What you should know about the Equifax breach settlement?

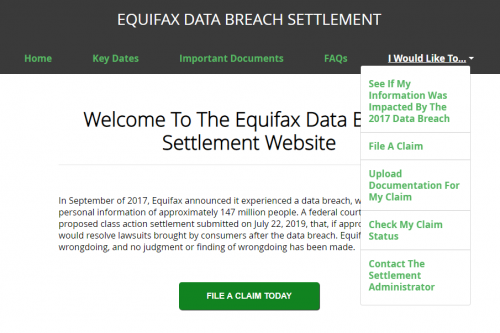

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

How to take advantage of the Equifax data breach settlement?

- Get a free credit report at www.annualcreditreport.com or by calling 877-322-8228.

- Call the Equifax Settlement Administrator at 1-833-759-2982.

- Take advantage of any free services being offered as a result of the breach.

- Use two-factor authentication on your online accounts whenever available.

- Consider a credit freeze.

What should I do after the Equifax data breach?

What to do if your account is compromised

- Least sensitive — change your password. If you’re notified that one of your online accounts has been compromised, change your password immediately.

- Moderately sensitive — notify your bank. If your card payment numbers have been stolen, notify the bank or company that issued the card immediately.

- Most sensitive — notify Equifax and TransUnion. ...

When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

See more

Has Equifax settlement been approved?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

What is the status of the Equifax lawsuit?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

How much can you get from a data breach settlement?

How much can I receive from the Capital One settlement? Class members can collect up to $25,000 in cash for lost time and out-of-pocket expenditures relating to the breach, including unreimbursed fraud charges, money spent preventing identity theft and fees to professional data security services.

How do I know if I qualify for Equifax settlement?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 2024 (the “Extended Claims Period”). During the Extended Claims Period, impacted class members may submit claim(s) for cash reimbursement.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How do I know if Equifax breach affected me?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

Where is my Bank of America settlement check?

Class members can expect settlement awards to be received by April 30, 2022. To view your check status, click here. Questions? Contact the Settlement Administrator at 1-855-654-0890.

What happens if impacted by breach of Equifax?

Information Assurance recommends that anyone who may have been affected by the Equifax data breach take the following five actions:Put a fraud alert on your credit report. ... Keep an eye on bank account and credit card statements. ... Check your free credit reports. ... Turn on two-factor for Weblogin and for personal accounts.More items...•

How do I know if I received a settlement check on Facebook?

If you are still not sure whether you are included, you can get free help on this website or by calling the Settlement Administrator at 1-844-799-2417. Please do not contact the Court or Facebook. Facebook will pay $650 million to settle this case.

Can you sue Equifax?

You can sue Equifax, but you may need to take certain steps depending on the reason. Suing Equifax requires that Equifax did something wrong like Equifax reporting you as dead, Equifax mixed you up with someone else, Equifax refused victim's rights with identity theft, or failed to investigate a credit error.

How much is the Capital One settlement per person?

The settlement allows reimbursement for up to $25,000 in out-of-pocket expenses related to the data breach. This includes money spent preventing identity theft or fraud, unreimbursed fraud charges, miscellaneous expenses, professional fees, and up to 15 hours of lost time at a rate of at least $25 per hour.

How much can you expect from a class action lawsuit?

A class action usually ends in a settlement as opposed to going to trial. Settlements in recent years have averaged $56.5 million.

How much will I get from the Bank of America lawsuit?

What does the Settlement provide? Bank of America has agreed to establish a Settlement Fund of $27.5 million from which Settlement Class Members will receive payments or Account credits. The amount of such payments or Account credits cannot be determined at this time.

How are class action settlements divided?

Class action lawsuit settlements are not divided evenly. Some plaintiffs will be awarded a larger percent while others receive smaller settlements. There are legitimate reasons for class members receiving smaller payouts.

Are class action settlements worth it?

In general, yes – class action lawsuits are worth it. For Class Members who are able to recover benefits from a class action settlement, all it takes is filling out a claim form and potentially providing documentation. This can allow them to recover up to thousands of dollars in compensation.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

For Those Affected by the Equifax Security Breach

Consumers affected by the Equifax Security Breach are eligible for at least 10 years of free credit monitoring service, plus at least 7 years of identity restoration, also for free, if you are a victim of identity theft. If you choose to use a different credit monitoring service, you could be reimbursed up to $125 for that cost.

What You Need to Do to Access Benefit from the Equifax Settlement

A series of deadlines have been set up for filing claims or opting out of the Equifax Settlement. The first deadline actually is for those who wish to opt out of the settlement, which leaves you free to pursue your own lawsuit against the company should you so choose. The opt-out deadline is Nov. 19, 2019.

