In addition, you can get your 401 (k) statement by accessing your 401 (k) account online and downloading your most recent statement, along with past statements for as long as you’ve been contributing to the plan. The Department of Labor requires 401 (k) plan administrators to send quarterly statements to participants of a retirement plan.

Full Answer

What is a settlement statement on a mortgage?

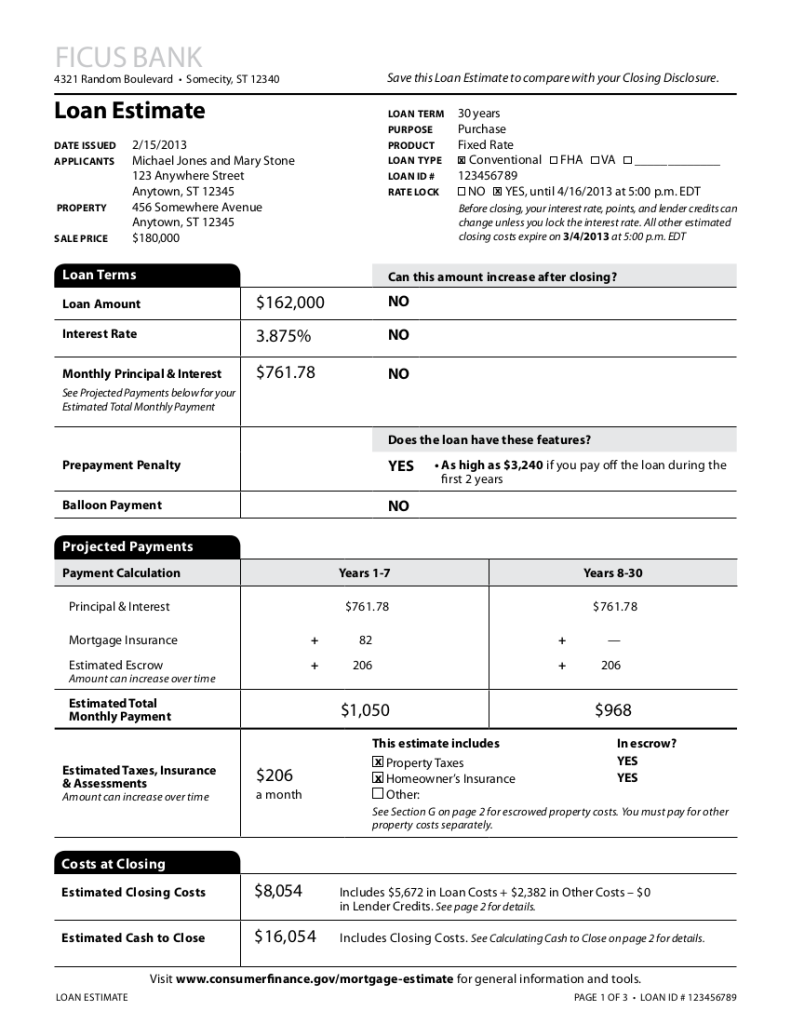

In its most common form, a settlement statement is part of a loan closing package provided to a borrower, usually from a loan officer at a lending institution. Comprehensive settlement statement documentation is required for mortgage loan products. It is also usually required for other types of loans as well.

How can I take money out of my 401(k) plan?

Loans and withdrawals from workplace savings plans (such as 401 (k)s or 403 (b)s) are different ways to take money out of your plan. A loan lets you borrow money from your retirement savings and pay it back to yourself over time, with interest—the loan payments and interest go back into your account.

How do I get a settlement statement for a commercial loan?

Commercial and personal loan borrowers will usually work with a loan officer who presents them with the closing, settlement statement. Some online lending and credit card agreements may provide different iterations of settlement statements that a borrower receives electronically.

How do I request a 401(k) loan or withdrawal?

If you've explored all the alternatives and decided that taking money from your retirement savings is the best option, you'll need to submit a request for a 401 (k) loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits ® to review your balances, available loan amounts, and withdrawal options.

