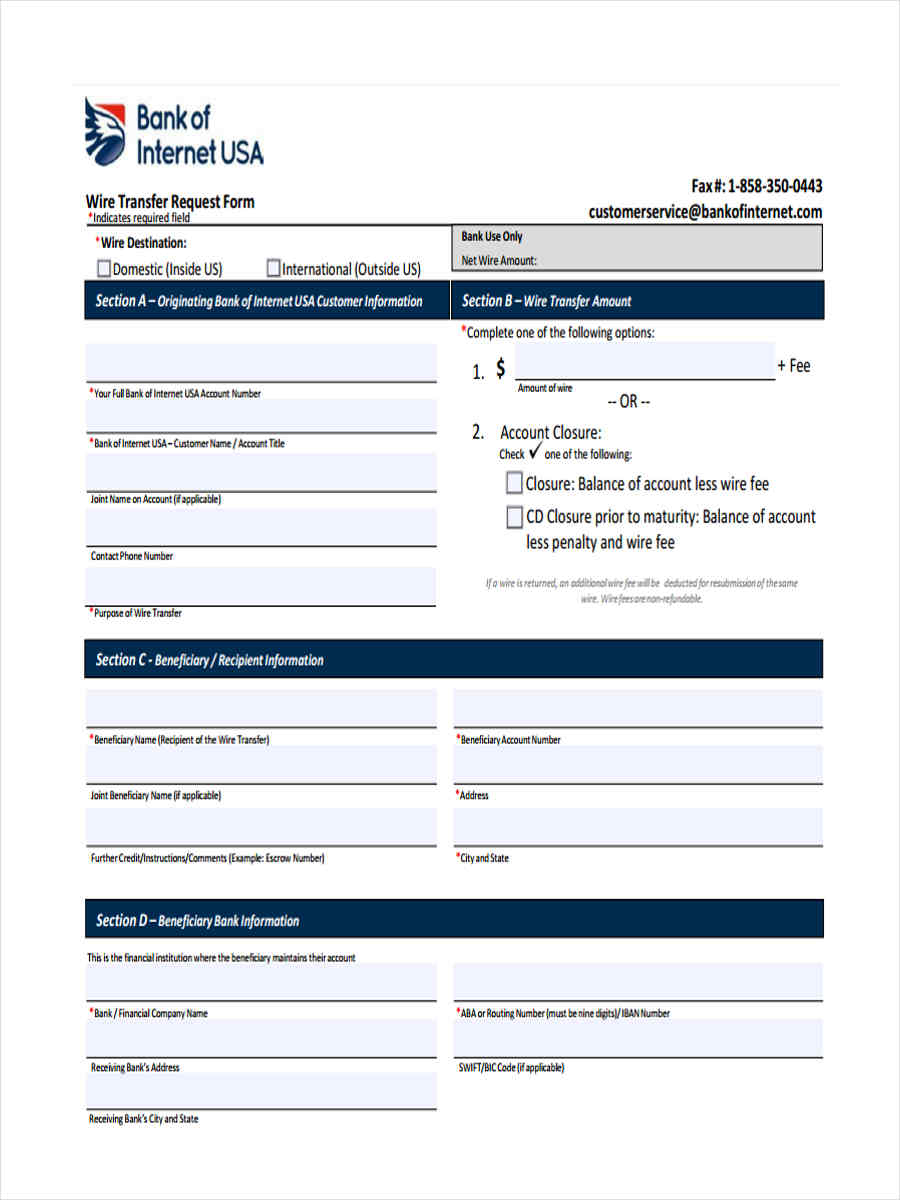

To set up a wire transfer, you'll need to complete a wire transfer authorization form on paper or online. This form typically includes: 1 Your name and contact information. 2 The amount you want to transfer. 3 Your bank's routing number and your account number. 4 Your recipient's contact information. 5 Your recipient's banking information. 6 Your signature to authorize the transfer and fees.

Why do people use wire transfers?

There are three main reasons to use a wire transfer: Speed. Wire transfers are usually faster than paper checks, and the recipient can use the funds immediately. Safety. Compared with cash, a wire transfer is a more secure way to send money. Required.

How to set up a wire transfer?

To set up a wire transfer, you'll need to complete a wire transfer authorization form on paper or online. This form typically includes: Your name and contact information. The amount you want to transfer. Your bank's routing number and your account number. Your recipient's contact information.

