Ways to Pay Medical Bills While Waiting on an Insurance Settlement

- Health Insurance. One of the first resources that you may be able to turn to for immediate payment of your medical...

- Medicare or Medicaid. If you have Medicare or Medicaid, you may be able to use this form of insurance to receive...

- Med Pay or PIP Coverage. Med pay or Personal Injury Protection (PIP)...

Will I have to pay medical bills after a personal injury settlement?

Waiting for an insurance company to offer you a settlement you feel is fair for your personal injury is will not happen as quickly as you would like it to. During this time, you may worry about how you will pay your medical bills that you have accumulated after the personal injury.

Can you negotiate medical bills and lien holders after a settlement?

With the legal advice of a personal injury lawyer, victims can negotiate with the lienholder to reduce the amount owed or work out a payment plan. Many healthcare providers would rather negotiate these types of liens than take a patient to collections or to court. It is also common to negotiate medical bills and liens after the settlement.

How much can a lien holder take from a personal injury settlement?

However, there are limits—the statute limits all lien holders to one-half of the settlement after attorney fees and expenses have been deducted. Your personal injury lawyer should discover the liens against your personal injury settlement when requesting medical records and medical bills related to your claim.

Will my car insurance company pay for medical bills?

Most car insurance companies will not directly pay your medical bills, but most of them will reimburse you for the expenses you and the health insurance company have paid for the medical bills. Some medical providers may state that your health insurance will not cover those expenses, but this is false.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

What reduces the amount paid in a claims settlement?

Car insurance coverage The insurance company pays up to the policy limits. They also reduce the settlement by the amount of any applicable deductible. Car insurance coverage can limit the amount of a settlement even if the damages are greater than the policy limits.

How long after settlement Do you receive the money?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

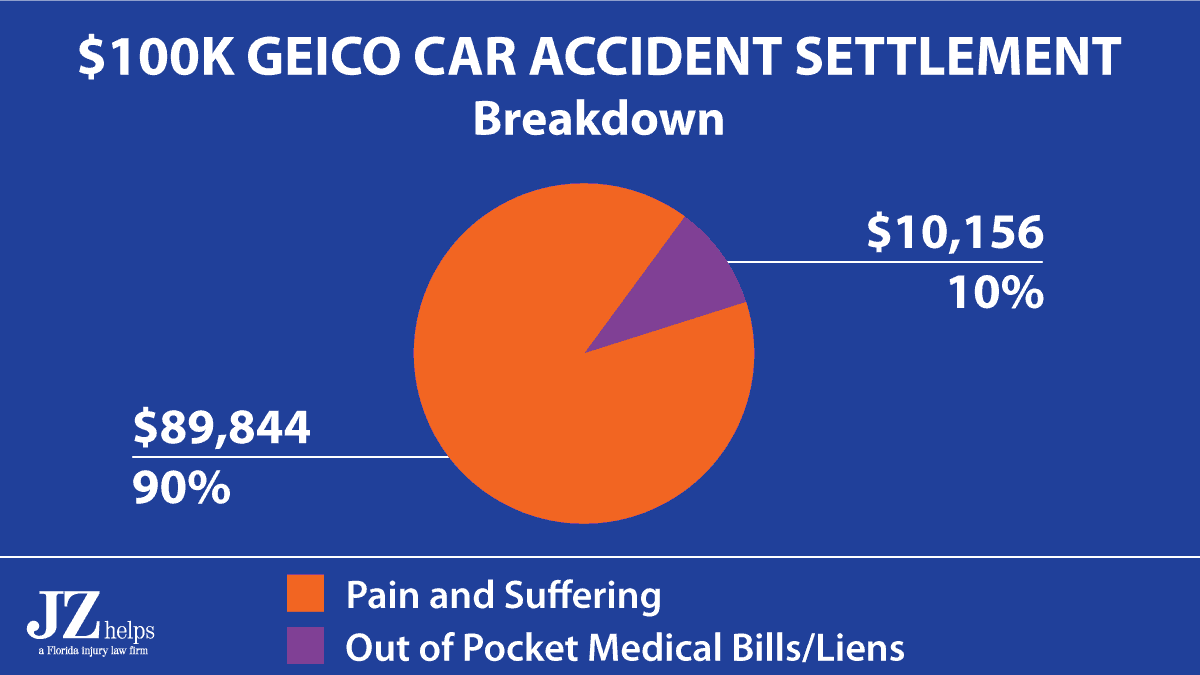

How is pain and suffering calculated?

