If you have the money to buy a car outright, you should get in touch with your DMP provider to see how you can deal with your debts first. The terms of your DMP may state that you pay any increased or extra income into your DMP to pay your debt off quicker. Buying a car instead of paying your debts off may be considered unfair to your creditors.

Full Answer

What is a car payment debt settlement?

The practice of allowing borrowers to satisfy their car loan obligations by paying a portion of the total amount owed is known as a car payment debt settlement. The decision about whether or not to negotiate for a settlement of your car debt is one that should be given significant thought.

Can I settle my auto loan debt?

Even though debt settlement is often associated with unsecured debt, such as credit card debt, when an auto loan debtor has fallen delinquent and the account lands in the hands of a collections agency, auto loan debt settlement becomes an option.

Can I write a settlement letter for a car loan?

While auto loan refinancing can often lead to a lower interest rate and lower monthly payment on a pre-existing car loan, auto loan debt settlement is another form of auto loan debt relief that can often make sense. Writing a settlement letter for a car loan is an important and time sensitive process. Learn more about how to write one.

What does it mean when a debt is settled?

Debt settlement means a creditor has agreed to accept less than the amount you owe as full payment. Once it accepts that deal, the creditor can’t continue to hound you for the money and you don’t have to worry that you could get sued over that particular debt. Debt settlement can destroy your credit.

Can car payments be included in debt consolidation?

No, you can not consolidate an auto loan into a debt consolidation program. Debt consolidation programs are tailored for unsecured debt, such as credit cards and personal loans. Your auto loan is secured by your vehicle.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What percentage will credit card companies settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What happens to the debt when a car is repossessed?

When your lender has your car or other property repossessed, it sells the property, usually at auction. If the proceeds from the sale don't cover the total of what you owe to the lender—they rarely do—you might be liable for the balance, called a "deficiency" or "deficiency balance."

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

How do you negotiate a car payoff settlement?

How to negotiate a car payoff settlementKeep making your payments. Even if your car is totaled or has already been sold, you're still contractually responsible for making your loan payments as agreed. ... Find out what you owe. ... Look at the big picture. ... Talk to your lender. ... Get everything in writing.

Can you negotiate after repossession?

Ideally, you should start these negotiations before the repossession process. If you negotiate after repossession, however, you may be able to use any questionable actions by the lender during that process to help bolster your bargaining position.

Should you pay off a repossession?

In most states, you have to pay off the entire loan to get your car back after repossession, called "redeeming" the car. The balance you would need to pay to redeem the vehicle might include extra fees and charges, including repossession and storage fees, and even attorneys' fees.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Is it OK to settle a debt?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

Can I negotiate with debt collectors?

You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney. Record your agreement. Sometimes, debt collectors and consumers don't remember their conversations the same way.

Why do debt collectors offer discounts?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

What Happens if You Decide Not to Settle Your Debt?

Choosing not to settle a car debt will eventually result in the lender having no choice but to repossess the car, thus having a significant impact on the credit score of a borrower.

What is settlement on credit report?

Another option for settlement is credit counseling, which often lowers monthly payments and allows borrowers to settle by adhering to a monthly payment plan.

Can you get your car repossessed after bankruptcy?

However, if you file for Chapter 7 Bankruptcy (personal bankruptcy), there is a good chance that your car payment debt will be discharged as part of the proceedings. If the debt is discharged, the car will be repossessed by the lender. If you decide that you want to continue to use your car, your lender may allow you to "re-affirm" your loan agreement. Essentially, this process renews the original loan agreement and binds the borrower post-bankruptcy. Once a borrower re-affirms after bankruptcy, the car debt is no longer dischargeable.

What does debt settlement mean?

Debt settlement means a creditor has agreed to accept less than the amount you owe as full payment. It also means collectors can’t continue to hound you for the money and you don’t have to worry that you could get sued over the debt. It sounds like a good deal, but debt settlement can be risky:

How does a settlement work?

Settlement offers work only if it seems you won’t pay at all, so you stop making payments on your debts. Instead, you open a savings account and put a monthly payment there. Once the settlement company believes the account has enough for a lump-sum offer, it negotiates on your behalf with the creditor to accept a smaller amount.

What happens if your credit score is shredded?

