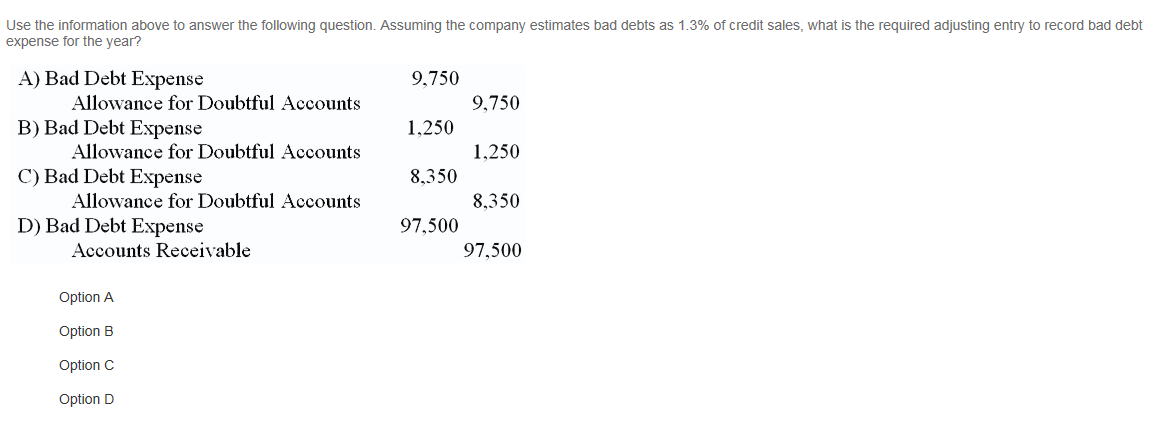

How long does debt settlement affect your credit score?

In some cases, debt settlement is your best option for debt relief. Unfortunately, it can leave an ugly mark on your credit report. Settled debt in good standing will remain on your credit report for seven years. But it can remain on your report for years more if you are not careful.

Can I remove settled accounts from my credit report after 7 years?

Under the Fair Credit Reporting Act, a consumer reporting agency can’t report negative information about your credit that’s more than seven years old or bankruptcies that are more than 10 years old. Seven years may still seem too long to wait, and in some cases, you may be able to remove settled accounts sooner.

Can I settle a delinquency on my credit report?

You can agree to settle your account and partially pay your balance if your creditor agrees to delete the delinquency from your credit report. Many credit repair or debt settlement companies specialize in settling accounts.

What is a settled account on a credit report?

A settled account is an account that has been fully paid or closed. Types of settled accounts can be a loan that was paid in full or a closed credit card account. Settled accounts can also be known as collection accounts. These accounts can appear on your credit report for up to 7 and a half years from the date it was paid in full.

Can a settlement be removed from credit report?

The short answer is no. Settled accounts aren't always be removed from your credit. There are several reasons why they can't be removed. Paying off a settled account without a pay-to-delete letter.

Why did my credit score drop after settlement?

A debt settlement plan—in which you agree to pay back a portion of your outstanding debt—modifies or negates the original credit agreement. 1 When the lender closes the account due to a modification to the original contract (as it often does, after the settlement's complete), your score gets dinged.

Will my credit score go up after debt settlement?

While your score may initially drop once you initiate the debt settlement process, it will slowly start to rise again once you pay off your debts and start to manage your credit more responsibly. You really do have the power to get your score back on track and improve your credit history.

How much does a debt settlement drop your credit score?

100 pointsDebt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Is it worth it to settle debt?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you.

How long does it take for a settlement to come off your credit report?

seven yearsHow Long Do Settled Accounts Stay on a Credit Report? Settling an account will cause the status to show that you no longer owe the debt, but the account will stay on your credit report for seven years from the original delinquency date.

How do I build my credit after a settlement?

5 steps to rebuild credit after debt settlementMonitor your credit report. As you begin to settle your debts, keep an eye on your credit report. ... Apply for new credit. ... Become an authorized user. ... Pay your bills on time and in full. ... Get a small loan.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

Why didn't my credit score go up after paying off collections?

Unfortunately, your credit score won't increase if you pay off a collection account because the item won't be taken off your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Why is my credit score going down if I pay everything on time?

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If you've paid off a loan in the past few months, you may just now be seeing your score go down.

Why did my credit score drop 30 points for no reason?

If you've made a late payment or have other derogatory information listed on one of your credit reports, it could cause your score to drop at least 30 points. Also, using more of your available credit or closing one of your oldest credit card accounts could cause a large drop in your score.