Is a closing statement the same as a settlement statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

Who prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

What form contains a settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is loan settlement?

The settlement of a loan is the act of paying back the amount of money owed to the lender. If you've ever been out on the town and had to settle your tab before leaving an establishment, you're familiar with the notion.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is a closing disclosure the same as a closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

What is included in full and final settlement?

The full and final settlement consist of clearance of dues towards an employee upon their exit from the company. It includes the salary drawn, leave encashment, reimbursements, variables etc.

What is F&F process?

Full and Final Settlement is the process when an employee quits an organization. It is actually the amount of money an employee receives after all the deductions after leaving the organization. In some cases, the employee has to pay the organization in order to get his/her relieving letter.

What does full and final settlement mean?

By contrast, a payment "in full and final settlement" can usually be interpreted as an offer to settle a dispute on terms that, in exchange for the sum tendered, the creditor will give up the rest of its claim.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

How easy is it to get a loan from a 401(k)?

1. Speed and Convenience. In most 401 (k) plans, requesting a loan is quick and easy, requiring no lengthy applications or credit checks. Normally, it does not generate an inquiry against your credit or affect your credit score . Many 401 (k)s allow loan requests to be made with a few clicks on a website, and you can have funds in your hand in ...

Why is 401(k) an attractive source for short-term loans?

Why is your 401 (k) an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 (k) is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your credit rating .

How long does a 401(k) loan last?

Regulations require 401 (k) plan loans to be repaid on an amortizing basis (that is, with a fixed repayment schedule in regular installments) over not more than five years unless the loan is used to purchase a primary residence.

Why are 401(k) loans tax inefficient?

The claim is that 401 (k) loans are tax-inefficient because they must be repaid with after-tax dollars, subjecting loan repayment to double taxation. Only the interest portion of the repayment is subject to such treatment. The media usually fail to note that the cost of double taxation on loan interest is often fairly small, compared with the cost of alternative ways to tap short-term liquidity.

What happens if you lose your job and take a plan loan?

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don't, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. 6 While this scenario is an accurate description of tax law, it doesn't always reflect reality.

What is the cost advantage of a 401(k) loan?

The cost advantage of a 401 (k) loan is the equivalent of the interest rate charged on a comparable consumer loan minus any lost investment earnings on the principal you borrowed. Here is a simple formula:

Is a 401(k) loan taxable?

Receiving a loan from your 401 (k) is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your credit rating . Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress.

What happens if you withdraw money from your 401(k)?

A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's look at the pros and cons of different types of 401 (k) loans and withdrawals—as well as alternative paths.

How long do you have to pay back a loan?

Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases. Your plan's rules will also set a maximum number of loans you may have outstanding from your plan. You may also need consent from your spouse/domestic partner to take a loan.

What is a 403b loan?

Loans and withdrawals from workplace savings plans (such as 401 (k)s or 403 (b)s) are different ways to take money out of your plan. A loan lets you borrow money from your retirement savings and pay it back to yourself over time, with interest—the loan payments and interest go back into your account. A withdrawal permanently removes money ...

What is hardship in 401(k)?

The IRS defines a hardship as having an immediate and heavy financial need like a foreclosure, tuition payments, or medical expenses. Also, some plans allow a non-hardship withdrawal, but all plans are different, so check with your employer for details. Pros: You're not required to pay back withdrawals and 401 (k) assets.

Can a 401(k) loan be used to pay off debt?

What's more, 401 (k) loans don' t require a credit check, and they don't show up as debt on your credit report. Another potentially positive way to use a 401 ...

Does 401(k) loan affect credit score?

Another benefit: If you miss a payment or default on your loan from a 401 (k), it won't impact your credit score because defaulted loans are not reported to credit bureaus. Cons: If you leave your current job, you might have to repay your loan in full in a very short time frame.

Do you have to pay back 401(k) withdrawals?

Pros: You're not required to pay back withdrawals and 401 (k) assets. Cons: If you're under the age of 59½ and take a traditional withdrawal, you won't get the full amount because of the 10% penalty and the taxes that you will pay up front as part of your withdrawal.

