How Does Pre-Settlement Funding Work?

- Pre-Settlement Funding Basics. Suffering a serious injury can throw a person’s life into instant disarray. ...

- The Process. The process of applying for and receiving pre-settlement loans is straightforward. ...

- The Details. Without an open case, there can be no settlement and without a prospective settlement there can be no funds to advance.

- Learn More. ...

What is a consumer presettlement loan?

A consumer presettlement loan allows access to a lawsuit recovery before the case settles. When Angie’s car was hit by a speeding delivery truck on a rain-slicked street, her world was upended. Her injuries kept her off work for months.

How does a lawsuit lender get paid?

The lawsuit lender, or more accurately, the litigation funding company, is paid out of the proceeds of the settlement or the judgment award if the case goes to trial.

Is the funding agreement based on the plaintiff’s credit score?

The funding agreement is not based on the plaintiff’s creditworthiness. Instead, funding agreements primarily consider the strength of the plaintiff’s case. For the litigation funding company, this transaction is an investment. Like all investors, the company wants to ensure that its investment is reasonably likely to lead to profit.

What does pre-settlement funding mean?

Pre-settlement funding is a cash advance for individuals that have a pending personal injury lawsuit (automobile accident, workers comp case or slip and fall, etc.) that are in need of money now.

How can I get money before my settlement?

To get money before your settlement, you first have to apply for pre-settlement funding and give permission to your attorney to speak to the lender. After your attorney sends in your file, a funding decision is made 24 hours later. Once approved, a contract is formulated for you and your attorney to sign.

Does Oasis take money directly from settlement?

Pre-settlement funding is a cash advance from your legal settlement. It's a safe, risk-free payment we offer you based on what your case is worth. You agree to pay back the amount plus fees and interest once the case settles.

How many loans can you get from settlement?

A pre-settlement loan, or more than one, can help reduce your financial stress and allow your lawyer the time they need to negotiate a strong settlement. There is no set limit on the number of pre-settlement loans you can receive.

Can my lawyer deny me from getting a pre-settlement loan?

Your attorney isn't required to approve any pre-settlement funding options. It's best to talk to them before starting the application process. Discuss with them your need for money to cover living expenses and other financial assistance until you can receive your settlement to help ensure your attorney's consent.

How can I get a loan while waiting for a settlement?

How do pre-settlement loans work?Hire a Lawyer and File a Lawsuit. To secure a pre-settlement advance, you must first file a lawsuit. ... Apply for a Lawsuit Loan from a Reputable Funding Company. ... Review the Proposed Funding Agreement with Your Attorney. ... Decide Whether a Pre-Settlement Advance is Right for You.

How much does Oasis charge for pre settlement funding?

Customers do not pay an application fee to apply for a settlement cash advance from Oasis Financial, and the company requires no upfront charges. Oasis offers cash advances ranging from $500 to $100,000.

How much do pre settlement loans cost?

Get competitive fixed-rate pre-settlement funding starting at 2% for attorneys and from 2.95% to 3.4% non-compounding for plaintiffs.

How much can you borrow from Oasis?

$500 to $100,000Approved applicants generally receive $500 to $100,000* cash to cover everyday expenses or costs from their injuries.

Can you get two pre settlement loans?

