What to do After you Send your demand letter?

What to Do When You Receive a Demand Letter

- Don't Blow It Off. You or your business can suffer consequences from failing to answer a demand letter in a timely fashion.

- Assess the Validity of the Arguments. ...

- Understand the Obligee's Motives. ...

- Determine Whether or Not You Need a Lawyer. ...

- Respond Formally, Factually, and Professionally. ...

- Get Verification of Receipt. ...

How long after my lawyer sends a demand letter?

Typically, after your attorney has sent a demand letter to the insurance adjuster or other party, it can take anywhere from a few weeks to a couple of months to obtain your settlement. Unfortunately, it’s impossible to determine exactly how long after a demand letter a settlement will take.

What to expect after a demand letter is sent?

This is usually how things go after a demand letter is sent: it triggers a back-and-forth process where the injured person starts with an inflated demand amount, the insurance company comes in with a much lower offer, and the two parties meet somewhere in the middle. (Get tips on responding to an insurance company's too-low settlement offer .)

How long does it take to get money after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

What's the next step after the demand letter?

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange.

How long does it take for a company to respond to a demand letter?

Once you've written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

What happens if insurance company doesn't respond to demand letter?

If an insurance company has still not responded to your demand letter, the next step may be to contact a legal representative and file a lawsuit. Be sure to understand the statute of limitations for your case. Once those run out, you could lose the right to sue.

Do insurance companies respond to demand letters?

Waiting for an insurance company to respond to your demand letter is challenging. In most cases, you'll get a response within a few weeks or months. Insurance companies have a financial motive to settle cases as efficiently as possible. But there is no guarantee that you'll receive a response to your demand letter.

How long does it take to negotiate compensation?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

How long does an insurance company have to make an offer?

In most states, the insurance adjuster has no obligation to respond to your demand letter. Even in states where they do have an obligation to communicate with the victim within 30 days or some other period, the law does not impose a significant penalty when an insurance adjuster simply ignores a demand letter.

How long does an insurance company have to investigate a claim?

In general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

Why do insurance adjusters take so long?

The most common reason for an insurer's delay is the adjuster's case load. An adjuster likely has dozens of claims to handle at a time. Many decisions made by insurers require the approval of one or more superiors, who also will have many other claims to review.

How do you respond to a low insurance settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

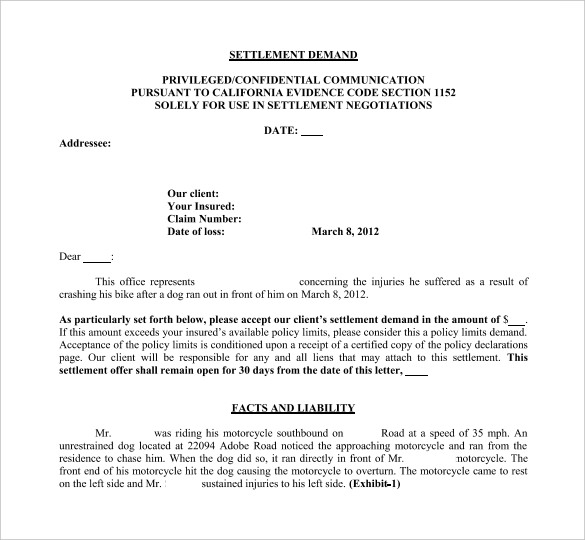

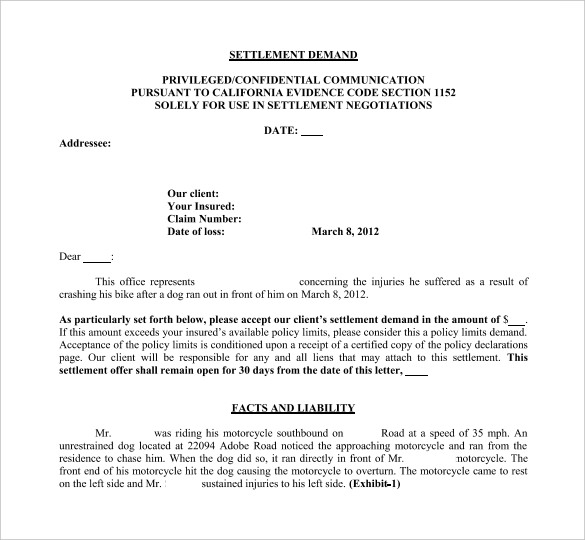

How does demand letter work?

