How long does it take to receive a settlement check?

The time it takes to receive a settlement check varies from one case to another. There is a dispute regarding the release form. The case involves a minor or an estate. Your attorney is negotiating the amount of a lien. The settlement and release agreement was not properly signed and returned.

How long does it take for a large check to deposit?

Large Deposits It bears mentioning again that large deposits may come with longer hold time. Some banks may hold checks that total $1,500 or higher for as many as 10 days. The number of days the bank holds these checks depends on your relationship with the institution.

Will I receive a settlement check for my accident?

Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses. It is a relief when a lawsuit concludes and you finally receive a settlement check.

How does a personal injury lawyer distribute a settlement check?

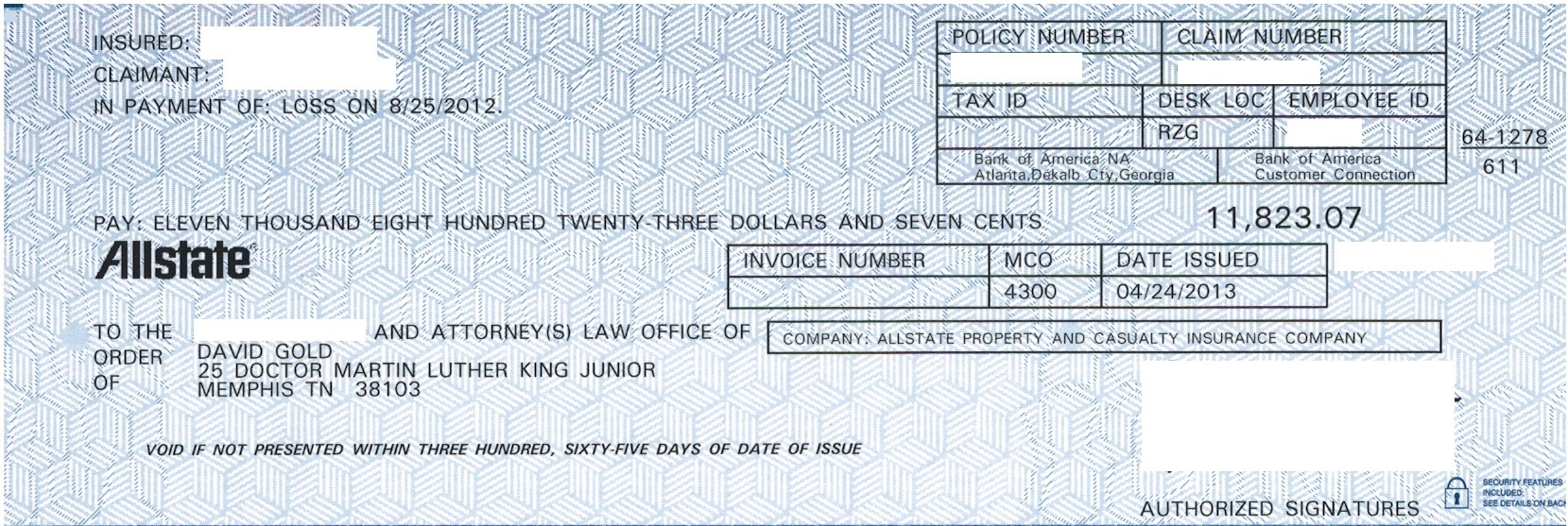

In most cases, the settlement check is sent to your attorney, and made payable in both of your names. 3. Depositing the check Once the check is received, your attorney will deposit it into a special trust or escrow account. As soon as the check clears, your personal injury case attorney will distribute the settlement money.

How long will my bank hold my settlement check?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

Can I deposit a large settlement check?

You can deposit your settlement check like any other check you receive. Most personal injury firms, including ours, still issue paper checks to clients. The bank teller may bring over a manager to authorize the transaction, but other than that you should be good to go.

How soon can you expect to receive compensation from the lawsuit?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How can I cash a large settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

What happens if you win a lawsuit and they can't pay?

