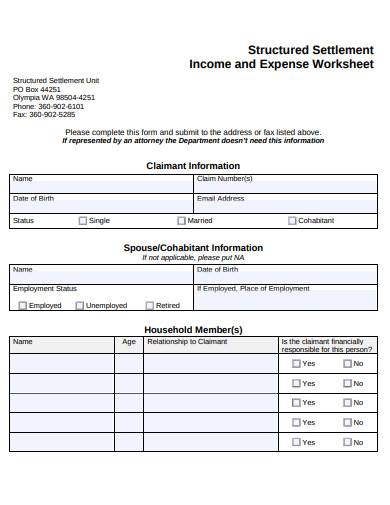

- Apply online Complete the online application. Complete the Structured Settlement Income and Expense Worksheet (F240-007-000). ...

- Download and print the forms Complete an Application for Structured Settlement (F240-002-000). Complete the Structured Settlement Income and Expense Worksheet (F240-007-000). Return both completed forms by email, mail, or fax.

- Contact us for an application packet

How do structured settlements payout?

Structured settlements payout over time as a stream of tax-free payments, rather than one lump sum. You can “cash in” your future structured settlement payments by selling them to a factoring company at a discount if you need immediate cash. Most structured settlements stem from personal injury, wrongful death or workers’ compensation lawsuits.

How do I apply for a structured settlement without an attorney?

If you do not have an attorney, there are 3 ways to apply for a structured settlement: Complete the online application. Complete the Structured Settlement Income and Expense Worksheet (F240-007-000). Note: This information will not be part of your claim file and is only for settlement purposes.

How long does it take for a structured settlement to start?

Structured settlement payments begin within 14 days after the agreement is final. If closure of the claim is part of the agreement, it is considered closed after the 30-day revocation period ends. Structured settlement law requires periodic payments with certain limits on the amount of each payment:

How do I initiate structured settlement discussions with an eligible worker?

The structured settlement process is different for State Fund and self-insured employers. You may initiate structured settlement discussions for an eligible worker’s claim by filing an application with L&I. However, structured settlements are voluntary and the decision whether to enter into a discussion is up to the worker and L&I.

Are structured settlements a good idea?

The best reason to support structured settlements is to have payouts of income to last throughout the beneficiary's lifetime. With guaranteed payments, there is less chance of losing principal to poor investments, spendthrift habits or the undue influence of family and friends.

How is a structured settlement paid out?

A structured settlement can be paid out as a single lump sum or through a series of payments. Structured settlement contracts specify start and end dates, payment frequency, distribution amounts and death benefits.

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

How do you buy structured settlements?

If you are interested in selling your structured settlement, you can contact their customer service representatives to receive free, no-obligation quotes, to learn whether they can provide a dedicated representative to support you, and find out if they offer competitive rates.

What is a disadvantage of a structured settlement?

A major drawback of a structured settlement is that it may jeopardize the beneficiary's eligibility for public benefits, which may be particularly problematic when the person's medical needs are covered by Medicaid rather than private health insurance.

Do you have to pay taxes on structured settlement?

Under a structured settlement, all future payments are completely free from: Federal and state income taxes; Taxes on interest, dividends and capital gains; and. The Alternative Minimum Tax (AMT).

How long does a structured settlement last?

If you receive a structured settlement instead of the $300,000 cash, you'll get payments over a term of years or your lifetime (however you choose), and each payment is fully tax free. Thus, a structure converts your after-tax earnings into a tax free return.

What's the largest lawsuit settlement ever?

$206 billion1. Tobacco settlements for $206 billion [The Largest Ever] In 1998, Philip Morris, RJ Reynolds, and two other tobacco companies agreed to a $206 billion settlement, at a minimum, covering medical costs for smoking-related illnesses.

What is the largest workers comp settlement?

a $10 millionTo date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan.

What is the interest rate on a structured settlement?

The internal rate of return on many structured settlement payments are pretty appealing in today's marketplace; rates of 4%+ are pretty common (although notably, that's not a huge spread relative to the yield on comparable long term bonds).

Can you cash out a structured settlement?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan.

Is structured settlement considered income?

Structured settlements are regular payments from a lawsuit over a long period of time. These are often given in cases like personal injury or worker's compensation lawsuits. They can be bought, sold, transferred, and inherited. They are an excellent source of income because they are regular and they are often tax-free.

Can you take money out of a structured settlement?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

How long after mediation will I get my money?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

What is a structured settlement and how does it work?

Structured settlements are periodic payments made to a plaintiff who wins or settles a personal injury lawsuit. Instead of receiving a lump sum of...

Where can you sell your structured settlement payments?

You can sell your structured settlement payments to a reputable factoring company, otherwise known as a purchasing company. It is important to do y...

