What is EPLI insurance and how does it work?

EPLI helps pay for court, settlement, and defense costs. EPLI coverage can be purchased as a stand-alone policy, but can also be found inside a management liability insurance package. These packages combine EPLI coverage with directors and officers liability and fiduciary liability insurance.

Does EPLI cover severance pay?

Damages (front & back pay): Almost all EPLI policies exclude coverage for severance pay, which is understandable given that these payments stem from standard business risks.

Does an EPLI policy cover front-pay and back-pay?

However, in addition to coverage for compensatory and punitive damages, any EPLI policy purchased should also provide coverage for front-pay and back-pay which can often be asserted during claims alleging wrongful termination.

How much EPLI coverage do I need for my business?

To determine how much EPLI coverage your business needs, you'll need to work with an independent insurance agent. Together, you'll discuss your business's operations and risks, and from there, be able to pinpoint the exact amount of coverage necessary to protect you.

What is not covered by Epli?

Generally, EPLI doesn't cover claims for bodily injury, intentional acts (assault, battery, criminal conduct), and privacy violations are not covered. Most importantly, EPLI protections almost always exclude wage and hour claims or only provide limited coverage to include defense costs, not repayment of back wages.

Is Epli claims made or occurrence?

Most EPLI policies are “claims-made,” meaning that the policy must be in effect both when the event took place and when a lawsuit is filed for a claim to be paid. The only time this isn't the case is if the policy has a retroactive date, which allows coverage for an incident prior to the start of the policy.

Is Epli expensive?

For Insureon customers, the median cost of EPLI is $182 per month, or $2,185 annually. The median provides a better representation of what you can expect to pay than the average because it eliminates high and low outliers.

What is the difference between Epli and professional liability?

Is EPLI the Same as Professional Liability? As a business owner, you should consider getting both EPLI and E&O insurance as the two policies differ in terms of covered risks. EPLI addresses liabilities from employees' claims, while E&O covers liabilities arising from clients' claims.

Which of the following damages are typically covered under an EPLI policy?

Employment Practices Liability Insurance (EPLI) — a type of liability insurance covering wrongful acts arising from the employment process. The most frequent types of claims covered under such policies include: wrongful termination, discrimination, sexual harassment, and retaliation.

What is a hammer clause?

A hammer clause is an insurance contract condition that limits the amount an insurer has to pay in a lawsuit if an insured refuses to approve a settlement offer.

Should I get Epli?

Even outside of those industries, it's wise to buy basic EPLI coverage if your business can afford it. According to a study by insurance company Hiscox, the average U.S. company faces a 10.5% chance of having an employment claim filed against them.

How much is employers liability insurance?

As of February 2022, employers' liability insurance in the United Kingdom cost an average of 61 British pounds for a single officer worker, whilst employers' liability insurance for one worker who performs tasks associated with your main line of business was set around 213 British pounds.

What is Epli insurance California?

What is it? EPLI insurance is specialized insurance that protects against employment-related liability risks. It may cover lawsuits filed by current employees, former employees and even job applicants.

Who pays for errors and omissions?

The insurance companyTo the company's benefit, its errors and omissions policy is robust and covers such situations. The insurance company pays for the legal expenses involved in the court case against multiple companies. It also pays for any monetary damages rendered by the courts or settled in arbitration.

What is the difference between Epli and D&O?

While D&O and E&O insurance policies cover claims made against the business by customers and clients, EPLI covers claims filed from within the company. Whoever is involved in the entire work process is effectively protected with the EPLI insurance they need to succeed at their job.

What causes Epli claims to rise?

With more workers bringing forth COVID-19-related legal actions, businesses are eager to purchase EPLI policies. However, the shift in the market has resulted in higher policy retentions, premium increases and new exclusions specific to COVID-19 exposures, and EPL insurers have started scaling back coverage.

What is the difference between an occurrence form and a claims made form?

An occurrence policy offers lifetime coverage for incidents that occur during the policy period, regardless of when the claim is reported. A claims-made policy only covers incidents that occur and are reported within the policy's time frame unless a 'tail' extension is purchased.

What causes Epli claims to rise?

With more workers bringing forth COVID-19-related legal actions, businesses are eager to purchase EPLI policies. However, the shift in the market has resulted in higher policy retentions, premium increases and new exclusions specific to COVID-19 exposures, and EPL insurers have started scaling back coverage.

What triggers a D&O claim?