A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation. A letter of demand is generally an initial step in the litigation process. In certain instances, a letter of demand is necessary to place the debtor in mora.

How does a demand letter work?

A demand letter is a letter, usually written by an attorney on a client's behalf, demanding that the recipient of the letter take or cease a certain action.

Why is my car accident settlement taking so long?

Your settlement could be delayed because your case involves large damages, or put simply, a lot of money. In this case, insurance companies will delay paying money out on a settlement until they are confident about it. They will investigate every aspect of the case and every detail of the liability and damages.

What does it mean when a case is in demand?

This means that the defendant must not have asked for a continuance after making a formal written Demand for Trial. The defendant must not have made a request for more time or asked for a continuance without the agreement of the State.

How long after a demand letter does a settlement take in Texas?

Texas Law Says 15 Days.

How long does it take for a settlement to be paid?

In some instances, the insurance company may accept your initial demand amount and pay it immediately —although that is relatively rare.

What happens after a demand letter is sent?

The most common route is that, after your demand letter has been sent, the insurance company will reject your settlement amount and come back with a different value. Once that has been sent, you and your attorney will either accept or refuse the amount. This back-and-forth process can go on until a dollar amount is agreed upon.

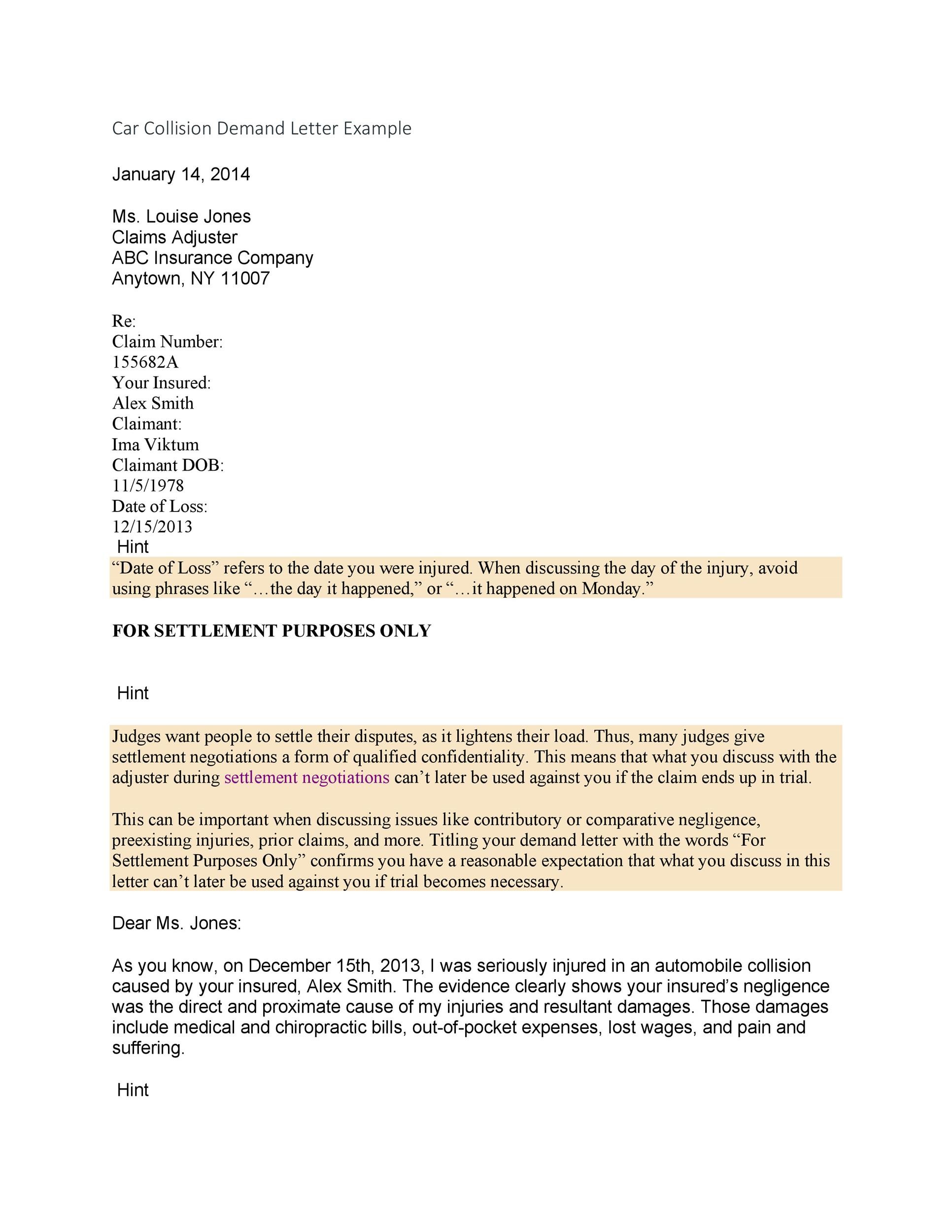

How to write a settlement letter for a car accident?

To expedite the settlement process, you and your attorney need to present the strongest case possible. The following are some details your attorney may include in your letter: 1 How your injuries were sustained 2 How your injuries have impacted your life 3 The extent of your medical treatment and associated expenses 4 Reasoning as to why the other party is liable for your injuries 5 The amount of income you lost over the accident

What is the purpose of a demand letter?

The ultimate goal of a demand letter is to provide you, the victim, with a settlement you are satisfied with. But if you’re facing a personal injury lawsuit, you’re likely wondering how long your settlement will take after your demand letter has been sent. Each case is different.

What to include in a settlement letter?