The sheriff or constable will bring you a copy of the execution and take your car or put a lien on your house. If the creditor wants you to pay them money, they can take you back to court on a Supplemental Process to “garnish your wages.” They can take money out of your paycheck before you get paid.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

What is the maximum amount you can cash a check for?

According to the Consumer Financial Protection Bureau, a check can be cashed for any amount if it is written on an account from the institution where it is being cashed, there is enough money in the account to cover the check, the check is dated within the last six months and the person cashing the check presents a ...

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How can I protect my settlement money?

Keep Your Settlement Separate Rather than depositing the settlement check directly into your standard bank account, keep the settlement money in its own separate account. This can help you keep it safe from creditors that may try to garnish your wages by taking the money you owe directly out of your bank account.

How do I cash a 20000 check?

Go to your local bank or credit union. Take your check to a friend or family member's bank or credit union. Go to the bank or credit union that issued the check to cash it. Go to any bank or credit union to cash a check.

How Long Is the Bank Likely to Hold my Settlement Check?

In the optimum scenario, the insurer will send payment as soon as they receive confirmation you are agreeing to a settlement. Once your attorney ma...

Cashing a Settlement Check Without a Bank Account

For those with no bank account or those looking to get money on the spot, there are options such as convenience stores, grocery stores, and check-c...

Is It Worth Considering Pre-Settlement Funding?

If the settlement check process is unfolding too slowly and you need cash now for medical expenses or living expenses, pre-settlement funding might...

How long does it take to get a settlement check?

Although the time required for a settlement negotiation process to be finalized can vary considerably from case-to-case, once a settlement is reached a victim can generally expect to receive a settlement check in approximately six weeks. There are, of course, exceptions to that rule, and delays can occur. Let’s take a look at the standard process for receiving a personal injury settlement check, the steps involved from start to finish, and also look at average settlements for personal injury cases.

What are the steps involved in receiving a personal injury settlement check?

Personal injury settlement checks can be issued for various types of cases, including car accidents, wrongful death claims, slip and falls, product liability or defect claims, premises liability claims, medical malpractice, TBI (traumatic brain injury) or spinal cord injuries, and more . When a victim is injured in an accident and suffers expenses from medical care, lost wages or earning capacity, reduced quality of life, pain and suffering, loss of consortium, and more, financial compensation via a civil lawsuit settlement is a means of helping the injured party recovery and live a productive life following an unfortunate accident.

What is a medical lien in a personal injury settlement?

Medical liens refer to a third party’s legal right to appropriate a portion or the entirety of the settlement or proceeds from your personal injury case. Said third party may file a request for a lien during the lawsuit, and a judge will ultimately decide whether to approve or deny the request. If a judge were to approve a lien, the person or entity who owns that lien would be paid from your total settlement amount before you receive any financial compensation. Again, this is just another example of why having an experienced and dedicated DLG lawyer fighting on your behalf can give you the advantage necessary to prevail, and help ensure another party does not wrongly take a portion of your settlement. Once a lien is approved by a judge, there is virtually nothing you or your attorney can do to reverse the decision, and the debt must be legally paid in full.

What is a legal settlement?

In civil lawsuits, a settlement is an alternative to pursuing trial litigation. Generally, a settlement occurs when the defendant agrees to some or all of the plaintiff’s claims rather than proceeding to fight the matter in a court of law. In almost all cases, a settlement requires the defendant to pay the plaintiff monetary compensation – whether for medical bills, pain and suffering, lost wages, psychological trauma, etc. Agreeing to a settlement is commonly referred to as settling out of court, and said settlement effectively ends the matter of litigation. Agreeing to a settlement is an advantageous option for both parties in many cases. By settling out of court, defendants can avoid exorbitant costs of litigation, which can drag on for an extended period of time depending on the nature of the case. A settlement may be reached before a trial, or during its early stages. In some cases, settlements are reached before a lawsuit is ever filed.

What happens if my attorney won’t turn over my settlement award check?

Most attorney-client relationships are built on respect and an understanding that both individuals are working together to achieve the same goal – a successful case outcome leading to a maximum financial damages award.

Can a delay in a personal injury settlement happen?

