/117455432-56a25f205f9b58b7d0c96d63.jpg)

Your family’s lifestyle and reasonable needs are the two components of expenses that play a part in a divorce. The difference in the definitions between “reasonable needs” and “lifestyle” becomes painfully obvious when a divorce court sets an amount of money for child support or spousal support.

Can I deduct my divorce settlement from my taxes?

This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

Can I get more assets in a divorce settlement?

If it is determined that you will be unable to maintain your lifestyle with the proposed offer, you have established a good case to request more assets, alimony, or child support. Hopefully, you're not in a situation where you distrust your spouse and fear there are hidden assets that should be included in the settlement.

What expenses play a part in a divorce?

Your family’s lifestyle and reasonable needs are the two components of expenses that play a part in a divorce. The difference in the definitions between “reasonable needs” and “lifestyle” becomes painfully obvious when a divorce court sets an amount of money for child support or spousal support.

Are you financially damaged during a divorce?

Unfortunately, many divorcing spouses are financially devastated as a result. One reason is that too often, divorcing spouses accept unfair settlements, and find that a few years later they're experiencing serious financial challenges. Below, are seven of the most costly financial mistakes commonly made during a divorce.

What can I spend money on during divorce?

Generally speaking, you want to spend conservatively and carefully while going through a divorce. Do your best to avoid spending marital assets unless it is for things that are for the family, such as your mortgage payment or expenses related to your shared children.

How do I avoid financial ruins in a divorce?

If divorce is looming, here are six ways to protect yourself financially.Identify all of your assets and clarify what's yours. Identify your assets. ... Get copies of all your financial statements. Make copies. ... Secure some liquid assets. Go to the bank. ... Know your state's laws. ... Build a team. ... Decide what you want — and need.

Who is better off financially after divorce?

Men who provide less than 80% of a family's income before the divorce suffer the most. On the other hand, men who provided more than 80% of a family's income before a divorce do not suffer as much financial loss, and may even marginally improve their financial situation.

How do I decide what I want in my divorce settlement?

5 Things To Make Sure Are Included In Your Divorce SettlementA detailed parenting-time schedule—including holidays! ... Specifics about support. ... Life insurance. ... Retirement accounts and how they will be divided. ... A plan for the sale of the house.

What are the most common financial mistakes made during divorce?

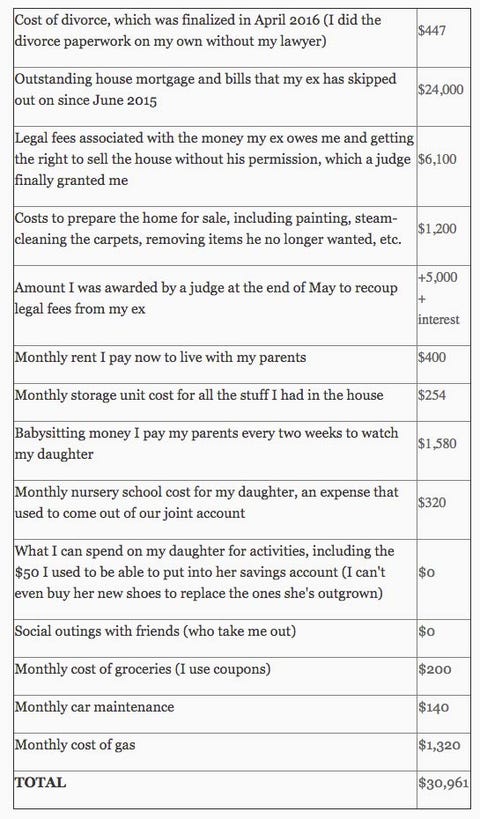

Ignoring or underestimating your expenses. Most people know exactly what they earn each month, but can't explain where their money goes. Take the time to write down all of your expenses, and develop a realistic monthly budget. Likewise, consider the cost of your future living expenses, taking inflation into account.

Can I empty my bank account before divorce?

Can You Empty Your Bank Account Before Divorce? However, doing so just before or during a divorce is going to have consequences because the contents of that account will almost certainly be considered marital property. That means it will be an equitable division in the divorce settlement.

How do people afford life after divorce?

10 Financial Steps to Take After a DivorceCreate a New Monthly Budget. ... Calculate Your Net Worth. ... Reduce or Eliminate Expenses. ... Build an Emergency Fund. ... Set New Financial Goals. ... Make a Plan to Pay Off Your Debt. ... Work on Rebuilding Your Credit. ... Find Ways to Increase Your Income.More items...•

What age is divorce most common?