If it appears that management has breached their duties to the detriment of an organization, shareholders may bring a claim against those directors and officers. Whether you're a nonprofit, privately held or a public company, it is likely that your business can benefit from a D&O policy.

What is an employee claim?

Employee Claim means a Claim based on salaries, wages, sales commissions, expense reimbursements, accrued vacation pay, health-related benefits, incentive programs, employee compensation guarantees, severance or similar employee benefits.

How much EPLI coverage do I need?

To determine how much EPLI coverage your business needs, you'll need to work with an independent insurance agent. Together, you'll discuss your bus...

What is the difference between employment practices liability and employers liability?

Employers liability insurance is similar to EPLI, but its scale is more limited. This coverage protects businesses against employee claims of injur...

What is employment practices liability insurance coverage?

EPLI insurance protects employers from lawsuits brought by employees. It provides coverage for many situations that general liability insurance doe...

What does an EPLI policy cover?

EPLI protects your business from numerous employee lawsuits, for claims of sexual harassment, wrongful termination, breach of contract, discriminat...

What is EPLI insurance?

Insurance Explained. EPLI (employment practices liability insurance) is a crucial coverage for any business, regardless of size. It protects companies against employment-related claims such as discrimination, wrongful termination, failure to promote, and other disputes. EPLI claims are on the rise, and companies should do everything in their power ...

What is EPLI deductible?

A deductible is the amount an employer will have to pay themselves in the event of an employment lawsuit before the insurance kicks in. The EPLI deductible will include attorney fees. The higher the deductible, the lower the premium.

What are the most common questions that business owners have about EPLI?

One of the most frequent questions business owners have about EPLI is how much they will have to pay to protect themselves from employment liability claims. This is a complicated question and one that needs careful consideration. One of the issues many have with insurance underwriting is that the calculation of premiums appears to be fairly opaque and hard to understand for the average user.

What is the importance of HR department in EPL?

Having the proper policies and procedures in place to help avoid situations that commonly lead to employment-related claims will significantly influence your EPL insurance premium.

What factors affect EPL premium?

This is the main factor that will affect your premium when securing EPL coverage and it’s reasonably intuitive; the more employees you have, the greater the chance of a claim, and the more you’ll have to pay for coverage.

Is EPLI on the rise?

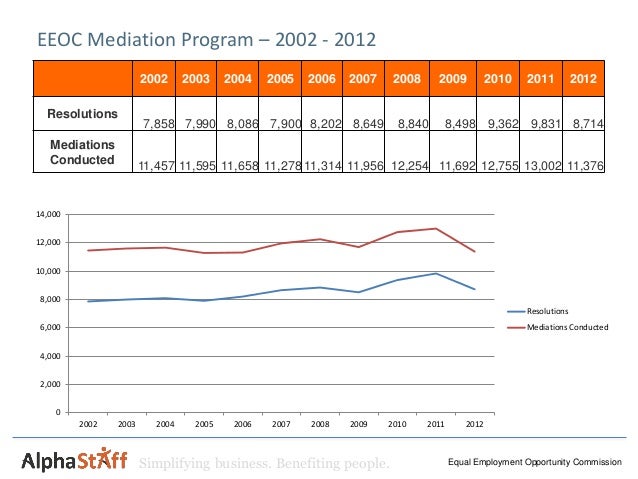

EPLI claims are on the rise, and companies should do everything in their power to adapt to this new reality. The number of employment-related lawsuits has risen roughly 400% in the past 20 years. And it’s not just large enterprises being sued either. Almost half of all employment-related legal cases are brought against companies that have less than 100 employees.

Which industries are at higher risk for EPLI?

Industries in which employees interact with customers such as retail, hospitality, and professional services will typically be considered higher risk by insurers and will have to pay more for EPLI. Some industries are having a difficult time securing EPLI over #MeToo liability, specifically “sales mentality” organizations.

EPLI Policy Defined

EPLI is optional business insurance that can be added to a Farm Bureau BusinessMax policy and provides coverage to protect your business from employment claims. Legal claims against employers generally include discrimination, wrongful termination, harassment, wrongful hiring, and other issues.

What Does EPLI Not Cover?

There are specific instances that are not covered by EPLI and may require additional add-on insurance. This coverage includes worker’s compensation, property damage, employee theft, umbrella insurance and more.

How much does EPLI cover?

Commonly, EPLI coverage comes with limits between $1 million and $25 million. It's important to work together with an independent insurance agent to choose the right amount of coverage for your business to cover possible attorney, court, and settlement costs in case of a lawsuit.

What is EPLI insurance?

