Reading an insurance claim settlement is easy as 1-2-3 using this basic formula: Recoverable Cost Value is the replacement value of an asset. Depreciation is the reduction in value of an asset due to its age and condition. Actual Cash Value is the fair market value of the asset.

Full Answer

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

How to generate a daily settlement report?

Settlement occurs for all batches submitted within the 24-hour "settlement day". For example, for a particular processor, all transactions from 9 PM Monday night through 9 PM Tuesday night occur during that "day". Generating a Settlement Report. To access the Settlement Report page, navigate to Reports-> Standard-> Settlement.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

How do you read a borrower's settlement statement?

0:277:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

How do you read a seller's settlement statement?

4:2013:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

What are points on a settlement statement?

One point is 1% of your mortgage amount, so one point on a $100,000 mortgage is $1,000. 6. The points have to show up on your settlement disclosure statement as “points.” They might be listed as loan origination points or discount points.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do you calculate points?

One point is 1% of the loan value or $1,000. To calculate that amount, multiply 1% by $100,000. For that payment to make sense, you need to benefit by more than $1,000. Points aren't always in round numbers, and your lender might offer several options.

How much is 1.5 points on a mortgage?

Origination points typically cost 1 percent of the total mortgage. So, if a lender charges 1.5 origination points on a $250,000 mortgage, the borrower must pay $4,125. Origination points differ from discount points in that they do not directly reduce the interest rate of the loan.

How do I know if I have paid points on my mortgage?

If you have points, they should be listed in Box 6 of your Form 1098, Mortgage Interest Statement. If you have your closing documents, you can do the following: Locate the “Settlement Statement” in the closing documents. The name should be clearly defined at the top of the document.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

What does Adjustments for items unpaid by seller mean?

Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller are amounts due to the consumer to be paid by the seller and are disclosed in two places.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

Are HUD 1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

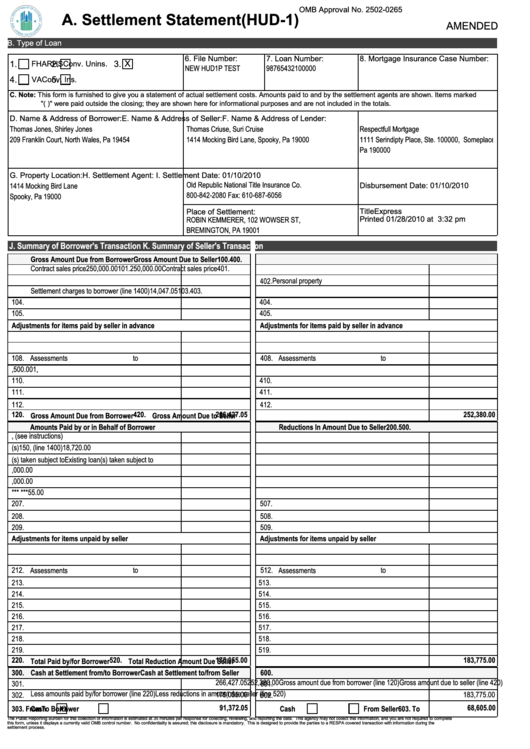

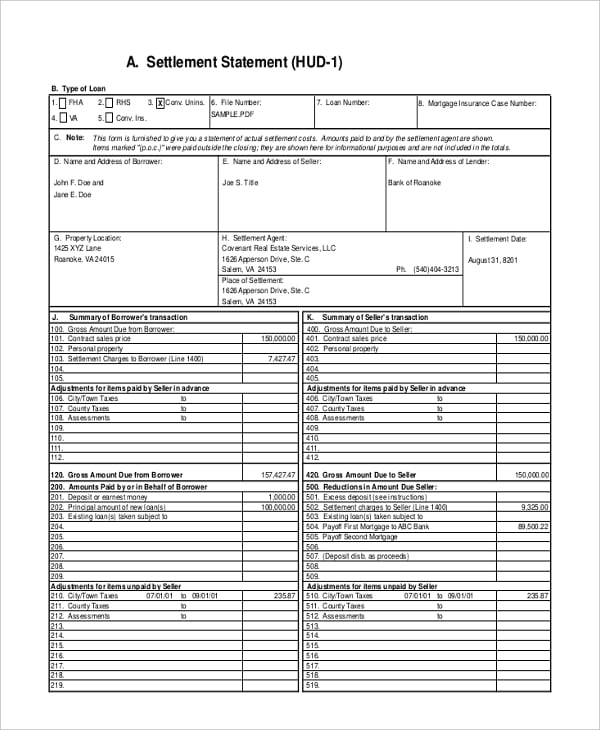

HUD-1 Sections A, B, C, D, E, F, G, H and I

Sections A through I are very general. They contain basic information about the type of loan being used to pay for the property, as well as personal information (i.e. addresses, date of transaction, location of the property, etc.).

HUD-1 Section J

Section J on a HUD-1 Settlement Statement contains details and information that pertain primarily to the borrower. The borrowers costs, credits, and net amount owed for the purchase of the property are carefully outlined in section J. The following sub-sections related to the borrowers responsibilities are important parts of section J:

HUD-1 Section K

Section K on a HUD-1 Settlement Statement contains details and information that pertain to the seller. It is basically a summary of the sellers transaction. Here you will find a figure that is the gross amount due to the seller, as well as adjustments that have been made for items like past due taxes or taxes paid in advance.

HUD-1 Section L

Section L on a HUD-1 Settlement Statement contains detailed information about the financing and processing of the sale or refinancing of the home. The following sub-sections related to the settlement charges are important parts of section J:

Good Faith Estimate

One final note. Mortgage lenders or brokers are required to provide borrowers with a Good Faith Estimate as required by RESPA. The Good Faith Estimate is documented on a form that matches the HUD-1 Settlement Statement. The HUD-1 is then required to provided to the borrower at lease one day before closing.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.