The average age for people going through a divorce for the first time is 30 years old. According to a recent report, more than half, or 60%, of divorces involve spouses who are between the ages of 25 and 39. However, while 30 is the average age, the divorce rate for people over 50 has doubled since 1990.

What are disadvantages of divorce?

Divorce hurts. Divorce reduces living standards. Divorce changes personal relationships. Divorce may strain your relationship with your church or synagogue.

How do narcissists negotiate divorce settlements?

Here are five tips for getting through a divorce that's been hijacked by a narcissistic spouse.Try to Keep Their Words Against You Impersonal. ... Keep Your Family Law Attorney in the Loop. ... Beat Them at Their Own Game with the Truth. ... Have Your Finances in Order. ... Create a Divorce Team Beyond Family Law Attorneys.

What happens to 401k in divorce?

This court order gives one party the right to a portion of the funds in their former spouse's 401k retirement plan. Typically, the funds from a 401k will be split into two new accounts, one for you and one for your ex-spouse.

Does having a new partner affect divorce settlement?

If you're the spouse responsible for paying alimony, your new live-in boyfriend or girlfriend probably won't affect your support obligation. While it may be tempting to flaunt a new love interest in front of your spouse, make sure you understand the potential impact this relationship can have on your divorce case.

How do you financially survive a divorce?

10 Financial Steps to Take After a DivorceCreate a New Monthly Budget. ... Calculate Your Net Worth. ... Reduce or Eliminate Expenses. ... Build an Emergency Fund. ... Set New Financial Goals. ... Make a Plan to Pay Off Your Debt. ... Work on Rebuilding Your Credit. ... Find Ways to Increase Your Income.More items...•

How do I protect myself from my husband's debt?

Keep Things Separate Keep separate bank accounts, take out car and other loans in one name only and title property to one person or the other. Doing so limits your vulnerability to your spouse's creditors, who can only take items that belong solely to her or her share in jointly owned property.

Mistake #1: Not Knowing The Liquidity of Assets

Liquidity refers to your ability to convert anasset into cash. For example, a bank savings account is highly liquid, becauseyou can simply withdraw...

Mistake #2: Failing to Consider The Impact of Taxes

The effect of your settlement on various taxescan be very costly if not addressed thoroughly. Words like “capital gains,income tax, and alimony” ma...

Mistake #3: Not Understanding The Rules of Retirement Accounts

Retirement accounts raise tax-related issues, buttheir complexity merits a separate category. Normally, distributions from aretirement plan prior t...

Mistake #4: Overlooking Debt and Credit Rating Issues

There's nothing worse than starting out a newlife with bad credit. You can take several steps during the divorce process tominimize the chances of...

Mistake #5: Not Maintaining Control Over Insurance Policies

Most divorce judgments call for one of theparties to obtain a life insurance policy to insure the value of alimonypayments, child support, or some...

Mistake #6: Failing to Budget

One of the most common mistakes is the failure to budget based on your post-divorce income and lifestyle. This happens most oftenwhen one spouse ke...

Mistake #7: Failing to Identify Hidden Assets

Hopefully, you're not in a situation where youdistrust your spouse and fear there are hidden assets that should be includedin the settlement. Unfor...

What are matrimonial assets?

Matrimonial assets, also known as marital assets, are the financial assets that you and your spouse built up during the period of marriage. This is...

What are non-matrimonial assets?

Non-matrimonial assets are financial assets which were acquired before or after the period of marriage. Each of the examples above, if acquired out...

Are non-matrimonial assets excluded from divorce settlements?

Not necessarily. A divorce settlement and division of assets will depend on various specific circumstances and pre-arranged agreements that might b...

Are assets split 50/50 in a divorce UK?

Not always and this is a common misconception. It is not a rule that matrimonial assets must be split 50/50 on divorce; however, it is generally a...

Are debts matrimonial assets?

Yes, if you and your spouse have accrued any debts during the term of your marriage, these will also be split as part of your divorce financial set...

How to work out your assets on divorce

Before any discussions about financial settlements on divorce, you must first work out exactly what your assets are in the eyes of the court. Here...

Do you legally have to declare all assets?

Yes. It is mandatory that all assets are declared before divorce proceedings get underway. This includes both joint and sole assets. Attempts to hi...

How do I protect my assets during a divorce settlement?

How matrimonial assets are divided is ultimately the court's decision; they will seek to do so in a way that is as fair and balanced as possible. I...

How do you make the financial divorce settlement legally binding?

To make your divorce settlement agreement legally binding, you should draft a consent order and get it approved by a court. This is important bec...

How Do You Protect Yourself Financially in a Divorce?

