- Firstly you need to work out how much to offer your creditors and then send your offer to them in writing.

- Always ask your creditors to confirm they accept your offer in writing before you send them any money.

- Keep any letters your creditors send to you about the settlement offer just in case you need to refer to them again in the future. ...

- You may find not all your creditors are willing to accept your offer of settlement and you’ll have to negotiate with each one individually. ...

- If your offers are accepted, make sure you send payment to each creditor by the date they give you. Keep proof of payment.

Full Answer

How do I make an offer to settle with my creditors?

Firstly you need to work out how much to offer your creditors and then send your offer to them in writing. Always ask your creditors to confirm they accept your offer in writing before you send them any money. Keep any letters your creditors send to you about the settlement offer just in case you need to refer to them again in the future.

How to ask a credit card company for a settlement?

How to Ask for a Settlement. You may want to settle a credit card to help reduce your debt load. Offer the settlement to the credit card company. You can start with a settlement figure of 30 to 35 percent of your outstanding balance. Tell the credit card company this is the amount you are prepared to pay as a settlement for your credit card debt.

How do I write a settlement offer letter?

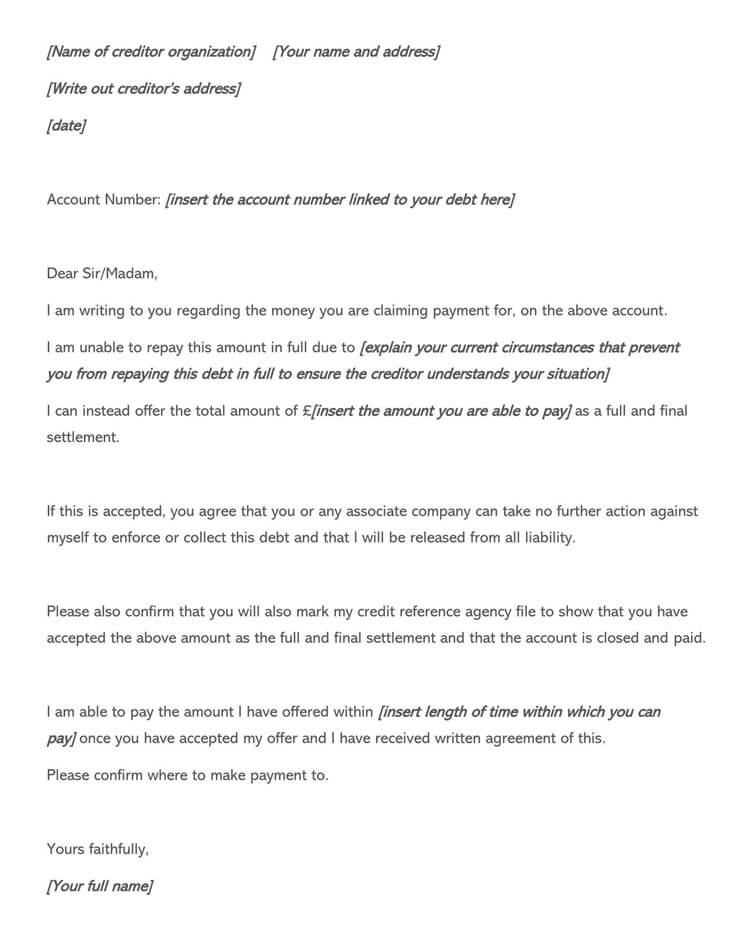

A settlement offer letter will contain your proposal to offer some sum of money to the creditor in exchange for forgiveness of the rest of your debt. The letter should typically explain why you can’t pay the full debt, how much you're willing to pay right now, and the exact action you want in return from the creditor.

Can a debt collector send you a settlement offer?

Before you pay or even speak to anyone about the settlement (particularly a debt collector), you need to be sure the settlement offer is legitimate. A settlement letter could be a debt collector ploy to get you to make one or more partial payments on a time-barred debt, that is one whose statute of limitations has expired.

How do you get an offer to settle a debt?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

What percentage will creditors settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you propose a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Can creditors refuse an offer of payment?

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How do I write a letter to request a settlement?

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

How do you negotiate a good settlement?

The following guidelines can help you settle out of court and reach creative, mutually beneficial resolutions to your disputes, with or without lawyers at the table.Make sure the process is perceived to be fair. ... Identify interests and tradeoffs. ... Insist on decision analysis. ... Reduce discovery costs.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What percentage will Portfolio Recovery settle?

Since Portfolio Recovery likely purchased your debt for less than 8% of its original values, they would still profit if you settled to a pay a percentage of the cost. Most debt collection agencies are will settle for 1%–60% of the original debt amount.

Can you negotiate with a creditor?