The insurance company, or a jury, will determine how many days you are expected to be in ongoing pain or discomfort. They then apply your daily rate of pay to the equation and multiply the days of pain by your rate of pay per day. It can be difficult to decide which method to use to calculate pain and suffering.

Are settlement checks taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the largest personal injury settlement?

Here are the Largest Personal Injury Settlements in US History$150 Billion For The Family of Robert Middleton. ... $4.9 Billion For The Anderson Family From General Motors. ... Gas Station Manager Awarded $60 Million After Suffering Brain Injuries Caused by Derailed Train. ... Ford Motor Co.More items...•

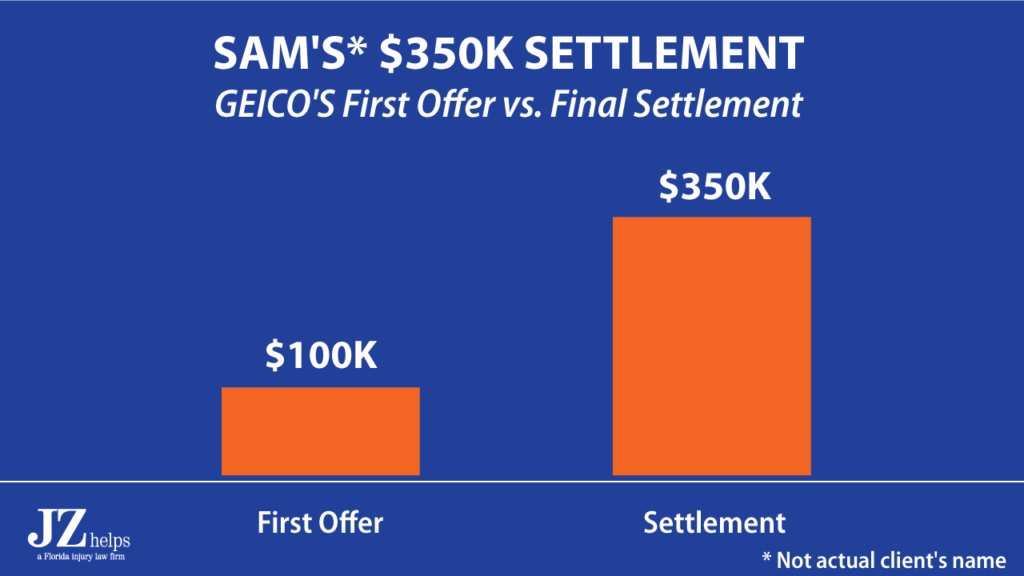

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What is the formula for personal injury settlements?

The formula goes like this: Damages = Economic damages x 1.5 (based on the injury severity) + lost income. For instance, assuming you fractured an arm in a motor collision and the medical expenses sum up to $10,000. Let's also assume that the injury made you miss 2 months of work which would have paid you $20,000.

Should I accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Why does a judge prefer a settlement over a trial?

Settlements are usually faster and more cost-efficient than trials. They are also less stressful for the accident victim who would not need to testify in front of a judge or hear the defence attempt to minimize their injuries and symptoms.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What is the usual result of a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

What happens if you take out a personal injury loan?

If you make the decision to take out a personal injury loan, you could pay back the loan at a very high interest rate. What will happen if your settlement does not yield the amount of money you initially thought? If you receive less than the amount you thought you would receive after taking out a large loan, you will be left with a deficit plus the interest you will owe.

What is a personal injury loan?

Personal Injury Loans. If you are in distress and you are in need of money while waiting for your claim to settle, you may find yourself in a very difficult situation. In many cases, a victim may think about taking out a personal injury loan in order to obtain funds.

How long does it take to recover from a disability?

After you file for disability, you could qualify for more benefits if your recovery is expected to take more than 1 year.

Can you put medical expenses on hold with Swor and Gatto?

We will work on your behalf to go through all of your options to alleviate your burdens while you are recovering from an injury. Swor & Gatto may be able to get the hospital to put your medical expenses on hold until the settlement has been finalized.

Does car insurance pay medical bills?

Most car insurance companies will not directly pay your medical bills, but most of them will reimburse you for the expenses you and the health insurance company have paid for the medical bills. Some medical providers may state that your health insurance will not cover those expenses, but this is false. Unless another insurance provider has been ...