In general, it’s a good idea to close joint credit card accounts so that one spouse can’t run up debt for which the other one will be held responsible. Reviewing your credit reports and monitoring your credit can help you make sure that your spouse hasn’t done anything to damage your credit. Do not take assets that are not yours, because a judge may sanction you heavily for doing so. A family law attorney and an accountant can help you take the specific steps that your situation warrants.

How does divorce affect financial aid?

The divorce can also affect the child’s financial aid award for college because some schools assume a certain contribution from each parent even if one parent has left the picture. 4 And parents will need to decide who will claim the child tax credit each year, because only one parent can claim it. They also will need to address possible issues created by advance child tax credit payments and shared custody. 5 6

What Are the Tax Consequences of Selling or Transferring Marital Assets?

When selling or transferring assets in the process of dividing them during a divorce, spouses need to be careful to avoid unnecessary capital gains taxes and gift taxes. An accountant can help you follow Internal Revenue Service (IRS) rules about timing and documentation to do a transfer incident to divorce and steer clear of or minimize these taxes.

How to keep more than your fair share of assets in a divorce?

Through trusts, overseas accounts, and less sophisticated methods, such as transferring assets to trusted family members or friends , spouses may attempt to keep more than their fair share of marital assets in a divorce. Hiring a forensic accountant or an attorney who specializes in finding hidden assets can help you make sure that you don’t lose anything you are entitled to in your divorce.

Why should each spouse obtain their own independent valuation of major assets?

That’s why each spouse should obtain their own independent valuation of major assets to make sure that they are divided fairly. A mediator, an arbitrator, or a judge can look at both valuations and help ensure a fair division.

Why do couples want their ex out of their lives?

This is especially true when physical, emotional, or financial abuse is involved. The problem with a rushed divorce is that it can lead to an unfair division of assets for the more vulnerable spouse. One party may take advantage of the other party’s desire to get things over with and convince them to leave the relationship with less than they deserve and without the support that they need to start over.

Why is it important to know about all marital debts?

Just as uncovering and properly valuing all marital assets is important, it’s also important to know about all marital debts. Ordering and reviewing copies of each spouse’s credit reports from all three major credit bureaus can help uncover hidden consumer debts, such as credit card, auto, student loan, personal loan, and mortgage debt. Identifying hidden business liabilities—such as bad debts and pending lawsuits—is more challenging but also important.

What to consider when considering a divorce settlement?

There are many factors to consider, including assets, incomes, living expenses, inflation, alimony, child support, taxes, retirement plans, investments, medical expenses and health insurance costs, and child-related expenses such as education.

How to minimize taxes after divorce?

Work together with a divorce financial planner or tax accountant to minimize the total taxes you and your spouse will pay during separation and after divorce; you can share the money you save. Don't forget that both spouses are liable for taxes due as a result of audits on joint returns, so it's usually in your best interest to work together and minimize possible liabilities. If you're facing complicated tax issues in your divorce, it's best to consult with an experienced family law attorney and an accountant.

What is the biggest mistake a divorced spouse can make?

The biggest mistake divorcing spouses can make is being in the dark about finances. If your spouse has always handled all of the financial decisions in your household and you don't have any information about you and your spouse's income and assets, your spouse will have an unfair advantage over you when it comes time to settle the financial issues in your divorce.

How does mediation help in divorce?

The mediation process involves a neutral third-party mediator (an experienced family law attorney trained in mediation) that meets with the divorcing couple and helps them reach an agreement on the issues in their divorce. Mediation is completely voluntary; the mediator will not act as a judge, or insist on any particular outcome or agreement.

How to know if you are getting a fair deal after divorce?

Sounds good, right? The only way to know if you're getting a fair deal is to determine the value of the investments on an after-tax basis, then decide if you like the deal. Again, you should speak with a tax professional about the impact of any proposed property division before you agree to it.

What to do if you suspect your spouse is planning a divorce?

If you suspect your spouse is planning a divorce, get as much information as you can now. Make copies of important financial records such as account statements (eg., savings, brokerage, and retirement) and all other data that relates to your marital lifestyle (eg., checking accounts, charge card statements, tax returns).

How does inflation affect college costs?

The effects of inflation on the cost of a child's college education, or on retirement, 15 years in the future can be dramatic. The "Rule of 72" is a simple way to judge the impact of inflation. For example, if the inflation rate is 3%, the "Rule of 72" means that prices will double in 24 years (72/3=24). College costs at 5% inflation will double in 14.4 years (72/5=14.4). Be sure to work inflation into your settlement negotiations so you can cover the true costs of future financial expenses.