What is the difference between a structured settlement and an annuity?

A structured settlement follows a court process, and it is a stream of payments determined through negotiations between a plaintiff and a defendant...

How much does it cost to sell a structured settlement?

Selling a structured settlement is not a dollar-for-dollar exchange. The purchasing company will charge a discount rate, which typically ranges bet...

What is a structured settlement?

A structured settlement is a stream of payments issued to a claimant after litigation or a court case. The settlement is intended to pay for damage...

Is a structured settlement considered income?

While a structured settlement is a stream of payments, the owner does not have to pay income taxes on the money received. The Periodic Payment Sett...

Can you sell your structured settlement payments?

Yes. You must follow several steps, including a court approval process, to receive your structured settlement payout. After obtaining the judge’s a...

What happens to your structured settlement if you die?

If you pass away before you receive all your structured settlement payments entitled to you, then your designated beneficiary will receive any rema...

Who is involved in a structured settlement?

The process of settling a civil case through a structured settlement involves the person who has been wronged (the plaintiff), the person or company who caused the harm (the defendant), a consultant experienced in such cases (a qualified assignee) and a life insurance company.

Who will help calculate the settlement amount?

Calculating the structured settlement amount can be a complex financial task. A financial advisor or lawyer will typically hire an economist to help calculate the value of the contract.

Why is a structured settlement annuity more than a lump sum payout?

A structured settlement annuity contract often yields, in total, more than a lump-sum payout would because of the interest the annuity may earn over time. Cons. Once the terms of a settlement are finalized, there’s little you can do to alter them if they do not meet your needs.

What are the pros and cons of structured settlements?

Structured Settlements Pros and Cons 1 Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time. 2 Income from structured settlement payments also does not affect your eligibility for Medicaid, Social Security Disability benefits or other forms of aid. 3 In the event of the recipient’s premature death, the contract’s designated beneficiary can continue to receive any future guaranteed payments, tax-free. 4 Payments can be scheduled for almost any length of time and can begin immediately or be deferred for as many years as requested. They can include scheduled lump-sum payouts or benefit increases in anticipation of future expenses. 5 Spreading out payments over time can reduce the temptation to make large, extravagant purchases, and it guarantees future income. This is especially helpful if you have a medical condition that will require long-term care. 6 Unlike stocks, bonds and mutual funds, fluctuations in financial markets do not affect structured settlements. 7 The insurance company that issued the annuity guarantees payments. Even in the unlikely event that the insurance company becomes insolvent, your state’s insurance guaranty association still protects you from loss. 8 A structured settlement annuity contract often yields, in total, more than a lump-sum payout would because of the interest the annuity may earn over time.

What happens if a case goes to trial?

If the case does go to trial and the judge rules in the plaintiff’s favor, the defendant may then be forced to set up a settlement. The defendant and the plaintiff work with a qualified assignee to determine the terms of the structured settlement agreement — that is, how much the regular payments should be, how long they should continue for, ...

Why do plaintiffs sue?

The plaintiff sues the defendant to seek compensation for an injury, illness or death the defendant caused. Often the defendant agrees to give money to the plaintiff through a structured settlement in order to keep the lawsuit from going to trial. If the case does go to trial and the judge rules in the plaintiff’s favor, the defendant may then be forced to set up a settlement.

Which settlement option has the most freedom?

Lawsuit Payout Options: Lump sum settlements come with the most freedom and the most risk. Structured settlements, on the other hand, are flexible to set up but rigid once established.

What is structured settlement?

Structured settlements are used by courts in many different types of cases to replace or supplement income that was lost through the fault of someone else. Since they’re conducted by a third party, it also means someone doesn’t consistently need to associate with the person or entity that wronged them.

How much money is issued in structured settlements each year?

It’s a solution that many people take advantage of: Nearly $6 billion in new structured settlements are issued each year, according to the National Structured Settlements Trade Association.

Why were structured settlements first issued?

Structured settlements were actually first issued after children were born with severe birth defects because of exposure to the drug Thalidomide in the womb.

Why are cases settled?

Cases are often settled which award a significant amount of money to a minor in the form of a series of payments to cover the living expenses of a child. Such cases are often won because the plaintiff is able to demonstrate that the child’s life will be irrevocably changed for the worse.

When was the Periodic Payment Settlement Act passed?

Congress passed the Periodic Payment Settlement Act in 1982, which streamlined the use of structured settlements in personal injury lawsuits. The legislation shielded structured settlement payments from federal, state and local income taxes.

Does structured settlement affect Medicaid?

The structured settlement issuing companies function in a manner that shields owners as well. Structured settlements don’t affect an individual’s ability to qualify for other forms of aid. Meaning, if someone is set to receive a settlement, the money they receive from it does not affect their ability to qualify for Medicaid, Social Security and other disability benefits.

