The Fullman Firm is here to work with clients through their Capital One debt settlement so they can put the anxiety behind them. The Good News About Capital One Debt What makes collections so frustrating is that creditors often farm this work out to third party companies.

Does Capital One accept settlements?

You can try settling your debt on your own. Keep in mind that Capital One is one of the largest credit card companies in the country. They have a vast team of attorneys and debt collectors whose entire job is to get you to pay them back in full.

How to settle Capital One credit card debt?

Know Your Negotiation Options

- Lump-Sum Payment Agreement. In this instance, you negotiate with the credit card company to pay a lump sum of money that is less than what you owe.

- Workout Agreement. ...

- Hardship Payment Agreement. ...

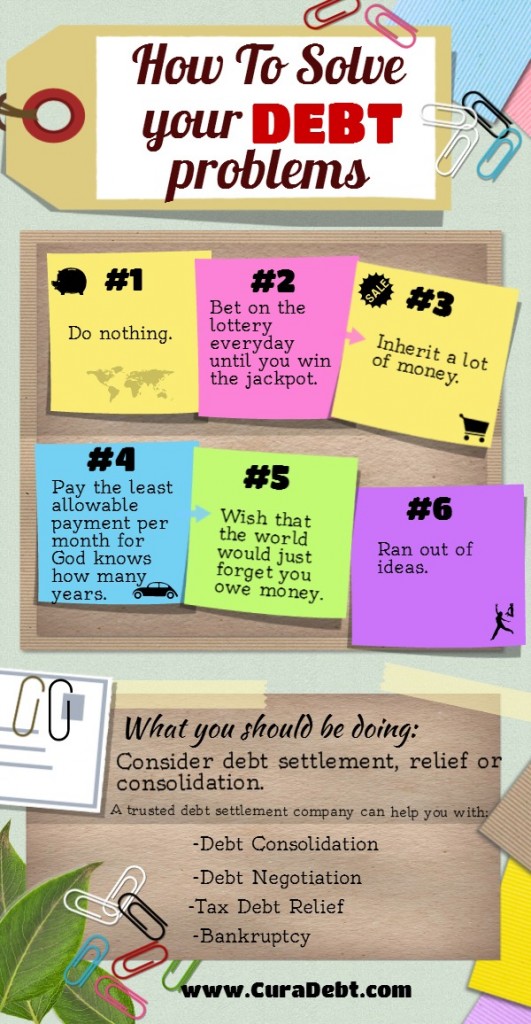

Can you really trust a debt settlement company?

You can also trust a debt settlement company if it’s been in business for five or 10 years. The con artists generally open up under one name, scam as many people as they can, close down and then open up a few months later under a new name. Legitimate debt settlement companies are accredited by the Better Business Bureau and belong to ...

Do I have to pay tax on a debt settlement?

The IRS may count a debt written off or settled by your creditor as taxable income. If you settle a debt with a creditor for less than the full amount, or a creditor writes off a debt you owe, you might owe money to the IRS. The IRS treats the forgiven debt as income, on which you might owe federal income taxes.

See more

Who is the collection agency for Capital One?

Capital One appears to use all three major credit bureaus—Equifax, Transunion and Experian.

How do I pay off my Capital One debt?

5 Ways to Pay Off Your DebtChoose a Debt Payoff Strategy. Creating a plan can help you figure out what works best for you and even help provide motivation. ... Pay More Than the Minimum. ... Reduce Your Spending. ... Switch to Cash Only. ... Consolidate or Transfer Your Credit Card Debt.

Does Capital One settle after lawsuits filed?

Capital One Debt Sent to a Law Firm for Collection Means Settling with the Attorney Debt Collector. It is certainly possible to contact the attorney and arrange for a lump sum pay off. If you don't reach a dollar amount you can fund, it is possible to stretch the settlement out over a few payments.

Does Capital One do pay for delete?

Make a Pay-For-Delete Agreement If you are unable to make a goodwill agreement with Capital One, you will need to work out a pay-for-delete agreement with them. This method will also work if Capital One has handed off the debt to a collection agency.

How do I get a Capital One lawsuit dismissed?

Overall, even if you do owe Capital One money, that is not a reason to ignore the lawsuit. Rather, you should engage with the suit by responding, and then you can either get the case dismissed entirely because Capital One can't prove its case, or at the very least, you can negotiate a reasonable resolution.

