How Does IRS Settlement Work

- Fresh Start Initiative. The Fresh Start Initiative has been available for many years, but it was recently updated to be...

- Offer in Compromise. If you’ve heard people talking about tax debt forgiveness, they were most likely referring to a...

- Partial Payment Installment Agreement. The Partial Payment Installment Agreement plan is a suitable...

What is a tax settlement?

A tax settlement is when you pay less than you owe and the IRS erases the rest of your tax amount owed. If you don’t have enough money to pay in full or make payments, the IRS may let you settle.

Do you have to file all taxes to get a settlement?

File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. If you have unfiled returns, make sure to file those returns before applying. You also must be up to date on your current tax obligations.

What happens if you dont have enough money to settle taxes?

If you don’t have enough money to pay in full or make payments, the IRS may let you settle. The IRS also reverses penalties for qualifying taxpayers. How Does a Tax Settlement Work? You determine which type of settlement you want and submit the application forms to the IRS.

What happens if a settlement agreement is silent on taxes?

The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

See more

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Will the IRS take a settlement offer?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC.

Will IRS take a lump sum settlement?

A "lump sum cash offer" is defined as an offer payable in 5 or fewer installments within 5 or fewer months after the offer is accepted. If a taxpayer submits a lump sum cash offer, the taxpayer must include with the Form 656 a nonrefundable payment equal to 20 percent of the offer amount.

How do tax settlements work?

An IRS tax settlement allows a taxpayer to settle a debt for less than what's owed. Additionally, some settlement options focus on small, manageable payments. The IRS looks at extenuating circumstances, a taxpayer's ability to pay what's owed, and applicable tax regulations when deciding to issue a settlement.

Can you negotiate with the IRS without a lawyer?

Tax attorney Beverly Winstead says there are many aspects of negotiating with the IRS you can do yourself, but there are some situations where a professional can help.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

What happens if you owe the IRS more than $50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

What if I owe the IRS more than 100000?

The bottom line: if you owe more than $100,000 in taxes, the IRS will demand quick liquidation of your assets to pay the debt and dramatic reduction in your monthly living expenses to pay back what you owe.

Can the IRS go after your family?

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.

Is there a one time tax forgiveness?

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn't for you if you're notoriously late on filing taxes or have multiple unresolved penalties.

Is the IRS forgiving back taxes?

The IRS rarely forgives tax debts. Form 656 is the application for an “offer in compromise” to settle your tax liability for less than what you owe. Such deals are only given to people experiencing true financial hardship.

Do I qualify for IRS Fresh Start?

People who qualify for the program Having IRS debt of fifty thousand dollars or less, or the ability to repay most of the amount. Being able to repay the debt over a span of 5 years or less. Not having fallen behind on IRS tax payments before. Being ready to pay as per the direct payment structure.

How do I write an offer in compromise letter to the IRS?

You must provide a written statement explaining why the tax debt or portion of the tax debt is incorrect. In addition, you must provide supporting documentation or evidence that will help the IRS identify the reason(s) you doubt the accuracy of the tax debt.

Can you negotiate with IRS to remove penalties and interest?

First, you should know that it is possible to negotiate for an abatement of penalties and interest, but it is at the discretion of the IRS agent with whom you are working. Second, it takes time, sometimes a year or two, to negotiate with the IRS for a reduction of interest or penalties.

What happens if you owe the IRS more than $50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

How can I avoid paying taxes on debt settlement?

According to the IRS, if a debt is canceled, forgiven or discharged, you must include the canceled amount in your gross income, and pay taxes on that “income,” unless you qualify for an exclusion or exception. Creditors who forgive $600 or more are required to file Form 1099-C with the IRS.

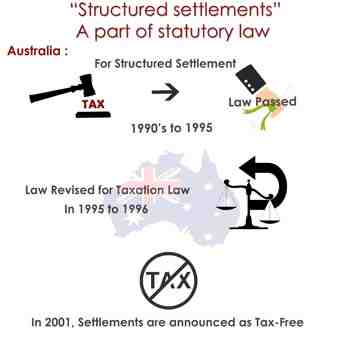

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

How Does a Tax Settlement Work?

You determine which type of settlement you want and submit the application forms to the IRS. The IRS reviews your application and requests more information if needed. If the IRS does not accept your settlement offer, you need to make alternative arrangements. Otherwise, collection activity will resume. If the IRS accepts your settlement offer, you just make the payments as arranged.

What is a tax settlement?

A tax settlement is when you pay less than you owe and the IRS erases the rest of your tax amount owed. If you don’t have enough money to pay in full or make payments, the IRS may let you settle. The IRS also reverses penalties for qualifying taxpayers.

How long do you have to pay back taxes?

If you personally owe less than $100,000 or if your business owes less than $25,000, it is relatively easy to get an installment agreement. As of 2017, the IRS gives taxpayers up to 84 months (7 years) to complete their payment plans.

What is partial payment installment agreement?

A partial payment installment agreement allows you to make monthly payments on your tax liability. You make payments over several years, but you don’t pay all of the taxes owed. As you make payments, some of the taxes owed expire. That happens on the collection statute expiration date.

How to settle taxes owed?

These are the basic steps you need to follow if you want to settle taxes owed. File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. If you have unfiled returns, make sure to file those returns before applying.

What happens if you default on a settlement offer?