What happens to the assets in a divorce settlement?

Often, in a divorce settlement, one spouse will receive mostly illiquid assets, including the home, while the other party receives liquid assets such as retirement plans, brokerage accounts etc. The potential problem with this type of settlement has to do with cash flow. How will the spouse that keeps the home pay the bills if his or her major asset is illiquid? In worst-case scenarios, that spouse will have to sell the home, purchase something smaller and use the remaining equity or profits from the sale for living expenses.

How does a settlement affect your taxes?

The effect of your settlement on various taxes can be very costly if not addressed thoroughly. Words like "capital gains, income tax, and alimony" may have a big impact on your tax payment. Capital gains are of particular importance and refer to the fair market value of an asset minus its cost. For example, if you paid $5 for a share of stock and it is now worth $25, you have a capital gain of $20. This applies to other assets such as real estate (including your home), mutual fund accounts and just about any investment that has appreciated in value. Be very careful that the property you're receiving in a settlement does not have large capital gains as compared with your spouse's property. Don't be fooled if your spouse offers you property of equal value but conveniently forgets to inform you of the tax liability. Be sure to consult a tax specialist before agreeing to any settlement proposal.

How long can you file taxes after divorce?

If it is income tax debt, even if the divorce is final, you may not be exempt from future tax liability. For three years after the divorce, the IRS can perform a random audit of a divorced couple's joint tax return. If it has good cause, the IRS can question a joint return for up to seven years. To avoid any potential problems down the road, your divorce agreement should have provisions that spell out what happens if any additional penalties, interest, or taxes are determined by the IRS as well as where the funds will come from to pay for any expenses associated with an audit.

What happens if you end up with very little liquid assets?

If you will end up with very little liquid assets as a result of a proposed financial settlement, be sure that you will have enough cash flow throughout the years to handle your living expenses. If not, you may have to consider selling the home and other assets, or significantly decrease your expenses in order to meet your financial needs.

What is the impact of settlement on taxes?

The effect of your settlement on various taxes can be very costly if not addressed thoroughly. Words like "capital gains, income tax, and alimony" may have a big impact on your tax payment. Capital gains are of particular importance and refer to the fair market value of an asset minus its cost.

How many divorces are there in the US?

There are nearly one million divorces in the United States each year. Unfortunately, many divorcing spouses are financially devastated as a result. One reason is that too often, divorcing spouses accept unfair settlements, and find that a few years later they're experiencing serious financial challenges. Below, are seven of the most costly ...

Does a settlement have capital gains?

Be very careful that the property you're receiving in a settlement does not have large capital gains as compared with your spouse's property.

What am I entitled to on a divorce financial settlement?

You may have noticed that Mediate UK’s tag line is “Find Your Future.” This is because our service is all about helping our clients agree a fair financial settlement on divorce or separation that puts the needs of any dependent children first whilst focusing on both your future needs.

What is the aim of a divorce?

On divorce, the aim is to divide the assets fairly. Fairness does not necessarily mean an equal division. What it does mean is that the parties must be left in the position of equal standing and that there must be no discrimination between the respective roles of breadwinner and homemaker - which are regarded as equal. In other words, the roles each party played in the marriage is not considered an important factor when agreeing a financial settlement on divorce. Instead, you should focus on what of you realistically need moving forwards.

What does the court do when there is a surplus?

If these needs can be met from the available assets and if there is then a surplus, the Court may go on to consider dividing the remaining assets taking into account their origin. This may require dividing the assets into matrimonial and non-matrimonial property.

How to make a divorce agreement legally binding?

To make your divorce settlement agreement legally binding, you should draft a consent order and get it approved by a court. This is important because, if your agreement is not legally binding, the court will not be able to enforce it, should there be any issues later.

What can the court take into account?

The Court can take into account the value of a business. This includes sole traders, partnerships and shares in limited companies. The value of a business can be extremely important, particularly so after a long marriage and where the business is of significant value.

How long have Martin and Angela been married?

Martin and Angela had been married for 12 years. They co-habited for 3 years before that and have two boys aged 8 and 10.

Why should domestic contributions not be undervalued?

The Courts have made clear that domestic contributions should not be undervalued simply because they cannot be quantified in the same way as economic activity.

How do divorce settlements work?

Simply put, a divorce settlement is like a legal road map that both parties are legally bound to follow.

What happens at the end of a divorce settlement?

At the end of negotiating a divorce settlement, both parties will be given the divorce settlement proposal, the preliminary but not final paper which will contain the “wish list” of both spouses. Also watch: 7 Most Common Reasons for Divorce.