Why are remittances delayed?

Remittances can be delayed due to bank holidays, delays at intermediary banks that assist in the funds transfer or slow-paying countries, among other factors. However, once the transfer shows up in a bank account, the funds should be available right away, with no waiting for the transaction to clear.

Can you reverse a wire transfer?

A wire transfer can be difficult or impossible to reverse even in a case of mistakes or fraud. That’s why you should be very certain that you know the identity of the person you're sending your money to before you authorize a wire transfer. [. Read:

How does wire transfer work?

For the wire transfer to work, the banks must have reciprocal accounts with each other, or the sending bank must send the money to a bank that does have such an account with the receiver. If the sending bank sends the money to a third-party bank, the transaction is settled between them, and the money is then sent to the receiving bank from the third-party bank. This last transaction may be a wire transfer, ACH transfer, etc.

What is ACH transfer?

ACH is a payment processing system that works through the Federal Reserve system , among others. The Federal Reserve (through the Fedline and FedACH systems) is by far the largest payment processor.

Is cash transferred through ACH?

The physical cash itself isn't transferred; in simple terms, the money is transferred through the ACH system between the accounts each bank maintains at the Federal Reserve.

Does Fedwire settle wire transfers?

You'll often find sources that state that Fedwire is only for transferring large transactions; while this is technically correct, it's important to understand that financial institutions don't settle every wire transfer or payment immediately. Although the orders are put in immediately, the financial institutions settle their transactions in bulk at the end of the business day, and even then they normally only settle the difference. So, if Chase owes Bank of America $1M, and Bank of America owes Chase $750K, they don't send these as two transactions; Chase simply credits BAC $250K.

What is a wire transfer in real estate?

A wire transfer is a fast way to move funds electronically between one person or bank account and another, usually taking one business day or less.

How long does it take for a wire transfer to arrive?

Domestic wire transfers generally take one business day or less to arrive in the recipient’s account, though different types can take longer. The process takes twice as long in real estate transactions, as money gets wired from the buyer to escrow, then from escrow to the seller. If you’re the buyer, give yourself a few extra days before ...

What is escrow to seller?

Escrow to seller: The seller’s proceeds from the sale after all expenses are paid. Before the seller gets paid, the escrow agent deducts the buyer’s agent fee, any closing costs that the seller agreed to pay, and any amount that the seller still owes on their mortgage.

Why do people do wire transfers?

Wire transfers are common in real estate for three primary reasons: Speed: wire transfers are faster than other payment options, such as certified check. Convenience: transfers can be initiated online or over the phone.

How long does it take for a mortgage to be wired to escrow?

After the mortgage loan has been approved, the buyer’s lender wires the funds to escrow. One to two days before closing, the buyer sends a wire transfer to escrow. The transfer includes the down payment, and any closing costs that the buyer hasn’t already paid. On closing day, all documents are reviewed and signed.

Why do scammers email buyers?

Using fake credentials, they email the buyer with new wiring instructions and urge them to send the money right away in order to avoid closing delays. Excited buyers sometimes follow the scammer’s instructions without verifying the details.

What is an escrow account?

An escrow account is a third-party account that holds funds until the necessary contractual terms have been met. The escrow officer then disperses payments to the designated recipients.

How long does it take for a bank to process a wire transfer?

A bank wire can take up to 2 days to process, although typically a domestic wire transfer is processed when it is received, which can be as soon as a few hours later. An international wire transfer is liable to take the full 2 business days because it has to be approved by both the domestic and foreign ACHs, as well as the fact that you may have to account for different time zones and even business day mismatches.

How Does A Wire Transfer Work?

A bank wire transfer can be accomplished easily, swiftly, and, most of all, safely. Let’s walk through the steps you would take for a money transfer.

What is an international wire transfer?

An international wire transfer is often used for people who are studying or traveling abroad. The main difference with a domestic wire is in the speed with which the transaction is completed. That’s because when you send a domestic wire transfer, it only has to go through the domestic Automated Clearing Houses (ACH). When you wire funds internationally, it will need to go through the foreign equivalent as well, which could take an extra day.

Is a money order a good option?

A money order operates much like a check, but it is more secure because they are prepaid so the funds are guaranteed … assuming the piece isn’t a counterfeit. A wire transfer will have a higher fee but can’t be faked like a money order could.