Do you get compensation if you get into an accident?

It is known that if you get into an accident you should receive compensation for any medical bills from the person who was deemed at-fault for the accident. However, you will not receive your financial compensation until the case has been successfully processed, and that is assuming that the insurance company will agree to pay you anything.

Can health insurance cover medical expenses?

Unless another insurance provider has been listed as the primary insurer, such as the insurance company of the other driver or workers’ compensation, your health insurance provider can cover the medical expenses.

How long does it take for a medical settlement to be processed?

Insurance settlements take time to process. It may be months or years before you receive the funds from your settlement, so paying with your own health insurance ensures that these payments are made while the case is pending. This can help you avoid the added costs and damage to your credit if you have unpaid medical bills. More importantly, you can receive the medical care you need after being injured by a negligent driver.

Can you negotiate a reduced hospital rate?

In some circumstances, you may be able to negotiate with the hospital for a reduced rate for services or get on a payment plan while you wait for your case to settle.

Can you get medical insurance after an accident?

If you have Medicare or Medicaid, you may be able to use this form of insurance to receive necessary treatment after an accident. However, you may be required to pay this insurance back if your claim is later resolved through a settlement or jury award.

Does insurance cover medical expenses?

Some medical providers may state that your health insurance does not pay for these expenses, but this is incorrect. Unless another insurance is considered the primary insurer, such as workers’ compensation or the other driver’s insurance company, your own health insurance may cover the medical expenses. Be sure that you give the medical provider a copy of your insurance card and list it as a backup payment. Provide this information at your first visit.

How do medical liens get paid?

Medical liens get paid out of a personal injury settlement or judgment. When accident victims are unable to pay for the costs of their care, some healthcare providers may choose to provide that care in exchange for a medical lien. They then recover the costs of that medical care from the defendant if the victim’s personal injury case succeeds.

What is a medical lien?

A medical lien, sometimes referred to as a hospital lien, is an agreement between a patient and his or her healthcare provider. The legally binding contract is known as a lien agreement. Liens are most frequently used when the patient has no other way to pay for the care they need after being hurt in an accident.

What is subrogation in insurance?

Subrogation is the legal process of an insurance company recouping from the defendant what it had paid to the plaintiff. Insurers generally retain their right to subrogation in their insurance policy. It most often happens in the context of medical expenses and a personal injury lawsuit. Auto insurance companies can also recover subrogation from victims who have benefited from med pay insurance. Even the government can take from your claim with a Medicaid lien or one through the Veteran’s Administration.

How does a healthcare provider perfect a lien?

Once the lien agreement has been signed, the provider will perfect the lien by notifying the interested parties about the agreement. By perfecting the lien, the healthcare provider guarantees that they will be paid from the personal injury verdict or settlement, first. They come even before the victim, who would be the case’s plaintiff.

What happens if a person loses a personal injury case?

If an accident victim agrees to a medical lien in order to pay for his or her medical care, but then loses the personal injury case, the victim will still be liable under the lien. This means that the victim will be personally responsible for paying his or her medical bills under the lien agreement. If the victim cannot pay, the healthcare provider and lienholder can invoke their legal rights to collect the debt.

What would happen if there was no subrogation?

However, if there were no subrogation, then victims would receive a windfall. They would have their medical bills paid for by their insurer. Then they would recover reimbursement for their medical bills in a successful personal injury claim.

Can a hospital lien be subrogated?

The insurer can then pursue its right to subrogation against the defendant in the case in order to recoup the amount it paid to the victim. Many states limit how much the insurer can take in subrogation. Those limitations do not exist for hospital liens.

What are the two types of medical bills in personal injury settlements?

Generally, there are two types of medical bills in personal injury settlements. First, there are those bills which are liens. Second, there are those bills which are not liens. The two are treated differently for purposes of whether they must be paid out of your personal injury settlement.

How to speak with a personal injury lawyer?

If you have a personal injury claim and you would like to speak with a lawyer, call us. You can reach us at 704.749.7747 or request a FREE CASE EVALUATION and we will call you today to discuss your case. February 12, 2019 / by Chris.

When should a personal injury lawyer discover liens?

Your personal injury lawyer should discover the liens against your personal injury settlement when requesting medical records and medical bills related to your claim. Keep in mind, if you were treated at a facility and did not tell your personal injury lawyer about it, it would be difficult for them to discover the lien.

