The early settlement fee is often calculated as a percentage of the outstanding balance during the time you wish to clear out your loan. Most banks make their profit through interest when they lend money. However, repaying your loan early means paying less profit to your bank as you would have for the full term of the loan.

Full Answer

How do you calculate my early settlement figure?

How do you Calculate my Early Settlement Figure? If you want to settle your agreement early, you can request an Early Settlement Figure, which we calculate in line with the rules set out within the Consumer Credit (Early Settlement) Regulations 2004. We add up your remaining monthly instalments between now and the end of your agreement.

What is an early settlement figure for car finance?

An early settlement figure is the amount still owed, plus interest and charges if you want to pay off your car finance early. Our settlement figure calculator does not include any additional penalty charges that may be incurred. For regulated agreements, this is normally an exit fee equal to around just 58 days interest charge.

How much is the early settlement fee for Citibank personal loan?

Early settlement fee: RM100.00 or 1% of the outstanding balance of the loan, whichever is higher, is charged if prepayment in full is made during the lock-in period of 6 months from the date of the letter of approval is issued. Notice period: Not disclosed. Rebate: Applicable based on the ‘Rule of 78’. 15. Citibank Personal Loan

Does the settlement figure calculator include any penalty charges?

Our settlement figure calculator does not include any additional penalty charges that may be incurred. For regulated agreements, this is normally an exit fee equal to around just 58 days interest charge. How is the settlement figure calculated?

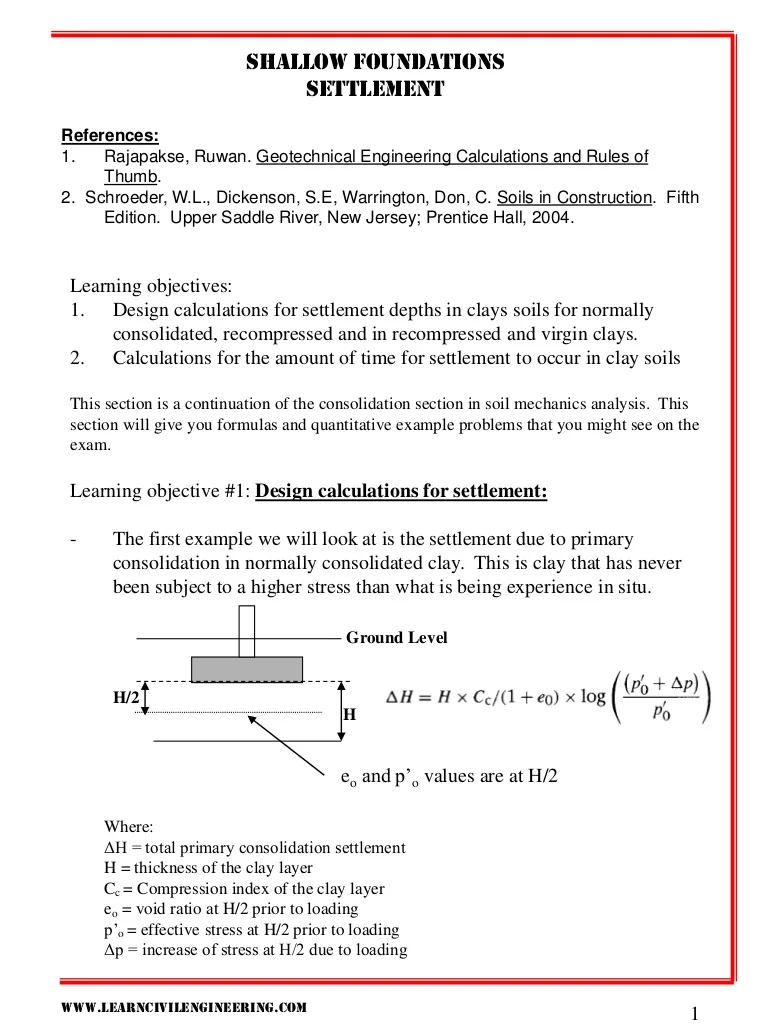

How is early settlement figure calculated?

To calculate your settlement figure, the lender will add up your remaining monthly instalments between now and the end of your agreement and take away any future interest that you won't need to pay. Finally, any arrears will be added. You'll receive your settlement figure in writing to confirm.

How is settlement amount calculated?

The settlement amount is calculated by adding back the accrued interest on the clean price and then multiplying by the face value.

How is mortgage settlement figure calculated?

Once the settlement date has been decided, we calculate your settlement figure by taking the current capital element of the balance outstanding, adding the interest due up to the agreed settlement date, plus one month's additional interest (as outlined above).

What is an early settlement quote?

What is a settlement figure? An early settlement figure is the amount still owed, plus interest and charges if you want to pay off your car finance early.

What is a settlement calculator?

This tool can be used to help you in your decision of whether to settle a case on your own or to hire an attorney. Based on the numbers you provide, it will calculate the settlement amount you would have to achieve with an attorney compared to the settlement amount you are being offered or hope to achieve.

How do you calculate emotional pain and suffering?

These types of compensation are called pain and suffering. Generally, pain and suffering awards will be calculated by adding up the economic damages and multiplying them by a number between 1.5 and 5, depending on the severity of the injury.

Why is my settlement figure higher than my balance?