Is it cheaper to wire money or send money through bank?

Bank transfers can also be a cheaper alternative to a wire transfer. However, there can be limits to the amount of money you send and the number of transactions you can do each month, so if you exchange money frequently, the wire might work better.

Is ACH a wire transfer?

ACH is a direct deposit, but it’s not as “direct” as a wire transfer since it relies on a middleman (the clearing house) and can take several days, compared with same-day access for most wire transfers. However, it can be more affordable and more secure, since it can be reversed in a way that a wire transfer cannot. Some people may call this type of transaction an electronic funds transfer, or EFT, which is one type of ACH transfer.

Is it safe to wire money to a bank?

While wire transfers are just one method of transferring funds , they can be a safe way to accomplish a transfer of a large sum of money since they go directly from bank to bank, which is why home closings are an ideal use of this technology. If you’re getting ready to dive into being a homeowner, be sure to check out other home buying resources that can make your process smooth.

How long does it take to wire money?

Though typically speedy, under some circumstances wire transfers can take up to a few days or more, such as if you're sending money internationally. 5 Depending on the financial institution, the funds might have to be wired to a corresponding or partner institution, which can delay receipt. The wire might also require approval before transmission. 5

How do wire transfers work?

Wire transfers move money directly from your financial institution to the payee's, skipping the intermediary and the check-writing process altogether. They used to be delivered via telegraph, but that's changed; most wire transfers are processed electronically these days.

How Do Cashier's Checks Work?

A cashier's check is essentially a check written by your bank or credit union to the intended payee. As the account holder, you must go to your financial institution in person, provide identification, and request a cashier's check from the bank teller. The check is drawn against the financial institution's funds—not yours—but you must have the amount of the check cleared in your account as insurance for the financial institution. 1

What is the safest way to send money?

So, a wire transfer or a cashier's check are the safest options.

Do cashiers check with payee's name?

They'll draw a cashier's check with your name and the payee's name on it and sign or stamp it with their official title, thereby branding it certified. Depending on the type of institution and services offered, they might charge a small fee for drawing the cashier's check. 2 .

Can wire transfers be undone?

Wire transfers typically can't be undone. 7 That means you can't change your mind at the last moment and reverse the transaction.

How to verify a wire transfer?

Credit unions can guard against this type of fraud in the following ways: 1 Establish procedures to call the title company back with a confirmed phone number to verify the legitimacy of wire transfer instructions received by email or fax; 2 Establish a passcode with the title company or closing agent in advance to be used in conjunction with your call back and verification process; 3 Require the title companies your credit union works with to use encrypted emails when sending wire transfer instructions; 4 Verify if your member received the wire transfer instructions by email and, if so, verify the instructions and information with the title company or closing agent separately prior to sending the funds on the member’s behalf; 5 Look for common red flags that are associated with any compromised email, such as misspellings, poor grammar, a sense of urgency, and emails sent outside of normal business hours; and 6 Be suspicious of emails that contain changes in payment type, such as changing from a certified check to a wire transfer, or account numbers at the very last minute.

Who follows the bogus instructions to generate the wire transfer request?

The buyer or financial institution then follows the bogus instructions to generate the wire transfer request. Once the funds are sent, the criminal moves on.

Is wire transfer scam real estate?

However, the very nature of real estate transactions—large amounts of money transferring between parties—makes them a prime target for criminals. Increasingly, financial institutions and home buyers are falling victim to wire transfer scams connected to real estate closings. According to a warning issued (opens new window) by the Federal Bureau ...

What is wire transfer in real estate?

Wire transfers are a very common aspect of a real estate transaction. Wires are sent from the client’s bank directly to the title company’s bank via the Federal Reserve bank. Because of this, wire transfers meet the Colorado Good Funds Statute and are considered immediately available upon deposit into the title company’s account.

How to track a wire?

The client will need to contact their sending bank to obtain the FED ID number.It will always start with the date, followed by letters then numbers. E.g. 20190912QMGFT0000000000. Give the FED ID number to the title company (via phone) to aid in tracking the progress of the wire.

Is it safe to transfer funds via wire?

Our closing team will also be in continuous communication with all parties involved in the transaction from beginning to end of the closing. Transferring funds via wire can be a safe and secure process, as long as all parties involved maintain communication and use simple security protocols to ensure that the funds arrive safely and on time.