Can Medicare be reimbursed for ERISA?

Healthcare providers like Medicare, Medicaid, and ERISA health plans, are entitled to be reimbursed if they pay for treatment related to your personal injury claim. Medicare applies what they call a “Procurement Formula” to the settlement amount. Your attorney can estimate what this amount will be prior to reaching a settlement. Medicaid is generally limited to roughly one-third of the settlement. ERISA health plans, unfortunately, are entitled to be reimbursed for their entire lien out of your settlement proceeds. Your personal injury lawyer can usually successfully negotiate the lien prior to reaching a settlement.

Can a medical provider claim a lien against a settlement?

Certain medical providers will claim a lien against your personal injury settlement. The claimant does so by citing the language in NCGS 44-49 and NCGS 44-50. This statute allows the medical provider to claim a lien against your settlement or jury verdict. However, there are limits—the statute limits all lien holders to one-half of the settlement after attorney fees and expenses have been deducted.

Can a medical bill be a lien?

Bills Which Are Not Liens. There will be other medical providers who will have an outstanding bill related to the injury. However, they may choose not to claim a lien. Or, they may simply fail to claim a lien against your settlement.

Can ERISA be reimbursed?

ERISA health plans, unfortunately, are entitled to be reimbursed for their entire lien out of your settlement proceeds. Your personal injury lawyer can usually successfully negotiate the lien prior to reaching a settlement.

What happens when you receive a personal injury settlement?

When a client receives a personal injury settlement, the medical bills are the responsibility of the client to repay. The insurance company for the at fault party will pay a global amount, including payment for past and future medical bills, lost wages, and pain and suffering.

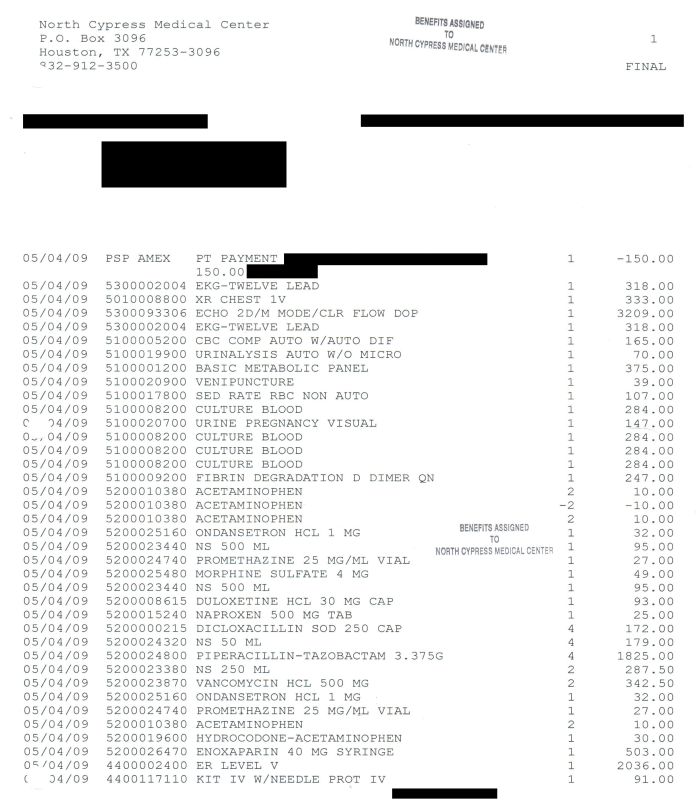

How much money do you have to pay out of the $30,000 settlement?

Out of the $30,000 settlement, you will be required to repay $18,250 for medical expenses, case expenses and attorney’s fees. That will leave you with a net of $11,750 in your pocket from the $30,000 settlement.

What is a lien on a medical settlement?

This is, in essence, putting a lien on the settlement whereby, prior to any settlement or commission payments being disbursed, the medical provider will receive their payment.

What If I Received Treatment with No Letter of Protection or Lien?

If this is the case, you have an opportunity to possibly clear more money from the settlement. If there is no lien against the settlement, you are still required to pay the bills, but you and/or your attorney may be able to negotiate a better rate. This is especially true when insurance rates are not originally quoted. Most hospitals and doctors have a published rate but also a rate that is far lower they accept from insurance companies. If you have a personal injury attorney, he or she will be very familiar with these rates and negotiate on your behalf to have these bills lowered to a more acceptable amount.