A money laundering risk assessment is a process that analyzes a company’s risk of financial crime exposure. The process aims to determine which aspects of the company put it at risk of money laundering or terrorist financing.

Full Answer

What are the findings of the money laundering risk assessment?

The findings of the money laundering risk assessment will result in individual risk scores for each KRI, as well as the total risk score, which is the compound or general risk offered by the business. During the risk assessment throughout the application, the following issues should be made;

What is the US Department of the Treasury doing about money laundering?

The United States Department of the Treasury is fully dedicated to combating all aspects of money laundering at home and abroad, through the mission of the Office of Terrorism and Financial Intelligence (TFI).

What are the steps involved in money laundering?

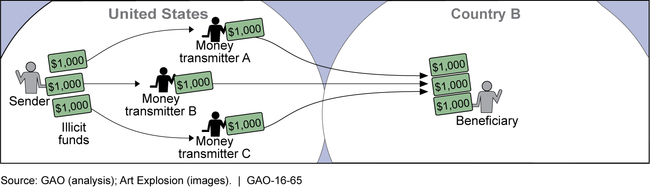

Money laundering generally involves three steps: placing illicit proceeds into the financial system; layering, or the separation of the criminal proceeds from their origin; and integration, or the use of apparently legitimate transactions to disguise the illicit proceeds.

What is money laundering and why is it important?

Money laundering facilitates a broad range of serious underlying criminal offenses and ultimately threatens the integrity of the financial system.

What is a money laundering risk assessment?

An AML risk assessment helps identify the institution's inherent risk and assesses the effectiveness of its preventative and detective controls. FATF recommends considering the following factors when assessing inherent money laundering risk: The nature, scale, diversity, and complexity of the business.

How do banks track money laundering?

Cash Transaction Reports - Most bank information service providers offer reports that identify cash activity and/or cash activity greater than $10,000. These reports assist bankers with filing currency transaction reports (CTRs) and in identifying suspicious cash activity.

What happens during a money laundering investigation?

The AML investigation process Usually an AML investigation starts with an alert from an automatic monitoring system. Rules-based monitoring systems are a key part of most AML solutions. They are useful for automatically screening large amounts of data and flagging transactions or other activity that could pose a risk.

What are the three categories to include in an AML risk assessment?

Inherent BSA/AML risk falls into three main categories: (1) products and services, (2) customers and entities, and (3) geographic location.

How much money is considered money laundering?

Money laundering is more about the intent than the amount of money, but you will likely be investigated for money laundering if you bring more than $10,000 in cash into or out of the United States, deposit $10,000 or more in cash into a bank account, or if you spend more than $300,000 in cash on a real estate purchase.

At which stage money laundering is easy to detect?

It is during the placement stage that money launderers are the most vulnerable to being caught. This is due to the fact that placing large amounts of money (cash) into the legitimate financial system may raise suspicions of officials.

Do police investigate money laundering?

Any police officer can undertake a money laundering investigation. Some forces have created teams focusing on money laundering investigations at both the neighbourhood and force level.

What is the maximum sentence for money laundering?

20 yearsAnyone convicted of money laundering could be sentenced to up to 20 years of incarceration and fines of up to $500,000 or twice the value of the property that was involved in the transaction, whichever amount is greater. Those who are involved with money laundering offenses can also face other related criminal charges.

What are the 4 stages of money laundering?

Money laundering is often comprised of a number of stages including:Placement. ... Layering. ... Integration. ... Money Laundering Charges. ... Defenses to Money Laundering. ... Lack of Evidence. ... No Intent. ... Duress.

How do you make an AML risk assessment?

The following steps for creating or updating your BSA/AML risk assessment should ensure you understand your institution's risk.Document the BSA/AML risk assessment.Identify inherent risk vs. residual risk.Classify the risks.Analyzing risk factors. Risk factor review.

What are red flag indicators in AML?

Red flag indications help companies detect and report suspicious activities easier. It helps the Money Laundering Reporting Officers (MLRO) to categorize suspicious activities and help them write Suspicious Activity Report (SAR) and report to the Financial Crimes Enforcement Network (FinCEN) if necessary.

What are the 3 stages of money laundering?

What are the 3 Stages of Money Laundering?Placement.Layering.Integration/extraction.

How is money laundering caught?

For money laundering charges to be brought, a prosecutor must show that the person concealed money specifically in order to conceal the ownership and source of the money, as well as control of the money, as to make it appear as if it came from a legitimate source. Proving concealment is key.

