How does a viatical differ from a life settlement?

We will explore these differences below. The main difference between viatical and life settlements has to do with the policyholder themselves. In general, life settlements are for healthy seniors, while viaticals are reserved for those living with a life-threatening illness, regardless of their age.

Who qualifies for a viatical settlement?

Viatical settlements are for people who are terminally or chronically ill, no matter their age. Also, as noted, the proceeds from a viatical settlement typically aren’t considered taxable income. Life settlements are generally only available only to women age 74 and older and to men age 70 and older. Life-settlement proceeds are taxed.

What does viatical settlement mean?

A viatical settlement is an arrangement in which you sell a life insurance policy to a settlement company before the insured person dies. The settlement company takes ownership of the policy and eventually receives the death benefit. A viatical settlement is one way to access a significant portion of your policy’s value prior to death.

What does a viatical settlement provider do?

A viatical settlement provider is a party who exchanges something of value to a person with a life insurance policy in order to obtain the right to the death benefits of the life insurance policy. It is common for a sum of cash to be exchanged to the life insurance policy holder for the rights to the death benefits. Advertisement.

What is the primary distinction between a viatical sale and a life settlement sale?

The main difference between viatical and life settlements has to do with the policyholder themselves. In general, life settlements are for healthy seniors, while viaticals are reserved for those living with a life-threatening illness, regardless of their age.

How is a life settlement transaction similar to a viatical settlement transaction?

How is a life settlement transaction similar to a viatical settlement transaction? A Life Settlement is similar to a viatical settlement in that it is the sale of an existing life insurance policy to a third party for more than its cash surrender value, but less than its death benefit.

How does a viatical settlement work?

A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at a price that is less than the death benefit of the policy. When the seller dies, you collect the death benefit.

What is a viatical life settlement transaction?

A viatical settlement is an agreement that allows a person with a chronical or terminal illness to sell their life insurance policy to a third-party for a cash payment.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

What is a life settlement transaction?

A life settlement is the sale of a life insurance policy to a third party called a life settlement provider. The owner of the life insurance policy sells the policy to the life settlement provider and receives an immediate payment in return.

Who benefits from a viatical settlement?

Viatical settlements are for people who are terminally or chronically ill, no matter their age. Also, as noted, the proceeds from a viatical settlement typically aren't considered taxable income. Life settlements are generally only available only to women age 74 and older and to men age 70 and older.

What is meant by a viatical?

viatical. / (vaɪˈætɪkəl) / adjective. of or denoting a road or a journey. botany (of a plant) growing by the side of a road.

Who approves a viatical settlement?

the CommissionerA viatical settlement contract or disclosure statement form shall be deemed approved by the Commissioner if not disapproved within 60 days from submission.

What is the difference between viatical settlements and accelerated death benefits?

The major difference between accelerated death benefits and viatical settlements is that with ADB the policy owner must continue to pay the monthly premiums. With a viatical settlement, the purchaser of the policy takes over the monthly payments. For this reason, seniors might consider a viatical settlement instead.

Are viatical settlements legal?

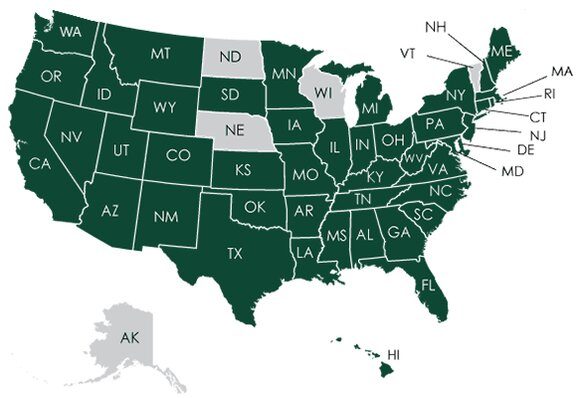

The truth is, life settlements are completely legal and enforceable. They're also regulated at the state level throughout most of the country. While life settlement fraud may exist, it's no more prevalent than fraud in other industries.

What is another name for the insured in a viatical settlement?

What is another name for the insured in a viatical settlement? The insured in a viatical settlement is also known as the viator.

What is another name for the insured in a viatical settlement?

What is another name for the insured in a viatical settlement? The insured in a viatical settlement is also known as the viator.

What influences a viatical settlement?

To be eligible for a viatical settlement, a seller must meet these requirements: The policyholder must be terminally ill or chronically ill. Generally, this means a person with a short life expectancy. Sellers must have medical records to prove they meet these specifications.

What does the word viatical mean?

viatical. / (vaɪˈætɪkəl) / adjective. of or denoting a road or a journey. botany (of a plant) growing by the side of a road.