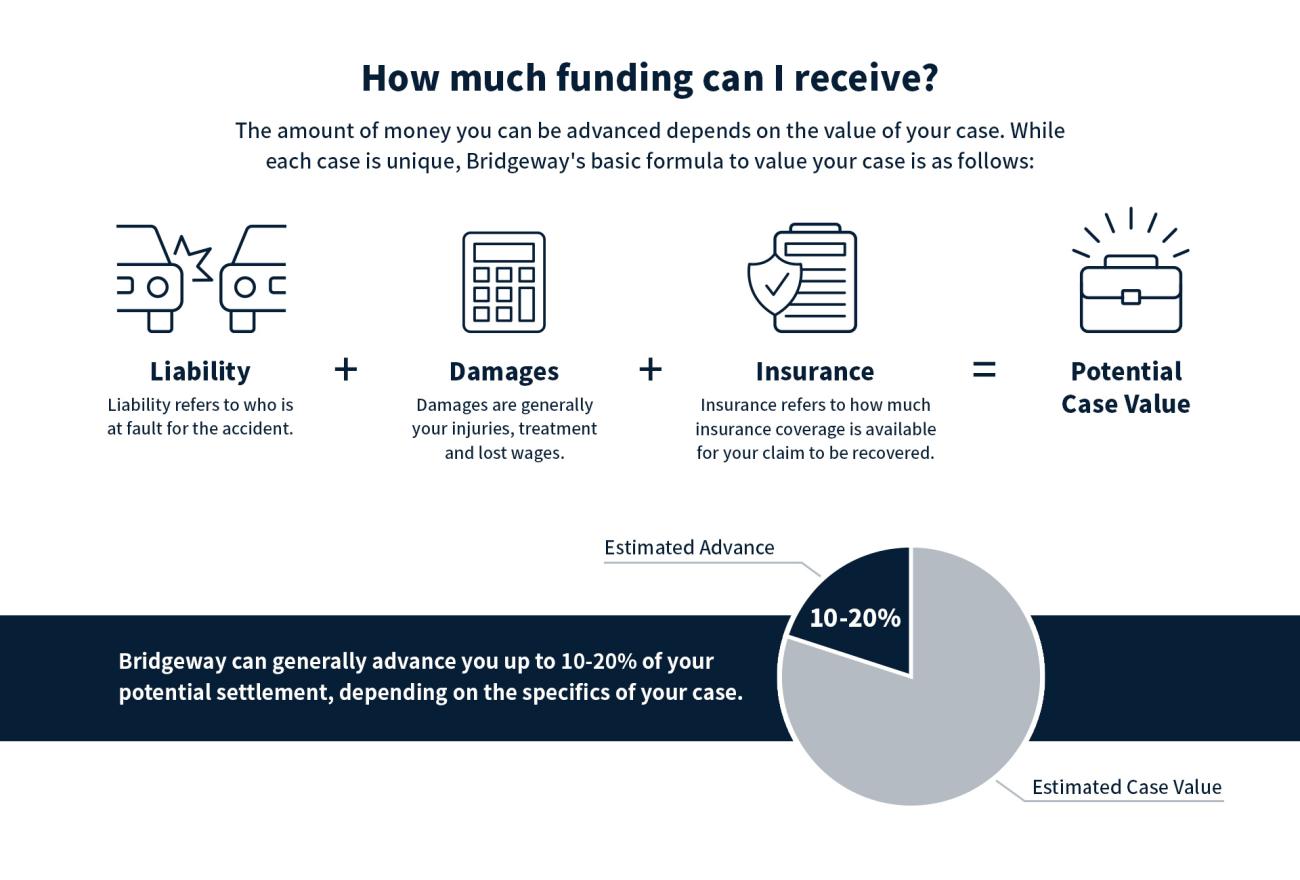

You may get more than one pre-settlement loan, but the total loan amount (including the previous payout) must stay under 20 percent of the lawsuit's value.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

What is the average settlement for roundup?

What is the average payout for a Roundup lawsuit? The average payout for an individual who has been diagnosed with non-Hodgkin's lymphoma or other cancers is between $5,000 to $250,000 in compensation. One report stated that the average amount per client suffering from cancer is $160,000.

How do structured settlements differ from pre-settlement advances?

Someone who settles a case or wins a lawsuit does not necessarily get paid in a lump sum. A structured settlement allows the defendant to pay the settlement or judgment award over time. It works like an annuity, allowing the plaintiff to receive the money in installments according to a negotiated schedule, and sometimes allowing the plaintiff to apply for payment as needed. The money will come either directly from the defendant in the case or as an annuity the defendant purchases from an insurance company. The terms of a structured settlement are negotiated as a part of the overall settlement or after a judgment is rendered.

Why do people get settlement advance?

Depending on the potential client’s personal circumstances, a settlement advance may make it easier for a plaintiff to suffer the frustrating effort and time it takes to resolve a personal injury case. Plaintiffs like Angie are more likely to allow the pretrial and discovery phases to fully develop before insisting on settlement if they have fewer financial distractions. Lawsuit loans can help them stay committed to the case long enough to realize the full potential of the case.

Who qualifies for a presettlement advance?

For the litigation funding company, this transaction is an investment. Like all investors, the company wants to ensure that its investment is reasonably likely to lead to profit. For this investigation, the company employs a team of underwriters who review the case to estimate its potential return.

What is the downside for the plaintiff?

While plaintiffs ponder the appeal of getting access to proceeds of an unresolved case, they should also carefully consider the consequences. In choosing to work with a lawsuit lender, the plaintiff trades the possibility of earning a higher recovery later for an immediate infusion of cash to cover present needs like replacing income or getting medical care. The plaintiff must also take care to ensure the company is experienced and reputable. Plaintiffs can increase their chances of finding an ethical lawsuit lender by making sure that the company is licensed, if required by their state, or that the company belongs to industry trade associations, like the American Legal Finance Association (ALFA) or the Alliance for Responsible Consumer Legal Funding (ARC). Each organization requires that its members adhere to a list of best practices. By choosing a member company, a funding client can rest assured that the company subscribes to the highest standards in the industry.

What is lawsuit funding?