Can Capital One garnish my wages?

Yes, your wages can be garnished over an unpaid credit card debt—especially if the debt ends up going to collections. Although many people associate wage garnishment with unpaid child support, defaulted student loans or back taxes, courts can also order your wages to be garnished over an outstanding credit card debt.

Is there really a Capital One settlement?

Important Update: 2019 Cyber Incident Settlement Reached On February 7, 2022, a U.S. federal court preliminarily approved a class action settlement relating to the cyber incident Capital One announced in July 2019.

How much is the Capital One settlement per person?

The settlement allows reimbursement for up to $25,000 in out-of-pocket expenses related to the data breach. This includes money spent preventing identity theft or fraud, unreimbursed fraud charges, miscellaneous expenses, professional fees, and up to 15 hours of lost time at a rate of at least $25 per hour.

How can I win a credit card debt lawsuit?

Common Defenses to Credit Card Debt LawsuitsImproper Service of the Summons and Complaint. ... Statute of Limitations. ... Fair Debt Collection Practices Act. ... Lack of Standing. ... Payment of the Credit Card Account, in Part or in Full. ... Fraudulent Credit Card Charges. ... Discharge in Bankruptcy. ... Mistaken Identity.

Can you get a Capital One card after defaulting on one?

Even if you've defaulted on one loan in the past five years, you might still qualify for the card. Other negative credit report items, though, could make it difficult to get approved. Capital One doesn't disclose the card's minimum credit limit upfront.

What happens if Capital One closes your account?

If Capital One does close your credit card account for inactivity, you should expect to see a drop in your credit score, due to a rise in your overall credit utilization and change in the average age of your accounts.

Is it worth paying off a closed credit card?

Paying off debt removes a bill from your budget, but that paid-off loan or closed credit card can stay on your credit report for years. That's great news if you paid on time: That positive payment information can continue to help your credit score. But if you didn't, your credit missteps can linger.

How do I pay off my debt?

How to Pay Off Debt FasterPay more than the minimum. ... Pay more than once a month. ... Pay off your most expensive loan first. ... Consider the snowball method of paying off debt. ... Keep track of bills and pay them in less time. ... Shorten the length of your loan. ... Consolidate multiple debts.

How can I pay off 10000 in credit card debt a year?

The simplest way to make this calculation is to divide $10,000 by 12. This would mean you need to pay $833 per month to have contributed your goal amount to your debt pay-off plan. This number, though, doesn't factor in the interest on your debt.

Should I pay off my credit card in full or leave a small balance?

It's Best to Pay Your Credit Card Balance in Full Each Month Leaving a balance will not help your credit scores—it will just cost you money in the form of interest. Carrying a high balance on your credit cards has a negative impact on scores because it increases your credit utilization ratio.

How many points will my credit score increase if I pay off a credit card?

If you're already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven't used most of your available credit, you might only gain a few points when you pay off credit card debt.

What is a settlement on a credit card?

A settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in a single payment or over a series of payments.

How to save money on credit card debt?

Working directly with your credit card company: Managing your own settlement can save you money by avoiding debt settlement fees associated with other services and ensures that you're involved and aware of every step in the process. The CFPB also provides recommendations for negotiating a debt on your own . “Consider all of your options, including working with a nonprofit credit counselor, and negotiating directly with the creditor or debt collector yourself.” - Consumer Financial Protection Bureau

Does a settlement affect your credit report?

The settlement may be reported to the credit bureaus. While it isn’t possible to say exactly how a settlement will affect your credit report, your settlement and payment information likely will be reported to the major credit bureaus as “settled in full for less than the full balance.”. This can stay on your report after you’ve paid ...

Is it risky to settle debt?

The CFPB emphasizes that dealing with debt settlement companies can be risky. They note that debt settlement companies “often charge expensive fees” and that “most debt settlement companies will ask you to stop paying your debts in order to get creditors to negotiate...a settlement.”

Do credit card settlements have to be complicated?

Credit card settlements can seem complicated, but they don’t have to be. By understanding your options, you can make an informed decision about how to manage your settlement.

Can a debt settlement company help you?

Debt Settlement Resources: You might have heard advertisements for debt settlement companies claiming to negotiate a settlement with credit card companies on your behalf. While these companies can help you with your debt settlement, there may be other associated costs.

How often do you have to set aside money for debt settlement?