How do banks identify suspicious activity?

The bank runs rules-based algorithms against transaction systems to generate alerts. The algorithms look for anomalous behavior — e.g. a large volume of cash transactions; large transfers to a country where the customer does not do business.)

Do banks track money orders?

To track a money order, the issuer must fill out tracking forms and pay an additional fee to learn whether the money order has been cashed. The entire process for researching the status of a money order can take weeks.

How do banks monitor transactions?

Currency transaction reports Another common reporting method is called a “currency transaction report,” or CTR, which is primarily used to record larger transactions. Financial institutions must file these reports for “cash-in” or “cash-out” transactions larger $10,000, according to FinCEN.

What Should Businesses Do To Prevent Money Laundering?

Tax evasion should be prevented in all steps from production to consumption, and significant money movements should be monitored.

Is electronic money a form of money laundering?

The newest form of money laundering includes cryptocurrencies like Bitcoin. Although not entirely anonymous, it is increasingly used in blackmail plans, drug trafficking, and other criminal activities due to their relative anonymity compared to more traditional currency forms.

What is money laundering?

Money laundering generally refers to financial transactions in which criminals, including terrorist organizations, attempt to disguise the proceeds, sources or nature of their illicit activities.

What is the Department of Treasury?

The United States Department of the Treasury is fully dedicated to combating all aspects of money laundering at home and abroad, through the mission of the Office of Terrorism and Financial Intelligence (TFI).

Introduction

This guide will assist in-house counsel and risk and compliance teams with the steps that their organisation should take to conduct or refresh an assessment of money laundering and terrorist financing (ML/TF) risk in terms of the UK money laundering regulations.

Section 1 – Overview

The guide is applicable to those organisations that are subject to the Money Laundering and Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended by the Money Laundering and Terrorist Financing (Amendment) Regulations 2019 (collectively, ‘the MLR’).

Section 4 – Practical guidance for assessing money laundering and terrorist financing risk

This will depend on the size and the nature of your business. Businesses with dedicated financial crime compliance resources may be able to commission one or more senior experts from those teams to undertake their risk assessment in-house.

Why do criminals resort to money laundering?

Without usable profits, the criminal activity cannot continue. This is why criminals resort to money laundering. Money laundering involves masking the source of criminally derived proceeds so that the proceeds appear legitimate, or masking the source of monies used to promote illegal conduct.

How do criminals obtain access to the financial system?

financial system by masking the nature, purpose, or ownership of their accounts and the sources of their income through the use of front companies, shell companies, or nominee accounts with unknown beneficial owners. Front companies typically combine illicit proceeds with lawful proceeds from legitimate business operations, obscuring the source, ownership, and control of the illegal funds. Shell companies typically have no physical operations or assets, and may be used only to hold property rights or financial assets. Nominee-held “funnel accounts” may be used to make structured deposits in multiple geographic locations and corresponding structured withdrawals in other locations. All of these methods obscure the true owners and sources of funds.

Why do criminals use banks?

In fact, in most money laundering cases, criminals employ banks at some point to hold or move illicit funds. Because they play such a significant role in the U.S. financial system, banks are often the front line in AML efforts by establishing effective BSA programs.

What is TBML in drug trafficking?

Trade-Based Money Laundering (TBML): Drug trafficking organizations also use money brokers to facilitate TBML. In complex TBML schemes, criminals move merchandise, falsify its value, and misrepresent trade-related financial transactions, often with the assistance of complicit merchants, in an effort to simultaneously disguise the origin of illicit proceeds and integrate them into the market. Once criminals exchange illicit cash for trade goods, it is difficult for law enforcement to trace the source of the illicit funds.

How do criminals buy real estate?

Purchase of Real Estate and Other Assets: Criminals also convert their illicit proceeds into clean funds by buying real estate and other assets. Foreign government officials who steal from their own people, extort businesses, or seek and accept bribery payments, in particular, have also used this method to funnel their illicit gains into the U.S. financial system. Recent investigations and prosecutions have revealed that corrupt foreign officials have purchased various U.S. assets to launder the proceeds of their corruption, from luxury real estate and hotels to private jets, artwork, and motion picture companies. The flow of kleptocracy proceeds into the U.S. financial system distorts our markets and threatens the transparency and integrity of our financial system. For example, when criminals use illicit proceeds to buy up real estate, legitimate purchasers—businesses and individuals—are foreclosed from buying or investing in those properties. Moreover, kleptocracy erodes trust in government and private institutions, undermines confidence in the fairness of free and open markets, and breeds contempt for the rule of law, which threatens our national security.