Why did my credit score drop 100 points for no reason?

Generally, the only thing that will cause your credit score to fall by 100 points quickly is a late payment. If you avoid those, you'll usually manage to avoid drastic credit score drops. To be clear, your credit score might decline by 100 points over time due to other reasons.

How long does a debt settlement stay on your credit report?

How long does debt settlement stay on your credit report? A settled debt with no late payments will stay on your credit report for seven years from the date it was settled accordingly to regulations outlined in the Fair Credit Reporting Act (FCRA). A late payment on an account is called a delinquency.

How will debt settlement affect my credit score?

When you settle debt, it means your lender has agreed to take less than you actually owe. This is a bad sign for future lenders. To them, it looks like you’re risky to lend to because they may not get all of their money back. This is why it’s a negative item on your credit report, even though it seems positive because you got out of debt.

How to get rid of a delinquent account on credit report?

Gather all the evidence you have to prove that the account isn’t yours and get ready to dispute. You need to send the credit bureaus reporting the error a dispute letter explaining your situation.

How long does it take for a delinquent payment to be reported?

Delinquencies are reported to the credit bureaus after 30, 60, 90, and 120 days of being late. If you do make a late payment, it will stay on your report starting on the date it became a delinquent account and was never current again. If the account that you settle is a collections account, then the negative item in your credit report would remain ...

What is re-aging on credit report?

Re-Aging. The process of Re-aging changes the status of your accounts – at least, how they’re shown on your credit report. If you work out a repayment plan with a creditor, they can re-age your account by no longer reporting it as delinquent. You get a kind of clean slate for your debt.

How many points does a debt settlement take?

When you settle your debt, your credit score can drop between 60 and 100 points, depending on your credit history and where you started. This is one of the major reasons why you should use a professional debt settlement company instead of trying to do it yourself. If you mess up, your score could fall even further and take even longer to repair.

What happens if you pay as agreed?

This is what debt settlement companies will negotiate with your creditors if you go through a debt settlement program. Once the settlement is paid and the account is closed, the creditor will list the account as paid as agreed.

How long does it take for a missed payment to drop off your credit report?

In at most 7 years from the first date of your missed payment or the date you paid the account in full, it will drop from your report. By reviewing your credit report you can see how much time is left on the settled account and from there determine how long it will still appear on your account.

How long does a settled account affect your credit score?

Settled accounts can appear and affect your credit score and report for up to 7 years. For more information on settled accounts and what actions you can take to remove them from your report, keep reading below to learn how to remove settled accounts from credit reports.

What Happens When an Account Is Closed?

When you pay off or close an account it’s not available for purchases or payments.

How Will You Attack Your Settled Account?

You know what a settled account is and how it can affect your credit score.

What happens if you close a credit card?

If you close an account like a credit card and it has been paid off, then your credit score can also be negatively affected. Your credit score is based on available credit, payment history, and the age of your accounts.

What to do if you feel like going to a credit bureau?

If you feel like going directly to a credit bureau isn’t the right attack, then you can send the lender a goodwill letter directly. This letter is a polite way to ask if a lender will remove the settled account from your credit history.

What happens if a settled account is faulty?

If the settled account was faulty, it will then be removed from your account. The only way it will appear again is if the creditor proves it was accurate. This is a great way to not have the account affect your score negatively but in most cases, it will still remain on your report.

How long do settled accounts stay on your credit report?

Accounts stay on your credit report for 7 years, so it’s important to settle them the right way.

How does a settled account affect credit?

How does a settled account affect credit? A settled account affects credit negatively if your creditor doesn’t agree to delete the negative information after you’ve paid the account. If you have a pay-to-delete agreement, the settled account shouldn’t affect your credit once the account is paid.

What is a settled account?

When a lender accepts a lower payment amount than the full balance owed on a debt, the account is settled.

What credit bureaus calculate your credit score?

Credit bureaus like Equifax, Experian, and TransUnion calculate your credit score or FICO® Score based on your credit history. Any delinquencies seriously harm your credit score and can affect your ability to get new credit, buy a home, get a car loan, rent an apartment, or set up utilities.

What happens if you don't get a letter from credit?

If you don’t get a letter and send payment right away, credit issuers or collection agencies don’t have any incentive to delete the delinquency from your account .

How does settling a credit card affect your credit score?

Settled accounts negatively impact your credit score. A settled account is like delinquency to credit bureaus because you didn’t pay them the amount you agreed to.