Delays, while not a common occurrence, can happen occasionally in personal injury settlements. In such cases, it’s helpful to know what to expect. If a defendant is not represented by an insurance company, it’s possible that he or she may have their own release form that needs to be agreed upon by all parties. In such cases, your attorneys, as well as the legal representation for the defendant, will have to review the release and agree unanimously on the terms. This may add additional time to your settlement check being received, but in most cases the situation can be resolved without issue and in a relatively short period of time. Wrongful death cases and other cases involving estates are two types of claims that tend to take a bit longer and require additional preparation.

How long does it take for a check to clear?

It usually takes about two business days for a deposited check to clear, but it can take a little longer—about five business days—for the bank to receive the funds. How long it takes a check to clear depends on the amount of the check, your relationship with the bank, and the standing of the payer's account.

What does it mean when you deposit a check at a bank?

When you deposit a check, whether at an ATM, a teller's counter inside the bank, or a drive-through window, you typically get a receipt that usually says when the funds will be available. Keep the receipt handy until the check clears. The funds-availability date on the receipt lets you know when it may be time to contact the bank regarding hold inquiries. If you don't receive a receipt, however, you'll need to contact your bank to check on this.

Why do banks hold checks longer?

Of course, the hold time often depends on the nature of the check. A bank may choose to hold a check longer if it's an unusual deposit if you've never deposited a check from that payer before, if the check is for a large amount, or if the check is from an international bank. The latter requires a much longer hold time because it can't be easily verified. Hold times for these checks depend on your institution, so you should check with someone about the policies.

Why does it take longer for a check to clear?

Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

Can a bank hold a check?

Some banks also issue holds for deposits on new accounts. Accounts that have no or little history may automatically qualify for holds on all check deposits until the time that the bank feels you have solidified your relationship with it. Accounts that have negative history—that is, accounts that frequently bounce payments or go into overdraft —may also have checks held.

Do banks clear checks?

The bank may be likely to clear checks right away if you have a consistent history with a certain payer. Say, you're a freelancer and receive checks every other month for work you do for that company.

Can a bank hold a check if you have never deposited it?

The payer also has a lot to do with hold times as well. If you've never deposited a check from that person before—and it's a sizable amount—your banking institution may choose to hold it until it clears.

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

How long does it take to get a settlement agreement signed?

Next, the court issues an Order of Settlement. This order generally requires that both parties complete all necessary paperwork within either 30 or 60 days.

What Is a Legal Settlement?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

How long does it take for a check to clear?

Just deposit it like any normal check. It may take a week or so for the check to clear and have full access to the funds.

How long did the scammers record on my phone?

They are sure all that money is gone but are also worried because the scammers were recording them for 9 hours a day on the phone and also got all of the personal data (SSN, Driver's License no., etc.)

Can I deposit a large amount at the teller?

I would just go to the teller and deposit it. For that large amount they will probably bring over a manager for authorization but you will be fine. Like I mentioned above they will put a hold on it though.

Insurance Companies Settle Insurance Claims Every Day

It is a myth that insurance companies do not want to settle insurance claims. We are here to dispel this myth right now. Insurance companies do settle insurance claims, and they settle them every weekday. They are extremely happy to settle out your insurance claim when you have claimed damages against their negligent, careless, or reckless insured.

The Settlement Check Is the Last Word on the Accident

When you have a loss or personal injury and have an at-fault party, the insurance company for that at fault or negligent party needs to come up with a settlement package to settle the claim with you. You will be better off calling our law firm to help you settle your claim because we do this every day of the week.

Depositing Your Settlement Check Is Easy

You will be getting a settlement check at the end of your negotiations for your accident and losses. You will be free to deposit that settlement check anywhere that you choose. If the check is a large sum of money, you can speak to a personal financial planner to decide how you want to disburse the check to yourself.

Ali Awad Law- Winning Atlanta Personal Injury Law Firm

We are here for you and know what to do to get you the money you deserve in this type of situation, such as depositing your settlement check. Your settlement check is the last chance you have to settle out your claim and case with the at-fault party’s insurance company.