Can you sell your settlement?

If you have a structured settlement you have a right to sell your payments . Facing a crisis like foreclosure or not having transportation to get to a job, many structured settlement owners choose to sell some or all of their payments. When a structured settlement is set up, it’s typically tailored to meet the needs of the injured or surviving person. Unfortunately, sometimes those needs change and the structured settlement owner needs access to his or her money right away. Selling future payments allows someone to get access to the money they need quickly.

What is a Structured Settlement?

Structured Settlements are an innovative method of compensating injury victims. Allowed by the US Congress since 1982, a structured settlement is:

Why are structured settlements beneficial?

Structured settlements have the support of attorneys, legislators, judges and disability advocates because they have seen first-hand what happens to injury victims whose financial security has eroded due to unforeseen circumstances.

What happens to an injured victim in a structured settlement?

Under a structured settlement, an injured victim doesn't receive compensation for his or her injuries in one lump sum. They will receive a stream of tax-free payments tailored to meet future medical expenses and basic living needs.

Why are structured settlements considered a safety net?

Structured settlements are viewed as a safety net to provide peace of mind to individuals for long-term financial security.

Is structured settlement income tax free?

In recognition of the value of providing a stable income stream for injury victims, Congress has made structured settlement earnings tax-free. That’s right - tax-free.

Is American General a structured settlement company?

American General is highly-rated by the rating agencies for financial strength and is part of Sun America Financial Group, one of the largest insurance companies in the world. We are an industry leader in structured settlements, not only are we one of the first companies to write structured settlements but we have written more premium than any other company. Our customer service area services more than 60,000 structured settlement annuitants annually.

What is structured settlement annuity?

A structured settlement annuity allows individuals to receive tax-free payments over time. Learn how structured settlements work and when they're used.

What happens if you withdraw money from a settlement?

Withdrawing money from a structured settlement prematurely could result in tax penalties and you may also pay surrender fees.

Why do we need structured payments?

Receiving structured payments can make it easier to manage recurring medical expensesor other costs associated with an injury.

Can you receive more from a structured settlement than a lump sum?

It’s possible that you may receive more from a structured settlement than you could through a lump sum payoutwhen interest is factored in. While a lump sum may be attractive, there may be a temptation to spend the money unwisely. And even if you choose to invest it, you still run the risk of losing money if those investments don’t pay off.

Who can work with the defendant and the plaintiff?

A qualified assignee can work with both the defendant and the plaintiff to negotiate the terms of the structured settlement. Specifically, both sides will need to agree on:

Can annuity payments be tailored?

Annuity payments can be tailored to fit the recipient’s lifestyle and needs.

Is structured settlement tax free?

Structured settlement agreements can be beneficial for individuals who are on the receiving end of these payments. Again, this is tax-free compensation so you don’t have to worry about payments affecting your tax liability. And if you’ve named a beneficiary for a structured settlement annuity, that individual could continue receiving tax-free payments after you pass away.

Understanding What is a Structured Settlement?

If you were awarded a structured settlement, you may have questions about how they work.

Personal Injury Lawsuit Settlements

Structured settlements can stem from different types of lawsuits, but they often come from personal injury lawsuits. This can include a wide range of specific lawsuits, such as car accident lawsuits, product liability lawsuits, slip and fall lawsuits, medical malpractice and so on.

Lump Sum vs. Structured Settlements

You may have also heard the phrase “lump sum” often as well. Understanding lump sum payments can also be helpful if you’re asking yourself, “what is a structured settlement?” A lump sum payment involves a single, one-time payment to the recipient. You’ll often hear about lump sum payments when it comes to lawsuits and lottery winnings.

Selling Structured Settlement Payments for a Lump Sum of Cash

If you are receiving structured settlement payments, you typically aren’t tied to receiving your money in the form of periodic payments indefinitely.

Contact DRB Capital Today

If you still have questions about how the process works and how to sell future payments for a lump sum of cash, contact DRB Capital today at 877-894-4541. We are happy to help and provide you with more information, as well as provide you with a completely free quote for the sale of your future payments.

What is structured settlement?

Settle your Claim (Structured Settlements) One option to resolve your claim is with a structured settlement. This is when you, L&I, and sometimes your employer, agree to close your claim for a sum of money you would receive in a series of fixed cash payments. The agreement generally resolves all future benefits except medical.

How old do you have to be to be eligible for a structured settlement?

Injured workers who are age 50 or over and have an accepted L&I claim at least 180 days old are eligible for a structured settlement. About Structured Settlements.

How long does it take for a settlement agreement to be revoked?

If the BIIA approves the agreement, there is a 30-day revocation period. Any party to the agreement may revoke consent to the settlement for any reason during the revocation period. L&I will continue to manage the claim and pay any benefits you are entitled to throughout the revocation period.

