You may need to pay your attorney out of your settlement funds and there may be liens against the settlement. In addition, your settlement may count as income, which can make it subject to income tax. Understanding what you need to pay from your lawsuit ensures you will not run into financial issues and you’ll be able to meet all your obligations.

Full Answer

Should I keep money in my settlement fund?

You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds. An investment that represents part ownership in a corporation.

What is a settlement fund?

A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon. Now that you understand how to use your settlement fund, let's break it down a little further:

What is a settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

Where do settlement funds go in a trust account?

Settlement Funds and Your Trust Account. Certain types of funds require special handling, and settlement funds fall into this category. Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account.

Should I keep money in my settlement fund Vanguard?

You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds.

What is a settlement fund at Vanguard?

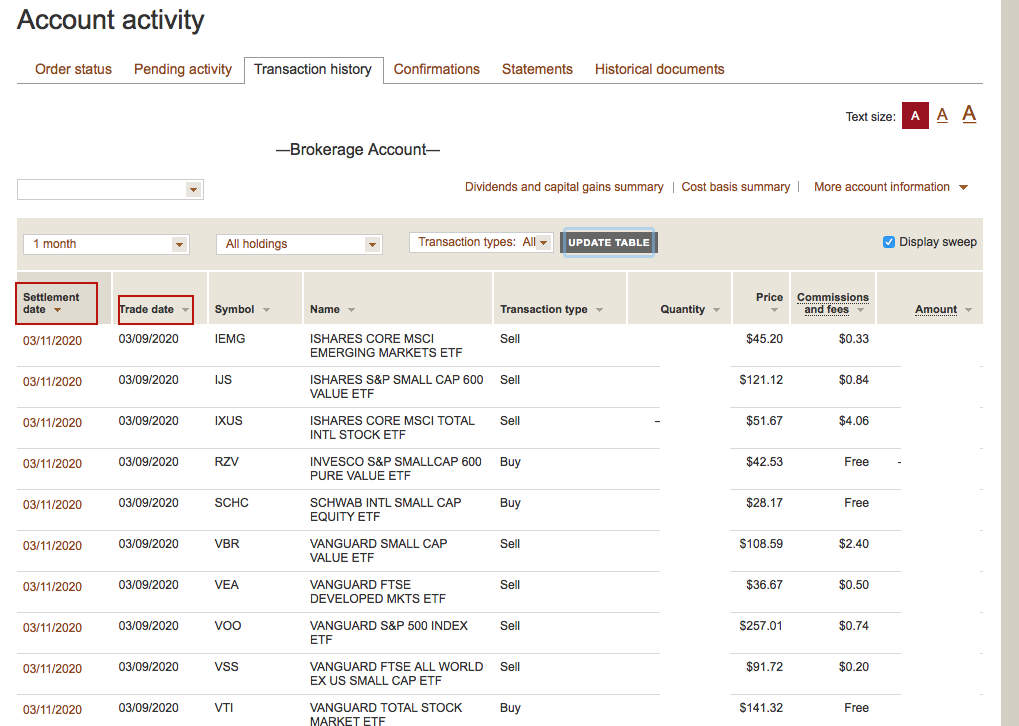

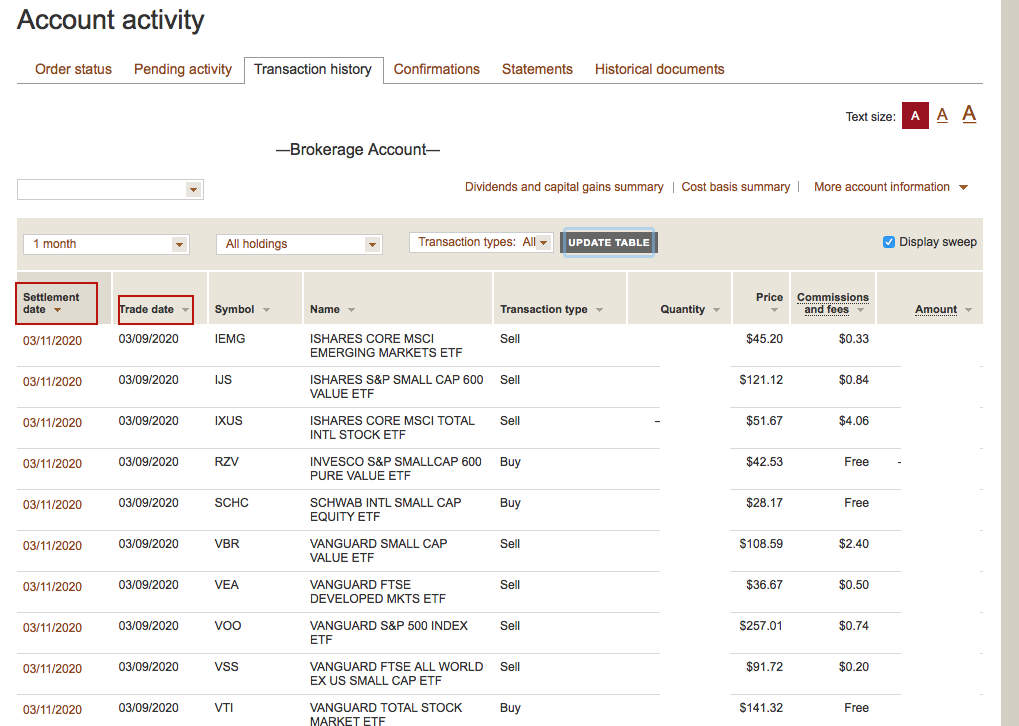

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

Can you withdraw money from Vanguard settlement fund?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Does my Vanguard settlement fund earn interest?