The following are some details your attorney may include in your letter: How your injuries were sustained. How your injuries have impacted your life. The extent of your medical treatment and associated expenses.

Can you file a personal injury claim in Wisconsin?

Luckily, Wisconsin protects victims like you by offering the option to file a personal injury claim.

Waiting Times Can Vary

You may know your lawyer can help, but how long will it take to get an answer from your insurance company for your economic and non-economic damages? Unfortunately, there’s no universal answer.

Ensuring You Get the Compensation You Deserve

But rushing your claim can hurt your future, and it can impact your claim. That’s why we’re focused on getting your compensation, not on rushing your claim to any conclusion. For example, if you have a long-term injury like brain trauma, you may need to spend more time calculating the long-term effects of your brain injury .

How long does it take to settle a claim after a demand letter?

Once the demand letter has been sent and the claim has been received by the defending party, settlement can take anywhere from a few weeks, to several months.

How long does it take to get a response from insurance company?

Once you’ve written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

What is holding up my demand letter?

Instead, the problem may lie with the insurance adjuster. They may be dealing with many cases at once, and that sometimes means that you won’t get as speedy a response for your questions and your letter.

Can an attorney help you get compensation after an auto accident?

In advanced cases, especially in those where you may be seeking compensation from an auto accident, retaining an attorney can help the process dramatically. You may not know how long after a demand letter a settlement can take, so you’ll need guidance from an attorney who can help you seek answers.

Why does it take so long for insurance to settle?

Insurance companies often have valid reasons for taking several weeks to reach a decision. However, the insurance provider in your case may be guilty of bad faith instead. Insurance bad faith means the company is treating your claim unfairly or dishonestly. A common bad faith tactic is to deny a client’s payout. If you suspect bad faith is what is making your settlement take so long, contact an attorney for a free consultation.

How long does it take for insurance to pay a claim?

Additional time often means a total of 60 days from the date of receiving your claim. Most clients receive settlement checks from insurance companies within two weeks of claim acceptance, making the total average timeline about one to three months long.

