- Make an electronic deposit. Move money from your bank account to your Vanguard account through an electronic bank transfer (EBT) or wire.

- Send money through a direct deposit. Send income directly from your employer, the government (including tax refunds), or other sources electronically to your Vanguard account.

- Use an online bill paying service. Use your bank's bill pay service to send money to your Vanguard account on a recurring basis.

- Invest by sending a check

Full Answer

How do I transfer funds from my bank account to Vanguard?

To wire transfer funds from your bank to Vanguard, first, select Buy & sell from the My accounts drop down in the main navigation. In the Transfer money section, choose the Wire money to a Vanguard account hyperlink Next, select the account you’d like to transfer your money to, the click the Continue button.

What is a settlement fund at Vanguard?

At Vanguard, settlement fund refers to the sweep program option used to pay for and receive proceeds from trades. VBS' sweep program automatically transfers (“sweeps”) any uninvested funds, such as new deposits or the proceeds from securities transactions, into a money market fund or bank product sweep option.

What types of investments can and can't be transferred to Vanguard?

Vanguard receives your investments at the market value on the date of the transfer. An in-kind transfer is one of the quickest and easiest ways to move an account. What types of investments can and can't be transferred to Vanguard in kind? Stocks. Bonds. Most options. Exchange-traded funds (ETFs). Unit investment trusts.

How do I buy and sell shares in Vanguard?

To complete this process, you need to have a bank account linked to your Vanguard account. You can learn how to link a new bank account here. First, navigate to Buy & Sell under the main navigation My Accounts tab.

Starting your transfer

Most account transfers are easy to do online. Watch our video tutorial to see how.

Vanguard contacts the other institution

We’ll reach out to the other institution and provide them with the information you give us.

Firm confirms information

Your other firm will confirm the information we send before transferring the assets to Vanguard.

Learn more about transfers

Still have more questions about how to transfer your assets to Vanguard?

How to add another Vanguard mutual fund?

If you are buying a new fund, check the box next to Add another Vanguard mutual fund. Then type in the fund name, symbol, or number. If you aren’t sure which fund, you can view a list of Vanguard mutual funds by clicking the Select from a list of our fundslink.

Who holds Vanguard assets?

All investing is subject to risk, including the possible loss of the money you invest. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Do you need to move money into settlement fund?

Note:If you’re buying a brokerage product like a stock or ETF, you’ll need to move money into your settlement fund to cover the trade.

Does Vanguard have a contribution?

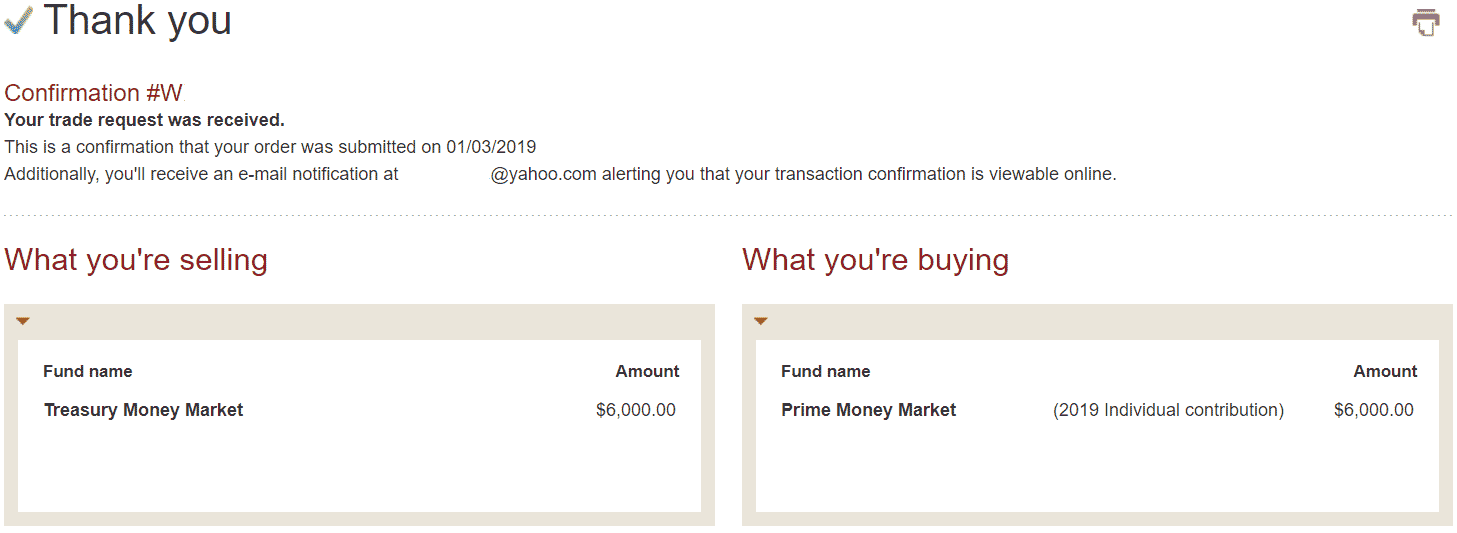

Vanguard.com defaults to a contribution. If this isn’t a contribution select Yesin the question that states Is this a rollover from an employer-sponsored plan or IRA? Then continue with the transaction.

Is Vanguard a brokerage?

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

Who owns Vanguard Brokerage Services?

Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

What to do once you have wire transfer instructions?

Once you have your wire transfer instructions, provide the information to your bank to have them finish the wire transfer.