Can Plan Administrators Reject a 401k Loan Application?

Plan administrators can reject a 401k loan application despite the fact that you want to borrow from your own savings. The IRS has set several regulations for 401k loans that articulate everything from what happens if an employee leaves a company to the period within which such loans must be paid.

Common Reasons Why 401k Loans Are Denied

Plan administrators may deny 401k loans for various reasons. Some of them may be within your control, while others may be things you can’t change.

Conclusion

Indeed, your plan administrator has a lot of say when it comes to approving or rejecting your request for a 401k loan.

How do I know how to best divide the 401K in my divorce?

The best way to divide accounts in your divorce is going to be based on your financial situation. There is no one-size-fits-all approach. It is best to consult with your financial advisor and/or tax professional to determine what is in your best interest. A CDFA (Certified Divorce Financial Analyst), who has specialized training in divorce financial planning can be especially helpful. A CDFA can help you make the right decisions when dividing your 401K and other assets in a divorce.

How to take out 401(k) in divorce?

To take advantage of this, when dividing a 401K in divorce, have the portion you need, paid directly from the account to you. It does not need to be the full amount that you are receiving. This is important, though. Don't roll it into an IRA first and then take it out because if you do, then you will be subject to the penalty. You only avoid the penalty when the distribution is made directly from your former spouse's 401K to you directly.

What age can you withdraw from a 401(k)?

Rember that withdrawals from a 401K prior to age 59.5 are subject to a 10% early withdrawal penalty. The withdrawal will be reported as income on your tax return. If the withdrawal happens before the divorce is final, the owner is responsible for the taxes and penalties unless you negotiate otherwise. If you are cashing out a portion of the 401K ...

What are the most common financial mistakes made during divorce?

Emotions are running high and it's common not to want to engage a financial professional if you are already paying legal fees. That said, the cost of a financial professional relative to the amount they can save you in financial mistakes is minimal. One of the most common financial mistakes I see is how money is withdrawn from a traditional pre-tax 401K in a divorce.

Does 401(k) work in divorce?

If you are under age 59.5, this is an important tip you need to know about a 401K in divorce. This only works if you are awarded all or part of your spouse's 401K. It does not work on your own retirement account.

Should you cash out a 401K in a divorce?

Am I suggesting that retirement plans are a good source of cash when going through a divorce? Let me be clear. No, I am not suggesting that at all. I simply want to share that if you have a cash need and it makes the most sense to take it from a retirement account, the IRS does allow you to take money from a 401K without penalty.

What to do if you can't get settlement papers?

If you are unable to obtain the settlement papers from any of those parties, you will need to reconstruct the transaction and estimate the amounts from whatever evidence you can gather from bank records, emails/correspondence, old property tax bills, or any other documentation involving the purchase or value of your Home.

How to get a copy of closing statement for 2006?

To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents . Other parties that may have copies of the Settlement Documents include your real estate agent, the seller's real estate agent, the mortgage broker, the financial institution that held the loan for the property, or the seller himself.

How to enter secured loan against 401(k)?

The amount of the secured loan should be entered as Secured Borrowed Funds in the asset section o the loan application. The secured loan amount should be subtracted from the market value of the actual asset, and the net asset value should be entered. For example, if the borrower has a vested value, less taxes and penalties, of $30,000 in a 401 (k) account and borrows $10,000 against the 401 (k), enter $10,000 as secured borrowed funds and enter $20,000 as retirement funds.

How long do bank statements have to be dated?

Monthly bank statements must be dated within 45 days of the initial loan application date .

Where to enter bridge loan?

Enter the amount of a bridge (or swing) loan in the asset section of the loan application. Do not include the amount of the bridge loan in any other liquid asset. (For example, do not enter the amount of the loan both as a bridge loan and in a checking account, even if the loan funds have been deposited.)

What happens if earnest money is not cleared?

If the earnest money check has not cleared the borrower’s bank account, the amount can be included in a depository account, such as a checking or savings account.