Debt Negotiation in a Nutshell Thankfully, speaking to creditors can help—even if you haven't followed through on a previous payment plan. Lenders can be surprisingly forgiving, and many settle for much less than their customers owe. You don't need a debt management company to do the work for you.

How likely is it that a collection agency will sue?

Roughly 15% of Americans who have been contacted by a debt collector about a debt have been sued, according to a 2017 report by the Consumer Financial Protection Bureau. Of those, only 26% attended their court hearing — again, a big no-no.

What to do before calling creditors?

When you call your creditors, tell them exactly how much you can afford to pay them and ask them how you can negotiate with them to get to that amount.

How to settle credit card debt before calling creditors?

Have the facts in place before you call. Before you call the creditors you owe, it’s important to get a copy of your credit report or have a current letter in hand from your creditor verifying the amount of money that you owe. Proper settlement of credit card debt can more easily occur if you have your facts straight.

Why is it important to ask for a specific reporting status to the credit bureau?

After you’ve settled on a specific dollar amount for the debt to be considered paid in full, it’s important to also ask for a specific reporting status to the credit bureau. Ask the creditor if they will report your agreement as “Paid as agreed upon” instead of “Settled” because the former is more favorable on your report than the latter.

What to do if you are behind on credit card payments?

Have you fallen behind on your credit card payments? Do you have old credit card debts that haven’t been serviced for a while? Then you may be able to create a settlement plan with your creditors to help you to avoid bankruptcy and put a plan in place that is both affordable for you and ensures repayment to those you owe.

What to do if customer service representative can't help you?

If the customer service representative can’t or won’t help you, calmly ask if there is a supervisor or crisis specialist that you can talk to. Professionalism is important in creditor negotiations, so no matter how frustrated you might become during the call, it’s vital to remain cool and calm during negotiations.

How to explain a sob story to creditors?

For this reason, it’s important to make them aware of the situation in a calm and honest manner. Be clear and concise as you explain your predicament. Explain calmly that because of your financial situation you can’t afford to pay them the full amount due and ask them who you can talk with to figure out a plan that will benefit both them and you.

What to do if you haven't paid your debt?

If you haven’t paid anything on your debt in a while, you may want to check and see if the collection amount is past the statute of limitations. It’s important to do this before you call any creditors so that you do not accidentally reactivate the account and start the statute of limitations timeline over again.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

Why do credit card companies offer settlements?

Credit card companies will be more willing to offer extend a settlement if you are experiencing financial difficulty or some type of hardship. Provide them with all of the details. You may want to settle a credit card to help reduce your debt load. Offer the settlement to the credit card company.

How much of a credit card settlement is acceptable?

Tips. As a rule of thumb, settlements in the amount of 50 to 70 percent of the balance are acceptable. Some credit card companies will settle for 20 to 70 percent of the balance. Warnings.

What to do if you have a large lump sum of cash?

If you have a large lump sum of cash, such as a tax refund or bonus, you may want to settle your credit card debt. When you call the credit card company have a target figure in mind to offer as a settlement. Call the credit card company and explain your circumstances.

Can a credit card company accept a settlement offer?

A credit card company is more likely to accept your offer if they think you will file a petition for bankruptcy, which means they will not receive anything. Ask for the offer in writing. Once you have successfully negotiated a settlement offer, make sure the credit card company provides you with the details in writing.

Can you settle credit card debt?

An excessive amount of credit card debt may lead you to ask for a settlement. When you settle your debts, you are making an agreement with the credit card company to pay an amount less than the full balance. Credit card companies do not readily disclose the fact that settlements are available. A credit card company will not let you settle your account unless you are at least 90 days past due. You can usually settle any where from 50 to 70 percent of your outstanding balance.

How do you make a settlement offer?

You can make settlement offers to all of your debts, sharing out the lump sum fairly among them.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What to do if you have a lump sum of money?

If you’ve received a lump sum of money and you’re struggling to repay your debts, get free, online debt advice to find the right solution for your situation, or call us (free from all landlines and mobiles).

How does a full settlement work?

But if the lump sum you have is less than the amount you owe to your debts you can make ‘full and final settlement’ offers. This means offering the lump sum you have in return ...

How long should you keep a settlement letter?

We recommend keeping these letters safe for at least six years after you’ve paid the settlement amount.

Can you get a lump sum of money from selling a property?

You can get a lump sum of money from selling an asset, such as a property or a vehicle, receiving an inheritance, or it could be a gift from family or friends. If it’s the best solution for you we have a specialist debt advice team who can help you make full and final settlement offers to your creditors.

Can creditors accept a settlement offer?

You may find not all your creditors are willing to accept your offer of settlement and you’ll have to negotiate with each one individually. It’s possible that none of your creditors will accept a full and final settlement.

