See more

Is Allstate good at paying claims?

Is Allstate good at paying claims? According to the J.D. Power 2021 U.S. Auto Claims Satisfaction StudySM, Allstate ranked slightly below average for its claims experience, with a score of 870 out of a possible 1,000 points.

How fast does Allstate pay claims?

But the Allstate settlement process is quicker than many insurance companies. You can expect a settlement offer after submitting a complete demand package within 30 to 45 days. When you settle, Allstate gets out settlement checks pretty quickly as well.

Does Allstate handle claims well?

Allstate is tied with Travelers for the No. 6 spot in our Best Car Insurance Companies of 2022. It has average to below-average scores in each all subcategories, including Best for Customer Service, Best for Claims Handling, and Most Likely to be Recommended.

Will Allstate send me a check?

The settlement check you receive from Allstate will be based on the estimated amount of your covered loss minus your deductible and any applicable depreciation. In most cases, you would pay the amount of your deductible directly to your repair facility once repairs are completed.

Does Allstate deny claims?

Delay, deny and defend claims. Allstate consistently and unreasonably delays paying claims to force its policyholders to give up, totally denies valid claims or offers a lower amount than what should actually be paid, and unfairly defends claims that should have simply been paid or settled.

What is Allstate claim satisfaction guarantee?

If you're not happy with your auto claim, the Allstate Claim Satisfaction Guarantee means you'll get your money back—no questions asked. And, it's included for free with standard Allstate policies.

What insurance company has the most complaints?

Geico customers were most likely to complain about claims (53.6%), while Chubb customers were the least (38.6%). Nationwide had the most favorable Complaint Index rating for auto insurance, while Chubb did best for home insurance.

Is Allstate a good insurance provider?

Allstate is a very good insurance company overall and one of the best for auto insurance. WalletHub's editors give Allstate a rating of 3.2/5 due to its wide variety of coverage options, generous discounts and nationwide availability.

Is Progressive and Allstate the same company?

No, Progressive and Allstate are separate companies. The Progressive Corporation and The Allstate Corporation are both independent, publicly held companies.

Can I keep the money from an insurance claim?

As long as you own your car outright, you can do whatever you want with the claim money you receive from your insurer. This means that you can keep any leftover money from your claim.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

How do car insurance payouts work?

After you've agreed to the payout, your insurer will first pay off any remaining car payments or loans from the payout directly to the lenders. Therefore, you may not receive any cash from the payout if your payout was less than or equal to the amount you owed for your car.

How long does Allstate take to settle a homeowners claim?

90 days to send your full settlement payment after your claim has been accepted.

How long does it take for Allstate to respond to a demand letter?

In a sample of 10 cases, Erie's average time to respond to our demand letter was 86 days....How Long Does It Take the Insurance Company Take to Respond to a Demand Letter?Ins. Comp.AllstateNo. Cases10Avg. (Days)65Shortest (Days)25Longest (Days)16011 more columns

How do you negotiate with Allstate?

The best way to negotiate your Allstate settlement is to hire a personal injury attorney who understands how insurance operate. Make sure you're prepared, documenting every penny, filing as quickly as possible, and calculating the real value of your claim.

How do insurance companies pay claims?

Most insurers will pay out the actual cash value of the item, and then a second payment when you show the receipt that proves you'd replaced the item. Then you'll get the final payment. You can often submit your expenses along the way if you replace items over time.