How does a settlement affect your future?

Settlements involve legal procedures and they can have a financial impact on you and your family. It's important for you to be informed of your rights and how a settlement may affect your future livelihood. You may be contacted by your employer to determine if you have an interest in a structured settlement.

Can a state fund employer be located?

The employer cannot be located . The employer is no longer in business.

Who must agree to a settlement?

All parties to a claim must agree to a settlement. The parties include L&I, you, and sometimes your employer. If you have an occupational disease claim, more than one employer may be a party to negotiations. There are some cases when a State Fund employer is not a party to an agreement:

Does the settlement agreement affect future claims?

The settlement agreement does not affect future industrial injury or occupational disease claims, including claims for future death or survivor benefits.

What to consider before entering into a structured settlement?

We recommend employers consider seeking the advice of legal counsel and/or a financial consultant before entering into a structured settlement. Settlements involve legal procedures and they can have a financial impact on your business, including premiums.

When is a structured settlement final?

Finalizing the settlement. The structured settlement agreement becomes final when the 30-day revocation period ends. Structured settlement payments begin within 14 days after the agreement is final. If closure of the claim is part of the agreement, it is considered closed after the 30-day revocation period ends.

How long does it take for a BIIA settlement agreement to be revoked?

If the BIIA approves the agreement, there is a 30-day revocation period. Any party to the agreement may revoke consent to the settlement for any reason during the revocation period. L&I will continue to manage the claim and pay any benefits the employee is entitled to throughout the revocation period.

What to do if a claim is appropriate for settlement?

If the claim is appropriate for settlement, we will contact all parties and negotiate specific terms of the settlement. If all parties agree, we will draft the settlement contract, circulate it for signatures, and send the contract to the BIIA for approval.

What are the limits for settlement payments?

Limitations. Structured settlement law requires periodic payments with certain limits: Initial payment: At least 25% of the state's average monthly wage, but no more than 6 times the state's average monthly wage. Subsequent payments: At least 25% of the state's average monthly wage, but no more than 150% the state's average monthly wage. ...

How old do you have to be to file a structured settlement?

Injured workers who are age 50 or over and have an accepted L&I claim at least 180 days old are eligible for a structured settlement.

When do you report settlements?

The full amount of the settlement must be reported for the quarter in which the agreement becomes final, and the remaining balance must be reported in each subsequent quarter until the balance is zero. You will pay claim cost assessments on the amount actually paid out each quarter.

How long does it take to get a structured settlement estimate?

Using this structured settlement calculator to get a custom estimate is a great starting point for a sales process that can take 45 to 90 days. By knowing what to expect and being prepared each step of the way, you can sell your structured settlement payments with confidence.

How Much Is My Settlement Worth?

Our calculator is specifically designed to evaluate the time, interest and long-term value of your settlement.

What happens after a judge approves a purchase?

After receiving the judge’s approval, the purchasing company will then provide your payout.

Can you use a calculator to sell a structured settlement?

While this calculator can get the process of selling your structured settlement underway, it may not account for certain features that are specific to your agreement. When you use the calculator, you can expect a quote using a basic formula based on fixed variables. Email or call us to receive a personalized offer.

The Structured Settlement Process

- The process of issuing a structured settlement is a complicated one that results in a simpler, easier solution for someone who wins a case. If in a court proceeding a plaintiff is determined to be owed money, a structured settlement can be considered instead of a lump sum. Both sides work with a trained consultant to determine the amount of money a...

How Structured Settlement Issuing Companies Work

- Structured settlements are used by courts in many different types of casesto replace or supplement income that was lost through the fault of someone else. Since they’re conducted by a third party, it also means someone doesn’t consistently need to associate with the person or entity that wronged them.

Your Right to Sell Structured Settlement Payments

- If you have a structured settlement you have a right to sell your payments. Facing a crisis like foreclosure or not having transportation to get to a job, many structured settlement owners choose to sell some or all of their payments. When a structured settlement is set up, it’s typically tailored to meet the needs of the injured or surviving person. Unfortunately, sometimes those ne…

Structured Settlement Laws and Regulations

- Structured settlements are regulated on a national, state and sometimes even local level. Congress passed the Periodic Payment Settlement Act in 1982, which streamlined the use of structured settlements in personal injury lawsuits. The legislation shielded structured settlement payments from federal, state and local income taxes. Congresses thinking was that by setting u…

Structured Settlements and Minors

- Adults aren’t the only ones awarded structured settlements. Cases are often settled which award a significant amount of money to a minor in the form of a series of payments to cover the living expenses of a child. Such cases are often won because the plaintiff is able to demonstrate that the child’s life will be irrevocably changed for the worse. It might be that because of an incident …