How to deal with a debt settlement?

You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer. Read the settlement offer carefully or have an attorney review the offer to be sure it’s legally binding – that the creditor or collector can’t come after you for the remaining balance at some point in the future.

What is a settlement letter?

A settlement letter could be a debt collector ploy to get you to make one or more partial payments on a time-barred debt, that is one whose statute of limitations has expired. The payment would restart the statute of limitations giving the collector more time to sue you for the debt 1 .

What percentage of a debt is typically accepted in a settlement?

Debt settlement agreements often range between 30% and 60% of the total amount owed, but there will also be substantial fees on top of that amount.

How long does debt settlement stay on your credit report?

Generally, settled accounts stay on your credit report for seven years after the original date of delinquency. A debt settlement will negatively affect your credit, but not as much as failing to pay the debt will. 6

How to stop a third party debt collector from collecting my credit report?

You can stop communication from a third-party debt collector by sending a written cease and desist letter. 4

Can a creditor accept a lower settlement?

Your creditor may be willing to accept a lower settlement than the one offered in the letter. Because the door for settling the debt is already opened, you can use this opportunity to see if the creditor is willing to accept a lower payment.

Do you have to convince a creditor to settle?

Plus, you don't have to convince creditor to settle because they’ve already made that decision. Don’t get too excited about the prospect of finally being rid of this debt. Before you pay or even speak to anyone about the settlement (particularly a debt collector), you need to be sure the settlement offer is legitimate.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

What do you need to negotiate with your credit bureau?

You need to negotiate two things: how much you can pay and how it’ll be reported on your credit reports.

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

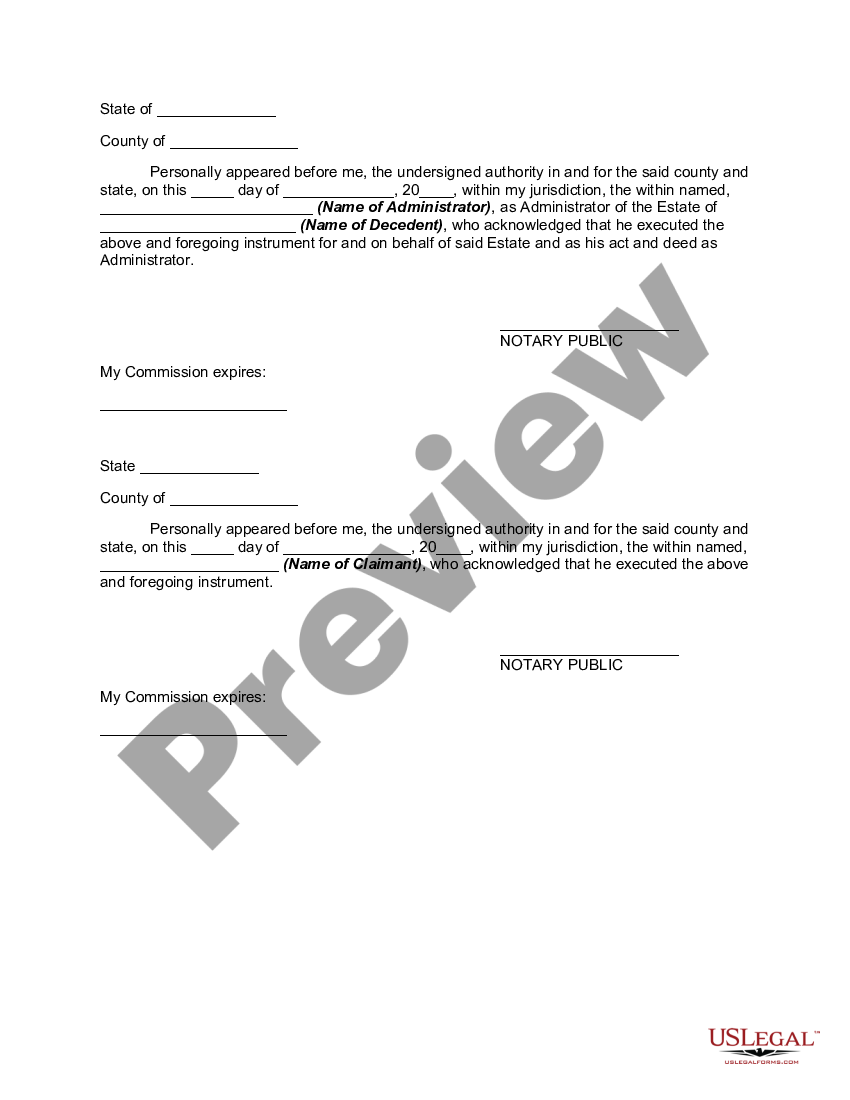

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.