Do I have to pay tax on a settlement agreement?

Many people believe that if money is paid under a settlement agreement it must be tax free. However, this not necessarily the case. The key issue is the nature of the payment. Make sure you obtain legal advice about which payments are taxable and which are not. Which payments are taxable and which are not?

Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

Are settlements from lawsuits taxable income?

The general rule of taxability for amounts received from the settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61, which states that all income is taxable “unless a specific exception exists from whatever source derived unless exempted by another section of the code.”

Does money paid in a legal settlement get taxed?

The settlement money is taxable in the first place; If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

What type of settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What part of a settlement is taxable?

You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

How is money from a settlement taxed?

Settlements for automobile and property damages are not taxable, but there are exceptions. Like medical expenses, the IRS and the State of California consider these damages as reimbursement for a car or home previously paid.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Will I get a 1099 for a lawsuit settlement?

Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors. In fact, the settling defendant is considered the payor, not the law firm. Thus, the defendant generally has the obligation to issue the Forms 1099, not the lawyer.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Are 1099 required for settlement payments?

Issuing Forms 1099 to Clients That means law firms often cut checks to clients for a share of settlement proceeds. Even so, there is rarely a Form 1099 obligation for such payments. Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors.

What is a settlement agreement in Northern Ireland?

P.S. In Northern Ireland, a settlement agreement is known as a compromise agreement.

Is a 401(k) taxable?

This is also taxable, just as it would be if you carried on working.

Is a settlement up to £30,000 tax free?

The headline news is that any settlement up to and including £30,000 is currently tax-free.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Is money from a lawsuit taxed?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income. If you receive a settlement allocations for bodily personal physical ...

Is a settlement for physical injury taxed?

If you receive a settlement allocations for bodily personal physical injury, you are not typically taxed on those proceeds as those monies are deemed to make you whole after an accident. Before 1996, all personal damages were treated as tax-free recoveries, including physical, defamation, and emotional distress injuries, for example.

How much tax will you pay on your settlement agreement?

Usually (but not always) an employer offers a settlement agreement because your employment is coming to an end.

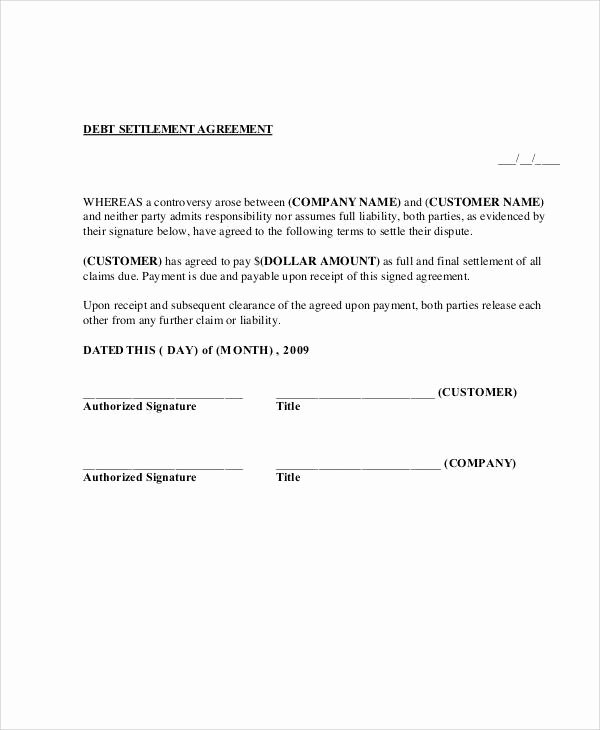

What is settlement agreement?

Settlement agreements are often used in the context of a redundancy situation, sometimes as a way for your employer to avoid a redundancy procedure. This usually means that your employer will consider your statutory redundancy payment entitlement. A statutory redundancy payment is a payment that you are legally entitled to when your employment ends ...

Are wages taxed if paid as part of a settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Is a Payment in Lieu of Notice taxable?

If you’re receiving a payment in lieu of notice (“PILON”), that payment must be taxed as though you had worked your notice.

Is holiday pay taxable?

When your employment ends, you’re entitled to be paid for any holiday you haven’t taken. This also forms part of your taxable income, even if it’s paid under a settlement agreement.

What happens if you don’t pay the right amount of tax?

Your employer should understand how different payments are treated for tax. But that’s not a guarantee that they’ll get it right.

What happens to tax payments when you are terminated?

As long as the payment is made because your employment is being terminated, for whatever reason, then the tax laws covering Termination Payments will apply.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Who has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during?

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Redundancy

Compensation

Payment in Lieu of Notice

- Since April 2018, this amount is now taxable too, except in cases of wrongful or constructive dismissal.

Restrictive Covenants

- You may receive a payment in return for agreeing that you won’t do certain things within a set period after leaving your employer. These might include not working with former colleagues, suppliers or customers for a year, for example. This amount is considered to be earnings, so they do attract tax.

What This Means to You

- If you’re offered £30,000 or less, and you’re able to use up your holiday period and work your notice, it is unlikely that you will have any tax to pay. To make it easy for HMRC to calculate the amount of tax and NI you owe, and ensure you pay them the right amount, the payment breakdown should be clearly defined in the settlement agreement. For an...

Need Help?

- For a FREE assessment of your claim, call 0808 168 7288or fill in the contact form on the top right of this page. We have already helped thousands of people to win millions of pounds in compensation. See what they say You have a choice of ways to pay, including ‘no win, no fee’. Browse funding options Back to all news June 5, 2018 at 2:27 pm Category: Blog