Employment practices liability insurance, or EPLI insurance, protects employers from lawsuits brought by employees. It provides coverage for many situations that general liability insurance doesn't. Even lawsuits that are won by your company can be expensive, due to the high cost of legal defense. EPLI coverage provides important financial ...

How to determine how much EPLI coverage I need?

To determine how much EPLI coverage your business needs, you'll need to work with an independent insurance agent. Together, you'll discuss your business's operations and risks, and from there, be able to pinpoint the exact amount of coverage necessary to protect you.

What is the difference between employer liability and EPLI?

Employers liability insurance is similar to EPLI, but its scale is more limited. This coverage protects businesses against employee claims of injury or illness that stemmed from the business's negligence. Employer's liability insurance also covers legal fees, such as attorney, court, and settlement costs.

Why is employment practices liability insurance important?

That’s why having employment practices liability insurance is so important. Employee lawsuits are also becoming more common over time, which makes employment practices liability insurance (EPLI) a critical option for all businesses. Fortunately independent insurance agents can help you find the best EPLI coverage in your area.

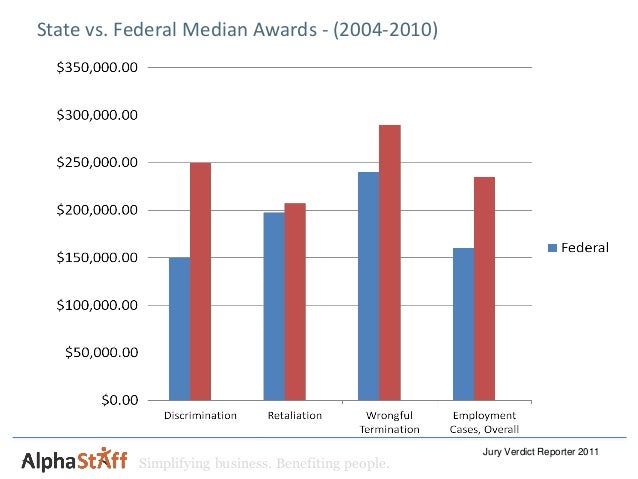

How much have employee lawsuits risen in the last 20 years?

Over the last 20 years, employee lawsuits have risen roughly 400%, with wrongful termination suits jumping up more than 260%. Oddly enough, you're more likely to be sued by an employee today than you are to have a fire at your business.

What does EPLI cover?

Your business may not be able to sustain a lengthy legal battle without the proper coverage. EPLI helps pay for court, settlement, and defense costs.

What does EPLI cover, and should you get it?

EPLI will pay for or reimburse your company for costs incurred in defending a lawsuit, whether you win or lose the case. Losses covered generally include compensatory damages, plus legal fees and costs, after you pay a (usually large, $10K+) deductible. Lately, there is a trend towards more carriers covering punitive damages as well, but this is not a sure thing, so it must be inquired about.

What is the benefit of EPLI?

Another typical EPLI benefit worth mentioning is access to skilled counsel in your area at discounted, insurance-contracted rates. The downside is that you lose the right to select your own counsel, and sometimes to make strategic decisions about your case. Still, many employers find the peace of mind that comes from knowing you have someone to call in the event of a claim to be well worth EPLI’s prices.

What is excluded in EPLI?

Generally, EPLI doesn’t cover claims for bodily injury, intentional acts (assault, battery, criminal conduct), and privacy violations are not covered. Most importantly, EPLI protections almost always exclude wage and hour claims or only provide limited coverage to include defense costs, not repayment of back wages. Wage and hour-based claims include all those relating to overtime, minimum wage, rest and meal periods, bonuses, and the like—and, unfortunately, they just happen to be the darlings of plaintiff’s lawyers. This is because the wage and hour statutes generally provide for automatic attorneys’ fees for violations, and the investigation usually involves doing the math, rather than the he said/she said subtleties involved in discrimination, wrongful termination, or other such claims.

Why are small businesses vulnerable to legal costs?

Don’t assume that you’re immune from these costs just because you’re a small business! Small employers are the most vulnerable because they usually don’t have their own legal team, and they often do not have insurance in place to pay the high costs of a legal defense.

Does EPLI cover accidental wrongdoing?

There are other notable exclusions including policies purchased after the claim is filed. EPLI also doesn’t cover “intentional wrongdoing,” which, ironically enough, has been applied to accidental wrongdoing as in the case of an employer simply being unaware of the law or confused by the way an existing law is worded. It also can’t help you (and this is a big one) if a third party decides to file a lawsuit on behalf of your employee, as was the case when the EEOC filed a discrimination lawsuit against Cracker Barrel on behalf of ten former employees.