How long does it take to get compensation from an insurance company?

If you and the insurance provider cannot agree on a fair and reasonable settlement, you may have to take your case to trial to obtain compensation. You might also have to take your claim to court if the insurance company responds to your initial demand letter with a claim denial. Rather than taking a few months, a personal injury trial takes a year or longer on average. At the end of the trial, you might not receive any compensation at all. If you win your trial, however, the verdict awarded could be more than what you would have received through an insurance settlement.

What happens if you submit a claim without an attorney?

If you submitted your demand letter without first running it by an attorney, it may contain errors that could make a settlement take longer to achieve. An issue could rest with your insurance company. The company might be dealing with a lot of claims or need additional time reviewing your case.

How long does it take to settle a lawsuit?

The discovery process can take anywhere from six months to a year, and the if the parties cannot reach a settlement, they may go before a mediator to arrange a settlement.

How long does it take for a personal injury lawyer to settle a lawsuit?

The negotiation process can take some time, up to several months. This is, however, a faster, easier, and cheaper process than going through the courts via a lawsuit.

What Happens If the Parties Cannot Reach a Settlement?

This can be because the litigating party decides to reject the insurance company or defendant’s counteroffer. In rare cases, it can be because the defendant party does not respond to the demand letter in the first place. Regardless, the next step for most attorneys is to initiate a lawsuit.

What is the process of reaching a settlement?

Reaching a Settlement. The majority of civil suits settle long before a trial is necessary. The negotiation process is a multifaceted procedure that involves all parties meeting with their respective lawyers and discussing the case. Settlements depend on the strength of each side’s case, and their available resources.

What happens if an insurance company does not respond to a demand letter?

If a company does not respond – a rare, but not unheard-of occurrence – it is typical to follow up on the demand letter.

What happens after a lawsuit is filed?

In cases that move directly to filing a lawsuit, this is normally the end of the line for these suits.

How long does a trial last?

Once a trial date is set, the actual trial can last from a day to several weeks, depending entirely on the schedule of the judge, lawyers and parties. It is common for trials to be rescheduled frequently, often for simple reasons, and this is often why they take more than one day.

Settlement Timeline

Knowing the timeline after a demand letter is sent can be hard to gauge because this is when the claim is in the hands of the opposing party. Depending on the defendant’s reception of the demand letter, it can take anywhere from a few weeks to a few months to receive your settlement.

Contact a San Diego Personal Injury Attorney

Making sure you hire a competent San Diego personal injury lawyer will be key to speeding up your settlement process. At The Kindley Firm, APC, our attorneys have years of experience with claims and will ensure yours gets filed properly and on time. Reach out today for a free consultation to discuss your case.

How long does it take for insurance companies to respond to a demand letter?

Insurance companies respond to demand letters at their own pace, meaning that you may receive your settlement as soon as a few days or as late as many months after you initially send your demand letter. If it takes a while to hear back, one of the reasons for this is that many insurance companies receive a high volume of demand letters.

How long do you have to wait to write a demand letter in NC?

Waiting too late puts you at risk of going over the statute of limitations, or amount of time you have to file your claim, which is three years in NC.

Why does it take so long to hear back from insurance company?

If it takes a while to hear back, one of the reasons for this is that many insurance companies receive a high volume of demand letters. In addition, if the insurance company responds negatively to your demand letter , then the process will naturally take longer.

What is demand letter?

Demand letters are essential parts of most personal injury cases. These letters detail your damages after an accident and give an accurate estimate as to how much compensation you should receive for your damages.

Can insurance companies settle after receiving a demand letter?

Depending on your situation, after receiving your letter, the insurance company may settle without any need for you to sue or go to court. However, you may wonder how long you have to wait to receive your settlement ...

Can you write a demand letter after an accident?

On the other hand, immediately writing a demand letter too soon after your accident will not allow you enough time to fully assess your damages. You must have all of your demands and damages within your demand letter or you can’t be compensated for them.