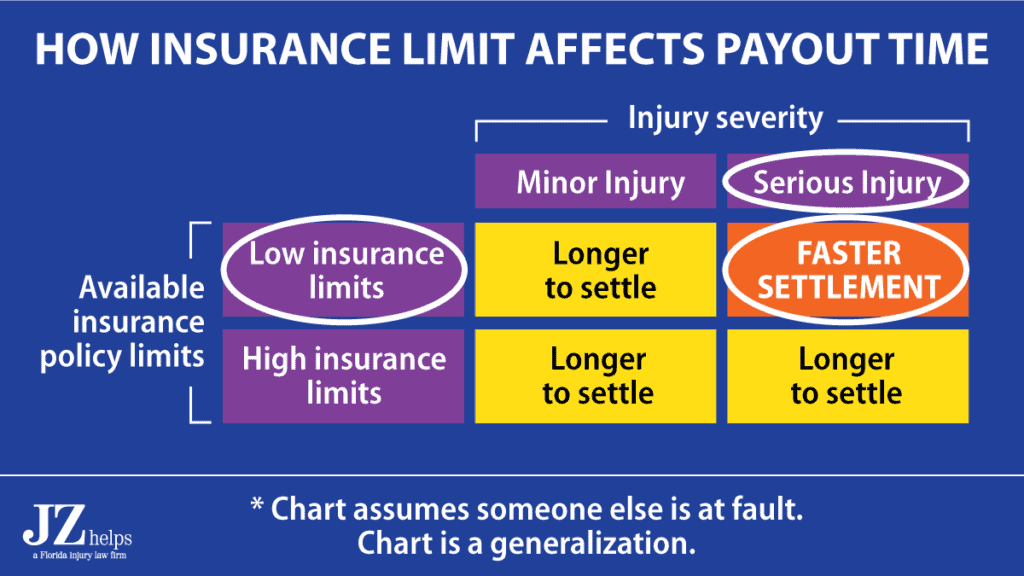

How long does it take Allstate to settle an injury claim?

As we discuss below, our lawyers are generally unimpressed with Allstate's first settlement offer. But the Allstate settlement process is quicker t...

What can you expect from Allstate in their first injury settlement offer?

We have had a lot of success getting quality settlements and verdicts against Allstate, earning well over $10 million against Allstate alone. Under...

Who and where are Allstate’s lawyers?

Allstate has regional claims departments throughout Maryland where its claims adjusters operate. Most claims go through the Columbia office. Will A...

Does Allstate Make Reasonable First Settlement Offers?

Compared to other insurance companies, Allstate makes low initial settlement offers on auto accident claims in Maryland. In our experience, Allstat...

Does Allstate Take Many Auto Accident Cases to Trial in Maryland?

No, Allstate does not take many car accident cases to trial in Maryland. Allstate takes a lower percentage of its Maryland auto accident claims to...

Is Allstate Difficult to Deal with on Maryland Auto Accident Claims?

Allstate claims adjusters can be somewhat prickly to interact with, especially if you reject their initial settlement amount offered. So if you mak...

What Maryland Lawyers Does Allstate Use for Auto Tort Cases?

Allstate has its own team of in-house counsel that litigates their auto tort cases in Maryland. Their office is located at 400 E. Pratt Street in B...

How much is Allstate worth in 2021?

Allstate is one of the oldest and wealthiest insurance companies in the United States. Founded in 1931, its net worth as on March 2021 stands at $3.505 Billion. Recent data suggests that Allstate Corporation provides insurance cover to nearly 113 million people. Allstate’s major business is private passenger auto and homeowners’ insurance, primarily offered through agencies.

Is it good to be prepared for Allstate?

But it is always good to be prepared. Here is some important information about the process involved while filing a claim with Allstate and some caveats involved.

Does Allstate use Colossus?

Use of Colossus: Allstate uses an in-house, complex software which calculates the settlement amount based on various factors. The biggest downside of this software is lack of human involvement in the whole process. This truly undermines and often ignores various important aspects of the accident in question. Moreover, they try to convince the victim to settle for their offer even before they have tome to get an injury attorney, don’t fall in this trap.

Does Allstate have lawyers?

Moreover, these lawyers are completely aligned to Allstate’s goals of low offers and quick settlement. These lawyers, while are on Allstate’s payroll, are often set up in a dummy corporation and represented as independent and objective lawyers.

Is Allstate insurance a for profit company?

However, like other insurance companies, Allstate works on a “for-profit” agenda. Their objective is to make as much money as possible by charging hefty premiums and giving miniscule settlements. Hence, if you’ve been in a motor vehicle accident, for instance, a car accident you’ve to file the claim with Allstate, it is best you leave it in the hands of a car accident lawyer to take a lead on the settlement.

How long does it take to get a settlement from Allstate?

You can expect a settlement offer after submitting a complete demand package with 30 to 45 days. When you settle, Allstate gets out settlement checks pretty quickly as well.

How many claims does Allstate handle?

Allstate is one of the largest insurance companies in the world. Between automobile, property, and bodily injury claims, they handle six million claims a year. Last year, in 2020, Allstate brought in over $44 billion in revenue even with the pandemic. Allstate has a great deal of market share in Maryland in automobile insurance ...