Equifax Settlement: Bottom Line

We want to see everyone remaining financially safe and sound, so we encourage you to check to see if you have been affected by the Equifax security breach and if you are entitle to an Equifax settlement. Those affected should be prepared to file their claims for monetary damages by the Jan.

How long does it take to get a free credit report from Equifax?

You can get six free credit reports from Equifax in a 12-month period, for seven years beginning January 2020. These are in addition to the free reports you’re already entitled to under the law.

What is the CFPB?

We're the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.

When did Equifax breach?

In September 2017 , Equifax announced a breach that exposed the personal data of approximately 147 million people. If your data was impacted, under a legal settlement, you may claim free services and payments.

Can you request reimbursement for Equifax?

You can request reimbursement if you spent money, for example: For certain Equifax products before the breach. To freeze or unfreeze your credit. For credit monitoring services. Dealing with fraud or identity theft after the breach.

How many hours of time can you claim for a data breach?

To claim reimbursement of more than 10 hours of Time Spent during the Initial Claims Period, you must have also provided reasonable documentation of fraud, identity theft, or other alleged misuse of your personal information fairly traceable to the Data Breach (i.e., letter from IRS or bank or police report).

When is the deadline for credit monitoring?

The deadline for all claims for Credit Monitoring Services was 1/22/2020. If you submitted a valid claim form and elected to enroll in Credit Monitoring Services, you will receive enrollment instructions by email after the Settlement becomes effective.

Did Equifax protect consumers' personal information?

Plaintiffs claimed that Equifax did not adequately protect consumers’ personal information and that Equifax delayed in providing notice of the data breach. The most recent version of the lawsuit, which describes the specific legal claims alleged by the Plaintiffs, is available here.

How many free credit reports will Equifax give in 2020?

In addition, beginning in January 2020, Equifax will provide all U.S. consumers with six free credit reports each year for seven years. That's in addition to the one free annual credit report that Equifax and the two other nationwide credit reporting agencies currently provide.

How much did Equifax pay in penalties?

The company has also agreed to pay $175 million in civil penalties to 48 states, the District of Columbia, and Puerto Rico, as well as $100 million to the Consumer Financial Protection Bureau (CFPB). The FTC Commissioners voted unanimously, 5-0, to take this action against Equifax.

Is Equifax breach preventable?

A scathing Congressional report released in December of 2018 called the Equifax breach “entirely preventable.” The 96-page report concluded that the financial reporting company failed to properly fix a vulnerability in its database software despite being warned about the problem in early March 2017, months before the data breach.

Who warns consumers not to rely too heavily on credit monitoring?

Brookman warns consumers to not rely too heavily on credit monitoring.

Did Equifax respond to Consumer Reports?

Equifax had not responded to Consumer Reports' request for comment at time of publication.

Do retailers earn affiliate commissions?

When you shop through retailer links on our site, we may earn affiliate commissions. 100% of the fees we collect are used to support our nonprofit mission. Learn more.

How did the Equifax breach happen?

The Equifax breach investigation highlighted a number of security lapses that allowed attackers to enter supposedly secure systems and exfiltrate terabytes of data.

What data was compromised and how many people were affected?

It potentially affected 143 million people — more than 40 percent of the population of the United States — whose names, addresses, dates of birth, Social Security numbers, and drivers' licenses numbers were exposed. A small subset of the records — on the order of about 200,000 — also included credit card numbers; this group probably consisted of people who had paid Equifax directly in order to order to see their own credit report.

Who was responsible for the Equifax data breach?

As soon as the Equifax breach was announced, infosec experts began keeping tabs on dark web sites, waiting for huge dumps of data that might be connected to it. They waited, and waited, but the data never appeared. This gave rise to what's become a widely accepted theory: that Equifax was breached by Chinese state-sponsored hackers whose purpose was espionage, not theft.

How did Equifax handle the breach?

Among their stumbles was setting up a separate dedicated domain, equifaxsecurity2017.com, to host the site with information and resources for those potentially affected . These sorts of lookalike domains are often used by phishing scams, so asking customers to trust this one was a monumental failure in infosec procedure. Worse, on multiple occasions official Equifax social media accounts erroneously directed people to securityequifax2017.com instead; fortunately, the person who had snapped up that URL used it for good, directing the 200,000 (!) visitors it received to the correct site.

How does the Equifax settlement work?

The settlement mandates that Equifax compensate anyone affected by the breach with credit monitoring services; Equifax wants you to sign up for their own service, of course, and while they will also give you a $125 check to go buy those services from somewhere else, you have to show that you do have alternate coverage to get the money (though you could sign up for a free service).

What are the lessons learned from the Equifax breach?

If we wanted to make a case study of the Equifax breach, what lessons would we pull from it? These seem to be the big ones:

Why did Equifax pull data out of the network?

The attackers pulled data out of the network in encrypted form undetected for months because Equifax had crucially failed to renew an encryption certificate on one of their internal security tools.