How to improve credit score?

If you have a credit card that’s close to its limit, pay it down to improve your credit.

Why do credit bureaus keep settled accounts on credit report?

Consequently, laws enabling credit bureaus to keep settled items on your credit report are specifically designed to protect the interests of lenders.

What to do if you refuse to cooperate with credit bureaus?

If they refuse to cooperate you can contact the credit bureaus directly and contest the faulty information. The bureaus are legally obliged to investigate and must remove items from your credit report if the party that reported the item cannot substantiate it.

How long do credit bureaus keep credit reports?

Legally, these entities may keep the information that your creditors provide on your report for up to seven years.

Where do credit bureaus gather information?

Credit bureaus gather vast amounts of information directly from your creditors but also from third parties, such as debt collectors and public records departments at local court houses. Occasionally, errors occur and unpaid or settled debts are listed on the wrong credit report.

What does "paid" and "settling" mean?

In the credit world, these two seemingly similar words have very different meanings. Paid means that you borrowed some money and repaid it in full.

Can you erase a settled debt?

Credit scores are complex and while you cannot erase a settled debt you can take steps to reduce its impact on your life. Positive credit activity such as paying your car loan on time or keeping balances on your credit cards to a manageable level can have a positive impact on your score.

How long does it take to rebuild credit after debt settlement?

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

How to get a debt collector to delete your credit report?

As part of your debt settlement negotiation, you may be able to get the creditor or debt collector to agree to report your account as paid in full or have them request to have it deleted from your report. You can suggest this in exchange for paying some of your debt or upping the amount you’re offering to pay. This is not all that likely to work with credit card banks and other lenders, but can be effective with medical and utility collections, and is also now part of the credit reporting policies at three of the largest debt buyers in the nation: Midland Credit Management (MCM), Portfolio Recovery Associates (PRA) and Cavalry Portfolio. You can learn more about each of these companies’ pay for delete policies here .

What percentage of credit score is based on unpaid debt?

If you have unpaid debt, then your credit score has already been affected. According to FICO, 30% of your credit score is based on the amount you owe on existing accounts. Late payments get reported to credit bureaus by lenders and then the delinquency is reflected in the credit score.

What is the purpose of settling debt?

Settling debt is essentially coming to an agreement with your creditors to pay back part of what you owe and be forgiven for the rest. If you’re at the stage of considering settling debt, then you’ve already missed several payments, probably months worth, which takes a toll on your credit. So how can you settle debt and minimize ...

How to avoid a lawsuit?

To avoid a lawsuit, try to settle your debts before a charge-off occurs. Call the creditor or the debt collector and see if you can negotiate a settlement. If you have more than one debt, try to target one or two accounts to settle first, prioritizing those that are most likely to sue you.

What to do if you sell your debt to a third party?

If your debt has been sold to a third-party debt collector, you’ll have to contact the new debt owner, or the collection agency they’re using, in order to resolve the debt. Be clear about your financial situation. If they know you can’t afford to pay much, that could make them more willing to accept a lower settlement offer. Before you send them any money, get your agreement in writing.

What happens if you pay your credit card balance in full?

Keep in mind however, that if you pay your balances in full each month — meaning, you aren’t paying interest charges — your credit utilization will remain low no matter how much you borrow month to month. 3. Don’t close credit card accounts, even if you don’t use them.

When will my credit report fall off?

1, 2018, but the account appeared on your credit report (s) 180 days after that date. So the account should fall off your credit report (s) by June 30, 2025.

How long does it take for collections to fall off your credit report?

Debts that enter into collections are generally treated the same and play by the same rules. In most cases, they’ll all take up to seven years to fall off your credit reports.

How long does credit karma stay on your credit report?

Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due. Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content.

How to update credit report before paying off debt?

Before paying off an account in collection, get on the phone with an agent from the debt collection agency and confirm that the agency will update your credit reports. If the agent can’t or won’t agree to remove the paid account from your credit reports, ask if the account can be updated as “paid as agreed upon” once your payment/s are received.

What happens if you don't pay off a medical bill?

This typically happens when the original company owed writes off your debt as a loss and sells it to a debt collection agency.

How long do collections stay on credit?

How long do collections stay on your credit reports? The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

How long does it take for medical debt to be reported?

As part of the National Consumer Assistance Plan, medical debts won’t be reported until after a 180-day waiting period to allow insurance payments to be applied. The credit reporting agencies must also remove previously reported medical collections that have been or are being paid by insurance.