Debt settlement programs typically ask you to “set aside a specific amount of money every month in savings...and transfer this amount every month into an escrow-like account to accumulate enough savings to pay off any settlement.”.

How to get your creditor to work with you?

First, try reaching out to your creditors to see if they’ll work with you. According to the Consumer Financial Protection Bureau (CFPB), “some creditors might be willing to...waive certain fees, reduce your interest rate, or change your monthly due date to match up better to when you get paid, to help you pay back your debt.”

What is debt management plan?

Debt Management Plan. A credit counselor can also help you setup a debt management plan. How it works: As the CFPB explains, “You make a single payment to the credit counseling organization each month,” and they send monthly payments to your creditors on your behalf.

How long does it take to pay off debt in Chapter 13?

With Chapter 13 bankruptcy, “the court approves a repayment plan that allows you to use your future income to pay off your debts during three-to-five year period , rather than surrender any property. After you have made all the payments under the plan, you receive a discharge of your debts.”.

What is credit counseling?

Credit counseling services are provided by organizations that are usually non-profit and, per the CFPB, “can advise you on your money and debts, help you with a budget, and offer money management workshops.”

What happens after you file Chapter 7 bankruptcy?

Chapter 7 bankruptcy “involves the sale of all assets that are not exempt. Exempt property may include cars, work-related tools, and basic household furnishings.”. These exemptions vary by state.

Do credit counselors negotiate with you?

Credit counselors “usually do not negotiate any reduction in the amounts you owe.”. Even if they’re a non-profit organization, credit counselors may charge fees for their services. Be sure the credit counselor you choose is a reputable, accredited and certified one you can trust to manage payments on your behalf.

How much will Capital One settle?

Settlements will vary based on the age of the debt, your available cash, and any financial hardship, among other factors, but you can probably expect to settle for about 30% - 50% of the original balance.

What happens if you settle a debt?

The process of debt settlement will send your credit into a nosedive and ruin your relationship with your creditors. You also risk getting sued and the creditor refusing to settle. On the other hand, you could potentially resolve your debt problems by paying a fraction of the amount owed.

What percentage of debt is accepted in a settlement?

The percentage of a debt typically accepted in a settlement is 30% to 80%. This percentage fluctuates due to several factors, including the debt holder’s financial situation and cash on hand, the age of the debt, and the creditor in question. The debt settlement company you decide to work with pl

What is Capital One hardship?

The Capital One hardship program is a temporary adjustment to a Capital One credit card’s terms to help out customers with financial troubles. This could include lowered interest rates, settlement for a portion of the total debt, or the ability to temporarily not make payments. Capital One does not directly ad

What happens when you negotiate with creditors?

Your financial situation. In the process of negotiation, creditors will try to ascertain your financial situation and amount of cash on hand. Greater disposable income and available cash will generally lead to a lower percentage of forgiven debt. This makes sense; creditors want you to pay off as much debt as you can.

How much does National Debt Relief charge?

For example, National Debt Relief has been able to settle debt for as low as 30% of the original balance, but could charge fees as high as 25% of that original balance. Additionally, while Donaldson Williams may reach a settlement as high as 60%, their fees are low at 17%. A few of the highest ranking debt settlement companies are listed in the table below.

What happens if Capital One doesn't charge off?

If your account has not charged-off, Capital One offers a few options to improve your financial situation. Charge-off occurs when your creditor writes your debt off as a loss (generally after a few months of missed payments) and passes it on to a debt collector.

How long is a Capital One account delinquent?

Mr. Figliuolo noted that at Capital One, an account that was one day overdue was considered delinquent, an account that was between approximately 30 days and 179 days overdue was typically considered in “active collections,” and after 180 days the account was considered ”in recovery.”.

Can a creditor make a settlement offer?

In addition to making settlement offers in response to a request by an individual consumer or debt settlement company, a creditor might make a settlement offer on its own initiative, directly to a consumer.

What does debt settlement mean?

Debt settlement literally means that credit card lender will settle on an agreement for the borrower to pay back less than they originally owed in debt. In most cases, the borrower pays back significantly lower than they originally owed.

How long does it take for a credit card to default?

In order to negotiate a debt settlement, the borrower must stop making credit card payments for about 180 days and then the credit card account goes into “default”. Once in default, the lender considers your account “charged off.”.

How Does Debt Settlement Work?