Vanguard Cash Reserves Federal Money Market Fund The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%.

Can you withdraw from a Roth IRA settlement fund?

Re: Does Roth IRA at Vanguard have a separate settlement fund? yes its separate, do not withdraw anything.

What is better Fidelity or Vanguard?

Fidelity and Vanguard both do a good job keeping costs fairly low, but Fidelity has a slight edge overall. Both brokers charge zero commission for stock and ETF trades, but Fidelity charges $0.65 per contract on options trades, while Vanguard charges $1 per contract for customers with less than $1 million in assets.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

How long does it take to get money out of Vanguard?

Completion times vary depending on the type of transfer, your account details, and the company holding your account. Some transfers can take 4 to 6 weeks, but your wait could be shorter. You'll get a more accurate estimate when you start your transfer online.

Can I sell stock on settlement date?

If you bought the stock (or other type of security) using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase have settled is a violation of Regulation T (a.k.a. a good faith violation, mentioned above).

Does Vanguard have a high yield savings account?

Income: The Vanguard Prime Money Market Fund pays a better yield than most savings accounts, checking accounts, and short-term CDs do. Although the fund's current annualized yield is only about 0.50%, it's far better than the sub-0.10% returns many savings accounts are offering.

Can Vanguard be trusted?

The company is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Vanguard is considered safe because it has a long track record and it is overseen by top-tier regulators. You can open an account at Vanguard if you live in United States.

What is a sweep in settlement fund?

Vanguard is offering a new settlement fund option for your cash—but only for some investors. Brokerage clients who end up with cash in their account typically have it deposited automatically in a settlement or “sweep” account until they decide to withdraw or reinvest it.

What is fund settlement?

Funds settlement refers to the transfer of funds from buyer to seller and the transfer of an asset's title from seller to buyer.

What is a settlement account?

an account containing money and/or assets that is held with a central bank, central securities depository, central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants or members of a commercial settlement system.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

What is settlement fund Roth IRA?

Your money gets transferred to a “settlement fund” inside of your traditional IRA. The settlement fund is in the Vanguard Federal Money Market Fund. This settlement fund will hold your money (i.e. prevent you from using it) that you wired from your bank account for up to 7 days.

How Do Lawsuit Settlements Happen?

Lawsuits usually happen as the result of a dispute over an injury or damages. For example, a lawsuit may be filed if an employee feels they have be...

Are Lawsuit Settlements Taxable?

Is an out of court settlement taxable income? In some cases, lawsuit settlements are taxable. The notable exception is personal injury settlements,...

What Type Of Settlement Is Not Taxable?

Personal injury claims that are not necessarily taxable income. 1. Car accident claim settlements are not taxable income (mostly) 2. Slip and fall...

Is Compensation For Medical Expenses Taxable Income?

Many lawsuit settlements also involve medical expenses and compensation for these visits. The good news is that medical visits for injuries and emo...

Is Compensation For Lost Income Taxable?

Since this compensation is meant to replace income, it’s not surprising that settlement amounts for lost income in employment-related and business-...

Is Compensation For Emotional Distress Taxable?

Most settlements for emotional distress are non-taxable, with a few exceptions. Money used for medical costs related to your distress, including vi...

Is Compensation For Punitive Damages Taxable?

Punitive damages are awarded in some cases where a defendant’s actions were especially egregious. In many cases, awards for punitive damages and an...

How Does The IRS Come Into Play?

The Internal Revenue Service (IRS) plays an important role in gathering taxes from income and the agency defines gross income very broadly , as “all income from whatever source derived.” However, the IRS creates tax rules which have many exceptions.

Are Lawsuit Settlements Taxable?

In some cases, lawsuit settlements are taxable. The notable exception is personal injury settlements, such as those that arise out of car accident claims or slip and fall claims. However, each situation is different and since the tax law is complex, it is important for any party in a lawsuit to speak with an attorney and a tax accountant.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

What is settlement funding?

You’ll get money for living expenses: Settlement funding is a financing mechanism that allows people injured in accidents through no fault of their own to access cash they need for day-to-day expenses and medical costs while their personal injury cases are pending.

How does the settlement funding company decide which applicants are qualified?

But how does the settlement funding company decide which applicants are qualified? To begin with, it requests certain information about you and your case. You must also provide the name of the attorney who is representing you in your personal injury case, and his or her contact information. Once it has this information, it will assess the merits of your case. As part of this evaluation, it will consult your attorney to get a better idea about the strength of the case and the chances for successful resolution. It will also estimate the potential case value.