Is EPLI insurance available in all states?

In the case of EPLI insurance though, it is important for employers to understand there are a set of exclusions so broad that often, things you might want to be covered are not. On top of all that, EPLI Insurance is not available in all states, and, even if it is, the conditions your business has to meet for approval are so strict, you may not even qualify.

Does EPLI cover workers compensation?

You may wonder if your current liability insurance covers these exposures. The answer is an emphatic NO. Neither your business liability nor your workers’ compensation policy covers employment-related claims. That’s the role of EPLI insurance.

What is EPLI insurance?

Employment practices liability insurance (EPLI) covers the cost to defend or settle employment-related lawsuits.

What is an EPLI policy?

Without adequate business insurance, your company might end up having to spend thousands of dollars to resolve an employee lawsuit. Employment practices liability insurance, or EPLI, gives small-business owners peace of mind that they won’t have to cover employee claims out of pocket. Learn more about EPLI in this guide, including what is and isn’t covered, how much EPLI coverage costs and where to buy it.

How many insurance companies underwrite EPLI?

The market for purchasing employment practices liability insurance is actually quite small. A group of about 20 insurers underwrite about 85% of EPLI policies. That should make it easier to find the right policy for your company, but if you’re having trouble, we recommend hiring an insurance broker. A broker can also help you decipher exactly what is and isn’t covered by a specific policy. The insurance company will cover the broker’s fee.

Does Nationwide offer EPLI?

Nationwide offers EPLI as a stand-alone policy and also offers EPLI as an endorsement to its business owners policy, or BOP, and general liability policy. Nationwide’s EPLI risk management services and law firm hotline can save business owners $1,000 or more during every policy period.

Is it wise to buy EPLI?

Even outside of those industries, it’s wise to buy basic EPLI coverage if your business can afford it. According to a study by insurance company Hiscox, the average U.S. company faces a 10.5% chance of having an employment claim filed against them. As the map below shows, the probability can increase to more than a 50% chance in some states, like California and New Mexico. Current events like the #MeToo movement and increased media attention to workplace discrimination have led to an increase in employee claims against all types of businesses. The average claim takes 318 days to resolve and costs $160,000, so insurance can be critical to your business’s survival.

Does EPLI cover board of directors?

Management decisions: EPLI doesn’t cover certain types of management decisions or board of director decisions, such as improper use of company funds or failure to follow company bylaws. In those cases, directors and office insurance can provide coverage.

Does EPLI cover employment practices?

Employment practices liability insurance, as you might expect, doesn’t provide coverage for every type of employment-related claim. The following types of claims usually aren’t covered by EPLI:

What does EPLI cover?

EPLI covers a small tech company when an employee sues over mishandling of employee benefits, like health insurance or a 401k.

What is EPLI protection?

EPLI protects a company if it is accused of discrimination based on a legally protected class, such as age, gender, religion, race, or disability.

What is EPLI in tech?

EPLI protects tech companies against lawsuits filed by employees claiming that their rights were violated.

What happens when an employee files suit for the company's failure to fulfill their obligations under the contract?

If an employee files suit for the company’s failure to fulfill their obligations under the contract, EPLI will cover the costs.

Can a tech company rely on EPLI?

A tech business can rely on EPLI to cover legal costs when a worker sues for sexual harassment in the office.

Is EPLI insurance required?

If someone outside of or unrelated to your company attempts to sue for libel or slander, a general liability insurance policy would be necessary for that company’s protection, not an EPLI policy.

What is an employee in EPLI?

Employees: When defining “insured persons” EPLI policies should include within their definition of “emplo yee”: seasonal, part time and leased employees, interns, volunteers, temporary and seasonal workers. Most policies will also include independent contractors (subject to some qualifying criteria). Obtaining a broad definition of “employee” can be of particular importance for non-profits, staffing firms, and professional service firms or those that frequently engage independent contractors. Some insurers will further broaden their policies to include coverage for “prospective employees” which is helpful for claims asserting failure to hire, discrimination, and EEOC actions involving background checks.

What are the statutory exclusions for EPLI?