At that point, you are in good standing with the IRS, but if you default on the terms of the agreement, the IRS may revoke the settlement offer . To explain, imagine you owe the IRS $20,000, and the IRS agrees to accept a $5,000 settlement.

Why do you settle taxes if you don't qualify?

If you don’t qualify for a tax settlement for less money, then it will ensure you are paying back a lower amount of taxes and penalties that are due.

What Does Tax Settlement or Tax Relief Include?

The tax settlement process generally begins with a free consultation. A case manager will review your current tax debt and other financial details and provide an estimate for their services. If you continue, the case manager will perform an in-depth investigation into your taxes, develop a plan of action, and negotiate with the IRS.

What is tax settlement firm?

Known commonly as tax settlement firms, these entities claim they can either drastically reduce or completely eliminate whatever the client owes the IRS. But can these firms really deliver what they promise or is it buyer beware? This article examines how tax settlement firms work and their success rate.

Are Tax Settlement Companies Worth It?

On the other hand, good companies charge reasonable, transparent fees and have proven track records. Some companies charge a flat percentage of the amount owed to the IRS, such as 10%. Others charge an hourly rate that might range between $275 and $1,000. Some companies will not accept clients with a tax debt of less than $10,000.

What is IRS offer in compromise?

Tax settlement firms use an accepted IRS procedure known as an offer in compromise in an effort to reduce their clients' tax bills. This is a special agreement that some taxpayers are able to make with the IRS to settle their tax debts for a lesser amount than what is owed. The taxpayer must supply substantial information to the IRS about their current assets and liabilities as well as projected future income. 1 2

Why are tax settlements impossible?

Promises by tax settlement agencies are virtually impossible to fulfill because the IRS rarely accepts any real proposal to reduce the amount of tax owed. Qualifying for offers-in-compromise is difficult and typically takes at least several months to complete. Most tax settlement companies charge high fees.

How much does a tax settlement cost?

The majority of tax settlement companies charge their clients an initial fee that can easily run anywhere between $3,000 to $6,000, depending on the size of the tax bill and proposed settlement. In most cases, this fee is completely nonrefundable. This fee quite often mysteriously mirrors the amount of free cash the client has available. This is generally the amount of cash the company says it will save the client in tax payments.

Can IRS accept pennies on the dollar?

Most tax settlement firms promise to send their experts to the IRS to negotiate on behalf of the client, where they can presumably persuade the agency to accept a much smaller amount—often pennies on the dollar. In reality, this is virtually impossible to do, and the IRS rarely accepts any real reduction in the amount of tax owed.

What Is a Standard IRS Tax Settlement?

A tax settlement is simply a mutual arrangement created by the IRS and a taxpayer that allows a taxpayer to settle an outstanding debt for less than the full, original amount owed. While there’s no guarantee that you’ll be granted a settlement, the IRS is often highly receptive in cases where it’s clear that a taxpayer is incapable of paying a full amount owed based on their finances. Both current tax laws and your specific financial details will help to shape the IRS’s decision in your case.

How Does the IRS Determine If You Qualify for a Settlement?

When determining eligibility for a tax settlement, the IRS looks at a number of factors related to your income, expenses, assets and liabilities. In addition, circumstantial factors like job loss or severe financial hardships are explored to get a clear picture of how likely it is that you can actually pay off what you owe. If it’s determined that you are not capable of reasonably paying off your tax debt, the IRS may be willing to accept a reduced amount. It is simply better to get “something” instead of “nothing” from the IRS’s perspective.

How Do Settlement Payments Work?

However, you may prefer to work out a settlement that allows you to pay off what you owe throughout a set, penalty-free window of time using scheduled payments. A tax professional should be able to guide you on the type of plan to request from the IRS.

What Happens After You Pay Off Your Tax Settlement?

Once your payment is complete, you’re considered to be in good standing with the IRS for all tax years covered in your settlement. This means that it’s essentially like your tax woes never happened! If you have a history of defaulting on tax payments, it’s important to get the help of a tax-preparation professional to ensure that you’re filing on time every year going forward. The IRS may not be as willing to provide you with a settlement again if you’re delinquent on future tax returns or payments.

How Hard Is It to Qualify for an IRS Settlement?

While it’s true that the IRS only grants settlements to a narrow spectrum of applicants each year, there’s room in the program for people who truly need relief. If you can reasonably pay off your debt using assets or borrowing power, you won’t qualify for a settlement. It’s important to get a payment in right away if you currently have enough money or borrowing power to cover your full tax debt because putting off payment will probably result in more needless fees and penalties.

What happens if you accept a tax offer?

You must meet all the Offer Terms listed in Section 7 of Form 656, including filing all required tax returns and making all payments; Any refunds due within the calendar year in which your offer is accepted will be applied to your tax debt;

How long does it take for an IRS offer to be accepted?

Your offer is automatically accepted if the IRS does not make a determination within two years of the IRS receipt date.

Do you have to pay the application fee for low income certification?

If accepted, continue to pay monthly until it is paid in full. If you meet the Low Income Certification guidelines, you do not have to send the application fee or the initial payment and you will not need to make monthly installments during the evaluation of your offer. See your application package for details.

Does the IRS return an OIC?

The IRS will return any newly filed Offer in Compromise (OIC) application if you have not filed all required tax returns and have not made any required estimated payments. Any application fee included with the OIC will also be returned. Any initial payment required with the returned application will be applied to reduce your balance due. This policy does not apply to current year tax returns if there is a valid extension on file.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal physi…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - Th…

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).