What happens if the case isn’t resolved in my favor?

There are two possible outcomes if your case isn’t successfully resolved. The first is that you won’t get anything at all. The second is that your settlement or judgment falls short of the estimated case value, and less than you agreed to repay.

What to know before getting settlement funding?

The first is that the total amount deducted from your settlement or judgment will include certain charges. The second is that lawsuits can drag on for years, so charges can add up quickly. Therefore, you should not be afraid to do some “comparison shopping” and find the company with the lowest rates. You should also know about the type of charges you’ll be liable for and how it is calculated.

What is Oasis pre settlement?

Oasis provides pre-settlement funding, also known as consumer litigation funding, to its customers through different products depending on their state of residence or cause of action. Many consumers will be provided pre-settlement funding in the form of a purchase agreement, which assigns a portion of the pending proceeds from their legal claim. Other consumers, such as those in CO, IL, MN, MO, SC, WI and some OK residents, will be offered a funding in the form of a pre-settlement loan, sometimes referred to as a lawsuit loan. These transactions have important differences, therefore, consumers should carefully review and be aware of the type of transaction that is offered to them by any funding company.

Why do people get settlement money for traffic accidents?

Each person has different legal case and financial needs. In most situations, people who apply for settlement funding do so because their injuries prevent them from working while their lawsuits are pending. As a result, they are often faced with the daunting prospect of mounting debt and limited options. This not only puts stress on traffic accident victims, but also on their families. In these circumstances, the money from settlement funding can be used to pay medical bills and cover day-to-day costs.

What is a spring forward agreement?

Although they aren’t well known to the general public, spring forward agreements are another means of financial relief. They provide for the sale of an asset (such as a portion of your settlement) for a certain price on a future date.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Last Day

Today is my last day of work after 45+ years in IT. Retirement starts tomorrow and the next chapter begins.

Life insurance in retirement

What are your thoughts on life insurance in retirement? I am 57 and hubby is 61. We have no mortgage, have almost a million in investments. We have a large policy $750,000 term each expires in 2025. Premiums are $404 a month but we can't get any other insurance because I had cancer 3 years ago and my hubby has diabetes. Do we even need insurance?

Looking for a retirement calculator

I am looking for a "how long will my money last" calculator that considers taxes paid on 401k withdrawals. The calculators I have found have a marginal tax rate variable but only apply that rate to the money earned through investments, not the principal withdrawal from the 401k balance (non-Roth)

Retirement location searching

Have been enjoying reading through this sub! Wife and I planning to retire* out of the country within next 5-7 years. Guess we're lower middle class income with maybe $400k total of savings. So FAR, Portugal and Costa Rica are the front runners, (except for requirement 4 below)Here's what I'M looking for in order of importance

Retirement Calculator

Has anyone else used the Marketwatch retirement calculator. It is not perfect but I have found it much more versatile than many other calculators. It includes a spouse, pension and the ability to adjust % growth of certain categories.

What are the benefits of a personal injury settlement?

The most significant benefits available to persons with disabilities are SSDI, Medicare, and SSI, Medicaid.

How are resources determined for SSI?

1. Timing: Resource determinations are made as of the first of the month for SSI eligibility purposes, and is based on what assets an individual has. 1 If an SSI claimant acquires additional resources during the month, then they are counted under the resource counting rules as of the first of the next month. 2 However, the receipt of additional resources during the month will first be evaluated under the income counting rules. Thus the receipt of a settlement may result in an overpayment of SSI benefits for one month. 3

What happens if you lose your SSI in Colorado?

If the individual countable assets exceed the $2,000 threshold, eligibility will be lost. In Colorado, the loss of S SI benefits will automatically disqualify the individual from receiving Medicaid.

What is asset vs resource?

2. Assets v. Resources . Not all of an individual’s assets are resources for SSI purposes. 4 The distinction is important because an asset that is not a resource does not count against the statutory resource limit (while a resource may count). 5 A resource is defined as cash and any other personal property, that an individual owns; has the right, authority, or power to convert to cash (if not already cash); and is not legally restricted from using for his support and maintenance. 6

Is a delay in filing a petition for SSI a resource?

So, with the above example, a word of caution that, even in those instances where the claimant is a minor or incompetent adult in need of a guardian of the estate or conservator, “delaying” the filing of a petition for appointment does not necessarily mean it is not a “resource” for SSI eligibility purposes. Time is always of the essence! But it may be beneficial and buy the claimant some time if the guardian of the estate or conservator is not appointed until after settlement or a judgment is entered, and condition the settlement on the court’s approval.

Can you deposit a settlement check into a trust account?

Before you deposit a settlement check into your trust account, you need to understand how the receipt of these funds will affect your client’s eligibility for Medicaid. The rules are complex but working with an attorney that specializes in this type of law will ensure a successful outcome.

Is a judgment award countable for SSI?

Bottom line is that, unless there’s a legal restriction to making the funds available for the claimant’s support and maintenance, the deposit of settlement funds or judgment award into a lawyer’s trust account will be a countable resource for purposes of SSI Medicaid eligibility in the month of receipt.