Your credit scores will have been shredded, you will feel hopelessly behind and your income won’t be enough to keep up with your debt obligations. Debt settlement companies negotiate with creditors to reduce what you owe, mostly on unsecured debt such as credit cards.

What are the two largest debt settlement companies?

There’s no guarantee of success: The two largest debt settlement companies are National Debt Relief and Freedom Debt Relief. Freedom Debt, for instance, says it has settled more than $8 billion in debt for more than 450,000 clients since 2002.

What to do if you don't want to use a debt settlement company?

If you don’t want to use a debt-settlement company, consider using a lawyer or doing it yourself.

What to do if you don't want to settle debt?

If you don’t want to use a debt-settlement company, consider using a lawyer or doing it yourself. A lawyer may bill by the hour, have a flat fee per creditor, or charge a percentage of debt or debt eliminated. Once you’re significantly behind, it usually doesn’t hurt to reach out to your creditors.

How to reduce debt?

Reduce your debt in three steps: 1. Get a handle on what you owe. 2. Assess which payoff strategy will work for you. 3. Set a goal and track your progress. More

How does debt settlement work?

The companies generally offer to contact your creditors on your behalf, so they can negotiate a better payment plan or settle or reduce your debt.

What is debt settlement?

Debt settlement is a practice that allows you to pay a lump sum that’s typically less than the amount you owe to resolve, or “settle,” your debt. It’s a service that’s typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor. Paying off a debt for less than you owe may sound great at first, but debt settlement can be risky, potentially impacting your credit scores or even costing you more money.

What is a resolve?

Why Resolve stands out: Resolve is a debt management service that provides users with features such as debt settlement and negotiation as well as budgeting tools and credit score monitoring.

How many payments do you have to make to a debt collector?

Once the debt settlement company and your creditors reach an agreement — at a minimum, changing the terms of at least one of your debts — you must agree to the agreement and make at least one payment to the creditor or debt collector for the settled amount.

What happens if you stop paying debt?

If you stop making payments on a debt, you can end up paying late fees or interest. You could even face collection efforts or a lawsuit filed by a creditor or debt collector. Also, if the company negotiates a successful debt settlement, the portion of your debt that’s forgiven could be considered taxable income on your federal income taxes — which means you may have to pay taxes on it.

How much debt has Freedom Financial resolved?

Why Freedom Financial stands out: Freedom Financial says it has resolved over $12 billion in debt since 2002. The company offers a free, “no-risk” debt relief consultation to help you decide if its program might work for you.

Can a company make a lump sum payment?

The company may try to negotiate with your creditor for a lump-sum payment that’s less than the amount that you owe. While they’re negotiating, they may require you to make regular deposits into an account that’s under your control but is administered by an independent third-party. You use this account to save money toward that lump payment.

What is debt settlement?

Debt settlement takes place when a debtor successfully negotiates a payoff amount for less than the total balance owed. The lower amount is agreed to by the creditor or collection agency and is fully documented in writing. Even though debt settlement is often associated with unsecured debt, such as credit card debt, when an auto loan debtor has fallen delinquent and the account lands in the hands of a collections agency, auto loan debt settlement becomes an option.

How to write a settlement letter for a car loan?

Your car loan settlement letter should be formatted as a formal business letter, with your name and complete mailing address in the top left corner of the page, followed by a blank line, your account number, another blank line, and the date listed beneath it. After another blank line comes the full name and address of the collection agency. After another blank line , you can begin the actual text of the car loan debt settlement proposal letter.