Statutory Exclusions: EPLI policies commonly contain a statutory violation exclusion precluding coverage for claims such as OSHA, WARN and NLRA violations. While these exclusions are understandable, policyholders should be aware of their ability to purchase coverage for certain statutory related claims, such as defense cost coverage for claims alleging FLSA (wage and hour) violations. Additionally, in order to preserve coverage for claims brought by whistleblowers should an employee assert they were wrongfully terminated following the disclosure of any suspected statutory violations, insureds should also ensure that their policies contain appropriate carve-backs for whistleblower claims related to the excluded statutory violations.

What is the bodily injury exclusion?

When addressing the bodily injury/property damage exclusion, policyholders should ensure that there is an appropriate carve back for claims asserting mental anguish, invasion of privacy, humiliation and emotional distress – all of which can be commonly asserted during employment claims.

What is an oral demand in EPLI?

Oral Demands: Most EPLI policies define “claims” broadly which is generally to the advantage of the policyholder. The one exception however is “oral demands”. Due to their ambiguous nature, “oral demands” can create considerable uncertainty for the insureds when determining if in fact any claim has actually been made.

Can an EPLI policy settle a claim?

Settlement Within Retention: When incurring an employment related claim, some directors may be tempted to settle the claim in-house without involving the insurer. This can be particularly true for seemingly smaller claims and companies whose EPLI policies contain larger retentions. Since any payment can be perceived as an admission of guilt and can compromise future defense, most carriers explicitly bar the policyholder from making any payments/settlements or incurring any defense costs without obtaining prior consent form the carrier - doing so will compromise coverage by violating the policy’s defense & settlement clause. Some policies however do contain a “settlement within retention” provision which will allow the company to settle any claims under the retention.

Why should companies pay careful attention to the consent to settle clause?

In addition to preventing against becoming a potential “soft target” for future claimants, it’s also often a matter of defending one’s moral character and proving their innocence. For this reason companies should pay careful attention to the consent to settle clause (hammer clause) contained within the policy.

Does EPLI cover severance pay?

Damages (front & back pay): Almost all EPLI policies exclude coverage for severance pay, which is understandable given that these payments stem from standard business risks. However, in addition to coverage for compensatory and punitive damages, any EPLI policy purchased should also provide coverage for front-pay and back-pay which can often be asserted during claims alleging wrongful termination.

What is EPLI insurance?

Today, EPLI is a recommended coverage for just about any business that has more than a handful of employees and has also become a staple coverage when putting together insurance programs for high-growth startups , given the often sensitive nature of interaction in companies that often employ a younger workforce.

What does EPLI cover?

Most EPLI policies will cover defense costs, judgments, and settlements. Legal costs will usually be covered regardless of the outcome of the lawsuit. EPLI policies will usually exclude criminal fines and civil fines, as well as damages that other insurance products are designed to cover, such as bodily injury and property damage claims ...

Why is EPLI so popular?

Employment practices liability insurance (EPLI) has recently seen a huge spike in popularity as a result of the changing social and cultural landscape of the modern workplace. Over the last several years, there have been many very highly-publicized employee liability lawsuits in the media, spearheaded by the #MeToo movement, which has caused the number of companies purchasing EPLI to skyrocket.

What is whistleblower retaliation?

Whistleblower and Retaliation: In these types of cases, an employee usually alleges harassment or discrimination at an earlier junction and claims that because they spoke out about these behaviors at work, they were punished in some way. Retaliation claims are often related to demotions or cuts in pay that employees believe had nothing to with their performance, but rather, was directly related to the fact that they spoke out about something at work or shed light on a situation that the employer didn’t want to become known.

Why is EPLI important?

One of the main reasons EPLI is important is because employee claims tend to be very involved and complex, meaning that it usually takes a long time to resolve them. This means that employee claims against their employers tend to be very expensive, and recent studies and expert analysis tend to agree that both the number of employment-related claims and the cost of these claims will inevitably continue to rise.

What is employment practices liability insurance?

At its core, employment practices liability insurance will protect your business in the case of employee lawsuits that allege either unfair or inappropriate acts committed against them by someone who represents your company.

How many discrimination charges were filed in 2019?

The Equal Employment Opportunity Commission (EEOC) recorded 72,675 charges of workplace discrimination in the fiscal year 2019 alone. Not only are employee lawsuits frustrating for your management and bad for your company’s reputation, they are also often financially devastating.

How many companies offer EPLI?

Should your company do so? The answer is, of course, "it depends." There are about 50 insurers offering EPLI policies, and there are significant differences among the coverage offered. This means that any employer - or its insurance broker - must shop carefully for the coverage desired at the right price.

What to consider when purchasing EPLI?