Are viatical settlements legal?

The truth is, life settlements are completely legal and enforceable. They're also regulated at the state level throughout most of the country. While life settlement fraud may exist, it's no more prevalent than fraud in other industries.

What is the difference between a life settlement and a viatical settlement?

The main difference between a life settlement and a viatical settlement is the criteria required to use the option, like the life expectancy of the seller. Viatical settlements are designed for those who have a terminal or chronic illness with a life expectancy of up to two years or less, depending on the company, and are considered slightly riskier for the buyer, due to the fact that the original holder of the policy may not pass away within the expected timeframe. They may live a shorter or longer amount of time than expected.

What is a viatical settlement transaction?

A viatical settlement is a transaction where someone who is terminally or chronically ill discounts their life insurance policy and sells it for cash. Similar to a life settlement, the buyer receives the death benefit. The buyer also pays all the future premiums left on the policy.

What is a lifetime settlement?

The lifetime settlement meaning is fairly simple: this refers to the transaction of selling your existing insurance policy on the secondary market for a one-time cash payment. Once the sale is complete, the third-party purchaser takes over paying the premiums and receives the death benefit when the insured dies.

Why do people choose a lifetime settlement?

Others may have unexpected expenses or life changes where they need an influx of cash to help meet their needs .

What type of settlement is right for me?

If you have an unwanted policy and are searching for extra money to help with your expenses or retirement funds, then a life settlement may be the right fit. Regardless of your circumstances, Life Settlement Advisors can help.

What is life settlement advisor?

Here at Life Settlement Advisors, we dedicate our business to helping individuals achieve greater returns on their life insurance because we know how valuable these investments are to policyholders . A life settlement empowers the policy holder to sell all or a portion of their whole life insurance as an asset the same way they would sell a car, house, or stocks and bonds.

Do life insurance settlements work?

Life settlements may not work for everyone, but they’re a valuable option that many people don’t consider. If you have a life insurance policy you’re planning to sell, you can contact us at any time to discuss your options. You can also see if a life settlement is a good fit for you by using our qualification calculator.

The Difference Between Viatical and Life Settlements

People choose to sell their life insurance policies when they find that the policy is no longer wanted, needed, or can no longer be afforded. When it comes to life settlements and viatical settlements, choosing the appropriate route is not always as easy as it may seem.

Viatical Settlements vs Life Settlements

So what is the difference between viatical settlements and life settlements? Both of these methods involve selling a life insurance policy and while they are similar, they do vary slightly.

When A Viatical Settlement or Life Settlement Makes Sense

There are several instances in which a viatical or life settlement might make sense for you:

Why do you need a viatical settlement?

Typically, the primary reason for transacting a viatical settlement is to access cash from the policy in order to pay for ongoing care or other medical expenses. If the funds are used for qualified long-term care, the money received is generally tax-free; however, it is important to discuss the tax implications with a qualified tax professional to determine whether the funds you receive will be subject to federal income tax. Viatical settlements can be extremely helpful to patients and their families dealing with the extraordinary costs of care for terminal illness.

Can you sell a life insurance policy to a third party?

Although the transaction - selling one’s life insurance policy to a third party - is the same, a life settlement can be undertaken by any policyholder – even if the insured’s life expectancy is longer than 2 years. Still, those that qualify for a life settlement are typically seniors with reduced life expectancy due to health impairments.

Is a viatical settlement the same as a life settlement?

Life settlements and viatical settlements involve the same basic transaction, but the criteria surrounding them are very different. Take Ashar’s Policy Value Quiz to determine if a life settlement is an option for your client.

What is the Difference Between a Viatical Settlement and a Life Settlement?

If you’re of retirement age and have a life insurance policy in your name, knowing the difference between a life settlement and a viatical settlement can help you make the right decisions for yourself and your loved ones later on.

What is a Viatical Settlement?

With a viatical settlement, you sell your life insurance policy to a third-party (such as a viatical settlement provider). You receive a lump sum payment from the buyer—and the buyer assumes responsibility for paying your policy premiums while becoming the sole beneficiary of the policy benefits.

What is a viatic settlement?

The best way to think about a Viatical Settlement is the sale of an existing life insurance policy. This trade is also sometimes referred to as a Life Settlement. Generally, the distinction has to do with the health status of the insured and how that potentially may impact the tax treatment of the income from the sale.

What is a viatical sale?

If the insured is terminally ill, the sale is generally referred to as a viatical. On the other hand, insureds with longer life expectancies typically sell through a Life Settlement. However, some states have created legal definitions that differ slightly.