Where do drug dealers use cash?

Customers typically use cash to purchase drugs from street-level drug dealers, who in turn use cash to purchase their drug supply from mid-level distributors. Mid-level distributors purchase drugs from wholesalers using cash, and wholesalers often make payment to their suppliers in cash.

Who is MLF in banking?

financial system, on behalf of their clients; complicit financial institutions (which can include banks, broker dealers, hedge funds, and MSBs); or TBML operations manipulating value systems to move value.

What is money laundering?

Actions that show crime assets as income from a legitimate source to hide the illegal source of money are called money laundering. With the development of technology, money laundering events are increasing. Therefore, it becomes more and more critical for businesses to measure the possibility of money laundering or terrorism financing.

How to reduce the risk of money laundering?

Developing policies, procedures, and controls to reduce the risk of money laundering, Apply a risk-based approach to detect and prevent money laundering. Understand the level of risk associated with individual business relationships and transactions. Making appropriate risk-based decisions about customers and employees.

What is AML risk assessment?

The AML Risk Assessment carries out this process by identifying places where money laundering is the easiest in business and those who want to finance terrorist activities. This security process is usually called Key Risk Indicators (KRI). Besides, countries, banks, authorities, and many financial sectors need risk-based approaches to understand and evaluate the risk of money laundering and terrorist financing. Many of the sanctions currently imposed by banking regulators contain provisions that require improvements in risk management programs for AML and The Office of Foreign Assets Control (OFAC) compliance. The starting point of the strong AML risk assessment program should be an accurate and comprehensive AML / OFAC risk assessment in business.

Why is it important to review your AML risk assessment?

It is also important to review your AML Risk Assessment to make sure that your Solicitors Regulation Authority (SRA) may want to see your assessment of your business, your business will not go wrong with compliance and also best know compliance meaning.

What is the most common method used for risk assessment?

The most common method used for risk assessment is sanction, PEP, and adverse media screening. With the development of technology, manual risk assessment methods lost their function and created a waste of time. Our product, AML Name Screening Software, provides sanction, PEP, and adverse media screening service. You can contact us to meet your AML and KYC obligations during the customer onboarding and monitoring process with Sanction Scanner.

What laws are in place to prevent money laundering?

These include the Bank Secrecy Act, the Trading with the Enemy Act and title III of The Patriot Act called the "International Money Laundering Abatement and Financial Anti-Terrorism Act of 2001.".

What is money laundering?

Money laundering is a crime defined as the process of creating the illusion that large amounts of money obtained from serious crimes actually originated from a legitimate source. Laundering is often done through crimes such as drug trafficking or terrorist activities.

How does money laundering affect business?

Money laundering is a multibillion dollar industry that impacts legitimate business interests by making it much more difficult for honest businesses to compete in the market since money launderers often provide products or services at less than market value.

What happens if a business is regulated by the government?

Where a financial institution or business is also regulated by the government, money laundering or a failure to put reasonable anti-laundering policies in place can result in a revocation of a business charter or government licenses. 1 .

Is HSBC a Mexican company?

According to the Unite States federal government, HSBC has been guilty of little or no oversight of transactions by its Mexican unit that included providing money-laundering services to various drug cartels involving bulk movements of cash from HSBC's Mexican unit to the U.S.

Table of Contents

Factors For The Risk Assessment

- For identifying and assessing the money laundering risk to which organizations are exposed, banks should consider a range of factors which should include the following: 1. The nature, scale, diversity and complexity of their business 2. An organizations target markets 3. The number of customers already identified as high risk 4. The jurisdictions t...

Retail Banking

- In retail banking, main areas of the money laundering risk may lie within the provision of services to cash-intensive businesses, the volume of transactions and high-value transactions, and in the diversity of services.

Wealth Management

- In wealth management, main areas of the money laundering risk may lie within the culture of confidentiality, the difficulty to identify beneficial owners, a potential concealment through the use of offshoretrusts, banking secrecy, the complexity of financial services and products, and high value transactions.

Correspondent Banking

- Last but not least, in correspondent banking, the main areas of the money laundering risk may lie within high value transactions and within limited information about the remitter and source of funds, especially when executing transactions with a bank located in a jurisdiction that does not comply or complies insufficiently with international standards in money laundering prevention. …