In purchasing EPLI coverage, an employer also needs to consider how much control it will retain over the defense of a claim where the insurer has accepted coverage. Can the employer select its own defense counsel? If the employer has counsel it trusts and who knows its employment practices, it may not want the insurer to appoint its own chosen counsel.

What is a claim under a policy?

Quoting the policy language, the court observed that, " [a] claim under the policies is defined as "a civil, administrative or arbitration proceeding commenced by the service of a complaint or charge, which is brought by any past, present, or prospective "employee (s) of the 'insured entity' against any 'insured'" for certain listed causes. Cracker Barrel argued that this definition required only that the proceeding "evolved from" or be started "as a result of" a complaint or charge brought by the employee. However, the court ruled that the words "evolved from" or "as the result of" were not found in the definition. As a result, the court held that the insurers did not have a duty to indemnify Cracker Barrel for the settlement of the EEOC complaint.

What is claims made coverage?

Under these policies, coverage occurs when the complaint or lawsuit is filed, not when the alleged wrongful action occurred. Thus, if you were to purchase a policy covering the 2011 policy period, coverage would be limited to complaints or lawsuits filed in 2011.

Does Cracker Barrel have EPLI?

An employer who purchases employment practices liability insurance ("EPLI") likely expects coverage for claims of unlawful employment practices. As one large employer recently found out the hard way, such coverage may be unavailable when it is most needed. A federal trial court recently held that Cracker Barrel is not entitled to coverage under its EPLI policy in a large lawsuit brought by the U.S. Equal Employment Opportunity Commission ("EEOC"), because the plaintiff technically was not an employee as provided in the policy. The Cracker Barrel decision highlights that EPLI is not a panacea, and there are important factors that should be considered by employers in considering whether to purchase this insurance.

Does CGL cover sexual harassment?

These policies typically do not cover employment claims such as sexual harassment, age discrimination, wrongful termination, and defamation. Indeed, these policies often expressly exclude employment-related claims.

Does EPLI cover retaliation?

EPLI policies typically cover claims such as sexual harassment, discrimination, wrongful discharge, and retaliation and sometimes personal injury claims, such as defamation and invasion of privacy. However, EPLI policies often expressly exclude intentional wrongdoing. This is significant because many employment claims, especially discrimination claims, involve allegations of intentional misconduct. If a jury were to conclude that an employer intentionally discriminated against a former employee, the EPLI policy may not cover the employer for the loss. The good news is that many EPLI policies often pay defense costs until a jury makes that finding and sometimes during any appeal. In employment cases, defense costs can often exceed a plaintiff's actual damages. As a result, the duty to defend is highly valuable to the employer.

Number of Employees

Turnover Rates

- Another fairly straightforward situation; businesses that have higher turnover rates will have to pay more for coverage. High turnover rates often correlate with an increase in wrongful termination claimsand other types of employment-related lawsuits.

HR Procedures

- While insurers have traditionally focused on the number of employees to determine EPLI insurance cost, recently, the focus has shifted towards how businesses are supporting their workforce. Your organization’s investment in its HR department plays an important role in this. Having the proper policies and proceduresin place to help avoid situations that commonly lead t…

Industry

- Industries in which employees interact with customers such as retail, hospitality, and professional services will typically be considered higher risk by insurers and will have to pay more for EPLI. Some industries are having a difficult time securing EPLI over #MeToo liability, specifically “sales mentality” organizations.

Limits

- The higher the limit, the higher the premium will be. Most EPLI policy limits range from $100,000 to $1,000,000. While many small businesses may feel that a $100,000 limit is sufficient, legal defense costs and potentially expensive settlements or awarded damages will quickly surpass that limit. Given the rising cost of liability lawsuits related t...

Claims History

- Any past employment liability claims will affect how the underwriter views your business today. Typically, insurers will look at your record over the past three years. If your company hasn’t had employment-related incidents in that time, you can expect to pay a lower premium.

The Deductible

- Many EPLI policies will include a deductible. A deductible is the amount an employer will have to pay themselves in the event of an employment lawsuit before the insurance kicks in. The EPLI deductible will include attorney fees. The higher the deductible, the lower the premium. However, it’s essential to understand that with a high deductible, you may end up paying the entire cost of …

Policy Terms

- Most conventional insurance policies have standard policy terms, but EPLI policy terms tend to vary quite a bit depending on which carrier is selling you the policy. It’s important to properly understand your coverage and read the fine print. Consulting a broker that is both very well versed in EPLI and the needs of businesses in your particular industry can help you get the right covera…