How much was the Allstate case worth in 2018?

The case went to trial and the jury awarded $150k. 2018, Maryland (Baltimore City): $89,000 Verdict A driver insured by Allstate is driving northbound on Reisterstown Road when an uninsured driver travelling in the opposite direction crosses the center line and hits her head-on.

Where does Allstate claim adjuster work?

Allstate has regional claims departments throughout Maryland where its claims adjusters operate. Most claims go through the Columbia office.

What advice did McKinsey give to claimants?

Another piece of advice McKinsey gave, which resonated with claimants after their recommendations were implemented, is to stall claims where the victim does not roll over for settlement. This advice was given many years ago, but the core of the message is still being used today by some of their claims adjusters.

What to do if you have been in an accident in Maryland?

If you have been injured in an automobile accident in Maryland, you need a lawyer to either handle your case or, in smaller cases, at least point you in the right direction.

Does Allstate offer settlements in Maryland?

Compared to other insurance companies, Allstate makes low initial settlement offers on auto accident claims in Maryland. In our experience, Allstate's first offer to settle a claim is usually around 30% to 50% more than the total medical expenses. This rarely approaches a reasonable settlement offer.

What Is the Average Car Accident Settlement in Florida?

You might be surprised to learn that there is no average Allstate settlement amount in Florida. Each case turns on the facts and circumstances of the accident. As a result, calculating the “average” of all Allstate accident insurance payouts is impossible.

Do Allstate Settlement Calculators Work?

To put it bluntly, no, Allstate settlement calculators do not work. We have discussed some of the variables that go into determining how much your case is worth. There is no way that a “settlement calculator” can compute all of the idiosyncrasies and nuances involved in your claim.

Why was the worker rear-ended?

Allstate disputed the liability of the claim, stating that he was rear-ended due to cutting off the other vehicle. The jury ruled against Allstate.

Does Allstate pay out for a fender bender?

Further, Allstate is more likely to pay out small sums coming from property damage than those that come about from injuries.

Does Allstate Insurance cover renters?

Allstate Insurance primarily deals with auto insurance, but it also provides homeowner’s insurance, business insurance, life insurance, renter’s insurance, and more. It insures millions of people across the country, and in California, it is guaranteed to have business; auto insurance is a requirement if you plan on driving on the roads.

Does Allstate offer settlements?

Allstate settlement offers vary from claim to claim because each case is unique; there is no exact set of circumstances surrounding each accident, and different adjusters, juries, defendants, and plaintiffs are involved. Two people who sustain neck injuries may receive settlements that are thousands of dollars apart.

Does Allstate pay for injuries?

However, as stated, Allstate will more than likely dispute the extent of your injuries if you were also hurt in the accident. They may claim that your injuries were already present beforehand and the accident did not cause them; therefore, they have no obligation to pay. Similarly, they may say that the injuries themselves are not as severe as you are making them out to be, regardless of doctor’s notes or medical records. If they are able to claim that your injuries are less severe and do not require as much compensation, the offer may be lower than what you deserve. You should enlist the assistance of an experienced attorney; the offer could be higher if you come out of the gate with good negotiation tactics.

How many claims does Allstate handle?

It is one of the largest insurance companies handling approximately six million claims a year totaling roughly $15 billion in claim payouts. In 2019, Allstate had a 4th Quarter revenue of $11.47 billion . Allstate operates in all 50 states and offers auto, home, renters, condo, motorcycle, business, life, roadside, identity, boat, motorhome, off-road, pet, event and landlord insurance coverage.

What is the slogan of Allstate?

Allstate’s recognizable slogan is “you’re in good hands,” however when it comes to assisting customers in time of need, it is not always the case. Allstate has a long history of claims adjusters presenting consumers with lowball settlement offers, employing a hardened “take it or leave it” approach which leaves many consumers longing for relief.

What happens after a damage evaluation?

Following the damage evaluation, you will receive a repair estimate as well as additional information about your claim settlement which will be based in large part on the terms and conditions set forth in your insurance policy. After reviewing the estimate, the next step is getting your vehicle repaired.

Is an auto accident a nightmare?

Although it is a common occurrence, auto accidents are overwhelming and a great source of stress. One would think that with insurance coverage , accidents would be less of a nightmare. Unfortunately, with some insurance companies, namely Allstate Insurance Company, it is only the beginning of a potentially very lengthy process.