Litigation funding is known by many names. Presettlement funding, lawsuit loans, car accident loans. For consumers, they all stack up to the same thing. Instead of waiting until the case settles or goes to trial, which can be months or years in a complicated case with potentially a high dollar payout, a presettlement funding company will advance a portion of the expected proceeds to the plaintiff or claimant, who in turn assigns a portion of the recovery to the funding company. In Angie’s case, she received a lump sum payment that she used to catch up bills, get medical treatment, and provide a cushion while she readied to go back to work. In exchange, her lawsuit lender will be paid a portion of her recovery when the case is finally settled.

How was Angie able to gain access to funds and bring some stability to her family without resolving her?

How was Angie able to gain access to funds and bring some stability to her family without resolving her case? She took advantage of an opportunity to draw on her expected settlement from a company that specializes in presettlement funding. The litigation funding company was able to give her a down payment on the money she expected to get from an eventual settlement or judgment in her car accident case.

What is consumer presettlement loan?

A consumer presettlement loan allows access to a lawsuit recovery before the case settles.

What is pre settlement funding?

Pre-settlement funding offers a great way to finance your lawsuit because this option is non-recourse. That means if you do not win your lawsuit or receive a settlement, you do not have to repay the loan. If you do win, you must use part of your settlement to repay the loan and any interest charges.

What are some alternatives to pre-settlement financing?

Alternatives to pre-settlement funding include traditional bank loans, low-interest mortgages guaranteed by your equity in the property, loans from retirement accounts, money from friends and family members, and even credit card funding. Before settling on an option, make sure to explore all alternatives. Each one offers a set of benefits and disadvantages; see which one answers your needs best.

What is the interest rate on a settlement loan?

Interest rates on settlement funding loans run as high as 60 percent per year. Try to find a company that offers a more reasonable rate. Reputable lenders are available for pre-settlement loans.

How much do settlement companies get from motor vehicle plaintiffs?

Mass tort settlement cases usually charge less interest, however, than motor vehicle injury cases. It is recommended that you only receive 15 to 20 percent of the expected settlement amount. Many lending companies limit your loans to this range.

Why do lawsuit funding companies advertise?

Lawsuit funding companies advertise heavily because they are anxious to loan money to those likely to receive compensation. However, the loans can be expensive, so you should shop around for the best value. Gather information about a couple of offers from different firms and see which one suits you best. If you can get by without a settlement loan, it is better for your future financial health.

How long does it take for a lender to make a decision?

Make sure that your attorney has as much information as possible to support your case and the amount of compensation you are seeking. It often takes weeks for a lender to make a decision. They tend to gather as much information as possible from your attorney before making a final decision.

Can you use a settlement for personal expenses?

In many cases, your settlement can be used for other purposes as well, like covering personal expenses. Many injury victims are not able to work after, and the settlement money can be used for their personal needs.

Pre-Settlement Funding Basics

Suffering a serious injury can throw a person’s life into instant disarray. Injured adults often cannot work and find themselves wondering:

The Process

The process of applying for and receiving pre-settlement loans is straightforward.

Learn More

When it comes to legal issues, knowledge is power. Learn more about pre-settlement funding and other tools that can help you come out on top in your case by browsing our other great articles today.

What Is Litigation Funding?

- Litigation funding is known by many names. Presettlement funding, lawsuit loans, car accident loans. For consumers, they all stack up to the same thing. Instead of waiting until the case settles or goes to trial, which can be months or years in a complicated case with potentially a high dollar payout, a presettlement funding company will advance a portion of the expected proceeds to th…

Who Qualifies For A Presettlement Advance?

- The funding agreement is not based on the plaintiff’s creditworthiness. Instead, funding agreements primarily consider the strength of the plaintiff’s case. For the litigation funding company, this transaction is an investment. Like all investors, the company wants to ensure that its investment is reasonably likely to lead to profit. For this investigation, the company employs …

Is Pre-Settlement Funding A Loan?

- Although many people call it a lawsuit loan, the transaction is not a loan at all. It is a vehicle for investors who, in essence, purchase a stake in the litigation. This is a non-recourse agreement. The plaintiff is not personally liable for repayment of the advances. The lawsuit lender, or more accurately, the litigation funding company, is paid ...

What Is The Downside For The Plaintiff?

- While plaintiffs ponder the appeal of getting access to proceeds of an unresolved case, they should also carefully consider the consequences. In choosing to work with a lawsuit lender, the plaintiff trades the possibility of earning a higher recovery later for an immediate infusion of cash to cover present needs like replacing income or getting medical care. The plaintiff must also take c…

How Do Structured Settlements Differ from Pre-Settlement Advances?

- Someone who settles a case or wins a lawsuit does not necessarily get paid in a lump sum. A structured settlement allows the defendant to pay the settlement or judgment award over time. It works like an annuity, allowing the plaintiff to receive the money in installments according to a negotiated schedule, and sometimes allowing the plaintiff to apply for payment as needed. The …