Debt settlement allows you to negotiate with Capital One to make a lump sum payment for less than what you owe. Payment options may be available, but lump sums generally offer more leverage to the debtor. Our law firm is dedicated to helping individuals resolve their Capital One debt. Although you are in a better position to negotiate your debt before a lawsuit is filed, we can help even if you’ve been sued and had a judgment entered against you.

What happens if you lose your job with Capital One?

And the situation becomes worse if you lose your job or get behind on payments. Phone calls, lawsuits, wage garnishment, seizure of your bank accounts, and other creditor actions can pile stress on top of your debt. Fortunately, you do have legal options. The Fullman Firm is here to work with clients through their Capital One debt settlement so they can put the anxiety behind them.

What is a summons for Capital One?

In a lawsuit, Capital One or the third party debt collector will file a summons and complaint. The complaint is what most people think of when they hear the word “lawsuit”: it describes the nature of your debt, the fact that you haven’t paid it, and the details of the legal claims made against you. The summons requires you to answer the complaint.

Is Capital One a bad company?

There is some bad news about Capital One and its approach to legal action. By some estimates, the bank files more lawsuits than other companies by far. It also files lawsuits on relatively small amounts of debt. If you think your balance is too small for Capital One or its third party collectors to worry about, you’re probably mistaken.

Can you lower your Capital One interest rate?

We can help in other ways too. You may be able to lower the interest rate on your Capital One account. Or you could be eligible for more favorable payment terms than the ones you are on, which can help you get out of debt. We have worked extensively with Capital One debtors, so we know what strategies work and how to use them.

Is every Capital One collection case the same?

Every Capital One collections case is different, but most follow the same or similar patterns.

Does Capital One keep collections in house?

Thankfully, however, Capital One generally keeps their collections in house. They also understand that not everyone is in a financial position to pay 100% of what they owe, so they are willing to negotiate. The terms to which Capital One will agree vary from one case to another, but we understand their practices and can devise a solution that fits your circumstances.

How does debt settlement affect credit?

Damage to your credit. Debt settlement companies often encourage you to stop making payments to your creditors. This can severely damage your credit. It can also cause you to accrue interest, late fees and penalties on your existing debt, pushing you deeper into debt.

What are the risks of debt settlement?

Debt settlement comes with significant risks that you should be aware of before entering into an agreement. These risks include: 1 Damage to your credit. Debt settlement companies often encourage you to stop making payments to your creditors. This can severely damage your credit. It can also cause you to accrue interest, late fees and penalties on your existing debt, pushing you deeper into debt. You could receive calls from creditors or, in some cases, be sued for repayment. 2 High costs. Programs for debt settlement may require you to put money away for many months or years before your debt is settled. This can be very costly and, if you can’t afford the monthly payments, you may have to drop out of the program. Ensure you can truly afford to put away a significant amount of cash per month before entering into a debt settlement program. 3 No guarantee. Your creditors are not obligated to negotiate with you or a debt settlement company. There’s a chance that the debt settlement company you hire won’t be able to settle all of your debts, leaving you with growing debt during and after the process.

How long has New Era Debt Solutions been in business?

New Era Debt Solutions has been in business for 22 years and settled more than $250 million in debt for its clients. With an A+ rating from the Better Business Bureau and a 4.9 out of 5 star rating on Trustpilot, it ranks high for customer satisfaction and tends to be well regarded by clients.

How many clients does Freedom Debt Relief have?

Freedom Debt Relief, the largest debt settlement service provider in the nation, has resolved more than $10 billion in debt for more than 650,000 clients since 2002. Those clients seem to be mostly satisfied with their experience, giving it 4.6 stars out of 5 on Trustpilot.

How long does it take to get a debt settlement with New Era?

The average time to complete a program with New Era is 28 months. It doesn’t disclose if there’s a minimum amount of qualifying debt to enroll in its program.

How long does it take Century Support Services to settle debt?

It’s been in business for nearly a decade, served more than 250,000 customers and settled more than $1.3 billion in debt. It typically takes around 24 to 48 months to complete debt settlement with this company.

Do debt settlement companies have to disclose information?

By law, debt settlement companies are required to disclose certain information before you sign up for services. This includes: fees and terms for any services offered, an estimate of how long it may take for the company to settle with creditors, how much money you must save before the company makes an offer to creditors and information about the negative consequences of halting payments to creditors.