What happens if a divorce settlement states that the wife gets the rosewood table and the husband gets the dining room?

If the divorce settlement states that the wife gets the rosewood table and the husband gets the dining room hutch, that property division is legally binding. The divorce settlement will detail all the financial assets that will be split: It may also give a timeline for exactly when the divisions will take place.

How to negotiate divorce settlement?

Divorce negotiation tips from experts usually advise that to negotiate divorce settlement, both sides must sit down, review what they want, compromise at times, barter, horse trade-call it what you want.

What are the terms of divorce?

Terms of the divorce. Division of your assets. Alimony and child support. Information about the custody and visitation schedule if you have children. It is important before getting to the stage of the settlement that you think about and determine which things to ask for in a settlement.

How much is alimony divided?

In most states, everything accrued during the marriage is divided fifty-fifty. Alimony is paid usually on the basis of the length of the marriage, the usual formula for alimony is that it is paid for half the years of the length of the marriage.

Can a lawyer handle a divorce?

Lawyers like to handle this part of the divorce ( it is where big hourly fees can really rack up), but truth be told, if the two people getting divorced are still on civil terms with one another, they should be able to sit down and work out parts of the divorce settlement themselves.

Can you make money from a divorce?

While that impending divorce may prompt you to sell high value assets, doing this cuts its appreciation value. As we all know, bills payment and cash are non-working assets, hence they won’t be able to make money for both of you. And never forget the taxes that go with it. Even after a divorce, you will still have goals to achieve and milestones to cover.

Can you get alimony if you filed before December 31?

If you’ve had the divorce filed before December 31, 2018, you would’ve gotten away with a smaller tax deduction if you’re the one paying the alimony. However, post-Trump tax plan, the game plan has changed. There are no more tax breaks for individuals paying alimony. This should be worth considering and re-thinking your budget plan.

How about the situation where one spouse has exclusive use of the community asset between the date of separation and the date the community?

How about the situation where one spouse has exclusive use of the community asset between the date of separation and the date the community no longer has an interest in the asset such as use of a car? The Spouse with the exclusive use of the community asset can be charged the reasonable use of that property under the Marriage of Watts. This is called Watts charge. So for example if the wife has exclusive use of the car, the husband may ask that the community be reimbursed by the wife for the value of the use of the car between separation and trial date or settlement date. The same thing can be applied when one spouse alone is staying at the family residence while the other spouse is paying for the house. The rules governing reimbursements can be confusing to lay people. It is best to obtain the representation of competent counsel.

Why is the date of separation important?

That is why the date of separation is very important and commonly litigated in highly contested divorce cases due to the difference in controlling presumptions. Instead, the trial court has discretion to order reimbursement of any separate property used to pay community debts after the date of separation under family code §2626.

Is there a righ to reimbursement during divorce?

Divorce can be a bit complicated specially if there are community assets and debts involved. Generally, accumulations and earning after the date of separation is each spouse’s separate property. What happens when you use separate funds to pay for community debts after the date ...

Can a spouse use separate property to pay for community debt?

Normally when a spouse uses separate property to pay for community debt prior to the date of separation, there is a presumption that it is a gift to the community unless you can trace the separate property contribution and seek reimbursement under family code §2640.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Do you have to accept the divorce?

Irrespective of how you feel about it, the fact remains that you agreed to the divorce and must accept the obligations that come with it.

Who is responsible for proving the presence of property in divorce?

It is the responsibility of the divorced parties to recognize and prove the presence of properties.

What is the recapture rule in divorce?

For instance, if a divorce decree orders the husband to pay his wife a large amount of alimony for one year with a lower amount to follow, the IRS uses the “recapture rule.”. This requires the paying party to “recapture” some of the money as taxable income. As if a divorce is not complicated enough, it is challenging to understand what part ...

Do you have to live separately to exchange money?

To begin, the exchange must be in cash or an equivalent, payment must be made under a court order, the parties must live separately, there are no requirements of payment after the receiving party dies and each party files tax returns separately.

Is it better to give one party a lump sum settlement?

For instance, when the couple has a home with a mortgage, it is common for one party to keep the house and pay the other spouse the equity as a property settlement. No taxable gain or loss is recognized.

Is child support deductible in divorce?

When a divorcing couple has children, child support is often part of the settlement. This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

Is alimony settlement taxable?

Is Divorce Settlement Money Taxable? After a divorce is final, assets change hands. It is important to understand what part of the settlement is taxable and to what party. In the case of alimony, the amount is taxable to the person who receives the support. In return, the person paying the money receives a tax deduction.