Is Allstate the worst insurance company?

In fact, Allstate Insurance was once named the number one worst insurer by the American Association of Justice.

What do you know about Allstate?

What You Know, Allstate Knows More. When you are dealing with Allstate, know that you are likely at an information disadvantage. The company has tens of millions of customers and an extensive amount of claims data. The chances are that the company knows the exact value of your insurance claim. Allstate uses a software program called Colossus ...

Does Allstate give settlements?

It is important to know that the values that are produced by Colossus are not necessarily what Allstate will give you as your settlement. It is simply what your claim may be worth, and there is nothing to stop Allstate from offering you a number below this value. In fact, this is what auto insurers routinely do since they do not make money by giving you top dollar for your settlement.

Is Allstate insurance fined?

At the same time, Allstate’s business practices have come under fire in numerous different forums. The company has been fined by several states for overcharging its customers . In addition, Allstate routinely faces class action suits for its practices in connection with its medical and auto insurance.

Can an attorney negotiate a settlement with Allstate?

When it comes to negotiating a settlement, your attorney can handle the back and forth with Allstate and best present your position to the company. If a settlement offer is made, a personal injury attorney will know how much your claim is worth and will be able to advise you on how far from the true value of your claim Allstate’s offer is. When it comes to deciding whether to accept a settlement offer or litigate the case, your lawyer will be able to advise you of your legal position.

Does it matter who the insurance company is?

It doesn’t matter who the insurance company is, all of them are seeking the same thing: to pay out as little as possible in a personal injury settlement. So how do you give yourself the best chance at reaching a fair settlement?

Is it hard to negotiate a settlement with Allstate?

After a car accident, negotiating a personal injury settlement with Allstate is very difficult at best and can be very stressful for the average person. With no attorney (and therefore no leverage), the victim is often at the mercy of the insurance company.

Should you handle your own case?

While most property-damage-only claims can be handled yourself, an injury claim is very different.

How long does it take Allstate to settle a case?

These questions are generally asked prior to filing a claim or during the claim process. Once you’ve submitted your evidence, the insurance agent at Allstate will examine all the information and come up with an offer. This offer will be based on your injuries, the impact they had on your daily life, the effects your injuries had on your job and future career opportunities, your age and career, and more. All of these factors will take some time to consider.

What to do if Allstate denies your claim?

If the agent denies your claim or makes you an unreasonably low offer, you will find it best to negotiate with him. This is best achieved with the assistance of a skilled attorney, as you may not be able to even get a hold of the agent if you try. The negotiation process can add weeks to the length of time it takes Allstate to settle a case, ...

How long has Allstate been in business?

Allstate has been in operation since 1931 and has operated out of Illinois since. It is licensed to write policies and provide coverage in all 50 states in the USA, and has operations in Canada as well. Despite being one of the most well-known insurance companies, it is also fraught with problems that are simply products of it being a business – namely that it wants to keep as many profits as possible by not paying out its clients and claims. One of the tactics the company uses is to delay action, leading to many clients asking questions like, “How long does it take for Allstate Insurance to settle an accident claim?” and “How long does it take Allstate to send a settlement check?”

How long does it take for an Allstate claim to be resolved?

Allstate’s Timetables. Depending on the situation, the timeline in which Allstate will complete its duty greatly varies. You may have to wait up to two years for your case to be resolved. If you are fortunate, it can take a few months. In truly cut and dry cases, the entire claim will be handled within a few weeks.

How long does it take to get a check from Allstate?

The amount of time it takes Allstate to send a check is usually between 20 and 45 days. Once the check has been sent out, you can either deposit it and pay off your necessary expenses, or go to your attorney to have your portion written out to you once the fees have been taken out.

How long does it take for an insurance agent to make an offer?

All of these factors will take some time to consider. If you are fortunate, the insurance agent will make an offer within two to three weeks of receiving the claim. Keep in mind that hundreds of thousands of customers likely submit claims each day, and the agents are usually swamped with work. Thus, your claim can be delayed while it goes ...

What happens if liability is not clear?

It can depend on whether or not liability is accepted in the first place. If liability is not clear, that could extend the process. It is important that you go the extra mile with learning the status of your claim and how a settlement is processed.