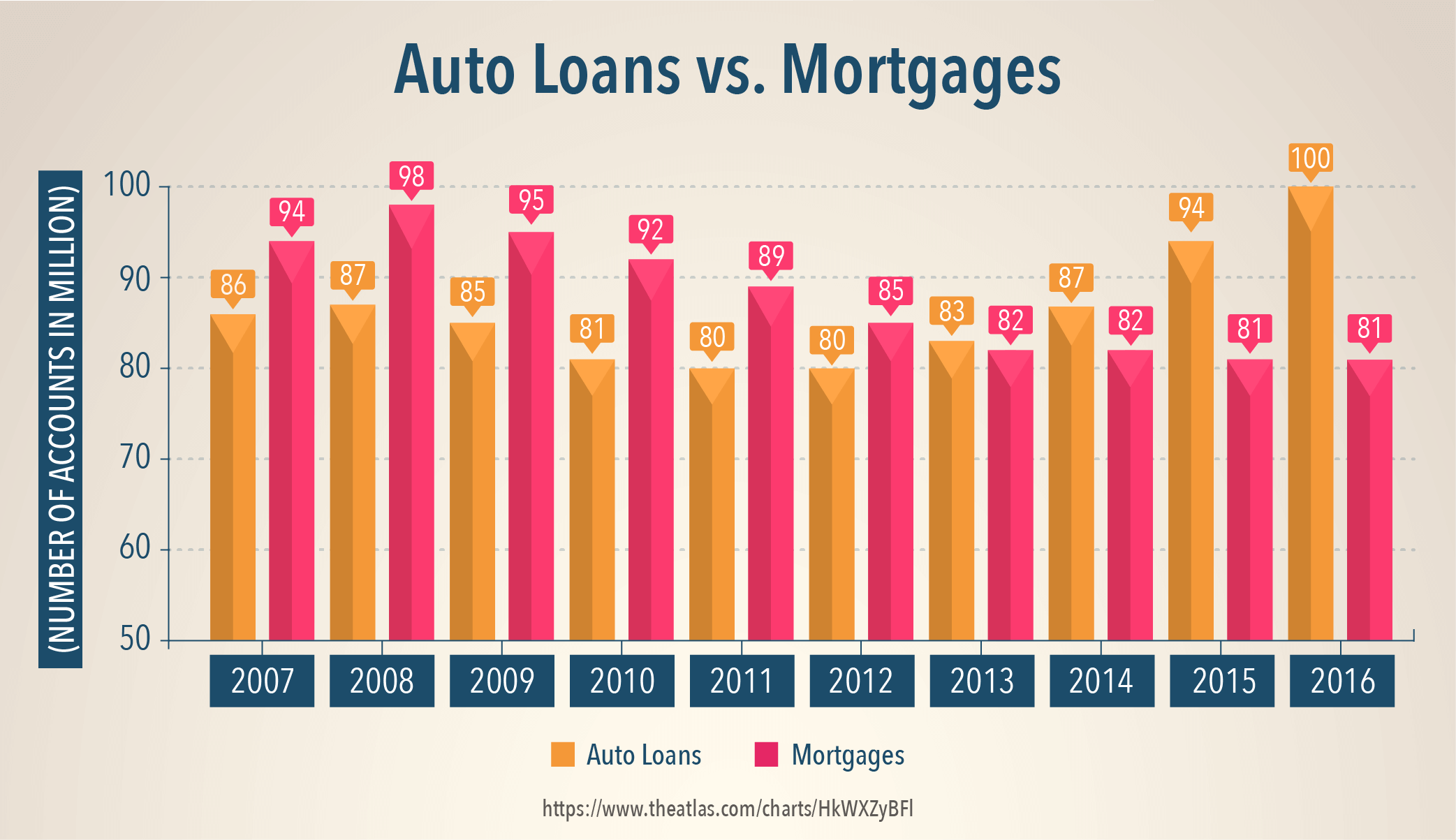

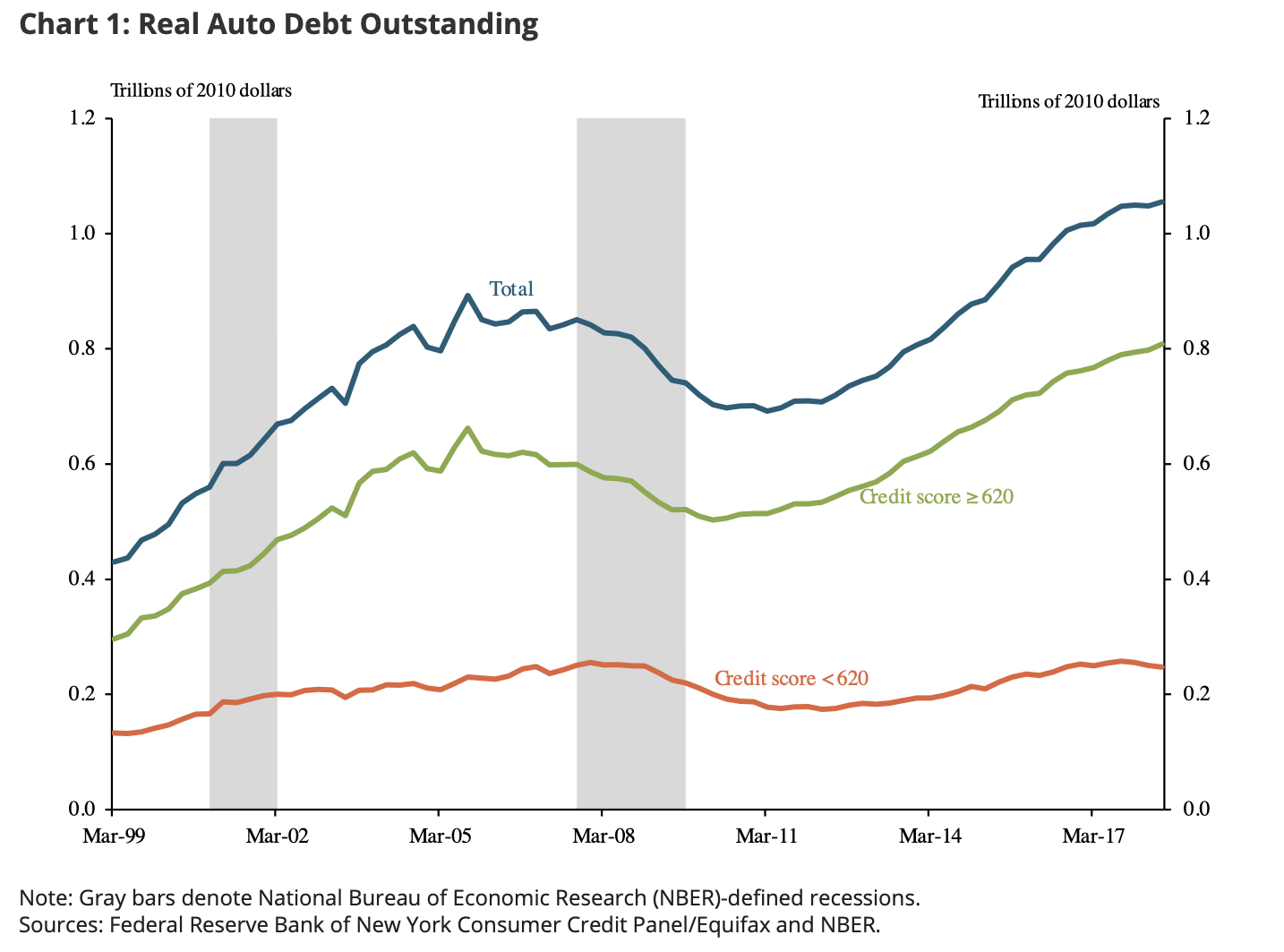

How much is auto debt in 2020?

Auto loans are big business in the United States, putting it mildly. At the end of 2020, the aggregate amount of auto debt in the U.S. stood at $1.36 trillion, with auto loans now comprising nearly 10% of all household debt, ranking as the third-highest debt category behind mortgages and student loans. Given the abundance of auto debt, it should come as no surprise that many borrowers encounter financial difficulty.

When communicating with a collection agency, it is important to do so in writing?

When communicating with collection agencies, it’s important to always do so in writing. In an auto loan debt settlement process, it is often the collection agency that initiates contact with a written settlement offer – especially when an account has been in collections for an extended period of time and proven difficult to collect. But that doesn’t mean that a debtor shouldn’t initiate the process either.

What happens if a collection agency accepts a car loan?

If the collection agency ultimately accepts your offer for car loan settlement, make certain that the acceptance is made in writing prior to sending the creditor any money. A written acceptance will serve as confirmation in the event that there are any future disputes.

How long does a negotiated settlement stay on your credit report?

Accounts marked as “settled” will remain on a credit report for seven years , and often have a detrimental impact on a credit score and profile.

Do collection agencies settle car loans?

In fact, collection agencies are more likely to settle when an auto loan debtor has demonstrated an inability to pay and the account gets closer to charge-off status – when a creditor or collection agency becomes unlikely to ever recover anything significant from the account again. For those individuals who wish to pursue car loan debt settlement on their own, without the aid of an experienced debt settlement company, contacting collection agencies with a carefully crafted debt settlement proposal letter is an absolute must.