Your balance might be lower than your settlement figure because of a Direct Debit payment you've made. A Direct Debit could still go out after you get a settlement figure and before you pay off your loan. This will reduce the amount you owe and make your balance lower.

How is the penalty for paying off mortgage early calculated?

Most lenders determine the mortgage break penalty for a variable rate mortgage by calculating three months of interest. The interest rate that they use can depend from lender to lender, but is usually either your current mortgage interest rate or the lender's prime rate.

What is the penalty for paying off a loan early?

While most personal loan lenders don't charge you to pay off your loan early, some may charge a prepayment penalty if you pay off your loan ahead of schedule. Prepayment penalties typically start out at around 2% of the outstanding balance if you repay your loan during the first year after applying and qualifying.

Do I pay less interest if I pay off my loan early?

1. If I pay off a personal loan early, will I pay less interest? Yes. By paying off your personal loans early you're bringing an end to monthly payments, which means no more interest charges.

Does paying car off early hurt credit?

In the short-term, paying off your car loan early will impact your credit score — usually by dropping it a few points. Over the long-term, it depends on quite a few factors, including your credit mix and payment history.

How does a settlement fee work?

What is a settlement figure? Simply put, it's the amount of money you have to pay back to the finance company to completely pay off your agreement. An early settlement figure is the amount outstanding, minus a rebate of interest and charges if you want to pay off your car finance early.

What is the formula for personal injury settlements?

The formula goes like this: Damages = Economic damages x 1.5 (based on the injury severity) + lost income. For instance, assuming you fractured an arm in a motor collision and the medical expenses sum up to $10,000. Let's also assume that the injury made you miss 2 months of work which would have paid you $20,000.

How much can I ask for in a settlement agreement?

The rough 'rule of thumb' that we generally use to determine the value of a reasonable settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary (in addition to your notice pay, holiday pay etc., as outlined above).

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

What is settlement amount?

Settlement Amount means, with respect to a Transaction and the Non-Defaulting Party, the Losses or Gains, and Costs, including those which such Party incurs as a result of the liquidation of a Terminated Transaction pursuant to Section 5.2.

Why is it important to settle early?

Important: You have the legal right to repay a debt in full at any time. An early settlement can save you money because lenders are not legally allowed to charge you interest based on the loan term. Interest must be based on the amount owed.

What is the assumption of a monthly repayment calculator?

The calculator assumes that monthly repayments are made in arrears and that identical monthly repayments are made.

Why settle a personal loan early?

Another good reason for you to settle your personal loan early is to allow your money to grow to its fullest potential. When you have an outstanding personal loan, you will always have to pay interest rates as a cost to the bank for the loan.

How long is the notice period for a loan restructure?

Notice Period: One month. Loan restructure: Not allowed once the loan is approved and disbursed. The extra payment will be treated as an advance payment to reduce your installment in the following month. You will not be able to redraw the extra payment made.

How long is a bank notice period?

Notice period: Three months prior written notice to the Bank, or payment of three (3) months’ interest on the amount redeemed in lieu of notice.

What is a settlement figure?

An early settlement figure is the amount still owed, plus interest and charges if you want to pay off your car finance early. Our settlement figure calculator does not include any additional penalty charges that may be incurred. For regulated agreements, this is normally an exit fee equal to around just 58 days interest charge.

Can you settle a Magnitude finance agreement early?

If you wish to settle any finance agreement early and you are a Magnitude customer please give us a call. If not, we recommend that you contact your existing finance provider for an exact figure and contact our finance team for a bespoke quotation on your next car.

Why use the Early Loan Repayment Calculator?

The early loan repayment calculator will help you to calculate the monthly interest repayments and compare how alterations to the loan payments can reduce the overall cost of the loan. With this calculator, you can also compare the loan repayments over different periods of time and opt for the most affordable option. The early repayment loan calculator provides interest repayment options over a variety of time periods starting from 1 year to 10 years. You can also compare them to monthly repayment periods of your choice.

Why pay off a loan early?

The moral of the story is that paying off a loan or any kind of debt early is always a great way of saving the amount of money paid in interest as well as decreasing the overall loan term. This extra money can be used to meet other imminent or long-term needs.

What is interest on a loan?

Interest is the extra amount of money paid for using the lender's money. Your lender could be a bank or any non banking financial institution, a private lender or a friend, ...

How to lower the payment on a loan?

Refinance the loan: This is a very easy way to lower the payment, pay the loan back in a much less time and save interest. Many local financial institutions offer very low interest rates. You can take advantage of these low interest rates to refinance the loans.

How often should I make biweekly payments?

Making Bi-weekly payments: You can submit half the payments to the lender every two weeks rather than making the regular monthly payment. Three things will happen due to this practice. There will be less accumulation of interest because the payments get applied more often. You will also make extra payments. Practising making bi-weekly payments could reduce several months.

What happens if you pay monthly on a mortgage?

You will reduce the total amount of interest paid on the loan, reducing from to which is a saving of in interest payments.

How to find extra money?

Finding extra money: This can be done by engaging in two habits. Firstly, never engage in buying things which are not necessary. Secondly, never buy anything out of impulse. This will always result in you saving a lot of money to pay off your loan early.

What percentage of interest is rebated on car loan?

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

Do banks charge early settlement penalties?

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.